Are you tired of paying for mortgage insurance that you feel you no longer need? Cancelling your mortgage insurance can not only lighten your financial load but also free up funds for other investments. In this article, we'll guide you through the necessary steps to make this process as straightforward as possible. So, let's dive in and discover how you can streamline your expenses and put more money back into your pocket!

Current policy details and reference numbers

Mortgage insurance cancellation requests require specific policy details and reference numbers for processing. Current policy details, including the policy number (e.g., MI123456789), mortgage account number (e.g., 01234567890), and the name of the insurance provider (such as U.S. Mortgage Insurance Corp.), must be clearly stated. Reference numbers related to previous communications (such as customer service ticket number 987654321) may also facilitate quicker processing. The effective date of the initial policy (like January 1, 2020) and the current loan balance (for example, $250,000) should be included to demonstrate eligibility for cancellation based on the required equity percentage (usually around 20%). Ensuring that these details are accurately provided supports a smoother cancellation process.

Borrower's full name and contact information

Mortgage insurance cancellation requires a formal request detailing the borrower's information, mortgage account number, and reasons for cancellation. This involves confirming that the mortgage balance has dropped below 80% of the home's appraised value, usually achieved through monthly payments or increased property value. The lender, typically a bank or financial institution, needs this request to process the petition. This cancellation can significantly reduce monthly expenses, providing buyers relief in lengthy loan terms, especially in favorable real estate markets. Proper documentation is essential to support claims for cancellation, such as recent home appraisals or payment history verification.

Reason for cancellation request

Mortgage insurance cancellation requests often stem from significant equity accumulation in the property. Homeowners frequently reach this point after their mortgage balance decreases due to consistent payments or increased home value, often influenced by favorable market conditions. For instance, if a property located in a growing neighborhood, such as Austin, Texas, appreciates by 10% annually, homeowners may surpass the 20% equity threshold generally required for policy cancellation. Additionally, refinancing opportunities can present themselves; many homeowners choose to refinance their mortgages at lower interest rates, which can also result in reaching the necessary equity levels. Documenting these changes is crucial, providing a clear rationale for the insurance cancellation request.

Proof of eligibility for cancellation (e.g., loan-to-value ratio)

Mortgage insurance cancellation eligibility is determined primarily by the loan-to-value (LTV) ratio. Homeowners, upon reaching an LTV of 80% or lower, can formally request cancellation of private mortgage insurance (PMI). This involves recalculating the current home value based on recent appraisals or sales of similar properties in the area. For example, in neighborhoods like Lakeside Estates, where average home prices have increased by 15% over the last year, homeowners may find their LTV ratio has improved significantly. Additionally, timely mortgage payments, meeting the required seasoning period of usually two years, bolster the case for cancellation. Documentation must include a detailed statement outlining the current LTV ratio, recent home valuation reports, and proof of payment history to support the cancellation request effectively.

Requested cancellation date and contact for confirmation

Mortgage insurance cancellation requests often require specifics for efficient processing. Homeowners typically seek to cancel their private mortgage insurance (PMI) when their loan-to-value (LTV) ratio drops below 80%, often after paying down 20% or more of the property's value. The requested cancellation date can vary, with many homeowners aiming for the completion of their current mortgage payment cycle. Homeowners should include their mortgage account number (usually found in loan documentation) and provide a reliable contact method, such as an email address or phone number, for confirmation of the cancellation request. This ensures effective communication and timely updates on the status of the cancellation.

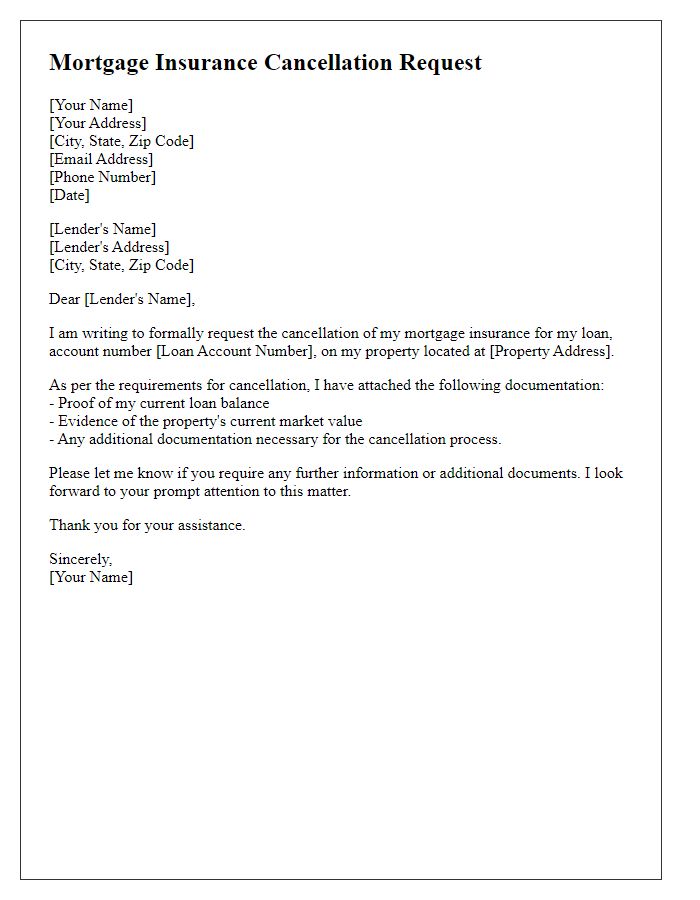

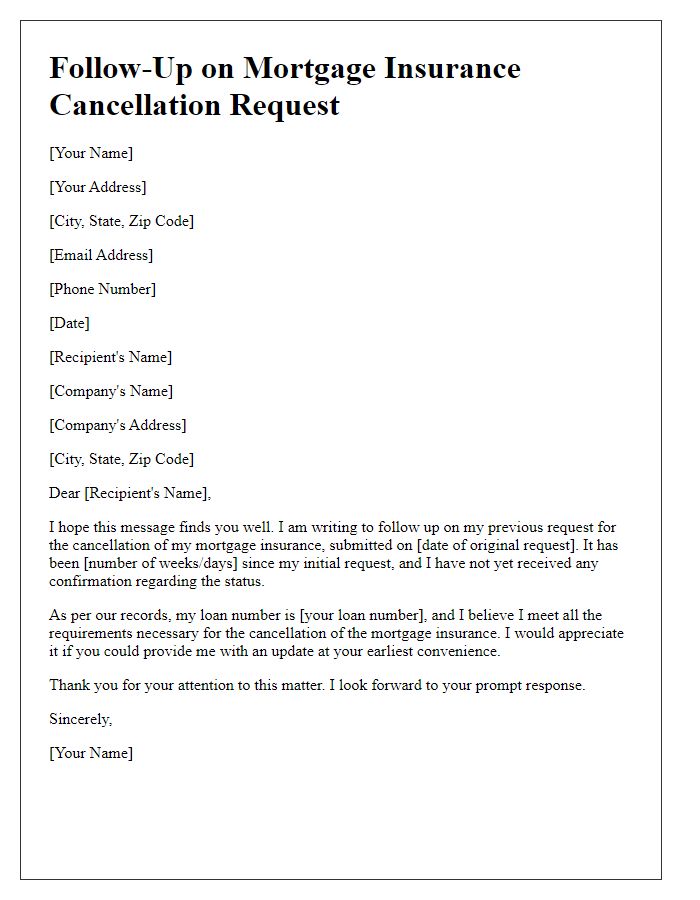

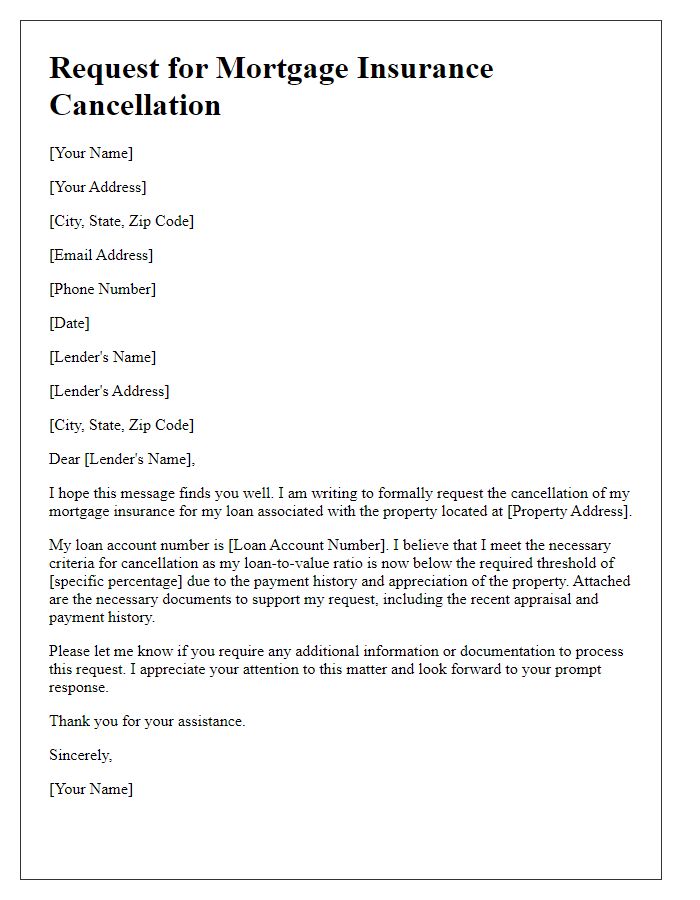

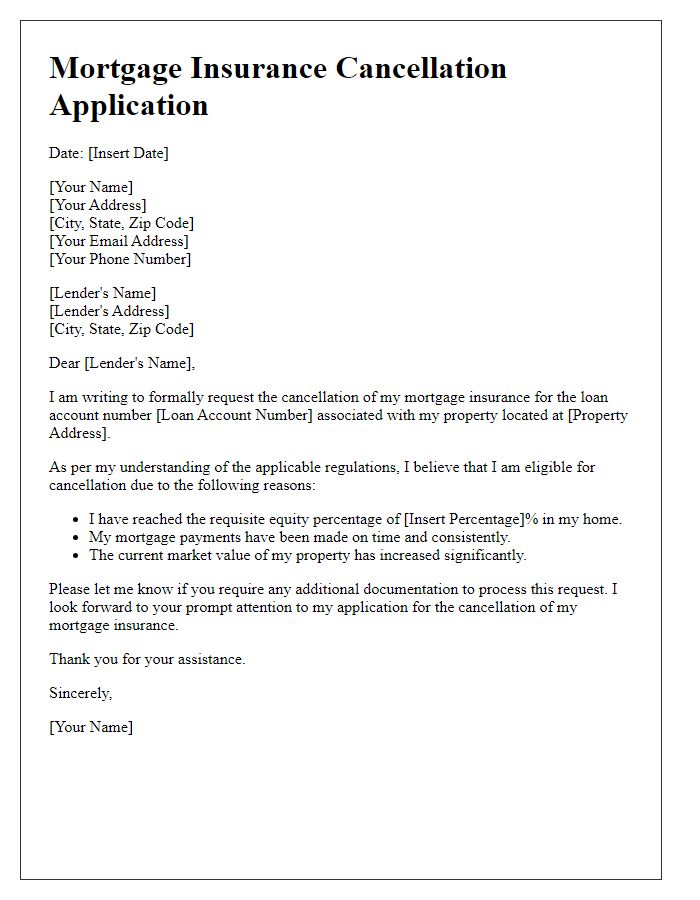

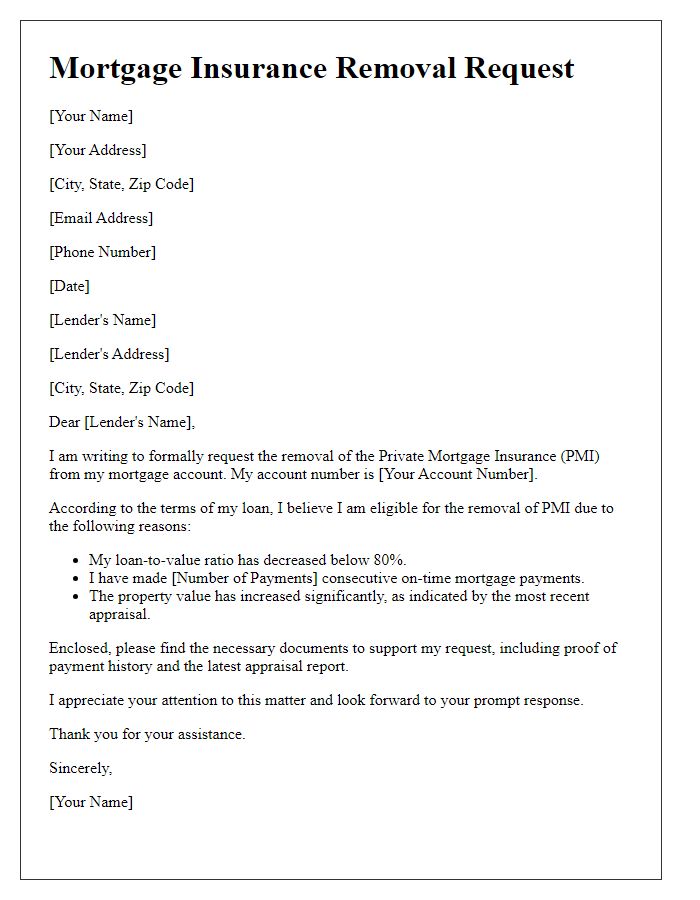

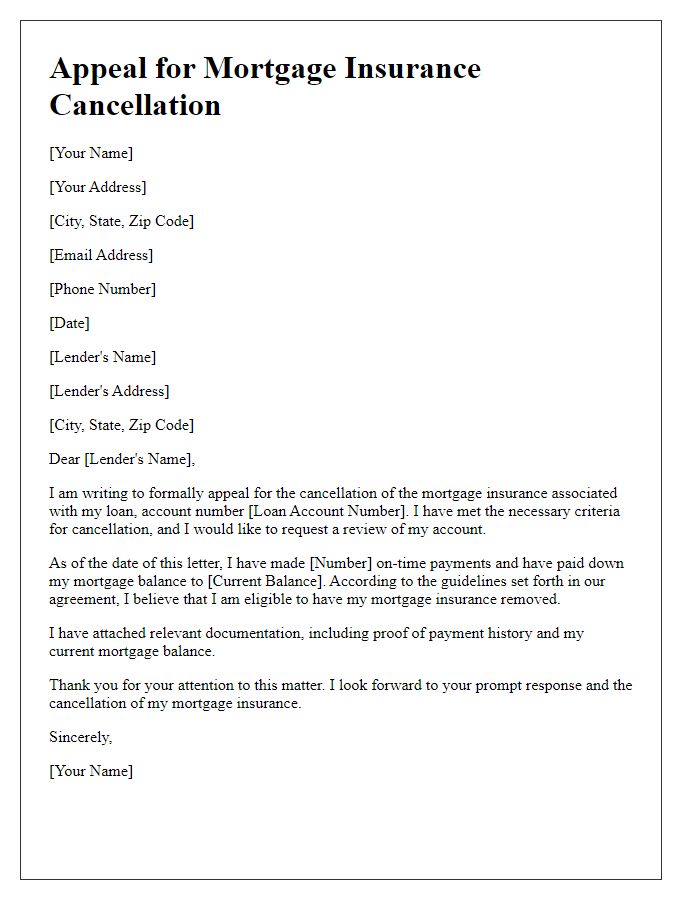

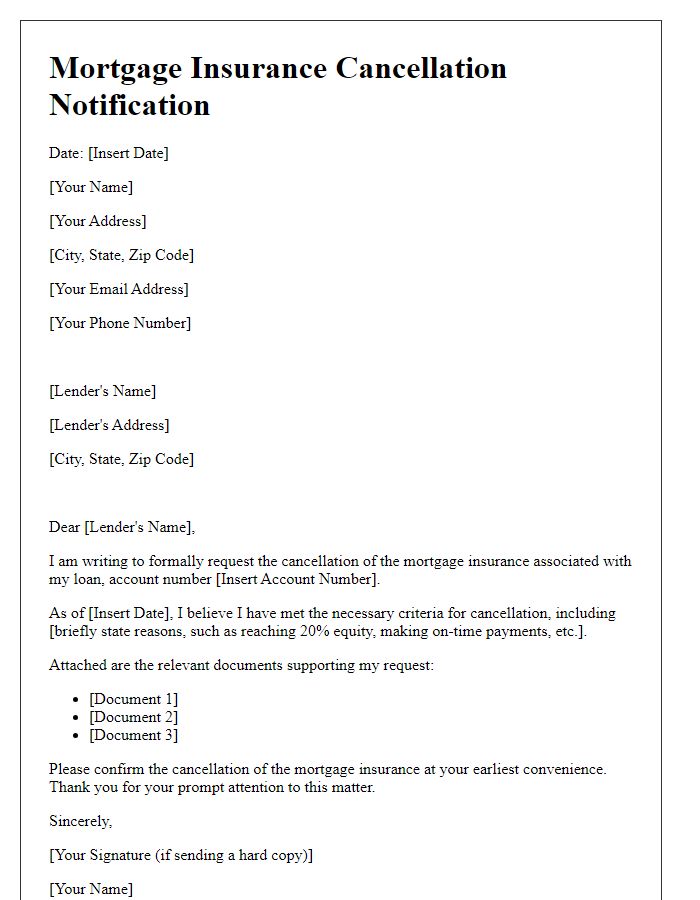

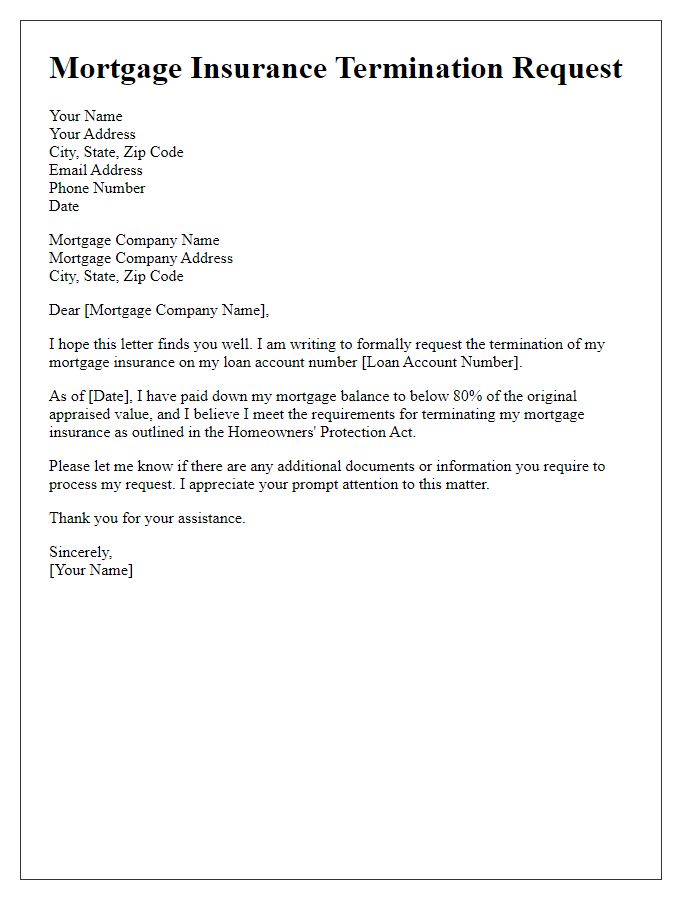

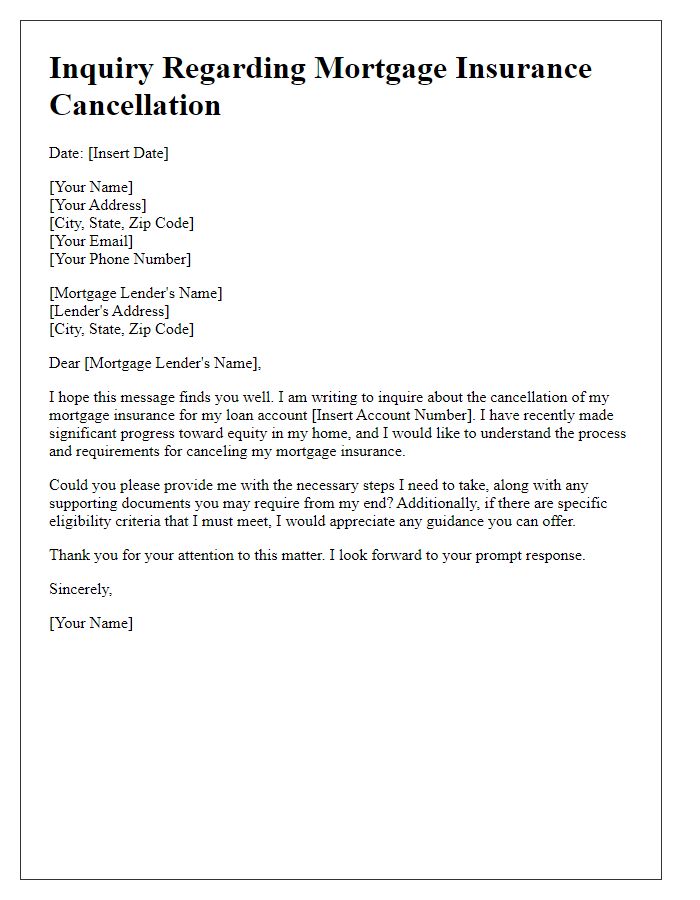

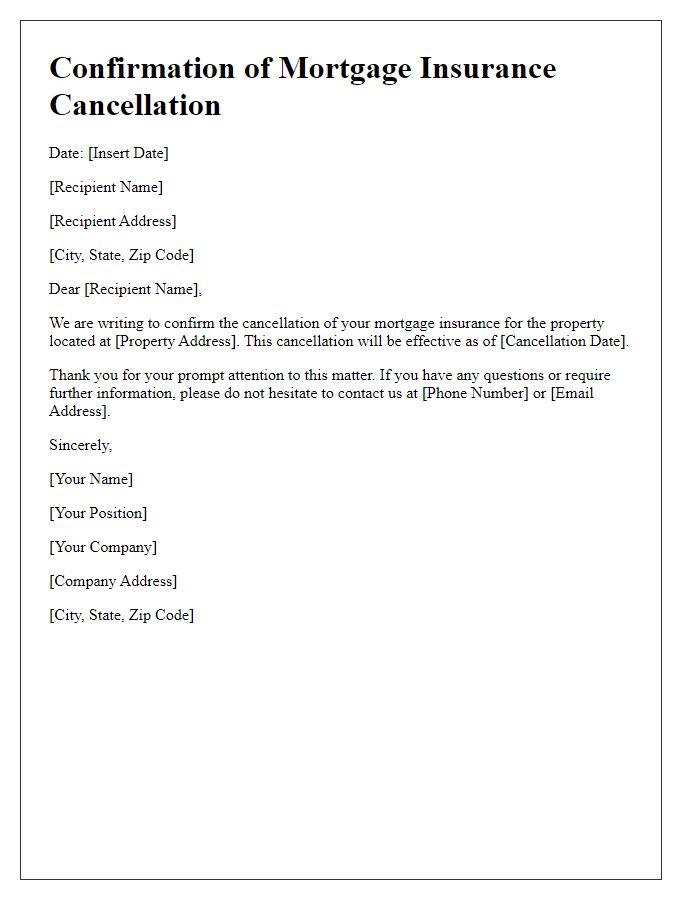

Letter Template For Mortgage Insurance Cancellation Samples

Letter template of documentation submission for mortgage insurance cancellation.

Letter template of follow-up on mortgage insurance cancellation request.

Comments