Are you looking to simplify the process of releasing a lien? A lien release confirmation letter is an essential document that not only provides clarity but also protects your interests. By understanding the key components of this letter, you can ensure a smooth transaction and avoid potential complications. So, let's dive deeper into the specific elements you'll need to include to make your lien release effective and professional!

Header with sender's and recipient's information

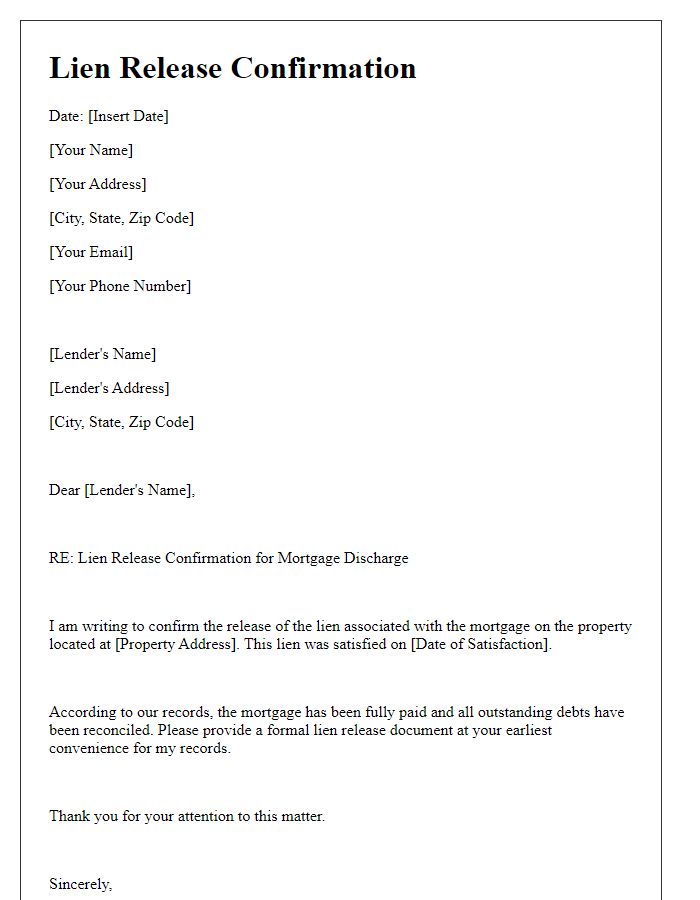

The process of confirming lien release involves specific legal terminology and documentation. A properly executed lien release protects the interests of parties involved by ensuring that the creditor relinquishes any claim to the collateralized property. This document should include crucial details such as the debtor's information (name, address), the description of the secured asset (vehicle identification number, property address), the original lien amount, and the date the lien was recorded. Confirmation of the lien release typically requires signatures from authorized representatives, often notarized, to provide legal validity and prevent future disputes. Properly recording this release with the appropriate governmental entity, such as a county recorder's office, finalizes the process and updates public records accordingly.

Clear statement of lien release

A lien release confirmation serves as a formal declaration that a lien placed on a property has been lifted. This document usually includes essential details such as the property owner's name, the lien holder's information, and the property's legal description, including street address and parcel number. The release statement explicitly states that the lien has been satisfied or canceled, often including a specific date when this occurred. Additionally, it may reference any relevant lien numbers or account details tied to the original agreement, thereby ensuring clarity for all parties involved. It is an important instrument in real estate transactions, providing assurance to potential buyers that the property is free of claims or encumbrances.

Description of the property or asset

A lien release confirmation serves as a crucial legal document indicating that a debt secured by a lien on a specific property or asset has been paid off or satisfied. This confirmation typically includes detailed descriptions of the property involved, such as the physical address (including street number, city, and state), legal description (a precise description found in property deeds), and identification number (like a tax parcel ID). In real estate contexts, this may encompass residential properties (single-family homes, townhouses) or commercial properties (office buildings, retail spaces). For vehicles, the description would entail the make, model, year, and Vehicle Identification Number (VIN). Clear identification of the lienholder (the party that had the legal claim) is also essential, ensuring that the lien release correctly reflects all obligations fulfilled by the borrower or property owner.

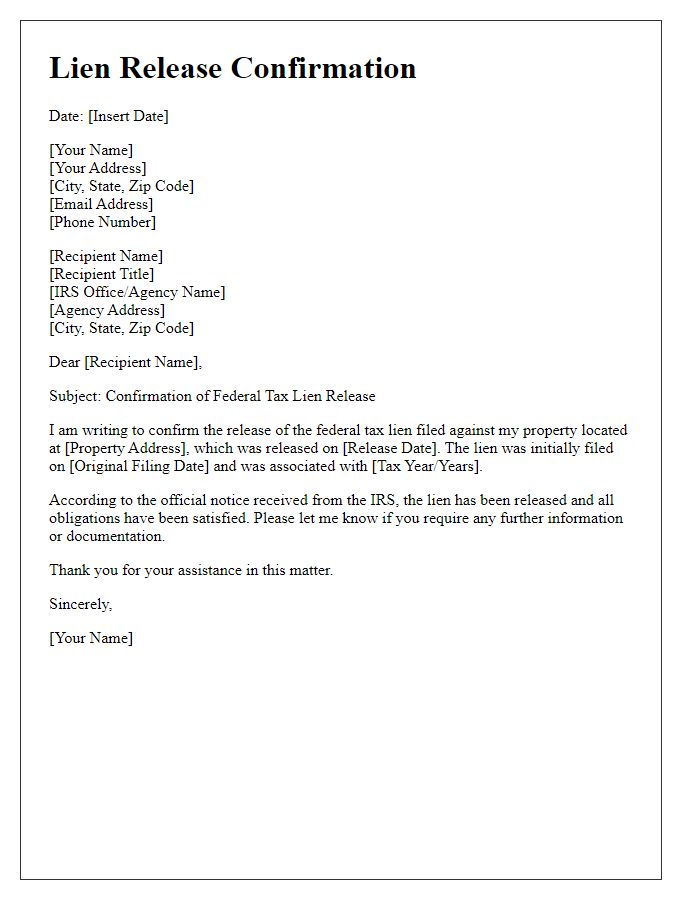

Confirmation of debt resolution

Debt resolution culminates in lien release confirmation, signifying the successful settlement of outstanding financial obligations. The lien, a legal claim placed on a property or asset, is formally discharged upon payment completion or agreement fulfillment. Documentation includes a lien release form, typically recorded with the appropriate county office, ensuring transparency and legal standing. Lien confirmation safeguards the borrower's ownership rights, allowing freedom of transaction regarding the formerly encumbered asset. Improvements in credit rating, post-resolution, can facilitate future borrowing opportunities, enhancing financial stability. Essential to this process is the verification of payment evidence, often provided through bank statements or receipts, ensuring all parties acknowledge the debt closure effectively.

Contact information for further inquiries

A lien release confirmation document serves as an official acknowledgment of the removal of a lien on a property or asset. It typically includes vital details such as the name of the lien claimant, often a bank or financial institution, the debtor's name, the specific property description, and the date the lien was satisfied. For further inquiries, individuals may need to contact the lien claimant or a designated representative, including direct phone numbers and email addresses, to ensure clear communication regarding the terms of the release or any follow-up actions required. Ensuring that all relevant identification numbers related to the lien, such as the account number or property parcel number, are included can facilitate efficient resolution of any outstanding questions.

Letter Template For Lien Release Confirmation Samples

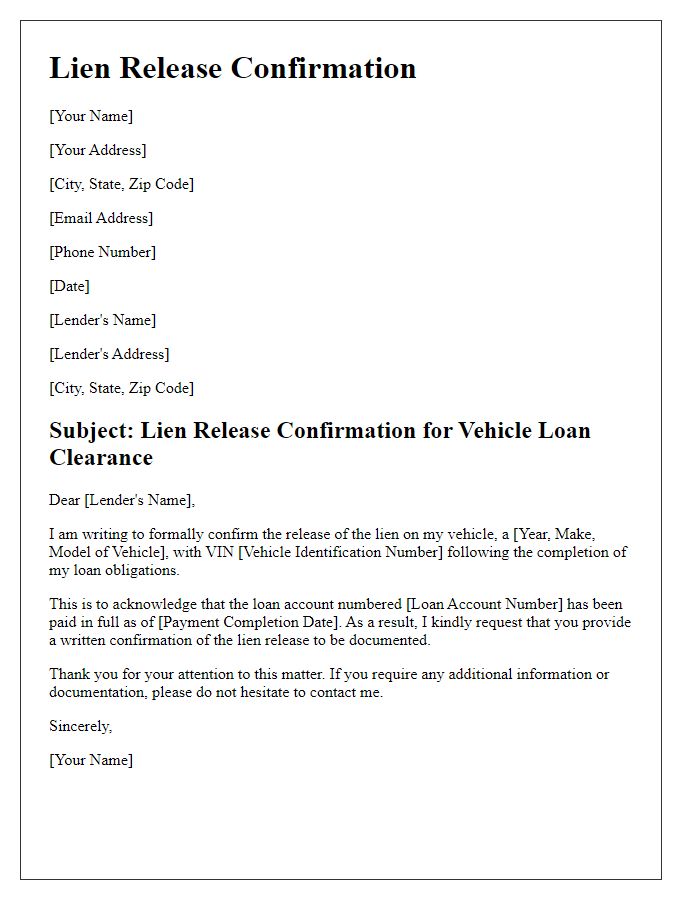

Letter template of lien release confirmation for vehicle loan clearance.

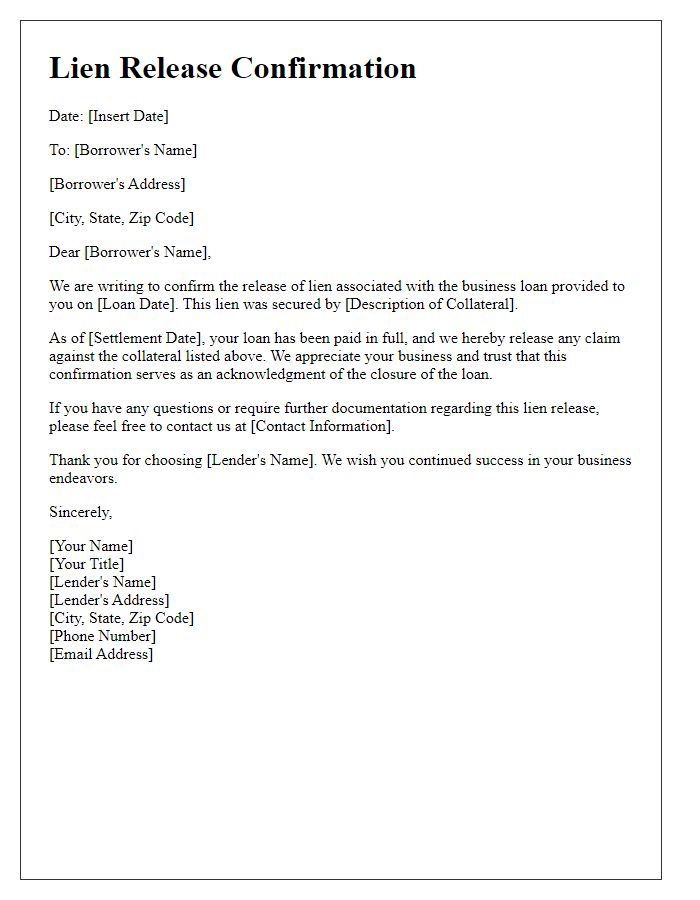

Letter template of lien release confirmation for business loan settlement.

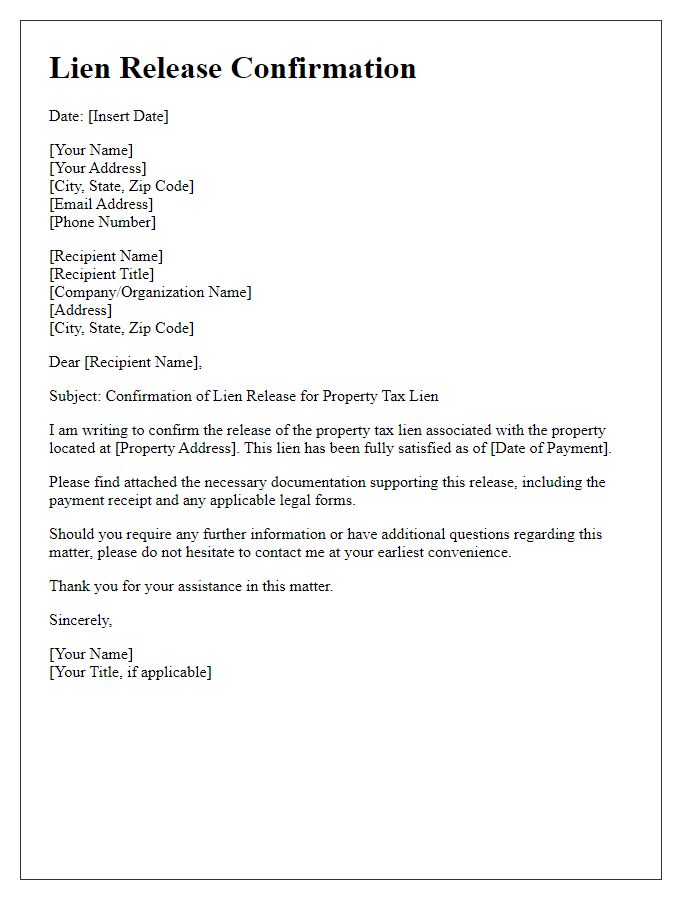

Letter template of lien release confirmation for property tax lien removal.

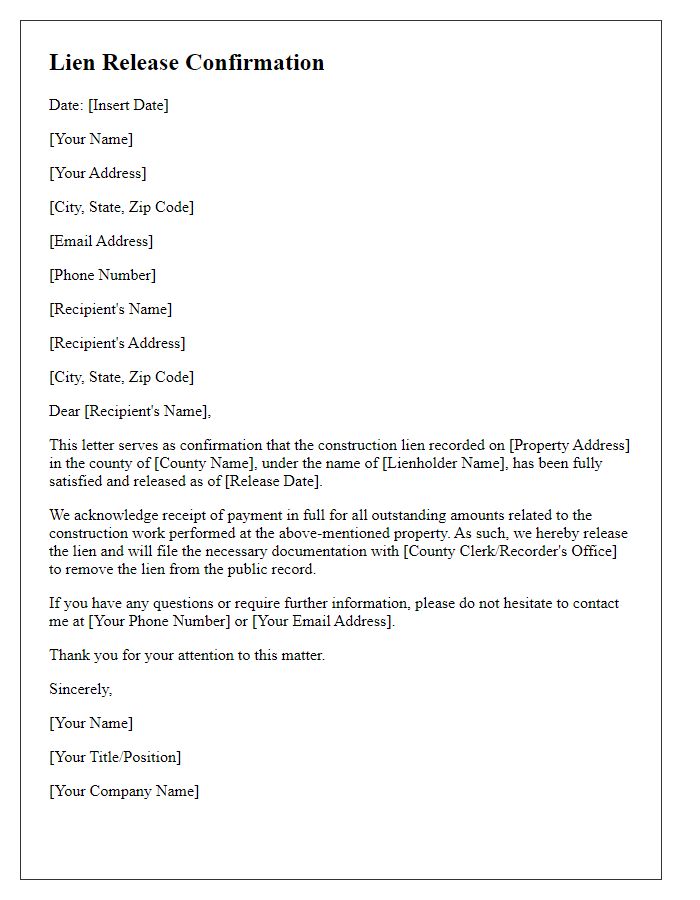

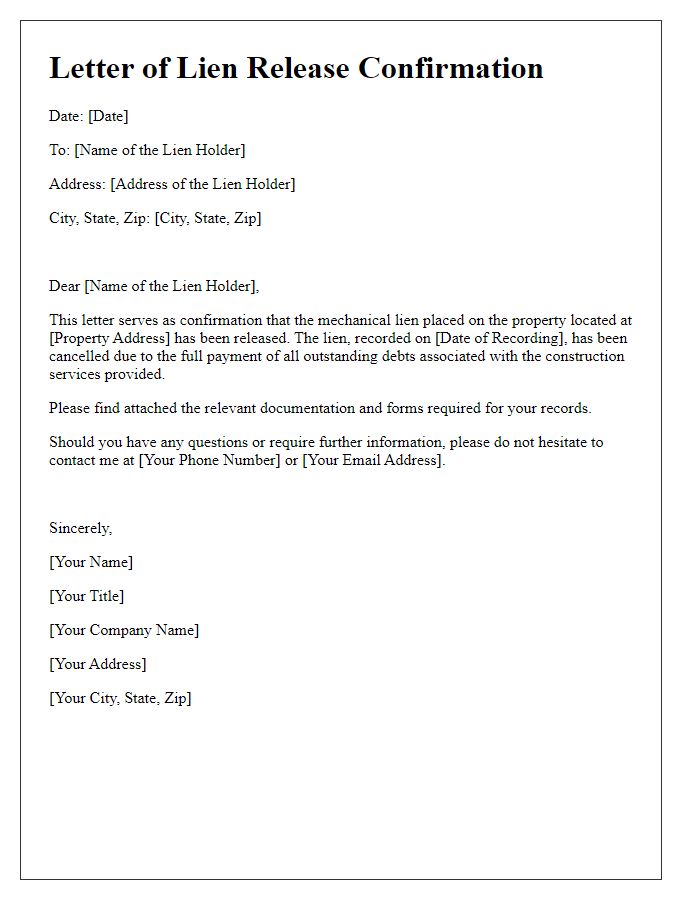

Letter template of lien release confirmation for construction lien satisfaction.

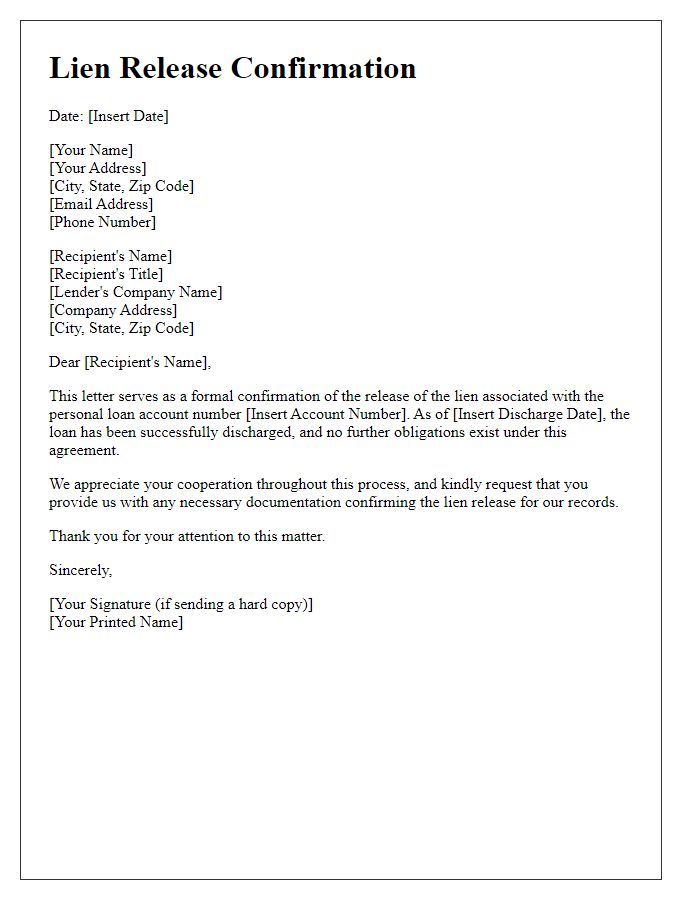

Letter template of lien release confirmation for personal loan discharge.

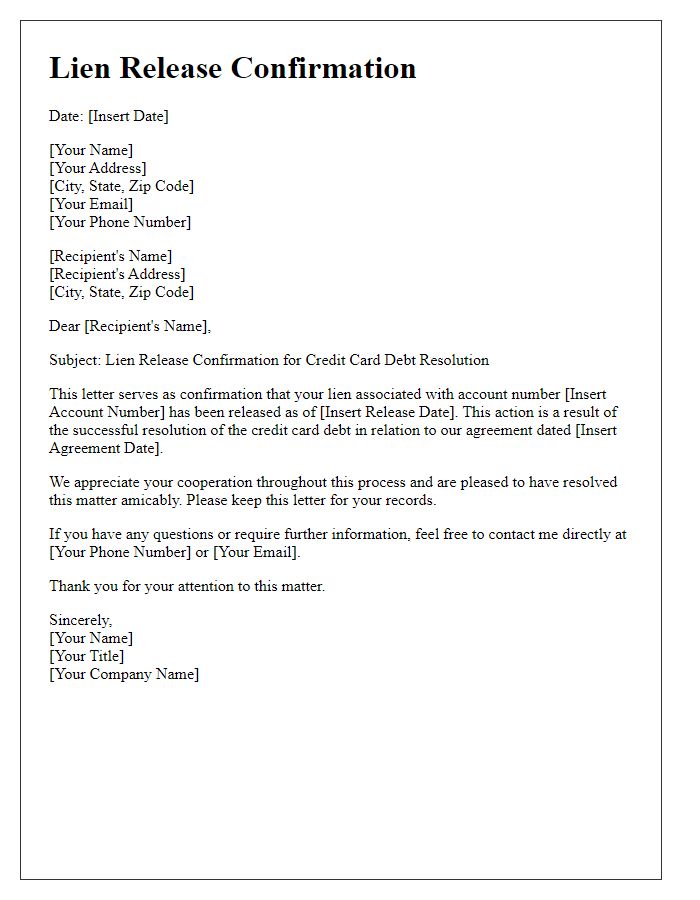

Letter template of lien release confirmation for credit card debt resolution.

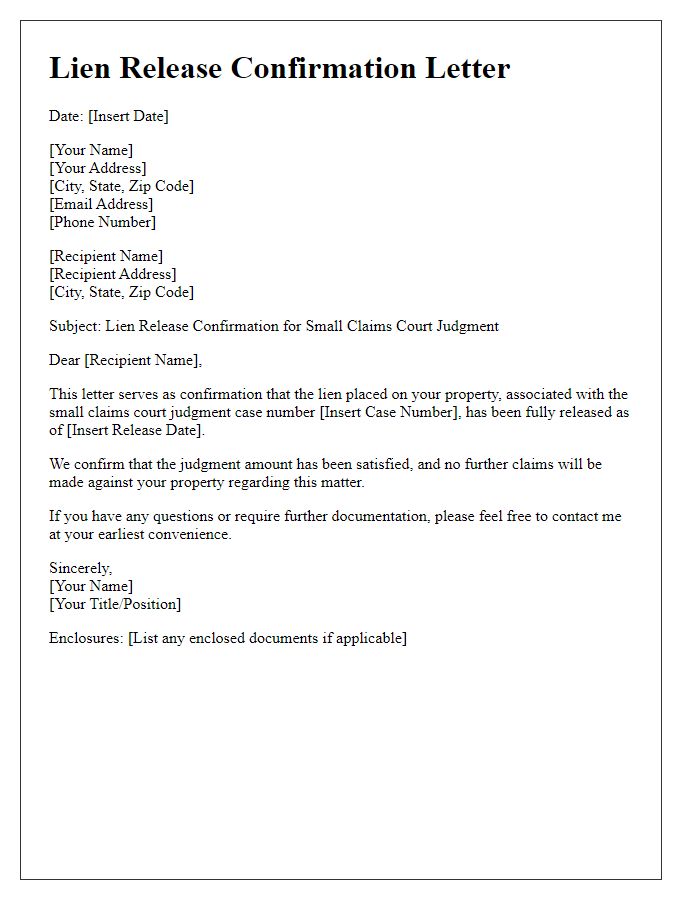

Letter template of lien release confirmation for small claims court judgment.

Letter template of lien release confirmation for mechanic's lien cancellation.

Comments