When it comes to financial matters, ensuring your mortgage account details are accurate is crucial. Whether you're applying for a refinance or just wanting peace of mind, verifying your mortgage account number is a simple yet essential step. This process not only protects your information but also aids in facilitating smoother transactions with your lender. Curious about how to tackle this easily? Read on for a comprehensive guide!

Account Holder's Full Name

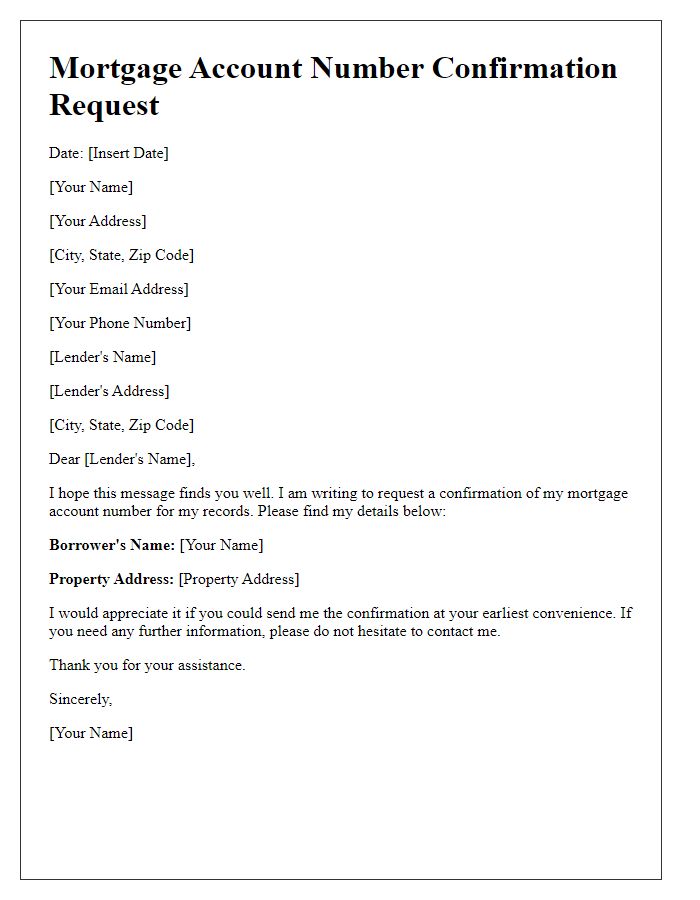

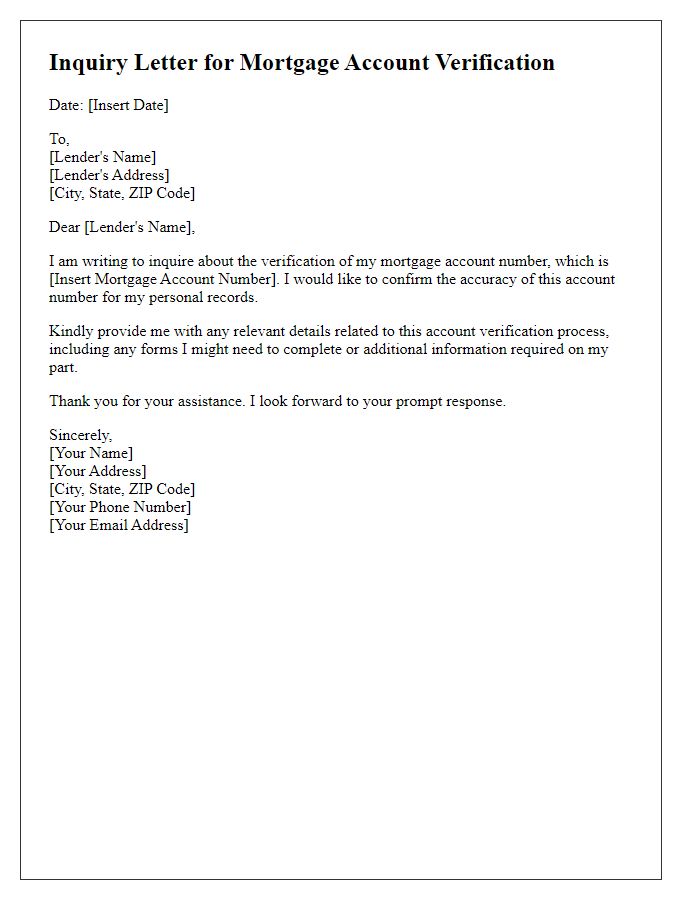

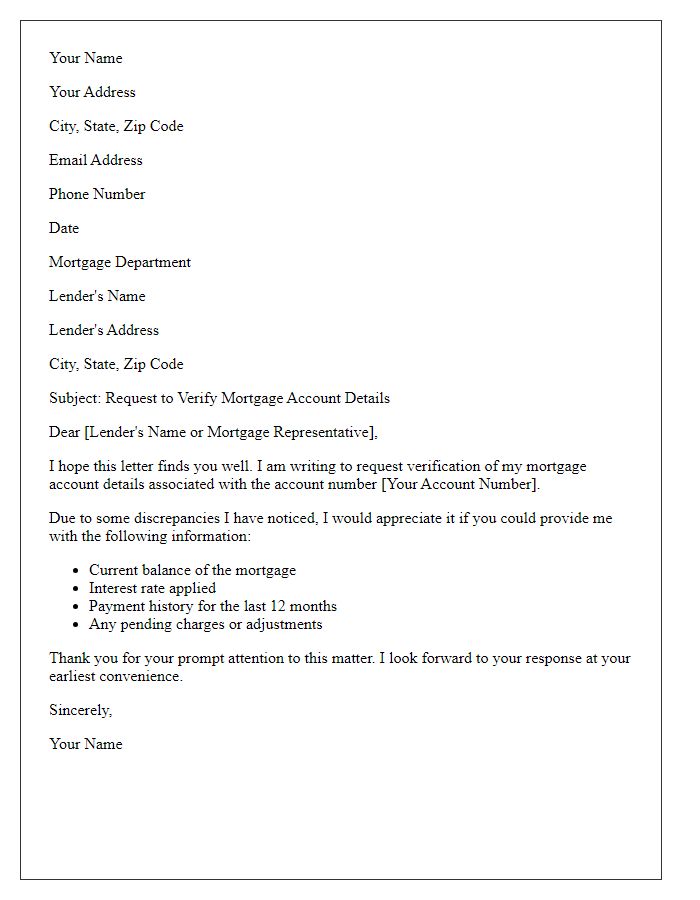

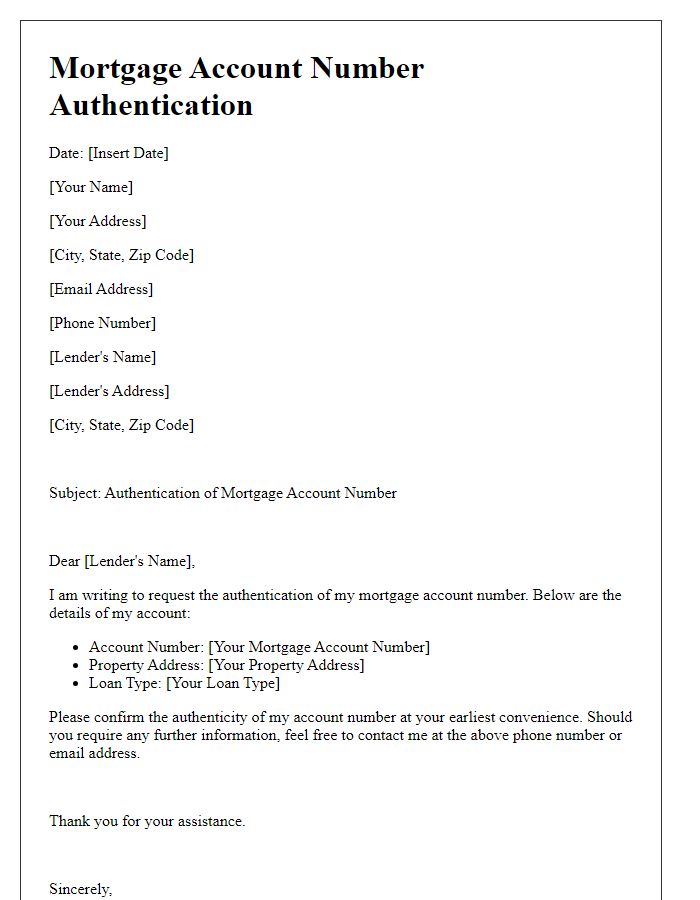

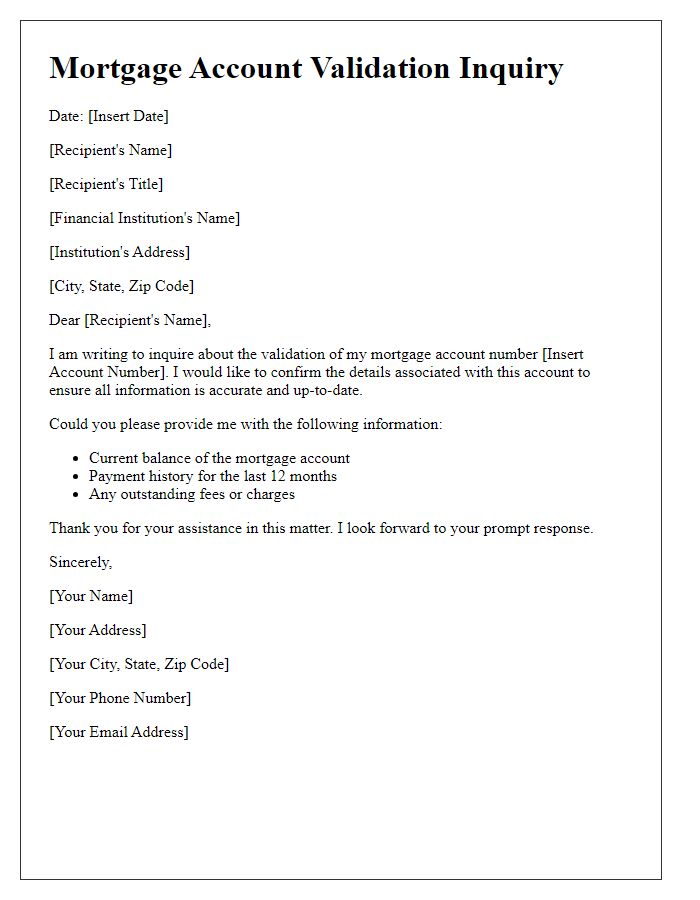

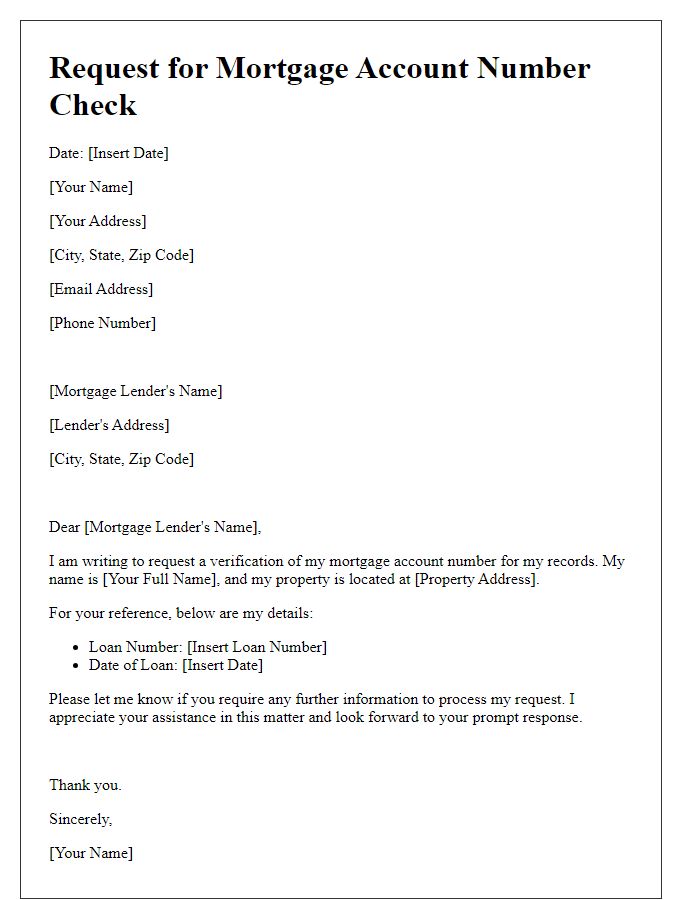

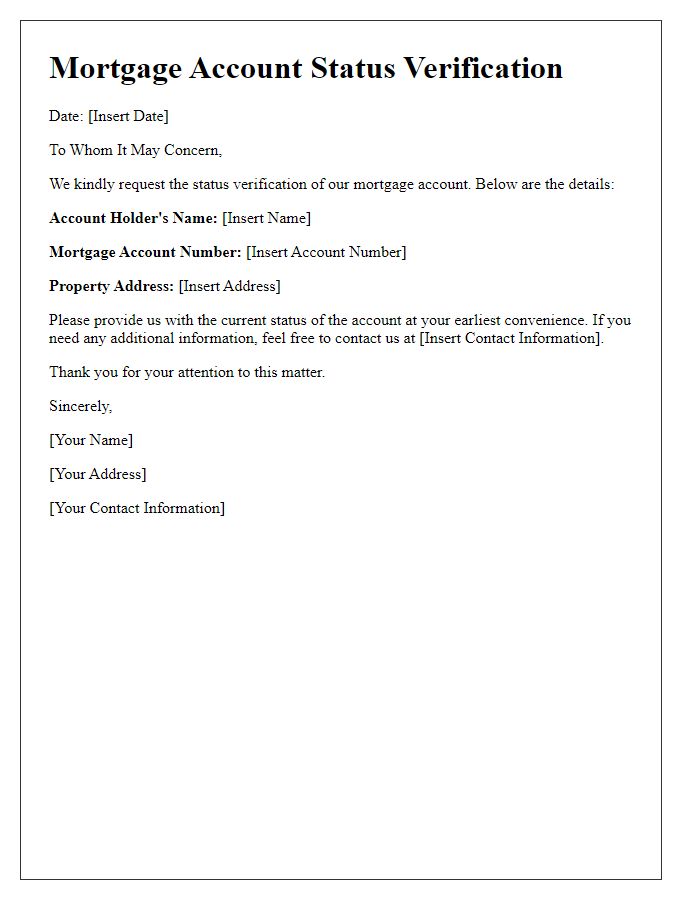

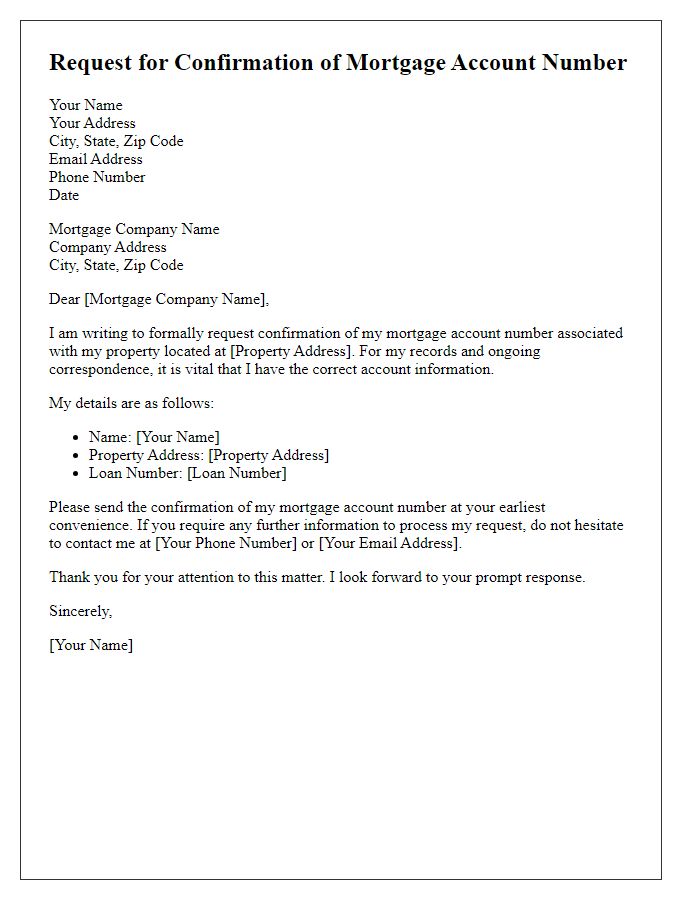

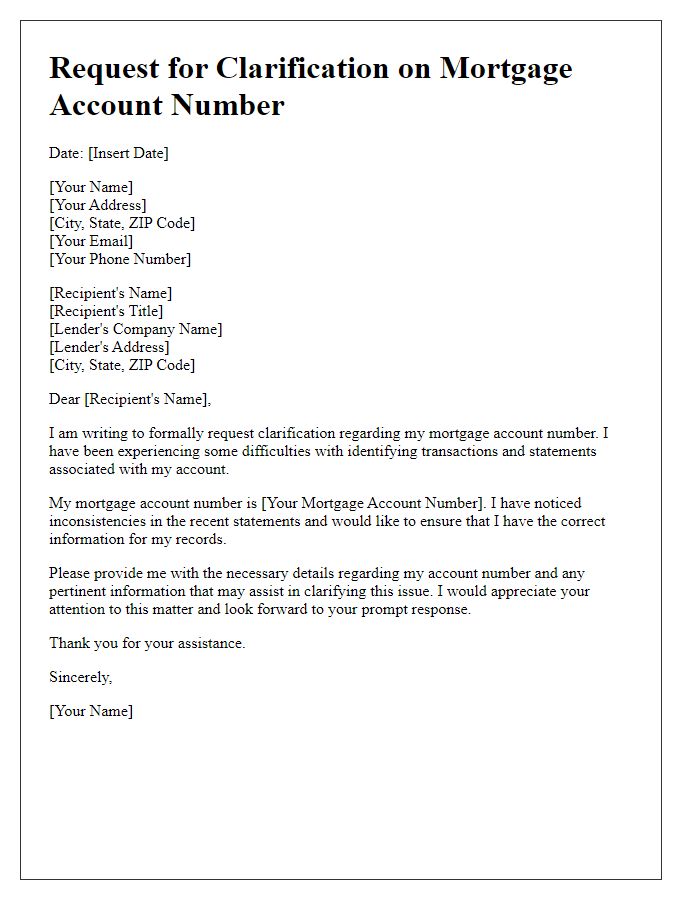

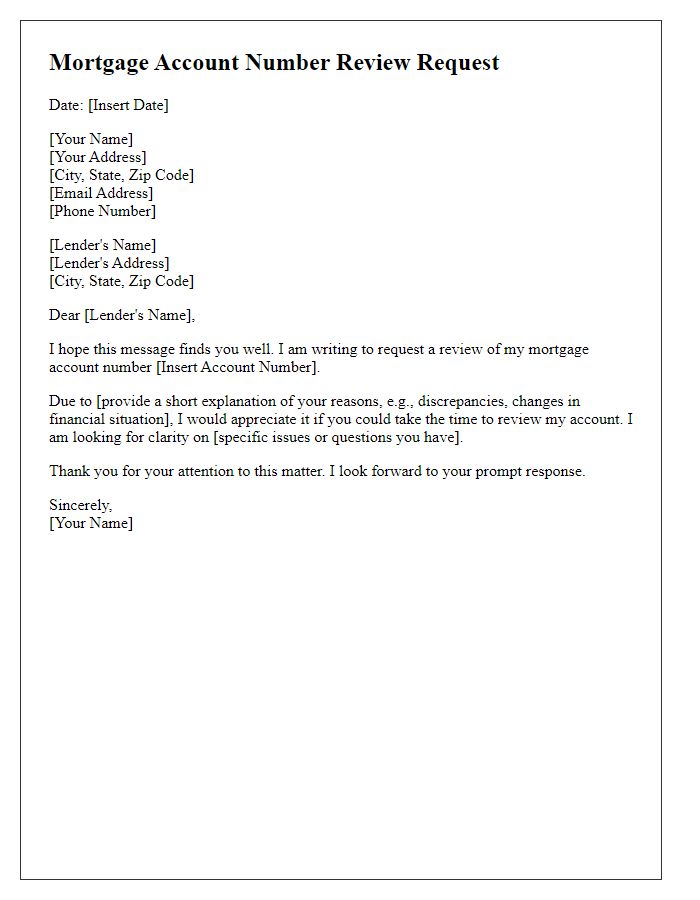

Mortgage account verification requires accurate documentation, especially when dealing with significant financial transactions. The account holder's full name (as listed on official identification such as a driver's license or passport) is essential for confirming identity (ensuring the request is legitimate). Mortgage account numbers, unique identifiers assigned to each loan (typically consisting of 10 to 20 digits), must be clearly referenced to facilitate accurate verification. Financial institutions operate under regulations that protect sensitive information; therefore, maintaining confidentiality and integrity in these communications is crucial for both the lender and borrower.

Mortgage Account Number

Mortgage account number verification is essential for maintaining accurate financial records. A mortgage account number typically consists of 10 to 15 alphanumeric characters, uniquely identifying home loans held with financial institutions like banks or credit unions. Verification of this number is crucial when referencing loan details, payment histories, or processing requests related to account management. Errors in account numbers can lead to payment misallocation or delays in service, impacting homeowner finances and credit scores. Proper verification procedures involve confirming the account number through official documents, such as mortgage statements or loan agreements, ensuring secure communication with the lending institution.

Contact Information (Phone/Email)

Mortgage account number verification is crucial for maintaining accurate records within financial institutions. For instance, a mortgage account number, typically a 10 to 12-digit identifier, allows lenders to manage loans effectively. Accurate contact information, including a phone number (format: (123) 456-7890) and a validated email address (following standard domains like Gmail or Yahoo), enhances the communication between borrowers and lenders, ensuring timely updates on account status. Verification requests often involve submitting proof of identity, such as a government-issued ID, to comply with regulations and protect against fraud. Regular verification can prevent unauthorized access and secure sensitive financial data linked to properties worth hundreds of thousands of dollars.

Verification Request Statement

Mortgage account number verification is a critical process for ensuring the accuracy and security of financial records related to property loans. This request typically involves identifying specific mortgage details such as loan amounts, borrower names, and property addresses. Obtaining confirmation of the mortgage account number, usually a 10 to 16 digit unique identifier, from financial institutions like banks and credit unions is essential. This verification helps prevent identity theft and fraud, ensuring that all transactions are secure. Additionally, establishing the correct account number is crucial for managing payments, tracking loan progress, and accessing customer service efficiently.

Signature and Date

Mortgage account number verification is crucial for ensuring accuracy in financial records. An official document includes account identification (typically alphanumeric), borrower's personal information, lender's name, and the date of verification. Verification processes often require a signed statement to confirm authenticity and prevent identity theft, providing a date stamp for record-keeping. Signature locations are vital, often placed at the bottom of the document, ensuring clear association with the verification statement. This data aligns with regulatory practices governing mortgage agreements in various regions.

Comments