If you're facing the stress of managing overdue loans, you're not alone. Many people experience financial hiccups that can affect their repayment timelines. At this stage, it's essential to understand your options and how to address your delinquency effectively. Keep reading to discover helpful tips and resources to get back on track with your financial commitments.

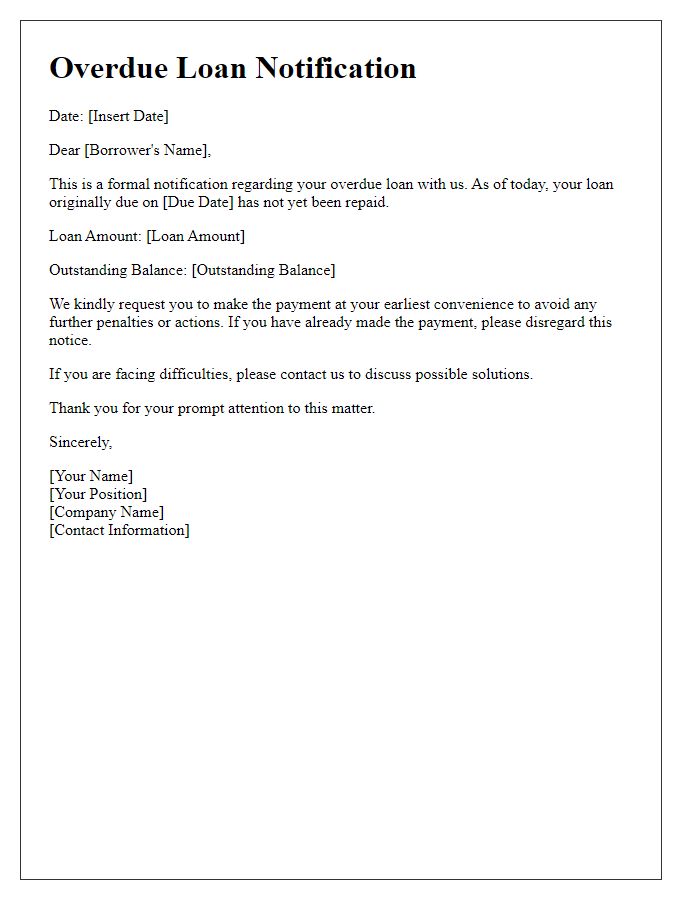

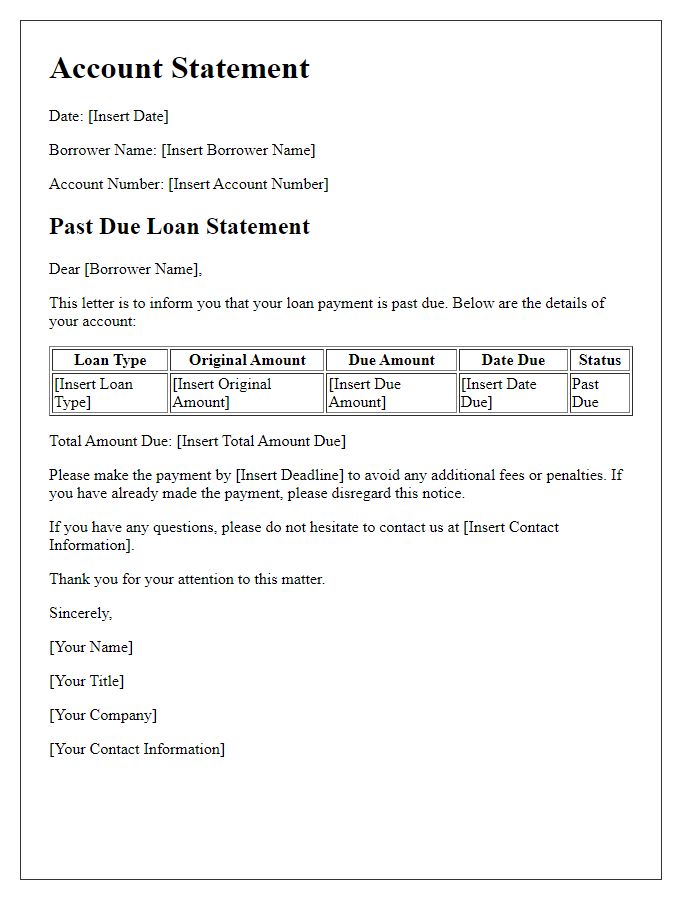

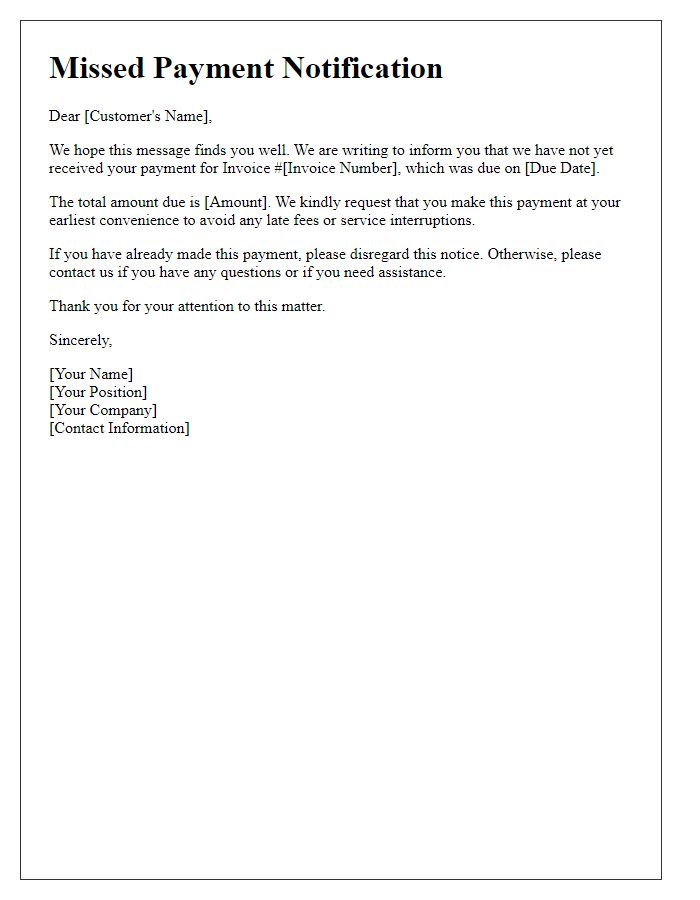

Account Details and Reference Number

The loan delinquency notice highlights crucial account details, such as account number 123456789 and reference number XYZ987654321. This communication outlines the outstanding payment status, reflecting a delay of 30 days beyond the due date for installment payment originally scheduled on September 15, 2023. The outstanding balance of $1,500 remains unpaid, prompting urgent attention to prevent further penalties or late fees. The notice emphasizes the importance of prompt resolution to avoid potential legal actions or negative impacts on the borrower's credit score within the next reporting cycle of the major credit bureaus.

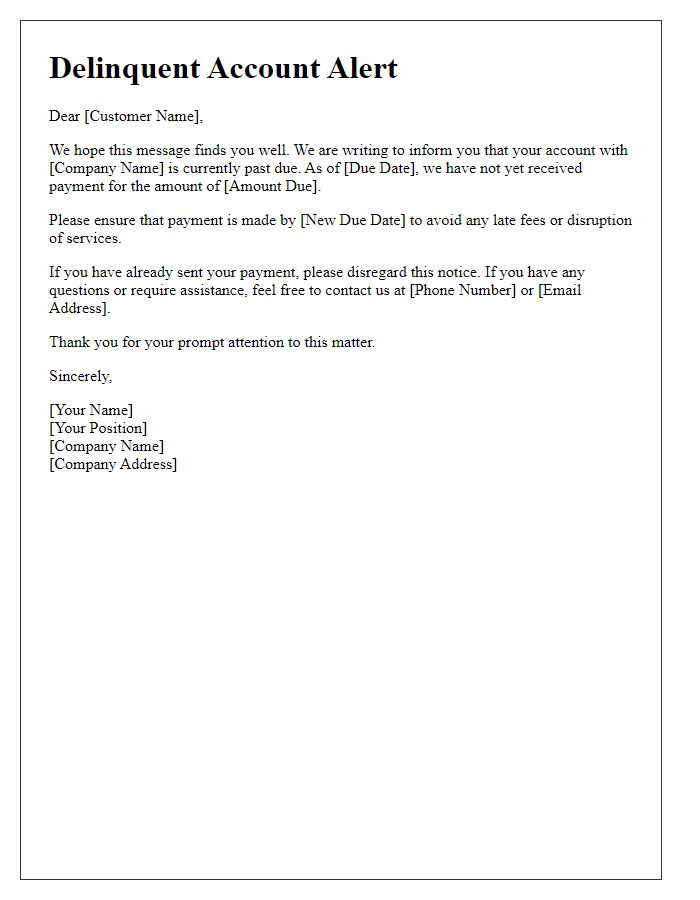

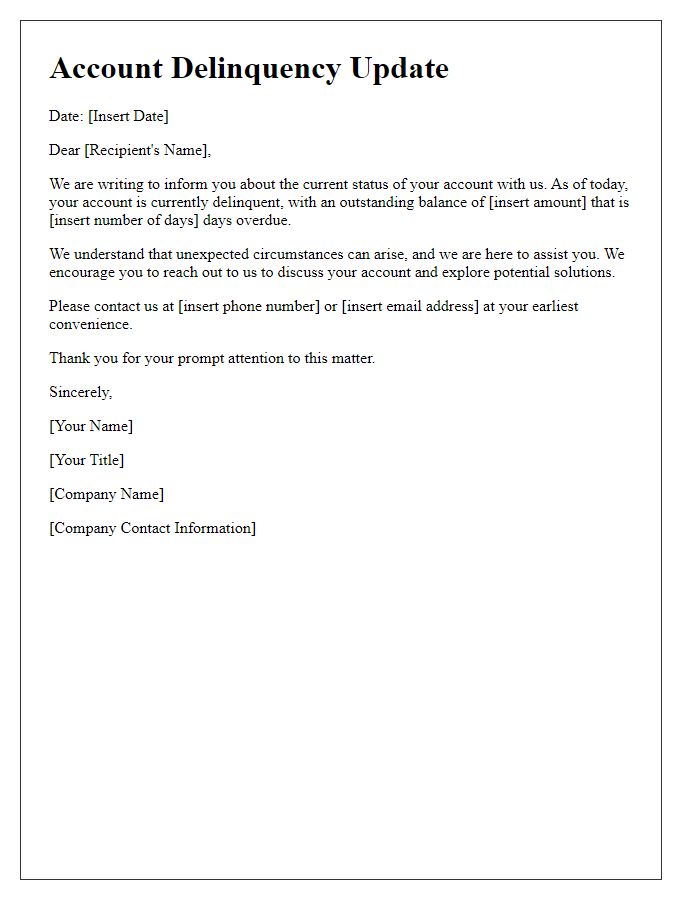

Description of Delinquency Status

Loan delinquency refers to the status of a borrower failing to repay a loan as per the agreed payment schedule. Delinquency often begins after a missed payment, typically ranging from 30 days to 90 days after due dates are established. This status can have significant repercussions, including late fees (often 1-5%, depending on the lender), increased interest rates on outstanding balances, and potential damage to credit scores (lowered by 100 points or more). Financial institutions report delinquent accounts to credit bureaus, impacting the borrower's credit report and future borrowing capabilities. Continued delinquency may lead to collections involvement, which can escalate the issue into legal action or repossession of secured assets. Timely communication with lenders is crucial to mitigate these consequences and explore options such as repayment plans or loan modifications.

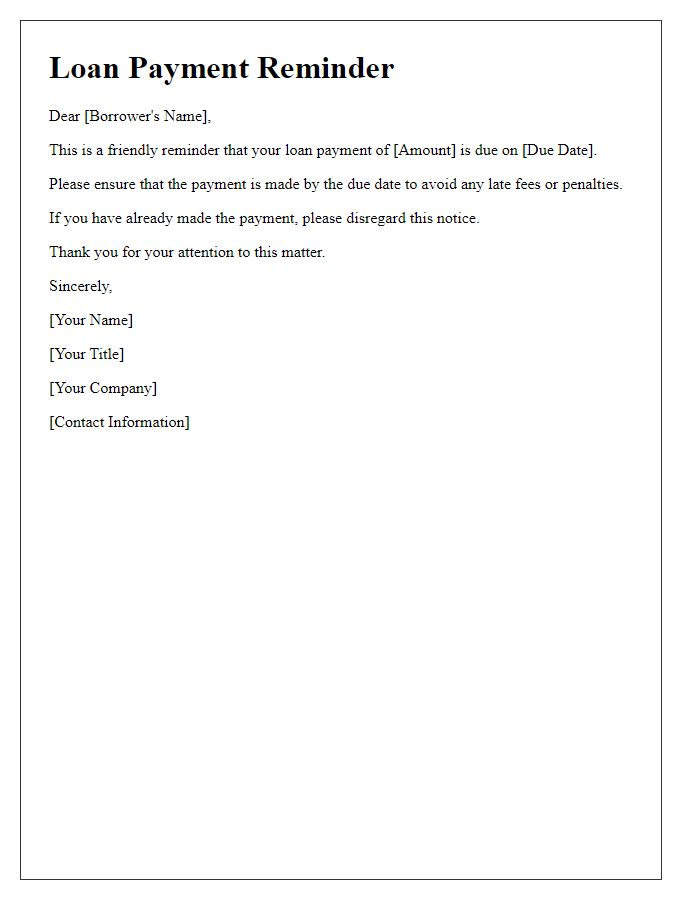

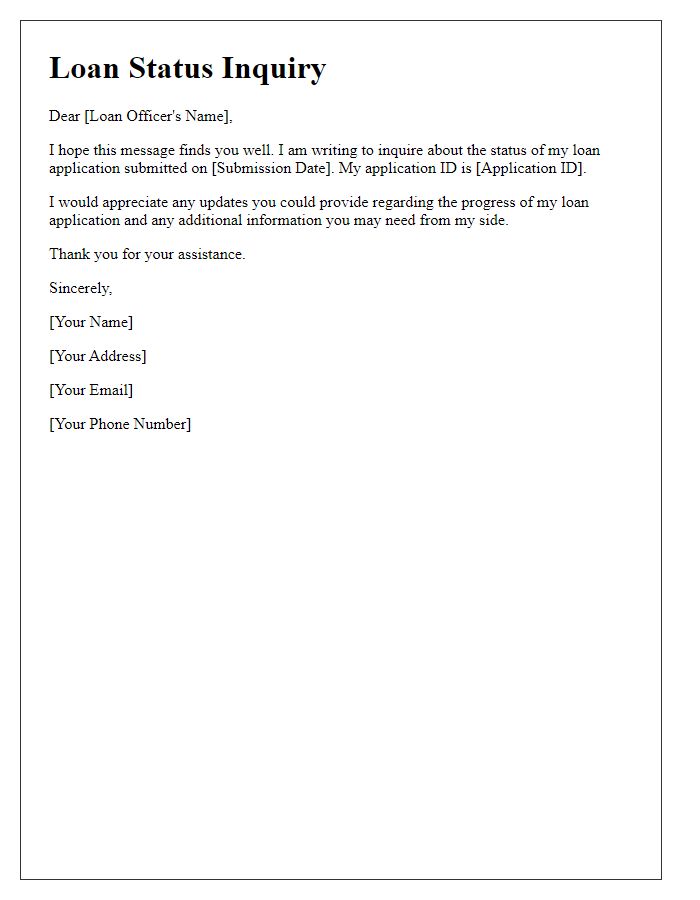

Specific Payment Amount Due

In a financial context, a loan delinquency notice serves as a critical communication to borrowers regarding the outstanding payment. A specific payment amount due, such as $1,200 for a personal loan taken from a bank like Citibank, highlights the urgency of the situation. The due date may be set for October 15, 2023, reflecting a 30-day grace period since the last payment was missed. This notice may also include potential fees, which could be around $50 for late payments, emphasizing the importance of prompt action to avoid further financial penalties. Moreover, contacting the loan officer's department at 1-800-555-0147 is recommended for any inquiries or arrangements.

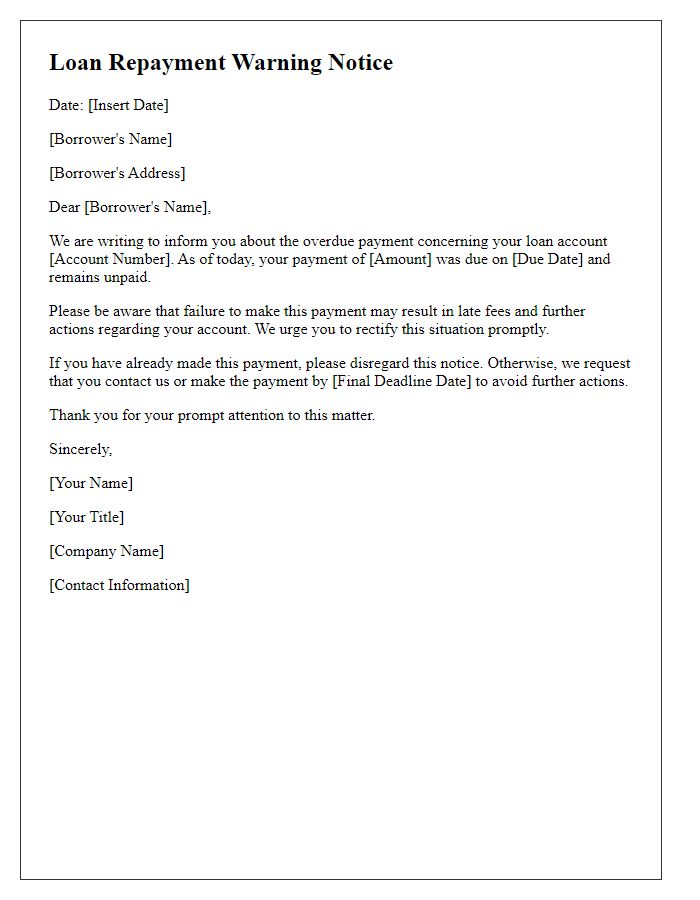

Payment Deadline and Consequences

Loan delinquency occurs when payments on borrowed sums are not made by the agreed-upon dates, often leading to financial penalties. A payment deadline, typically defined by the loan agreement, signals the last day to remit the due amount before further actions are taken. Consequences of delinquency may include late fees, which can be 5% of the missed payment amount, and a negative impact on credit scores, potentially reducing the score by 100 points or more. Lenders may initiate collection processes, which could involve contacting borrowers multiple times via email or phone, potentially escalating to legal measures if payments remain outstanding beyond 90 days. Moreover, depending on the loan terms, secured loans could lead to the repossession of collateral assets, like vehicles or property, threatening the borrower's financial stability.

Contact Information for Queries

Loan delinquency notices serve as formal communications to borrowers regarding overdue payments on secured financial obligations, such as personal loans or mortgages. Prompt notifications can prevent further financial complications for the borrower and help lenders manage risk. Key details in these notices typically include the original loan amount (often ranging from $500 to several hundred thousand dollars), outstanding balance (including interest and fees), due dates (usually at 30-day intervals), and contact information to resolve issues. The contact information section is crucial, providing borrowers with multiple communication channels, such as phone numbers (local or toll-free), email addresses, and physical addresses for direct correspondence. Immediate responses from borrowers can help coordinate repayment alternatives, potentially mitigating further action such as collections or legal proceedings.

Comments