Welcome to our guide on reaffirming your mortgage agreement! If you're navigating the complexities of mortgage reaffirmation, you're not aloneâmany find this process daunting yet crucial for their financial well-being. In this article, we'll break down the essentials of reaffirmation, ensuring you understand its benefits and implications for your future. So, stay with us as we explore this important topic further!

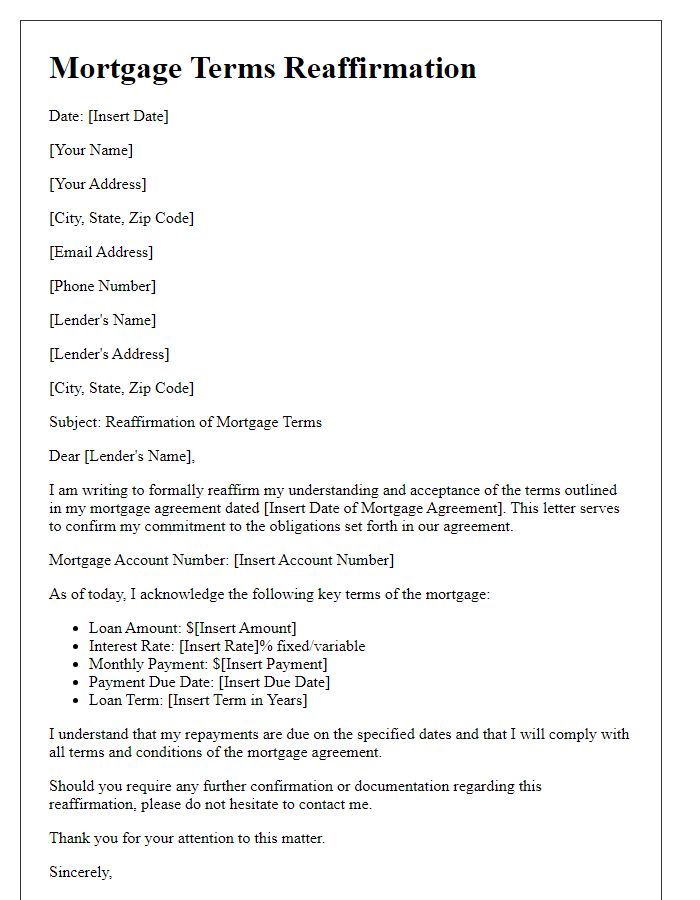

Loan Details and Terms

The reaffirmation of a mortgage agreement is a significant legal step for borrowers and lenders, typically requiring specific loan details and terms to be outlined clearly. Key components of the mortgage agreement include the principal balance of the loan (often hundreds of thousands of dollars), the interest rate (which might fluctuate from 3% to 6% annually), repayment term (commonly 15 to 30 years), and monthly payment amounts (ranging generally from $1,200 to $2,500). Additionally, borrowers should verify details such as the property address (located in a specified ZIP code) and any associated fees or penalties for early repayment. Understanding these terms is essential, especially in the context of bankruptcy or other financial circumstances, to ensure all involved parties maintain a clear and legally binding agreement. Proper documentation is vital, subjecting any changes to the scrutiny of mortgage regulations and consumer protection laws based on jurisdiction.

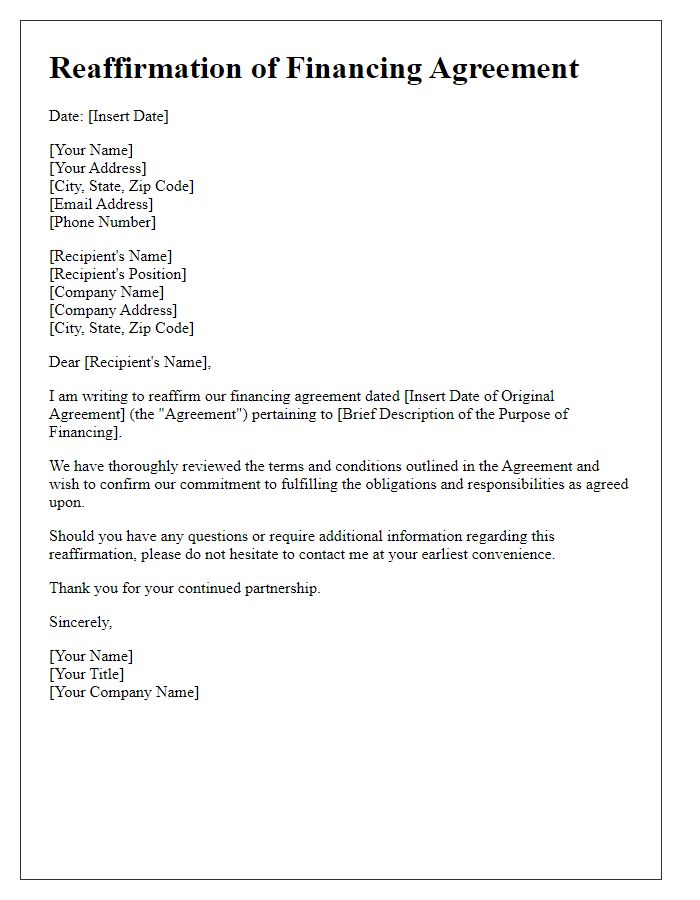

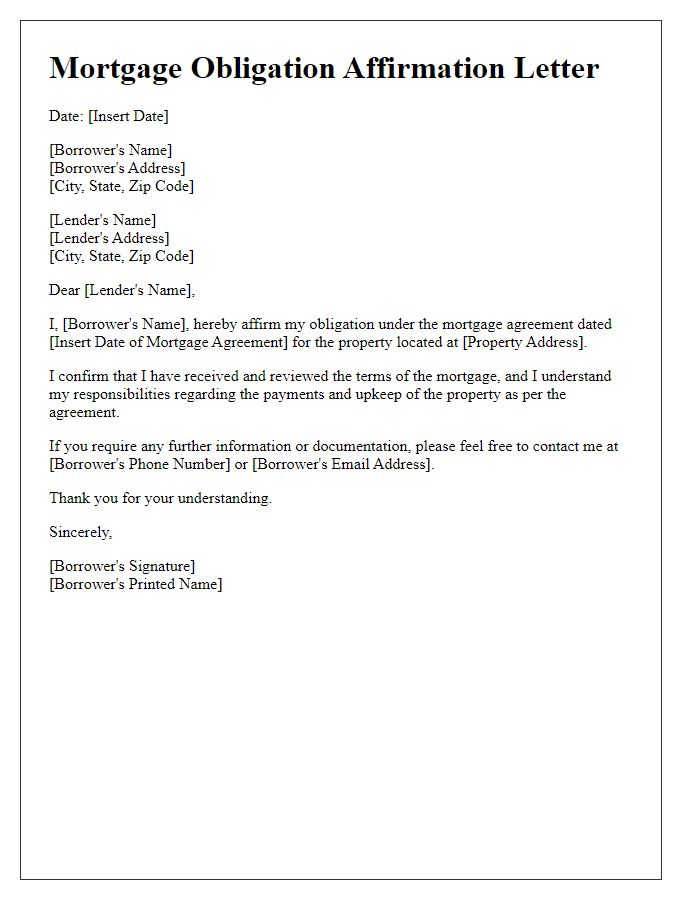

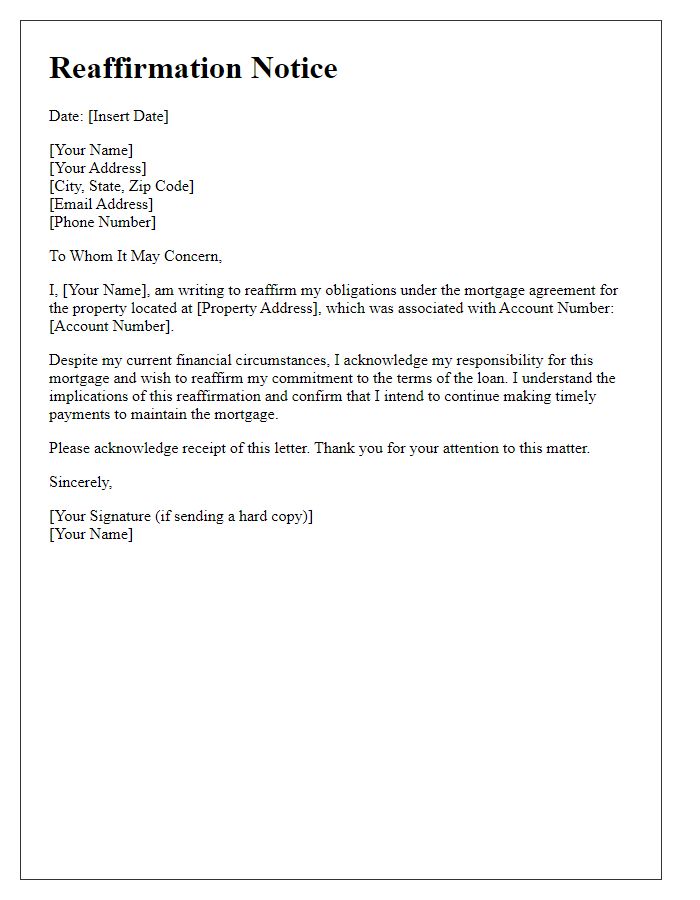

Borrower's Identification and Consent

The reaffirmation of a mortgage agreement is a crucial step in the legal process that allows borrowers to maintain personal liability for the mortgage debt after filing for bankruptcy. Borrowers must provide their identification details, including full name, Social Security number, and property address, to validate their identity and confirm their ownership of the property. The consent section requires the borrower's signature, indicating their understanding and agreement with the terms of the reaffirmation. This legally binding document often requires notarization to ensure authenticity and may involve additional disclosures regarding ramifications of reaffirming the debt, such as potential implications on credit score or future financial obligations.

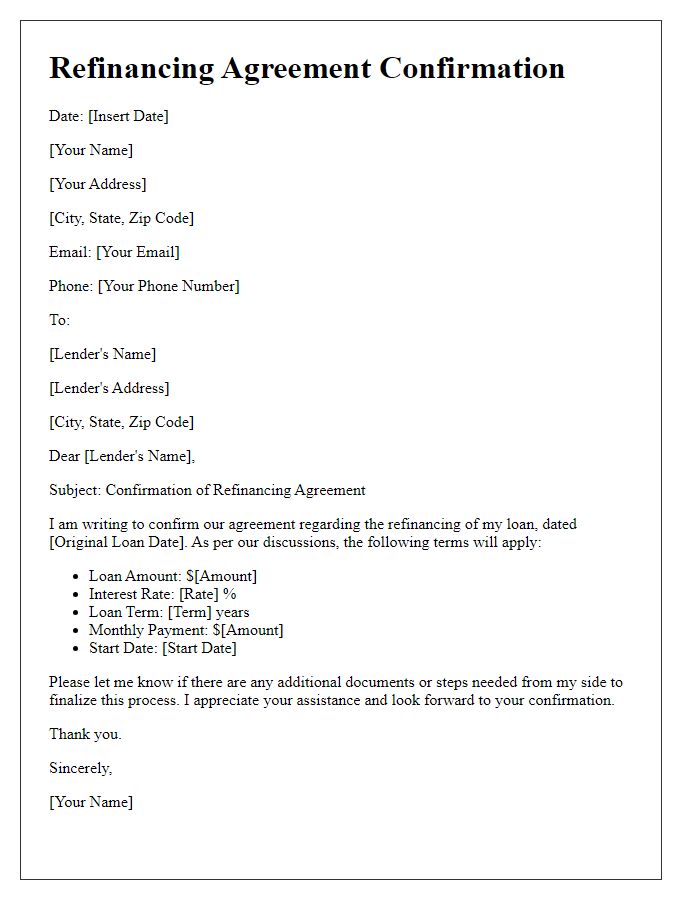

Interest Rate and Payment Schedule

Mortgage agreements, specifically regarding interest rates and payment schedules, are critical for homeowners and financial institutions. An adjustable-rate mortgage may initially offer lower interest rates, often starting around 3% annually, which can adjust periodically based on the LIBOR rate (London Interbank Offered Rate). Payment schedules typically follow a monthly structure, where homeowners might pay a principal amount alongside accrued interest. For instance, a 30-year fixed mortgage might show a breakdown of a $200,000 loan with payment amounts around $1,200 per month, including taxes and insurance. It is essential to review documents for stipulated terms, potential penalties for late payments, or changes in interest rates that can occur after the 5 or 10-year adjustment periods, impacting long-term affordability. Understanding these elements ensures financial preparedness and stability throughout the mortgage term.

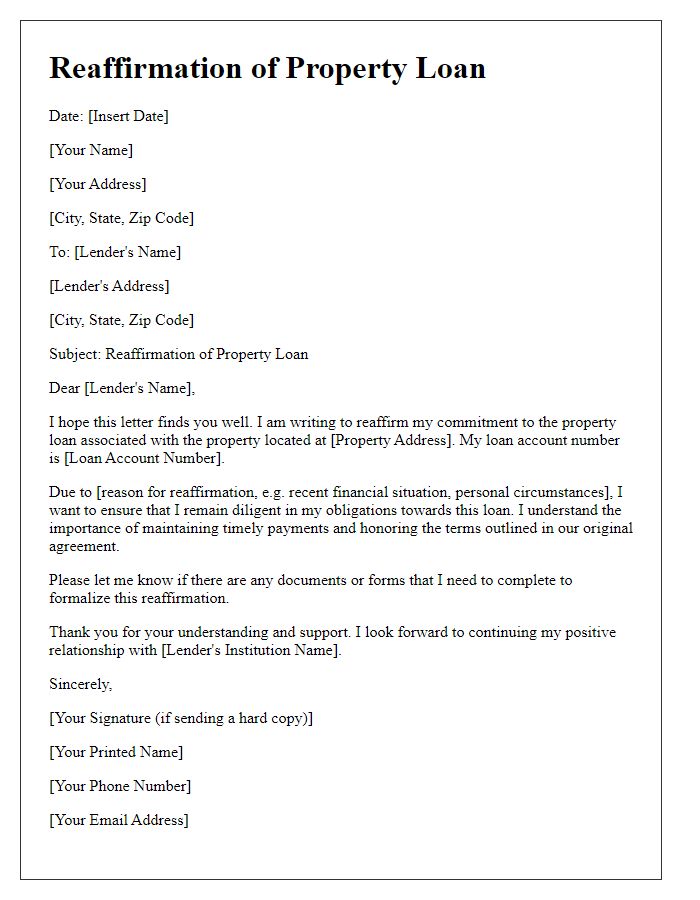

Lender's Obligations and Rights

Lenders possess numerous obligations and rights within the framework of a mortgage agreement, which is a legally binding contract between the borrower (homeowner) and the lender (financial institution). Lenders must adhere to specific regulations set forth by the Consumer Financial Protection Bureau (CFPB), ensuring transparency in disclosing terms, conditions, and fees associated with the mortgage. Timely and accurate communication regarding payment schedules and any potential changes in interest rates are imperative responsibilities. The lender also retains the right to initiate foreclosure proceedings if the borrower defaults on payments, which could occur after a grace period typically lasting 15 to 30 days. Furthermore, lenders have the obligation to provide an annual statement detailing the borrower's payment history, current balance, and any escrow adjustments related to property taxes or homeowners insurance. Understanding these obligations and rights helps safeguard the interests of both parties in the mortgage transaction.

Legal Compliance and Jurisdiction

The reaffirmation of a mortgage agreement involves significant legal considerations, including compliance with jurisdictional regulations and adherence to specific laws governing debt obligations in various regions. In the United States, for instance, reaffirmation agreements must comply with the Bankruptcy Code, specifically Section 524(c), which requires a signed agreement, court approval, and a clear understanding of the borrower's obligations. Additionally, jurisdictional policies, such as those applicable in California or New York, may impose unique requirements regarding disclosure and the potential consequences of reaffirmation. Legal counsel is often advisable to navigate the complexities of federal and state laws, protecting the rights of all parties involved while ensuring that the reaffirmation process meets the standards set forth by the relevant courts.

Comments