Navigating disputes with your mortgage lender can feel like a daunting task, but you're not alone! Many homeowners find themselves in similar situations, wrestling with misunderstandings or unexpected challenges. Understanding how to communicate effectively with your lender is key to resolving any issues that arise. Let's dive into some practical steps and template ideas that can make this process smoother for youâread on to find out more!

Clear identification of parties involved

Disputes regarding mortgage agreements can arise, impacting borrowers and lenders. The parties involved typically include the borrower, an individual or entity seeking a loan structured as a mortgage, and the mortgage lender, an institution or organization providing the financing, such as a bank or credit union. Proper identification of these parties is crucial in dispute resolution processes, including referring to relevant documentation like loan agreements or account numbers. Clear definitions help facilitate effective communication and establish responsibility in resolving the disagreement. Accurate identification ensures that all correspondence and actions directly address the correct entities involved in the mortgage dispute.

Detailed description of the dispute

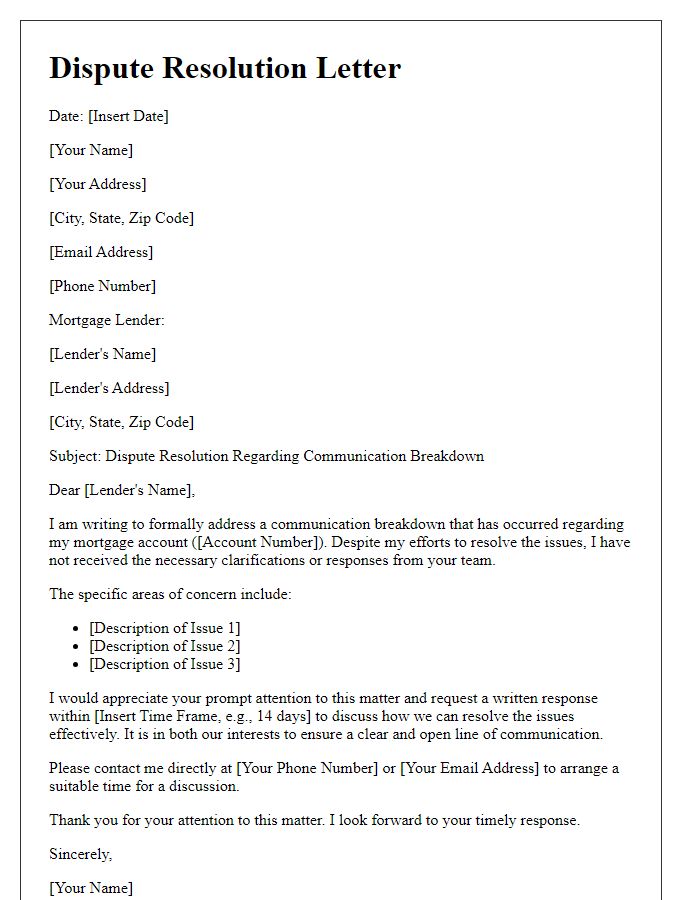

A mortgage lender dispute may arise when discrepancies occur regarding loan terms, fees, or the handling of payments. For instance, a borrower might notice irregularities in the monthly statements issued by the lender, such as incorrect balances that deviate from the originally agreed-upon amount of $250,000. This situation can be exacerbated by unapproved fees, including a late fee of $200 charged despite timely payments recorded by the borrower's bank. Additionally, communication issues can contribute to the dispute; borrowers may experience delays or lack of response from customer service departments, hindering their ability to resolve issues swiftly. Regulatory bodies like the Consumer Financial Protection Bureau (CFPB) provide guidelines to ensure fair treatment, emphasizing that lenders must adhere to proper disclosure laws under the Truth in Lending Act (TILA). Addressing these disputes requires thorough documentation of all communications, payment histories, and pertinent loan agreements to support the borrower's claims.

Relevant account and loan information

In the context of mortgage lending, account details play a crucial role in dispute resolution processes. Specific account identifiers, such as the loan number (typically a unique 10-15 digit code), serve as a reference point for lenders and borrowers alike. This aids in streamlining communications and ensuring that the correct loan is being addressed. Additionally, interest rate figures (commonly ranging from 3% to 10% depending on market conditions) are vital, as they directly impact monthly payments. Payment history, detailing dates and amounts for the past 12 to 24 months, can highlight inconsistencies or errors in billing. Furthermore, property information, including the address and estimated market value (often determined through comparative market analysis), provides context for the loan's performance and any associated issues, fostering a clearer understanding during the resolution dialogue.

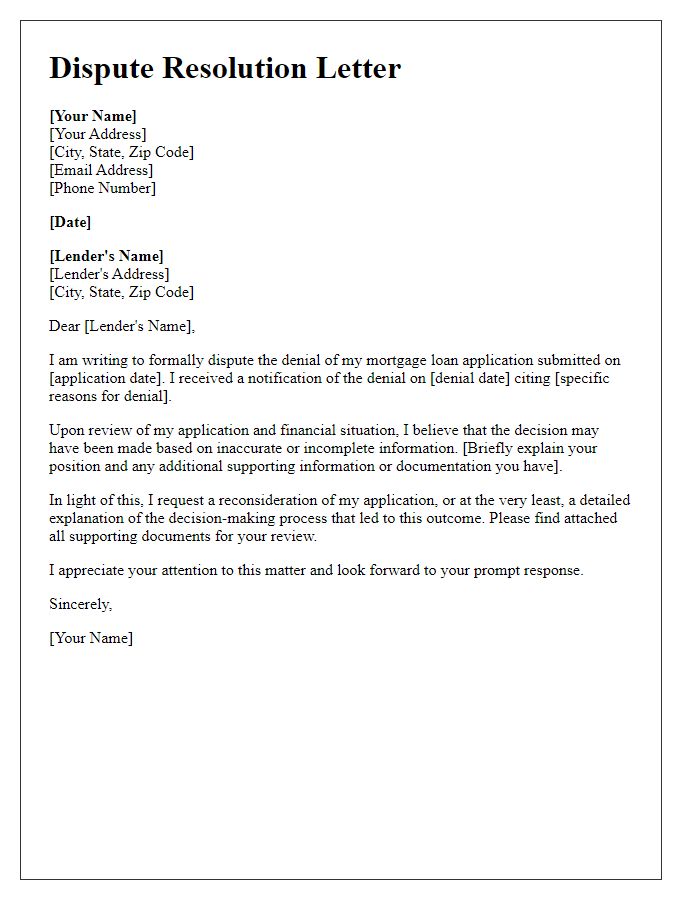

Specific requests and desired resolution

In the realm of mortgage lending, disputes may arise, necessitating an efficient resolution process. Homeowners, facing challenges such as improper fee assessments or incorrect interest rates, often seek clarity from lenders. Specific requests typically include a detailed account of disputed charges, a transparent breakdown of loan terms, and a timeline for addressing the issues. Desired resolutions may encompass a waiver of unauthorized fees, an adjustment to the interest rate to reflect contractual agreements, or even mediation involving third-party services such as the Consumer Financial Protection Bureau (CFPB). Timely responses and clear communication strategies play critical roles in resolving disputes effectively, restoring trust between homeowners and lenders.

Contact information for further communication

To effectively resolve issues related to mortgage disputes, clear and accessible contact information is essential. Providing accurate contact details, such as the mortgage company's customer service hotline (often 1-800-XXX-XXXX) and a specific email address (like support@mortgagelender.com), facilitates efficient communication. Additionally, including physical mailing addresses, such as the lender's corporate office located at 1234 Lender St, City, State, Zip Code, ensures that important documents can be sent directly for resolution. Designating a representative or department, like the Dispute Resolution Team, with a direct contact number or extension (e.g., Ext. 456) can further streamline the process, allowing borrowers to connect with knowledgeable personnel familiar with their cases. Updated operating hours (e.g., Monday to Friday, 9 AM to 5 PM ET) should also be mentioned to guide borrowers on the best times to reach out for assistance.

Letter Template For Mortgage Lender Dispute Resolution Samples

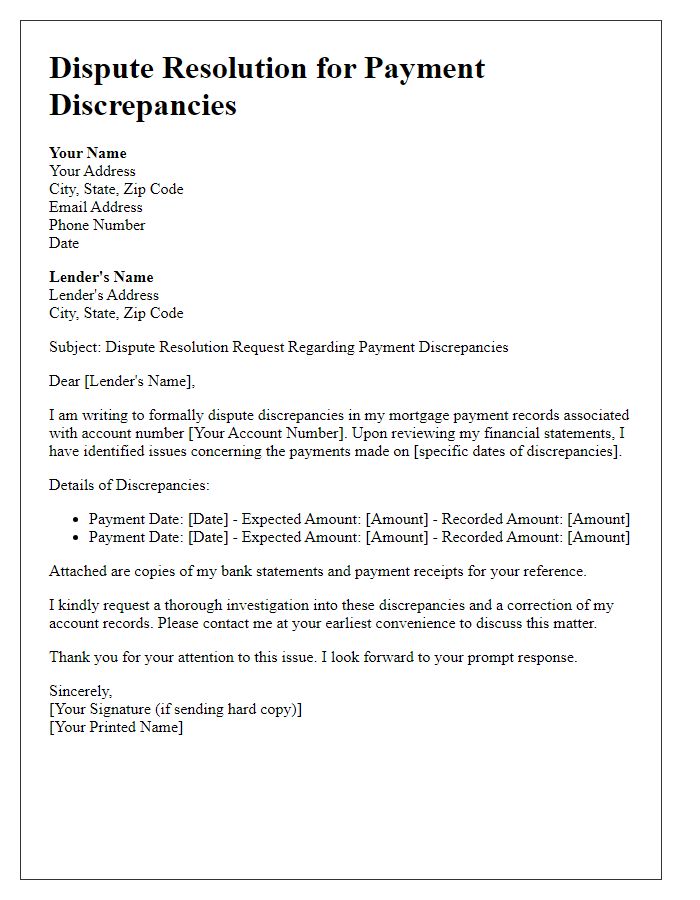

Letter template of mortgage lender dispute resolution for payment discrepancies.

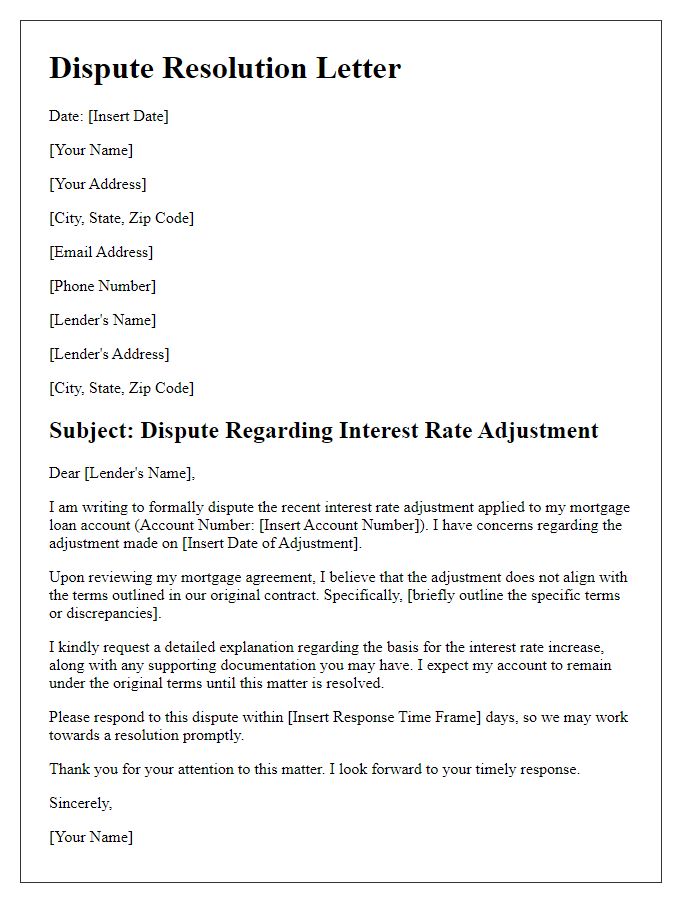

Letter template of mortgage lender dispute resolution for interest rate adjustments.

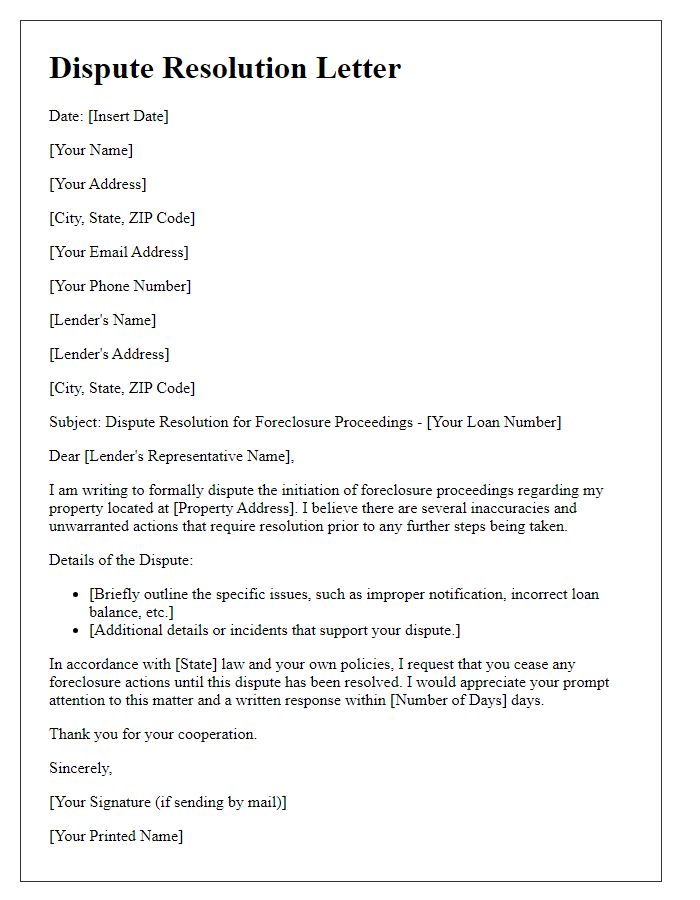

Letter template of mortgage lender dispute resolution for foreclosure proceedings.

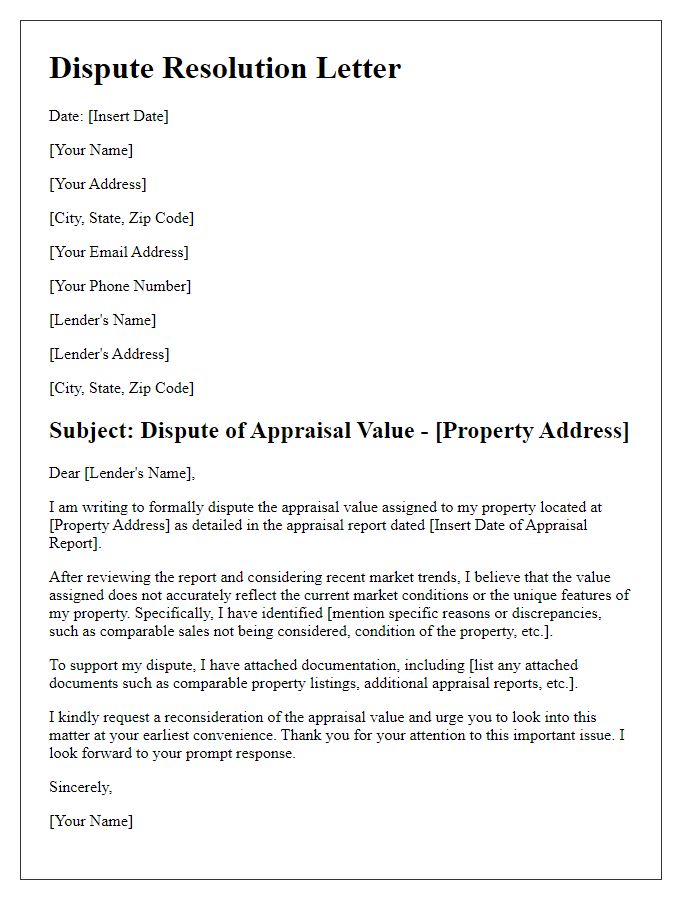

Letter template of mortgage lender dispute resolution for appraisal disputes.

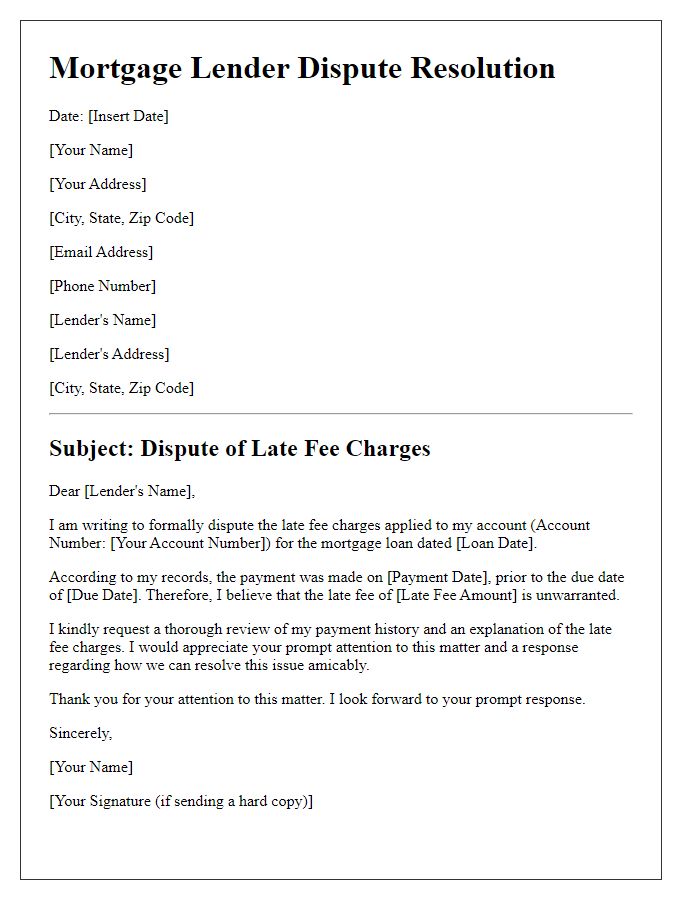

Letter template of mortgage lender dispute resolution for late fee charges.

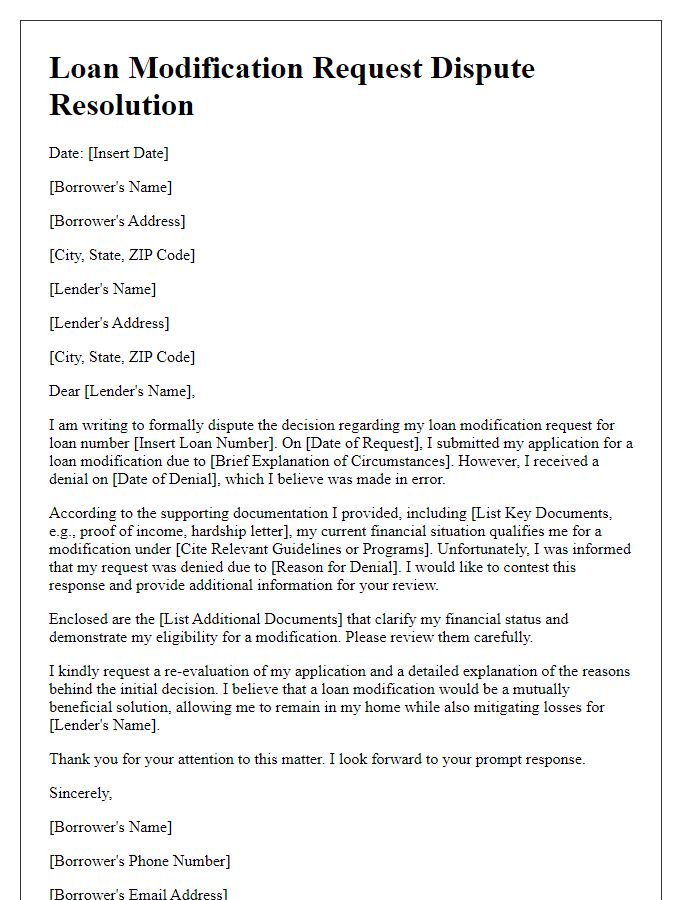

Letter template of mortgage lender dispute resolution for loan modification requests.

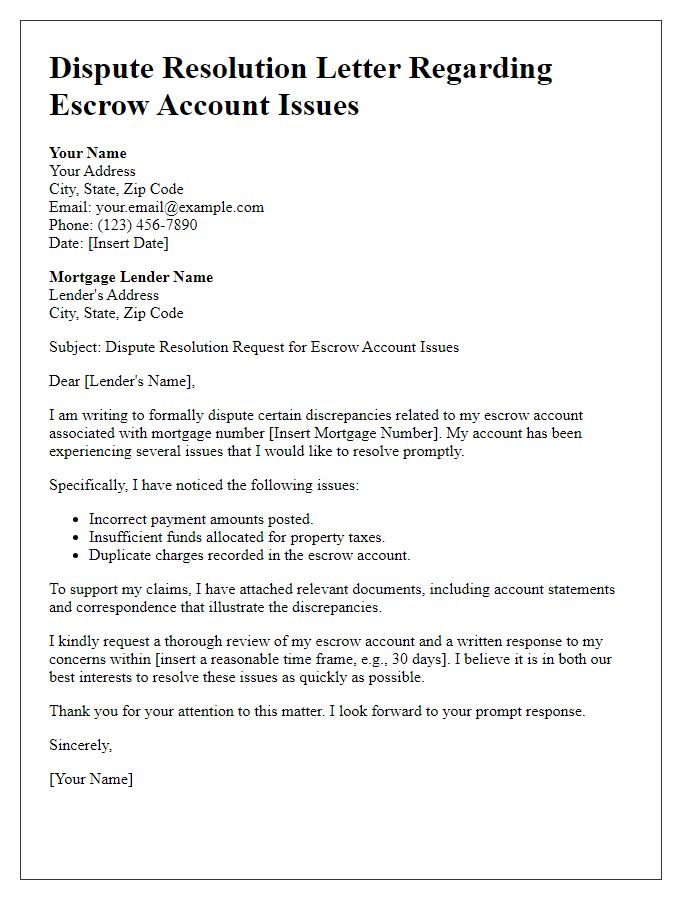

Letter template of mortgage lender dispute resolution for escrow account issues.

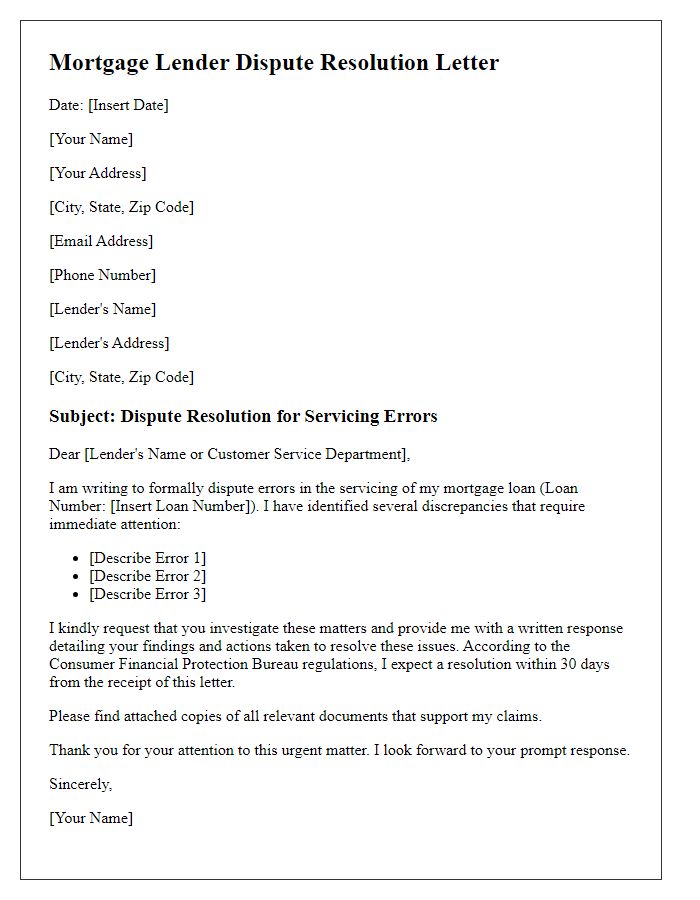

Letter template of mortgage lender dispute resolution for servicing errors.

Comments