Hey there! If you're navigating the tricky waters of overdue loan payments, you're not aloneâmany people face this situation at some point. It's essential to address overdue payments promptly to avoid further complications and maintain a healthy credit score. In this article, we'll explore the best practices for sending a gentle yet firm reminder to borrowers, ensuring that your communication remains polite and effective. So, let's dive in and discover how to craft the perfect overdue loan payment reminder together!

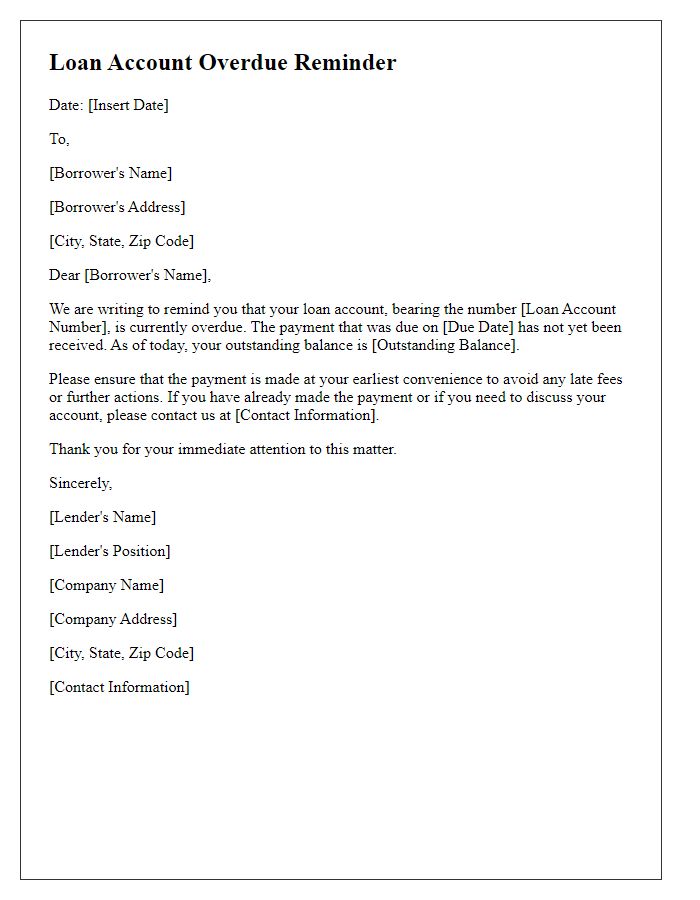

Clear subject line

Overdue loan payments can lead to serious financial consequences for borrowers. Lenders often send reminder notices after the due date, highlighting the amount owed and specifying the original loan agreement details, such as interest rates and payment schedules. The reminder should include the exact overdue amount and a revised payment deadline to avoid late fees, which can range from 5% to 15% of the overdue sum. Additionally, contact information for customer service representatives can facilitate communication, potentially leading to repayment arrangements or loan modifications. Keeping clear records of all correspondence regarding overdue payments is crucial for both lenders and borrowers, ensuring transparency and accountability.

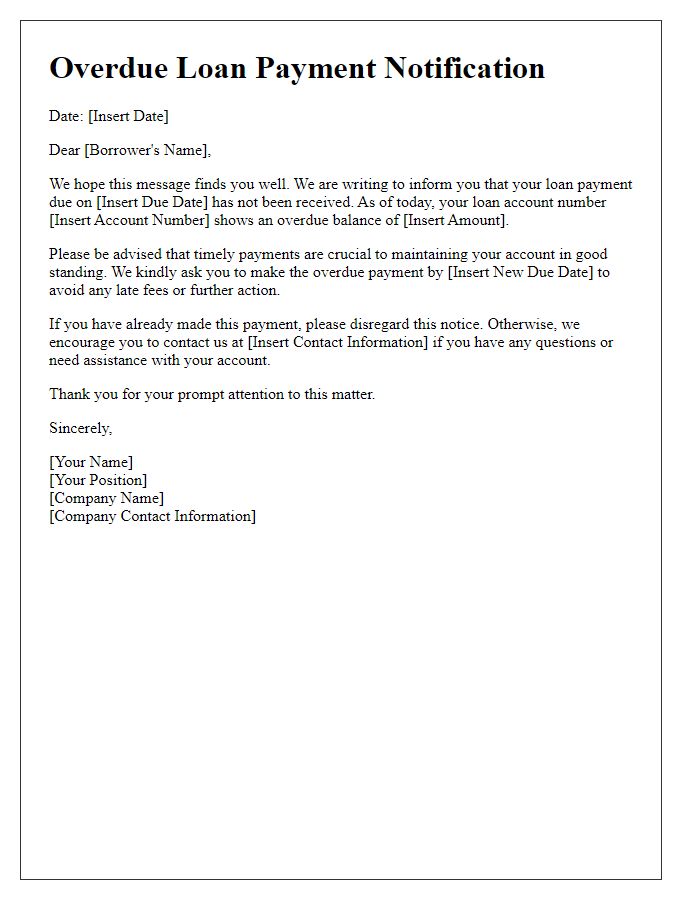

Borrower's information

An overdue loan payment reminder provides crucial information regarding outstanding debts. Borrower's information encompasses essential details such as the borrower's name, which identifies the party responsible for repayment. Contact information, including an address and phone number, facilitates communication regarding overdue payments and collection processes. Loan specifics, including the amount owed, original loan date, interest rate, and due dates, establish a clear understanding of the obligation. Additional details, such as the lender's name and account number, help streamline the communication process while maintaining clarity and focus on the pertinent financial obligations. This solitary focus highlights the importance of timely repayments, ensuring borrowers remain informed and accountable.

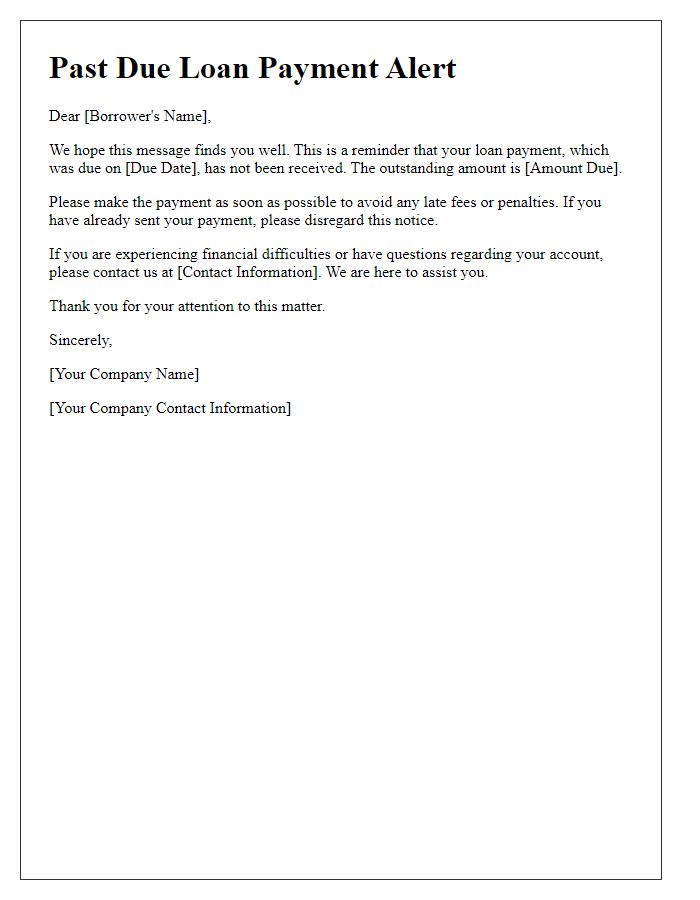

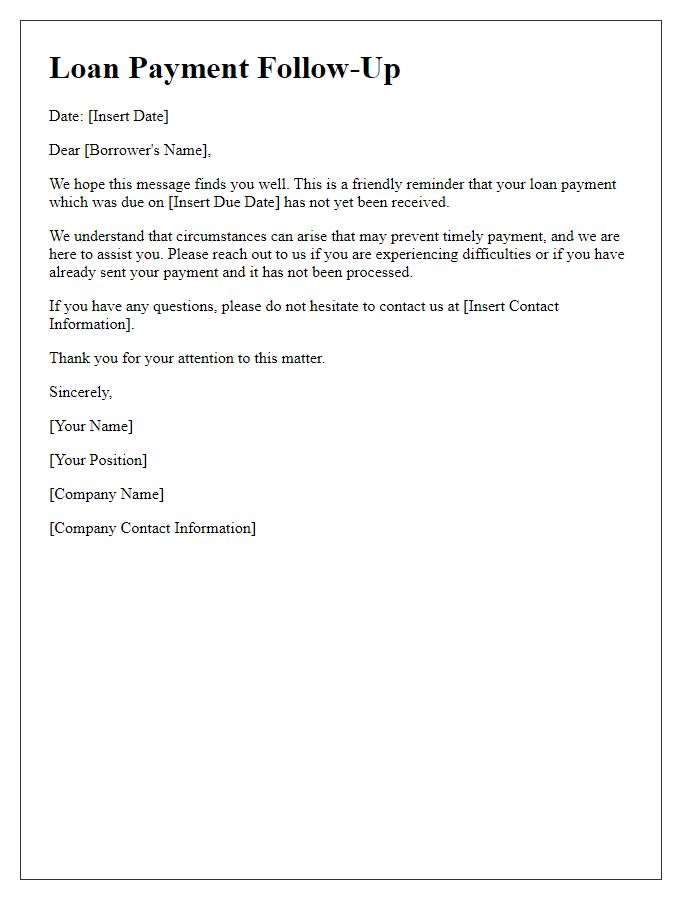

Details of overdue amount

Overdue loan payments can significantly impact the financial stability of the borrower, affecting credit scores and future borrowing opportunities. An overdue amount of $2,500 might incur late fees (often around 5% of the outstanding balance) and accrue interest (ranging from 4% to 6% annually). Payment delays can also trigger communications from lenders, escalating the urgency of debt recovery through phone calls, emails, or written notices. Borrowers should be aware that maintaining open communication with their financial institution, such as ABC Bank located in Downtown, can lead to negotiation options. Additionally, ignoring overdue payments may result in further legal actions, including collections, impacting future financial engagements.

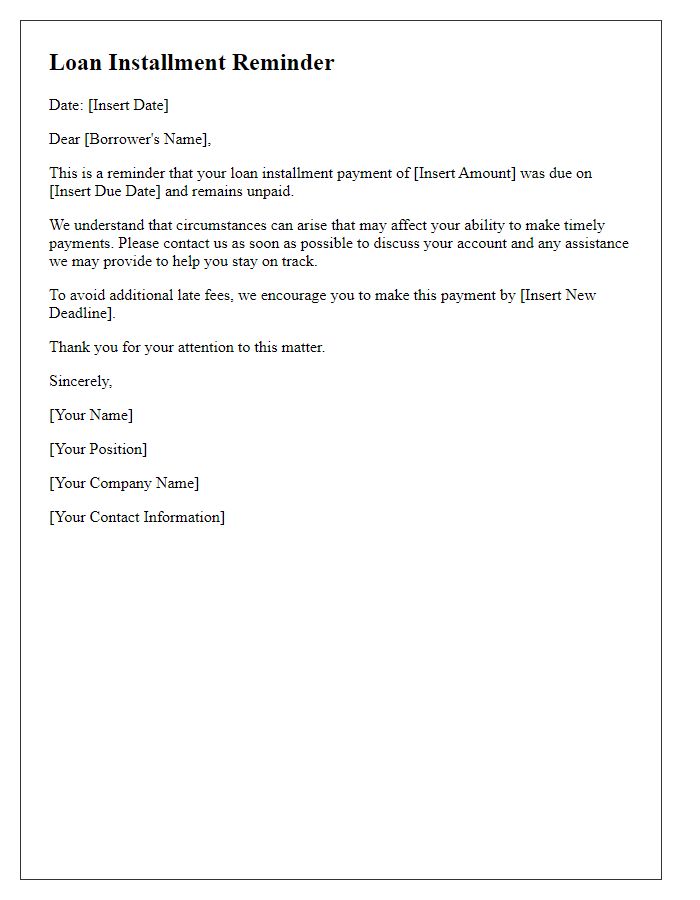

Payment deadline

Overdue loan payments can significantly impact both the borrower's credit score and the lender's financial stability. A missed payment deadline, typically 30 days after the due date, may result in late fees, typically ranging from $15 to $50, and can lead to reporting to credit bureaus like Experian or TransUnion. Borrowers situated in regions affected by financial hardship are advised to communicate with their lenders regarding potential deferment options or hardship programs before impacting their financial standing. Additionally, maintaining open channels of communication can often alleviate the urgency of reminders received via email or traditional mail from financial institutions.

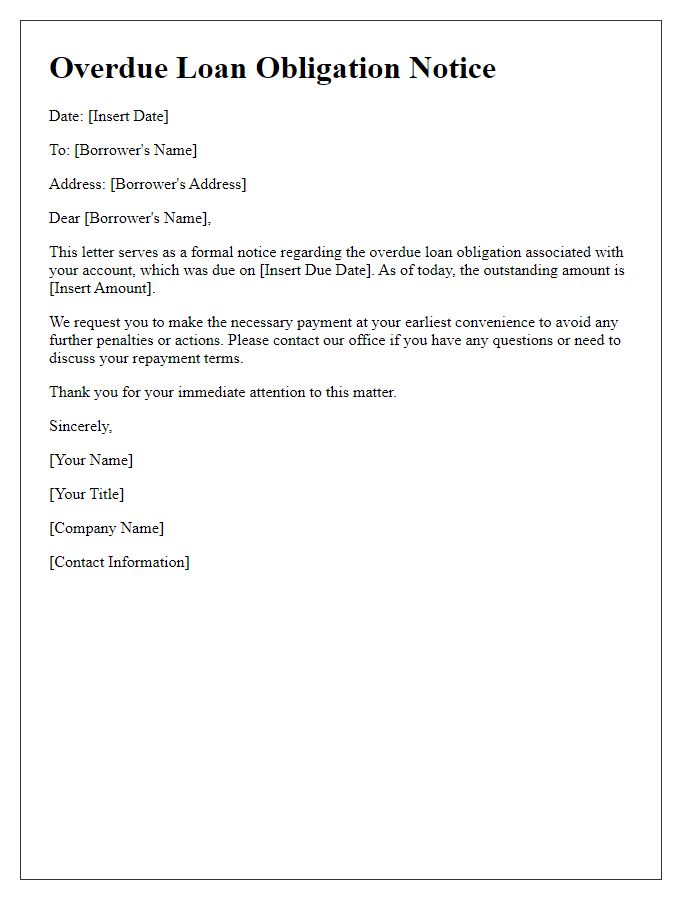

Consequences of non-payment

Consistent non-payment of overdue loan obligations may result in severe repercussions, including significant financial penalties, damage to credit scores (potentially dropping by 100 points or more), and legal action (such as lawsuits or wage garnishment). Loan agreements, often governed by jurisdictions like varying state laws, stipulate default clauses that outline the lender's rights to recover outstanding debts. Additionally, failure to meet repayment deadlines can lead to increased interest rates, often reaching exorbitant percentages over time. The accumulation of unpaid balances may also prompt referral to collection agencies, further complicating financial stability and enhancing stress.

Comments