Are you considering refinancing your long-term loan but feeling overwhelmed by the process? You're not aloneâmany people find themselves in the same boat, unsure of where to start or what options are best for their financial situation. This article will break down the essential components of a loan refinance proposal, making it easier to understand and navigate this important decision. So, if you're ready to unlock the potential savings and improve your financial future, keep reading!

Borrower's financial overview

A comprehensive financial overview of the borrower is essential for understanding repayment capability and financial stability. Key metrics include annual income, with figures exceeding $75,000, and total monthly debt obligations amounting to approximately $2,000. The borrower's credit score, a critical factor, stands at 720, classified as a strong rating indicating reliable repayment history. Assets include savings accounts with balances over $30,000 and a 401(k) retirement plan worth around $150,000. Employment history showcases a stable position at a reputable company for over five years. Average monthly expenses, including mortgage payments, utility costs, and insurance, total $3,500, providing insight into financial management. Additionally, the borrower maintains a debt-to-income ratio of 25%, well below the industry benchmark, supporting the viability of a long-term loan refinance.

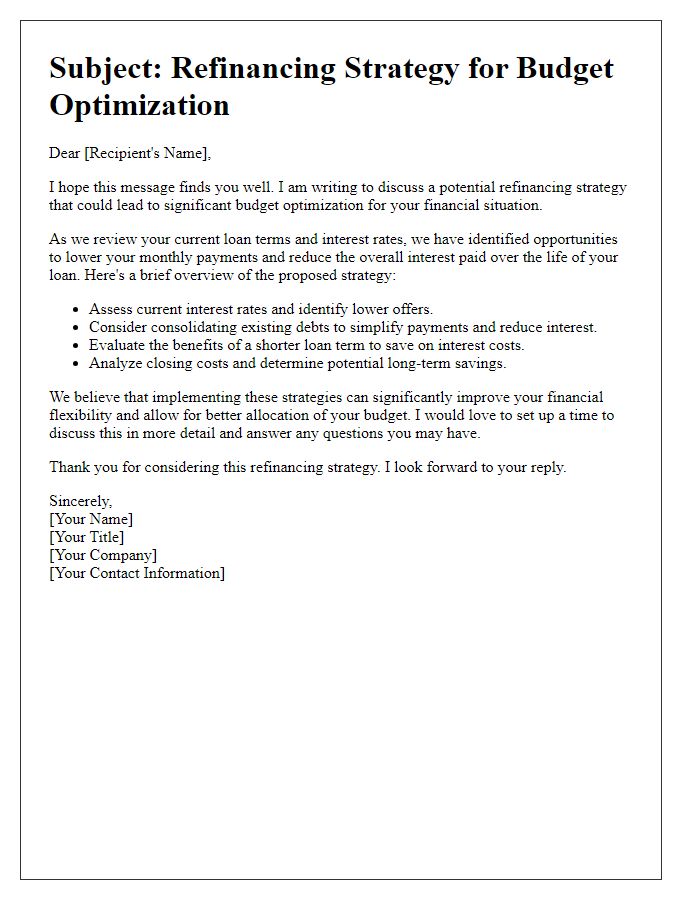

Loan terms and conditions

A long-term loan refinance proposal can provide numerous benefits to borrowers looking to improve their financial situation. The proposal details the specific loan terms, such as a duration of 15 to 30 years, as well as conditions that may include fixed or variable interest rates, typically ranging from 3% to 6%. This refinancing option can lead to lower monthly payments and reduced overall interest paid over the life of the loan. Important factors such as the borrower's credit score, which ideally should be above 620 for favorable rates, and the loan-to-value ratio (ideally 80% or less) must be considered to ensure eligibility. Additional conditions might involve appraisal requirements and closing costs, which can amount to 2% to 5% of the loan amount. Transparency regarding these terms facilitates informed decision-making essential for achieving long-term financial stability.

Current loan performance

Current loan performance indicates the effectiveness of existing loan structures and repayment capabilities. Metrics such as loan-to-value ratio (LTV) typically around 80% for secured loans and debt-to-income ratio (DTI) ideally under 36% provide insights into financial health. Relevant payment history reflects punctuality; a record of on-time payments over the past five years boosts credibility. Interest rates fluctuating between 3% to 5% directly impact monthly obligations, with a consistent principal repayment schedule enhancing long-term stability. Additionally, market conditions in regions like the Pacific Northwest, characterized by rising property values, influence refinancing strategies, facilitating favorable terms for borrowers seeking lower rates or better cash flow.

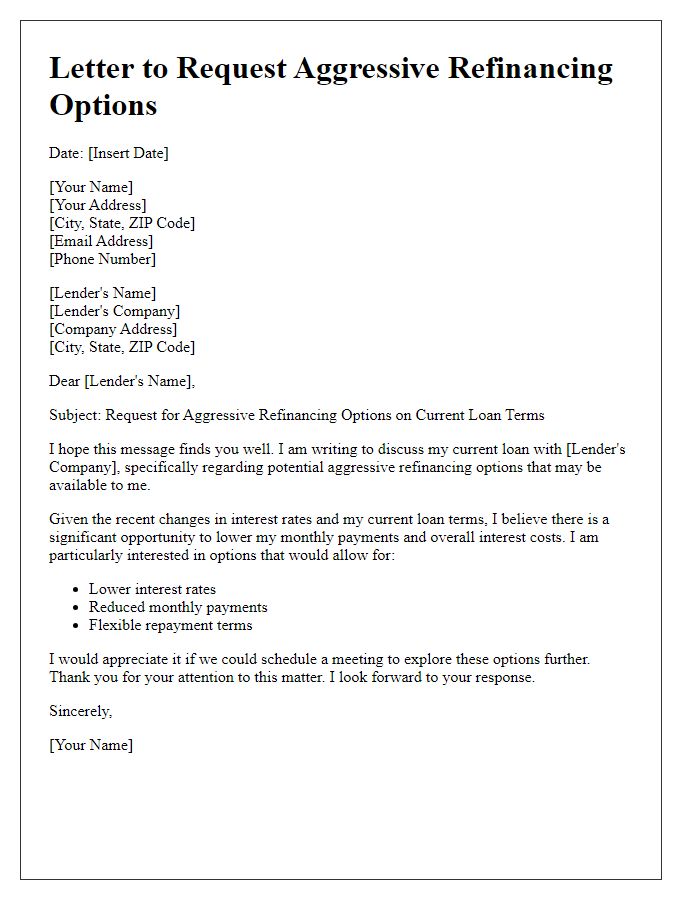

Proposal for interest rate adjustment

In a long-term loan refinance proposal, the primary focus is often on interest rate adjustment strategies that can provide significant financial relief. For example, homeowners with a fixed-rate mortgage, originally taken at 5% interest in 2019, may consider refinancing to a lower rate, such as 3.25% in 2023, given the current market conditions. Notably, reducing the interest rate can lead to substantial savings over the loan's lifespan, which may extend to 30 years, resulting in thousands of dollars saved. Additionally, a lower rate can lower monthly payments, enhancing cash flow for borrowers. An emphasis on loan terms, such as whether to extend or shorten the remaining duration of the mortgage, also affects overall costs and financial strategy. Furthermore, factors like credit score improvements and rising home equity can enhance the chances of securing favorable terms during refinancing negotiations.

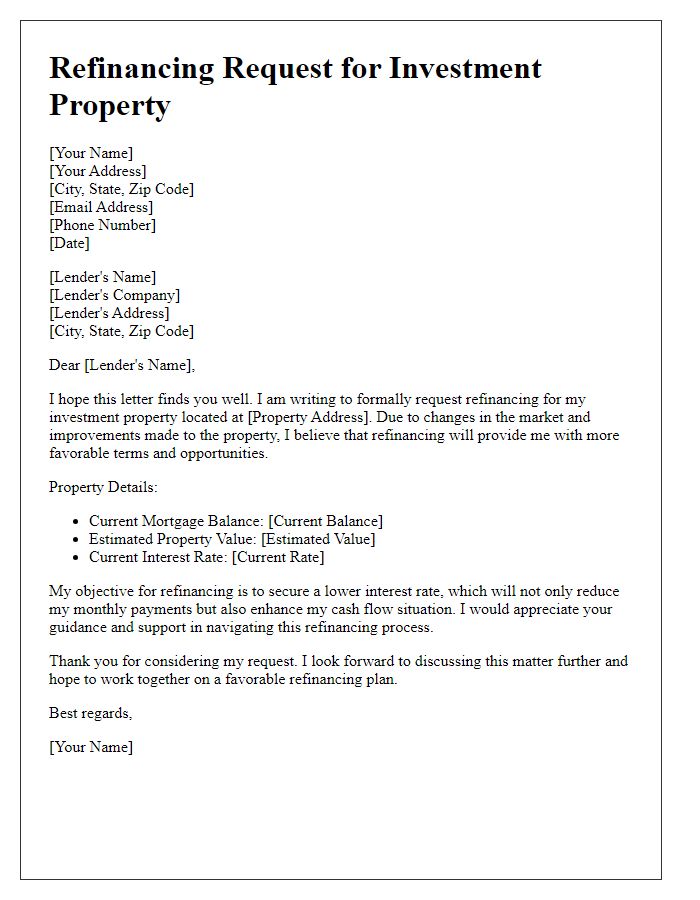

Collateral and asset appraisal

A comprehensive collateral and asset appraisal plays a crucial role in secure long-term loan refinancing, especially for financial institutions. Properties should be appraised by certified professionals to determine current market values, which influences loan terms. Common types of collateral include real estate (residential or commercial properties), vehicles, machinery (such as CNC machines in manufacturing), and financial instruments (stocks or bonds). An accurate assessment can reveal appreciation or depreciation over time, impacting lenders' risk assessments. Furthermore, clear documentation of condition and ownership helps streamline the refinancing process, ensuring all parties can make informed decisions regarding loan amounts and repayment terms.

Letter Template For Long-Term Loan Refinance Proposal Samples

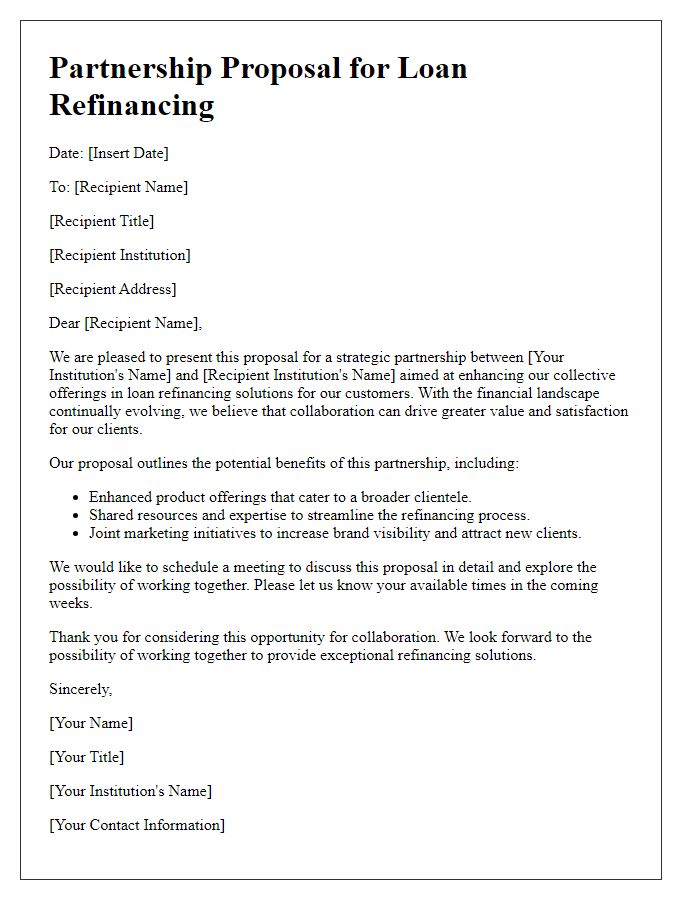

Letter template of financial institution partnership for loan refinancing

Comments