Are you considering a change to your mortgage agreement but unsure of how to initiate the process? Crafting a well-structured letter can make a world of difference when communicating with your lender. In this article, we'll guide you through an effective template to request a mortgage amendment, ensuring your request is clear and persuasive. Ready to take the next step in your mortgage journey? Let's dive in!

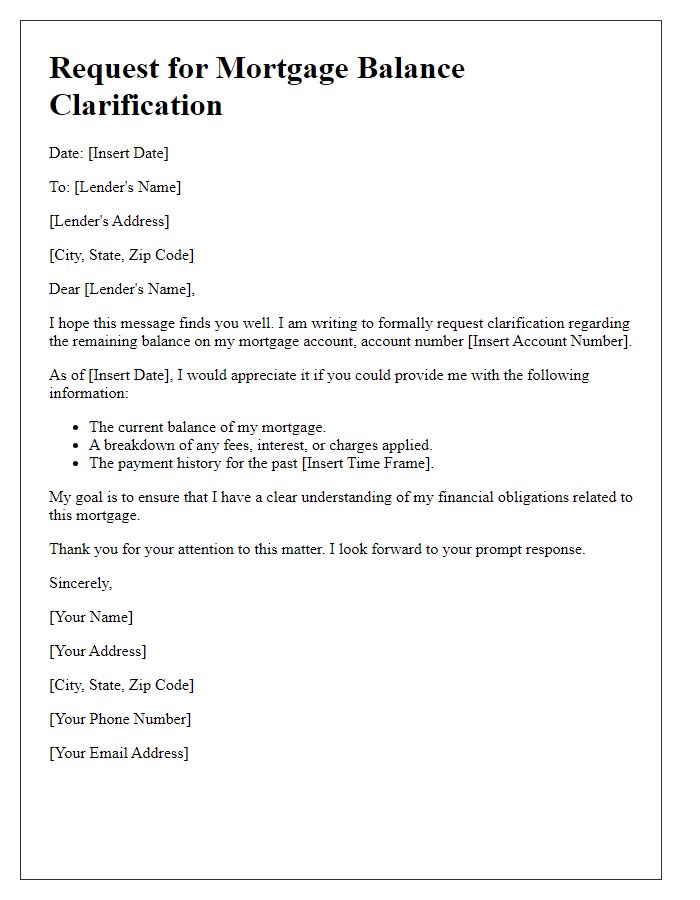

Clear identification of borrower and lender details.

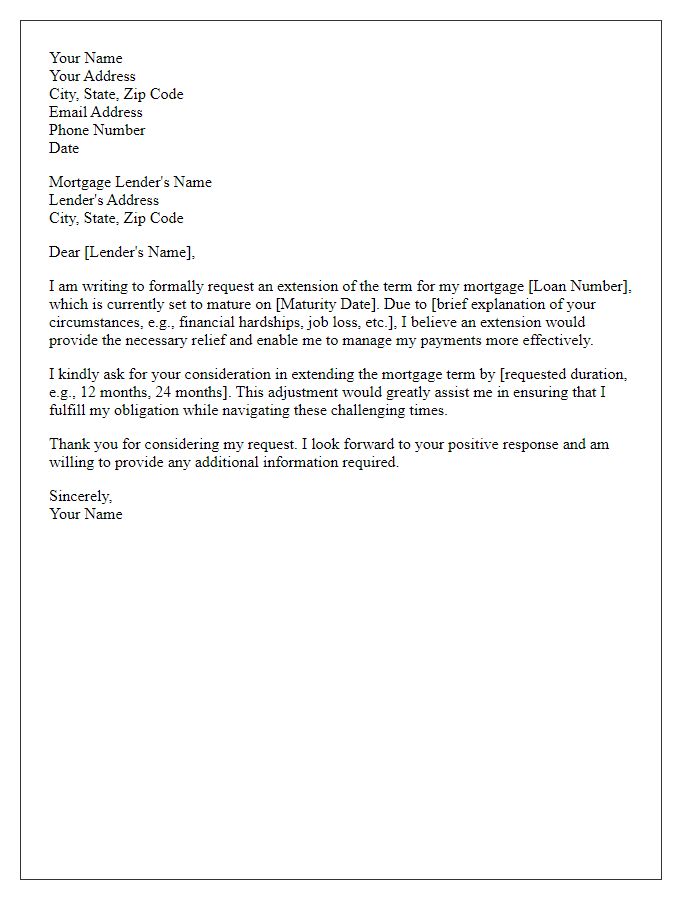

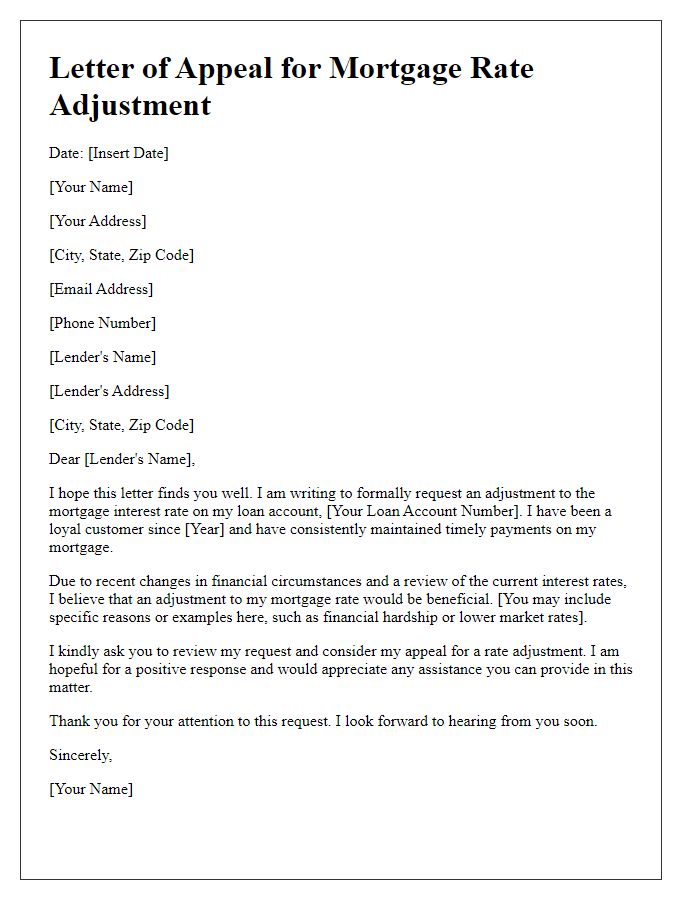

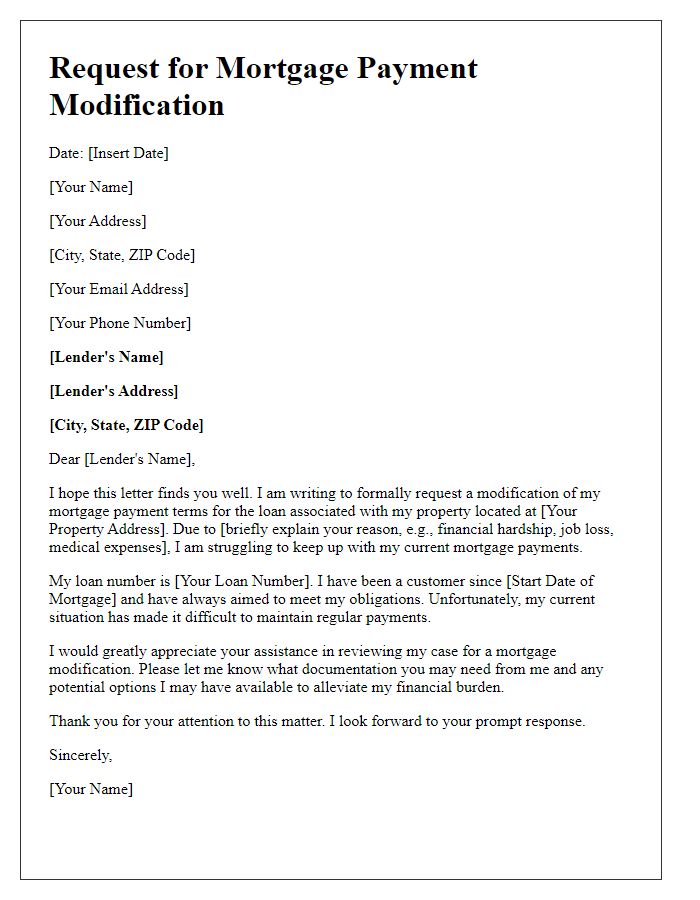

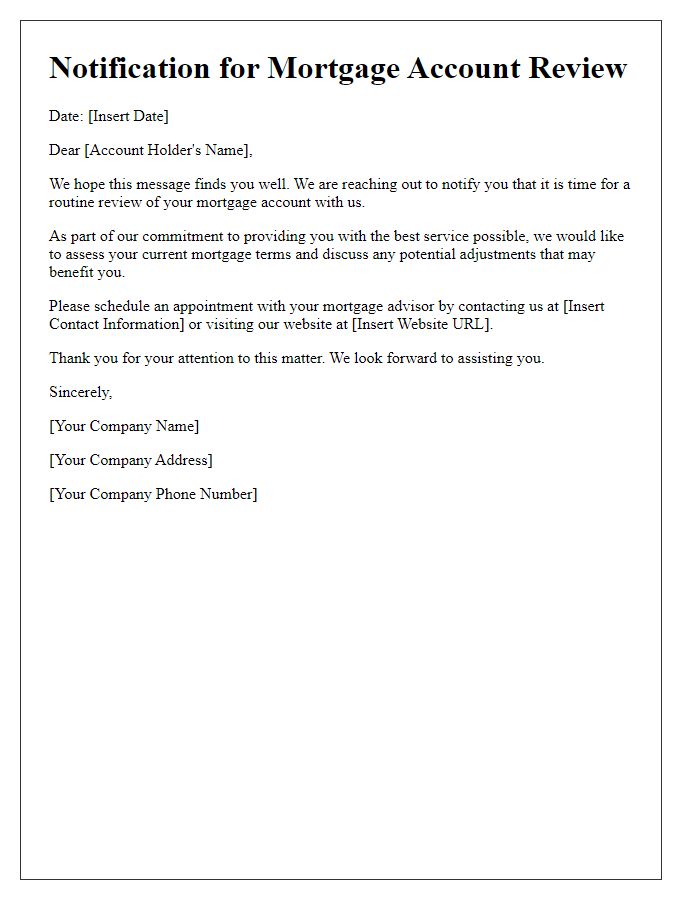

The mortgage amendment process involves clear borrower and lender information to establish responsibility and facilitate communication. The borrower, typically a private individual or joint owners, should include full names, contact details, and the mortgage account number associated with the home loan, which can be at financial institutions like Wells Fargo or Bank of America. The lender, a bank or mortgage company, must provide business name, address, and contact information for the loan officer or department handling mortgage amendments. Clarity in these details ensures accurate processing of the request for modifications in terms such as interest rates, payment schedules, or principal amounts.

Specifics of the requested amendment.

A mortgage amendment request typically involves alterations to the terms outlined in a mortgage agreement, such as interest rates, repayment schedules, or loan amounts. Homeowners often seek these modifications due to financial changes, such as loss of income or fluctuating market conditions. For example, if a homeowner wishes to request a reduction in their mortgage interest rate from 4% to 3.5%, they might cite current economic indicators, such as the Federal Reserve's decisions and trends in the housing market. This request would specify the loan number, property address, and detailed reasons for the change, emphasizing the current financial situation, including any job loss or significant expenses that have arisen. By providing the lender with supporting documentation, such as pay stubs or bank statements, and explaining the importance of the amendment for financial stability, the homeowner increases the likelihood of approval for the modification.

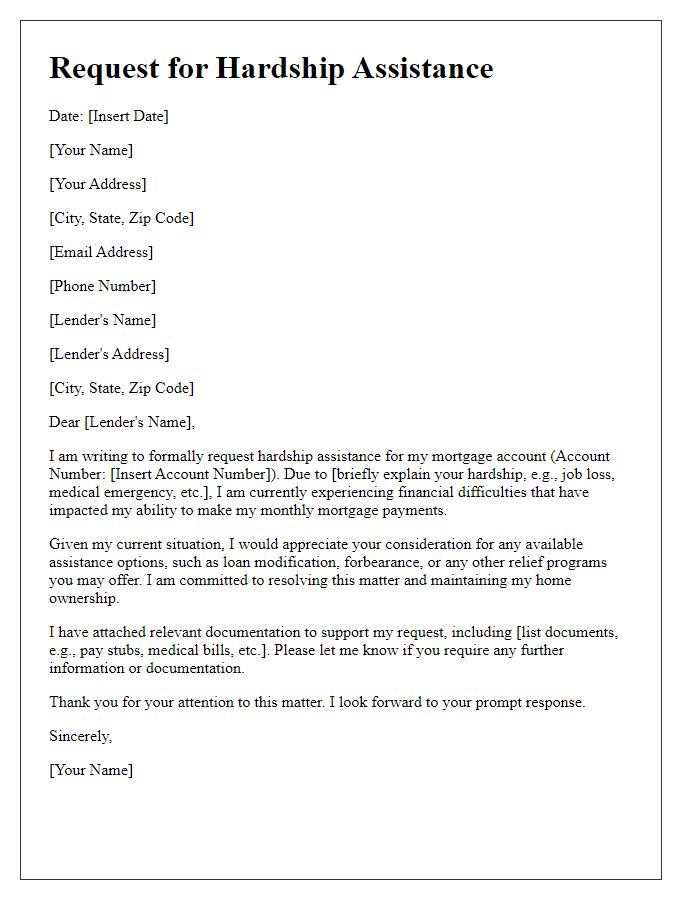

Justification for the amendment request.

A mortgage amendment request can be justified by various factors impacting the original agreement. First, changes in financial circumstances, such as job loss or reduced income, may necessitate a revision of payment terms to avoid default. Second, fluctuations in interest rates could prompt a borrower to seek a lower fixed-rate mortgage, provided current rates are more favorable than the original loan's adjustable rate. Additionally, improvements in property value can warrant a refinancing opportunity, enabling access to equity for home renovations or debt consolidation. Furthermore, significant changes in family dynamics, such as divorce or the birth of a child, may require an adjustment in financial obligations tied to the mortgage. Each of these factors provides a solid foundation for a request for amendment from the lender, aiming for mutually beneficial terms that reflect the current economic realities of the borrower.

Current mortgage terms versus proposed terms.

Current mortgage terms often reflect the original agreement between a borrower and lender, detailing aspects such as interest rates (which can vary significantly, typically ranging from 3% to 7% depending on market conditions), loan duration (commonly 15 to 30 years), and monthly payment obligations. Proposed terms for a mortgage amendment might include a lower interest rate, potentially decreasing monthly payments, or alterations in loan length, which can affect total interest paid over the life of the loan. Additionally, borrowers may request adjustments to principal repayment structures or a switch from fixed-rate to adjustable-rate mortgages, which have different implications for future payments based on market fluctuations. Understanding these terms is crucial for making informed financial decisions that can enhance overall financial stability.

Supporting documents or financial evidence.

A mortgage amendment request requires comprehensive documentation to support the application process. Essential documents include income verification, such as recent pay stubs (preferably from the last two months) or tax returns for self-employed individuals covering the past two years. Furthermore, detailed information on current debts, like credit card statements showing balances or loan statements for personal loans, is crucial. Homeowners should also provide documentation related to property insurance, such as a copy of the homeowner's insurance policy and recent premium notices. A comprehensive list of monthly expenses, including utilities and other recurring payments, will further strengthen the case for the amendment. Additionally, any relevant correspondence with the mortgage lender must accompany these documents to ensure clarity and facilitate the review process, leading to a more favorable outcome.

Comments