Hello there! If you've recently received an update regarding your property tax payment, you're not alone in navigating this important aspect of home ownership. Understanding the implications and details of these changes can be quite the task, but it's crucial for managing your finances effectively. Our guide will break down everything you need to know about the latest updates, ensuring you stay informed and prepared. Ready to dive into the details? Let's explore more!

Recipient Information

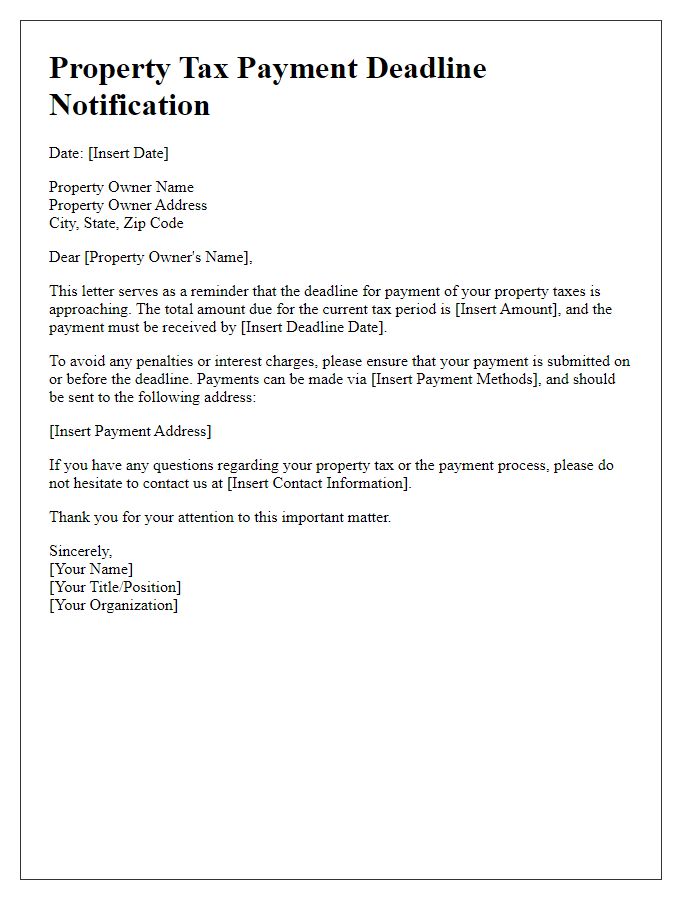

Property tax payment updates serve as crucial communication for homeowners and municipal offices. Property taxes, typically assessed annually, vary significantly across regions such as Cook County, Illinois, where the tax rate can reach 2.25%. Payment deadlines, often in the spring and fall, play a critical role in budgeting for local services such as education and public safety. Property owners must monitor changes in assessment values, influenced by market trends in neighborhoods like Park Slope, Brooklyn, where recent gentrification has increased property values substantially. Keeping track of payment methods, whether through online portals or in-person checks at city offices, ensures compliance and avoids penalties, which can accumulate at rates of 1.5% per month.

Payment Details

Property tax payment updates are essential for homeowners and property investors to manage their financial obligations. The annual property tax assessed by local governments, such as counties or municipalities, varies widely depending on market valuations and local tax rates (ranging from 0.5% to over 2%). Details of the recent payment, including date, amount (often several thousand dollars), and payment method (such as online bank transfer or check), are crucial for record-keeping. Delinquency in these payments can incur penalties, often at rates of 1% per month, affecting property ownership and credit standing. The understanding of payee information, such as the local tax authority or treasurer's office, ensures accurate processing and timely updates.

Property Identification

Property tax payment updates are essential for homeowners to maintain compliance and avoid penalties. Property Identification Number (PIN) serves as a unique identifier assigned to each property, crucial for tracking tax obligations. Local tax authorities often send notices upon changes in tax rates or assessed values, impacting payment amounts. Understanding the due dates, typically set annually or semi-annually, helps property owners manage their finances effectively. Failure to update contact information can lead to missed notifications, resulting in potential late fees or interest charges, emphasizing the importance of timely communication with local tax offices.

Due Date and Amount

Property tax payments are crucial for maintaining local services and infrastructure. In Harris County, Texas, the upcoming due date for property tax payments is January 31, 2024. Homeowners should prepare to pay an estimated amount of $3,500, depending on assessed property values. Timely payments help avoid penalties, which can accrue at a rate of 6% per month after the due date. Local government services, including emergency response teams and public education funding, rely heavily on these tax revenues to operate and improve community standards. Remember, payment methods often include online transactions, mail, or in-person visits to the local tax office located at 1001 Preston St, Houston, TX 77002.

Contact Information for Queries

Property tax payments are crucial for maintaining local government services. Property owners need to stay updated on their tax obligations to avoid penalties. For inquiries regarding property tax payments, residents can reach the local tax office at 123 Main Street, Springfield, with a contact number of (555) 012-3456. The office operates Monday through Friday from 8:30 AM to 5:00 PM, providing assistance and clarification on payment methods and due dates. Additionally, an online portal is available, allowing property owners to view their tax statements, make payments, and access historical records conveniently.

Comments