Are you navigating the often confusing waters of variable-rate loans? Understanding how adjustments can impact your finances is crucial, especially in today's fluctuating interest rate environment. This article will guide you through the intricacies of variable-rate loan adjustments, providing insights on what to expect and how to prepare. So, grab your favorite beverage and dive in, as we break it all down for you!

Loan Account Details

Variable-rate loans, such as those associated with adjustable-rate mortgages (ARMs), are influenced by changes in benchmark interest rates, like the London Interbank Offered Rate (LIBOR). Over time, these fluctuations can lead to monthly payment adjustments for borrowers based on the specific terms outlined in their contract. These adjustments typically occur on predetermined dates, often annually or semi-annually, with adjustments reflecting the latest interest rate indices plus a margin set by the lender. For instance, a borrower with a $300,000 ARM tied to a LIBOR index might see their payments change based on the index moving from 0.5% to 1.5%, resulting in varying monthly obligations that can significantly impact long-term budgeting. Note: Borrowers should regularly monitor their loan terms and stay informed about market interest rates to anticipate potential changes in their payment structure.

Current Interest Rate and Terms

Variable-rate loans, such as those commonly offered in financial institutions, are subject to periodic adjustments based on changes in benchmark interest rates like the London Interbank Offered Rate (LIBOR) or the Prime Rate. Current interest rates for variable loans can fluctuate significantly, often ranging from 3% to 7% annually based on economic conditions. Borrowers may receive notices about adjustments typically every six months or annually, detailing new interest rates and revised monthly payment amounts. It is vital for borrowers to understand how these changes impact overall loan cost, including aspects like amortization schedules and total interest paid over the loan term. Regular monitoring of market trends and regulatory policies by entities like the Federal Reserve can also influence these variables, altering future payment obligations for borrowers.

New Adjusted Interest Rate

Variable-rate loans, such as adjustable-rate mortgages (ARMs), typically adjust based on changes in the benchmark interest rates, like the London Interbank Offered Rate (LIBOR) or the Secured Overnight Financing Rate (SOFR). Loan servicers typically notify borrowers about new adjusted interest rates, which can change every six or twelve months. For instance, an original interest rate of 3.5% might increase to 4.2% following an adjustment period due to rising economic factors. The adjusted rate can significantly impact monthly payments, potentially increasing them by hundreds of dollars for borrowers, especially with a principal amount of $200,000 over a 30-year term. Borrowers should closely monitor these adjustments to manage their financial responsibilities effectively.

Effective Date of Adjustment

The effective date of adjustment for a variable-rate loan is a critical milestone in the borrowing process. Typically, this adjustment occurs on the first day of the month following the predetermined adjustment period set during the loan origination. For example, if a borrower secured a loan in January with a six-month adjustment period, the new interest rate would become effective on July 1st. Market indices, such as the London Interbank Offered Rate (LIBOR), often dictate the changes in interest rates, reflecting broader economic conditions. Borrowers should closely monitor these adjustments to understand their financial obligations better, as the revised rates directly influence monthly payment amounts. Clear communication from lenders regarding the effective date ensures borrowers are adequately prepared for any changes in their payment structure.

Contact Information for Further Inquiries

Variable-rate loans can undergo adjustments impacting monthly payments and overall interest. Borrowers should be aware of annual percentage rate changes based on market indexes like the London Interbank Offered Rate (LIBOR) or the Secured Overnight Financing Rate (SOFR). For concerns regarding these adjustments, contact the loan servicer, whose information should be readily available on the loan statement or the lender's website. Timely communication is crucial, especially if potential increases could affect budgetary planning significantly. It's recommended to have account numbers and personal identification ready for verification purposes when reaching out.

Letter Template For Variable-Rate Loan Adjustment Samples

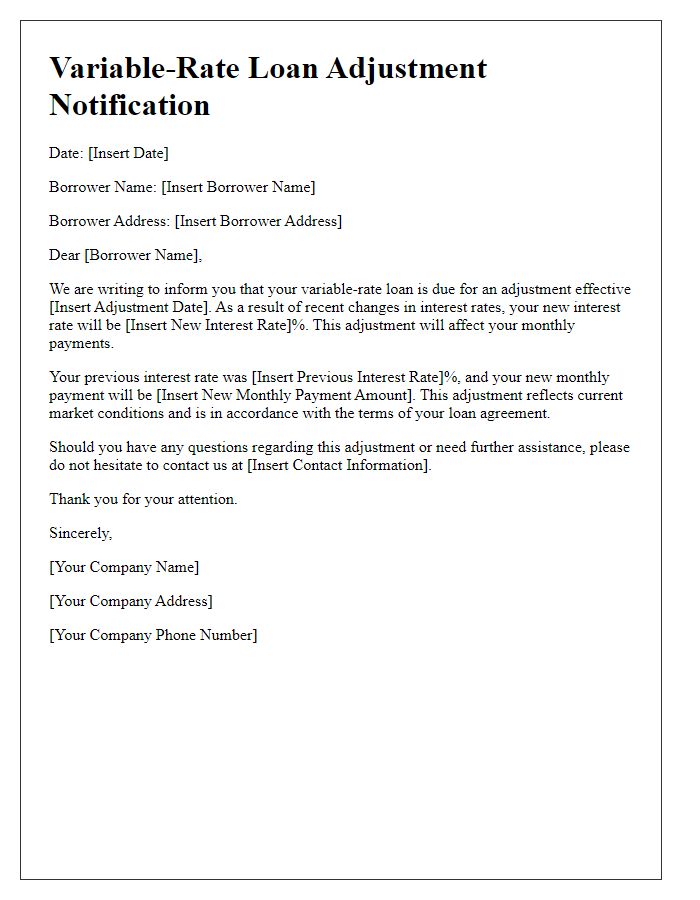

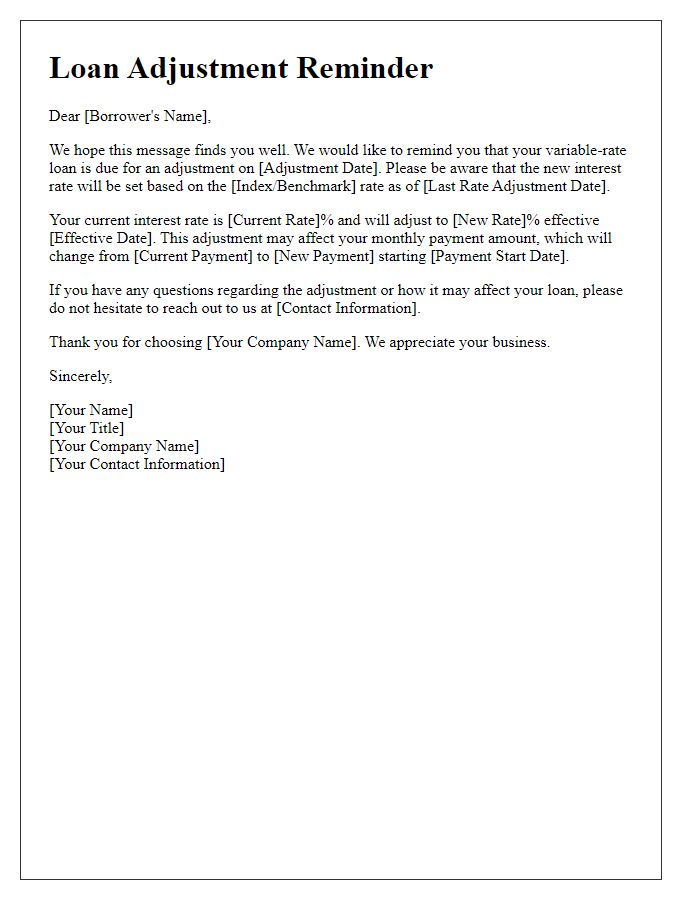

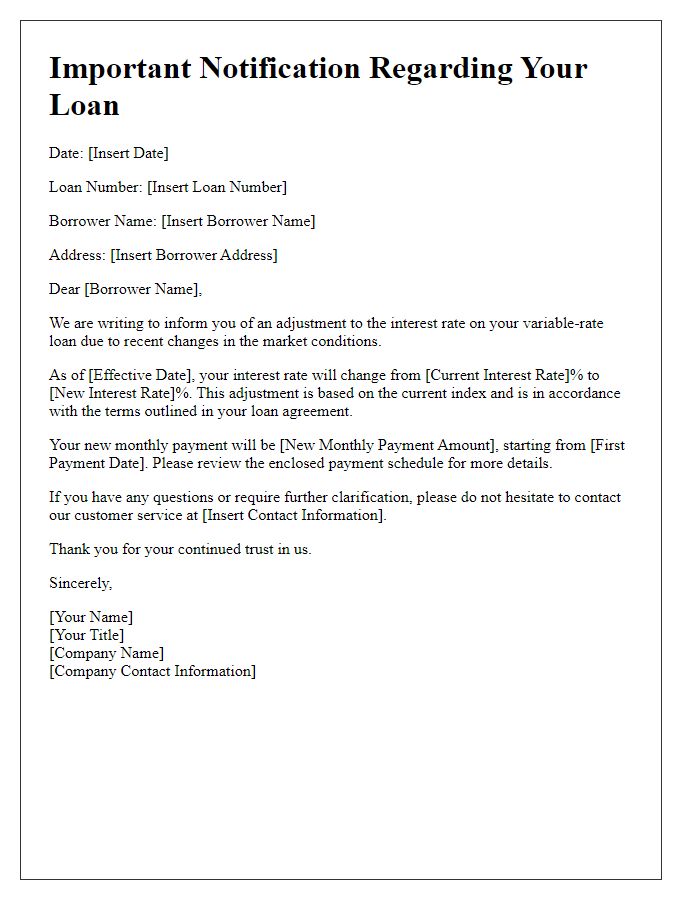

Letter template of variable-rate loan adjustment notification for borrowers.

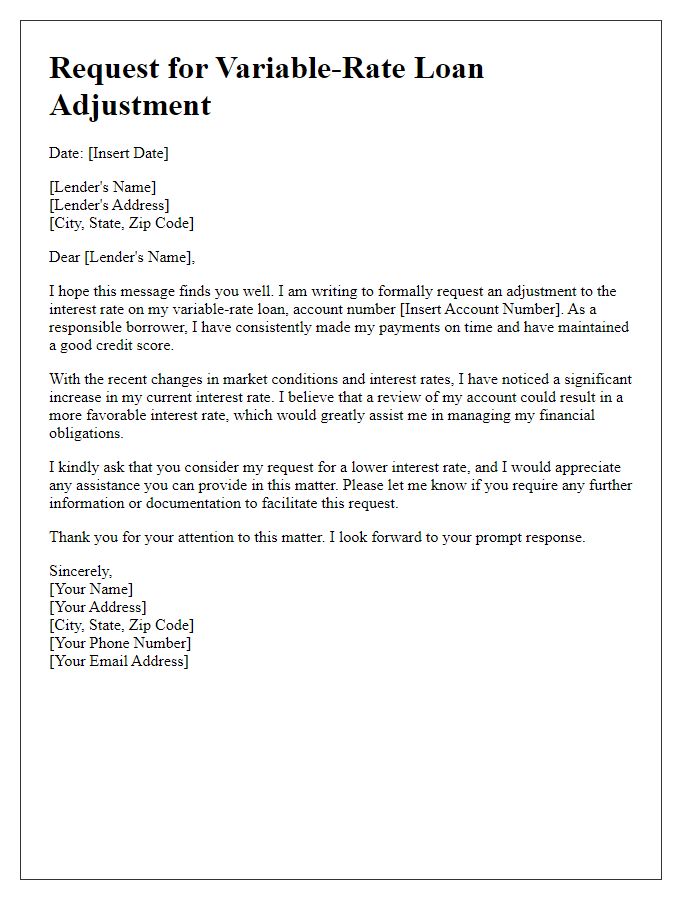

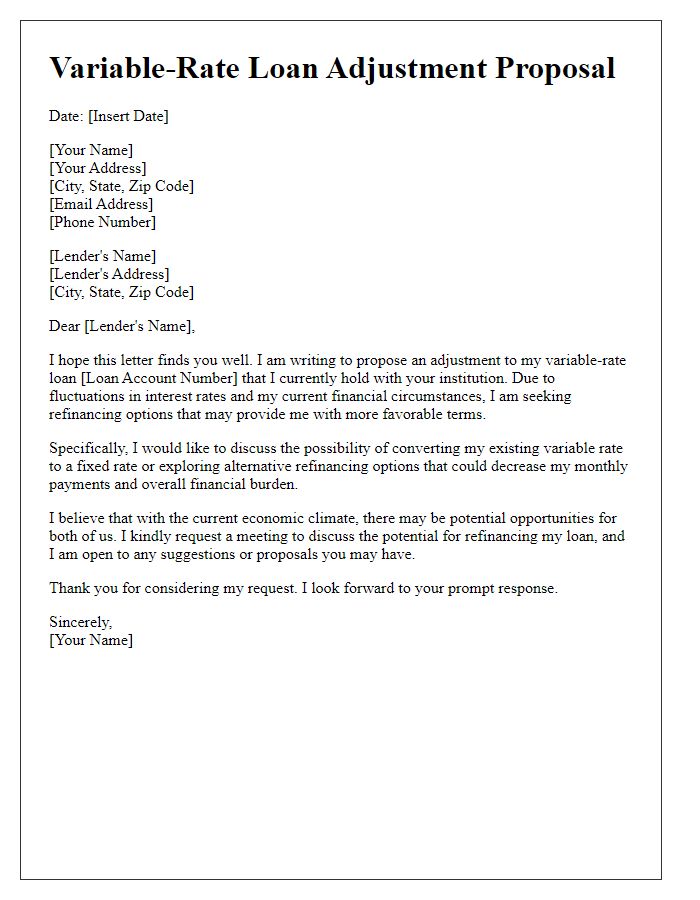

Letter template of variable-rate loan adjustment request for lower interest.

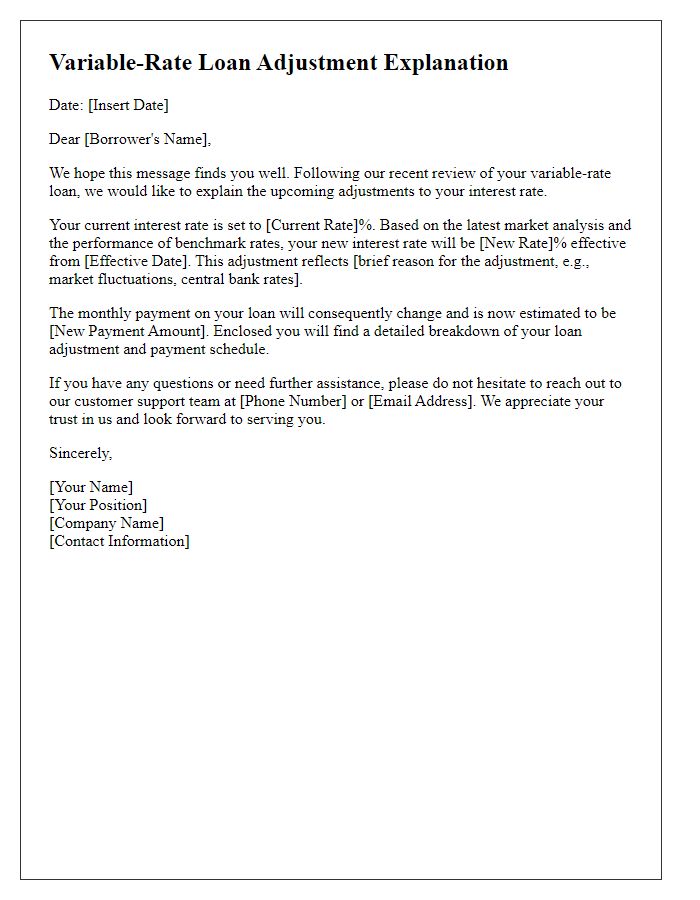

Letter template of variable-rate loan adjustment explanation after recent review.

Letter template of variable-rate loan adjustment confirmation for payment changes.

Letter template of variable-rate loan adjustment update for account holders.

Letter template of variable-rate loan adjustment inquiry for customer support.

Letter template of variable-rate loan adjustment agreement for new terms.

Letter template of variable-rate loan adjustment reminder for upcoming rates.

Comments