Are you feeling overwhelmed by the prospect of managing your installment loan payments? You're not alone! Many individuals find themselves navigating the complexities of payment plans, and having a clear, structured approach can make all the difference. In this article, we'll outline a simple letter template that will help you communicate effectively with lenders about setting up an installment loan payment plan. Dive in to discover how you can take control of your financial journey today!

Account Information

An installment loan payment plan outlines the terms for repaying borrowed funds, often used for large purchases such as cars or home renovations. Account information typically includes the loan number, principal amount, interest rate, and payment frequency (monthly, bi-weekly). For example, a loan for $15,000 at a 5% interest rate over a five-year term results in monthly payments of approximately $283. Key details also involve the payment start date, representing the deadline for the first payment, and the total cost of the loan, which sums to $16,980, including interest. Clear account information ensures borrowers understand their obligations, fostering responsible financial management.

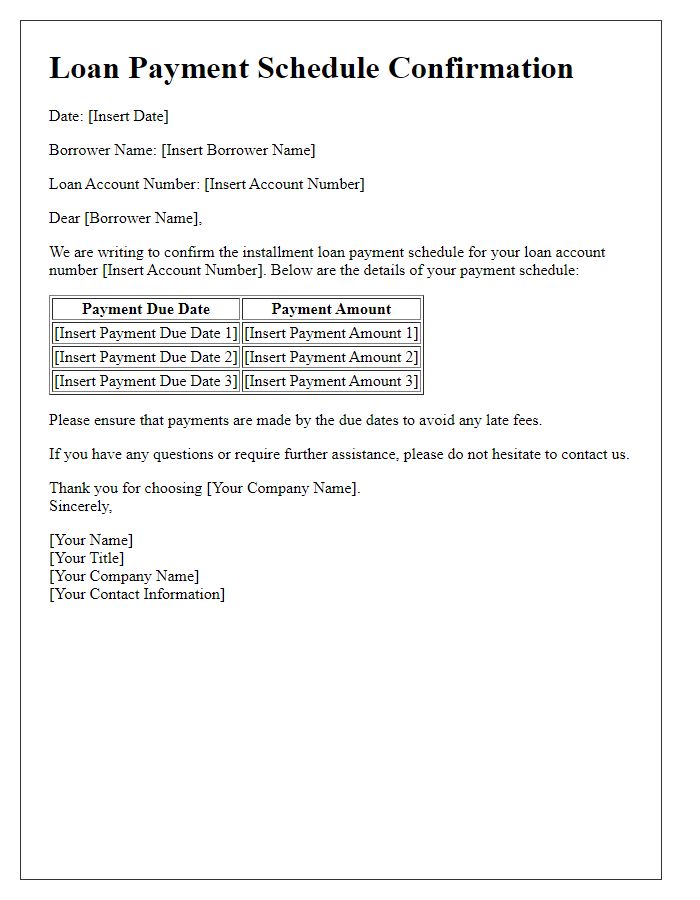

Payment Schedule

An installment loan payment plan outlines a structured payment schedule for borrowers, detailing the specific amounts due, due dates, and total duration of the loan. Borrowers typically receive fixed monthly payments, calculated based on the loan amount, interest rate, and term length. For example, a $10,000 loan with a 5% interest rate over five years results in approximately $188.71 monthly payments. Loan servicers often provide an amortization schedule, listing each payment's principal and interest portions, aiding borrowers in tracking repayment progress. Consistently adhering to this schedule helps maintain a positive credit score and avoids late fees.

Loan Terms and Conditions

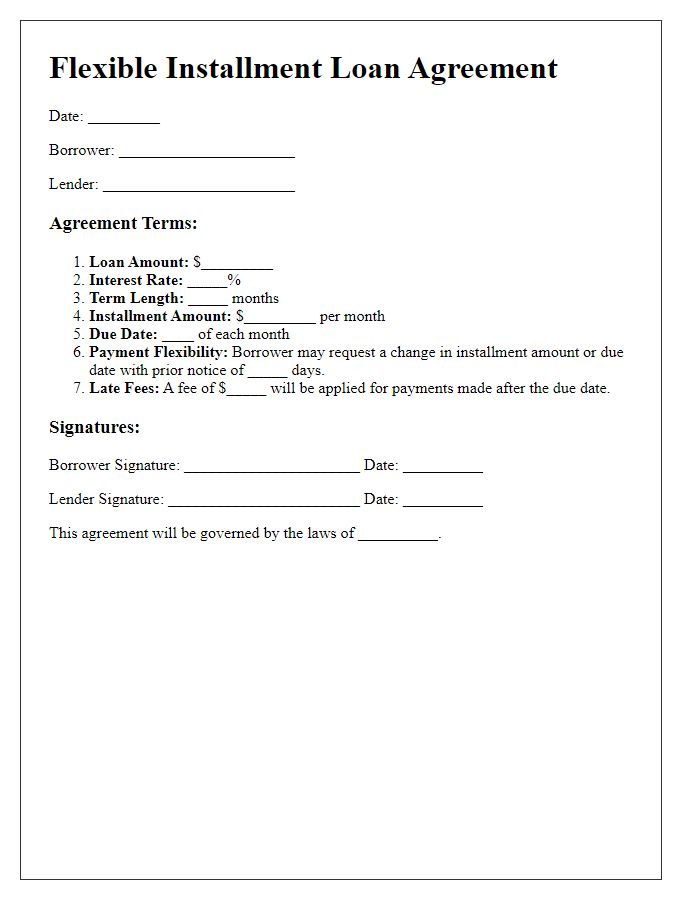

An installment loan payment plan, typically defined in a loan agreement, outlines the terms and conditions governing the repayment schedule for borrowing funds. The principal amount, which is the initial sum borrowed, is usually accompanied by an interest rate, expressed as a percentage of the loan balance, which can vary widely based on the lender and borrower's credit profile. Repayment duration often ranges from 12 months to several years, depending on the total loan amount, influencing the monthly payment amounts. The payment frequency, whether monthly, bi-weekly, or weekly, dictates how often the borrower makes payments, affecting cash flow. Late fees may apply, usually a percentage of the missed payment, encouraging timely repayments. Additionally, early repayment options often exist, allowing borrowers to pay off loans ahead of schedule, potentially reducing total interest paid over the life of the loan. Important legal elements include the borrower's and lender's obligations, outlining consequences for default, including potential recovery actions on collateral, if applicable.

Contact Information

An installment loan payment plan typically includes essential details like borrower identity, loan amount, interest rate, and payment schedule. Clear identification includes full name, address, contact number, and email. Financial institutions commonly provide a unique account number associated with the loan, making it easier to track. The loan amount, distinguishing between principal and interest, specifies the total borrowed. Interest rate, expressed as an annual percentage rate (APR), is a critical component affecting monthly payments. The payment schedule indicates due dates, frequency (monthly, quarterly), and duration of the loan, outlining the repayment timeline for borrowers.

Signature and Date

A detailed installment loan payment plan outlines specific terms, including the loan amount, interest rate, payment frequency, and payment schedule. The loan amount, for example, may be $5,000 with an interest rate of 5% per annum. The payment frequency could be monthly, typically requiring a payment date, such as the 15th of each month. A standard payment schedule entails a term of 24 months, resulting in total payments of $250 each month. The borrower is required to sign the agreement with the current date written next to the signature to confirm acceptance of the payment terms and conditions.

Letter Template For Installment Loan Payment Plan Samples

Letter template of notification for change in installment loan payment plan

Comments