When it comes to managing your finances, sometimes life throws unexpected challenges your way, making it necessary to adjust your plans. If you're facing difficulties meeting your loan maturity date, you're not alone, and seeking an extension could be a viable solution. Writing a clear and professional letter to your lender is the first step in this process, ensuring they understand your situation. Curious to learn how to craft the perfect letter for a loan maturity date extension? Let's dive deeper into the essential components you'll need.

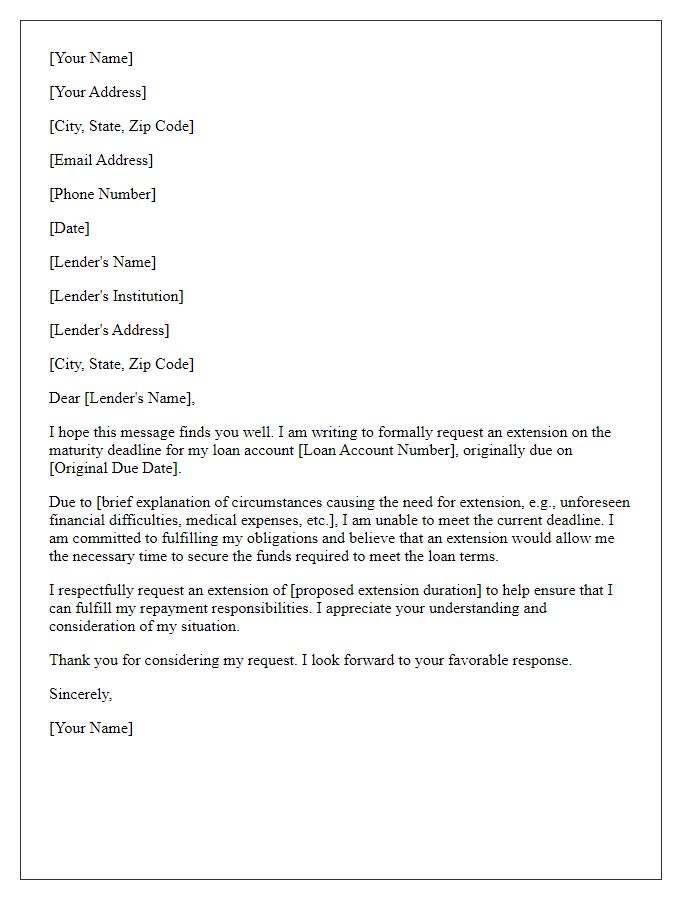

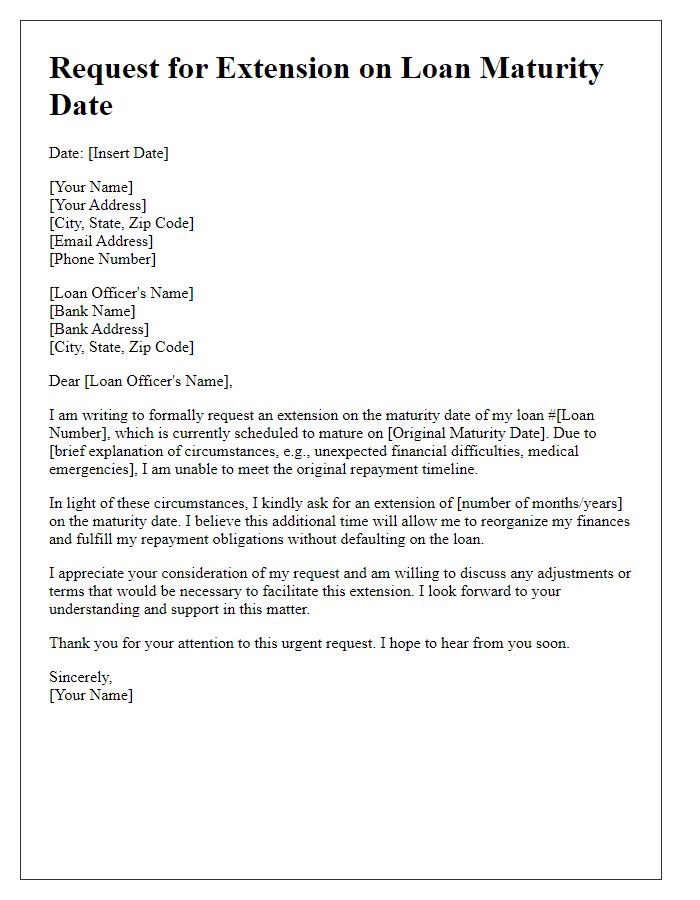

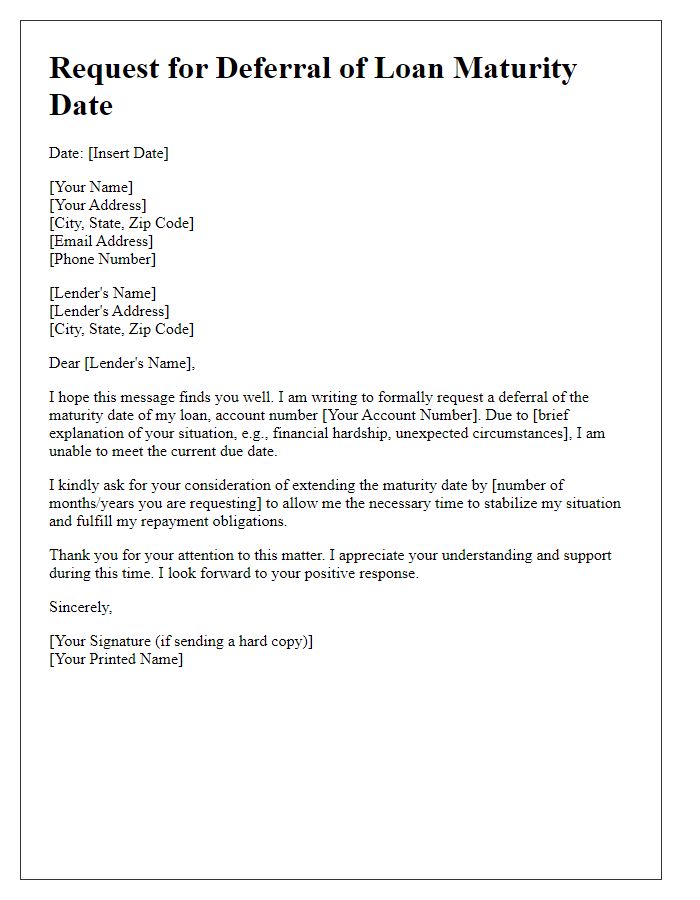

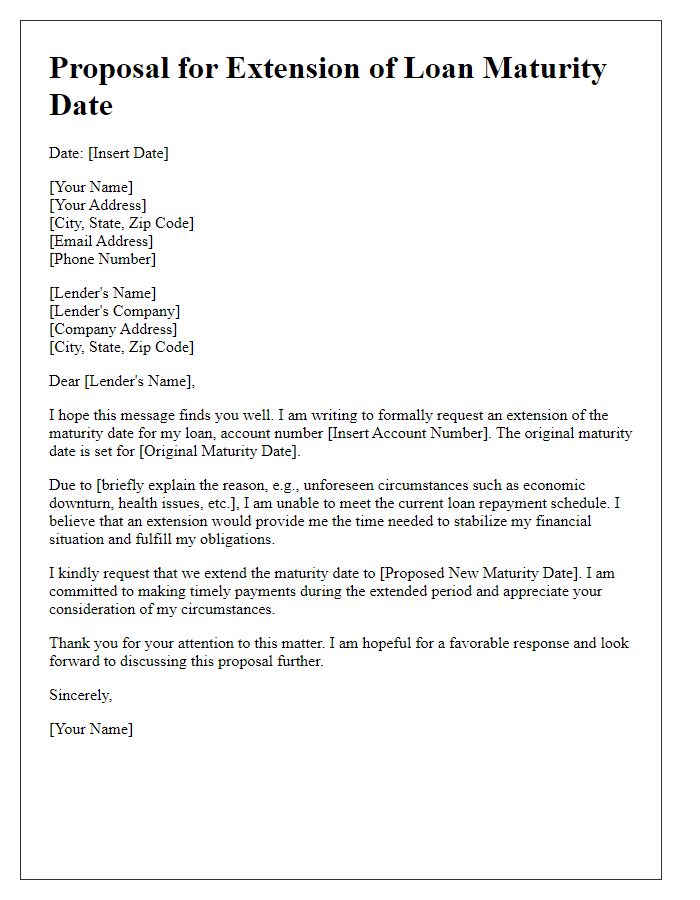

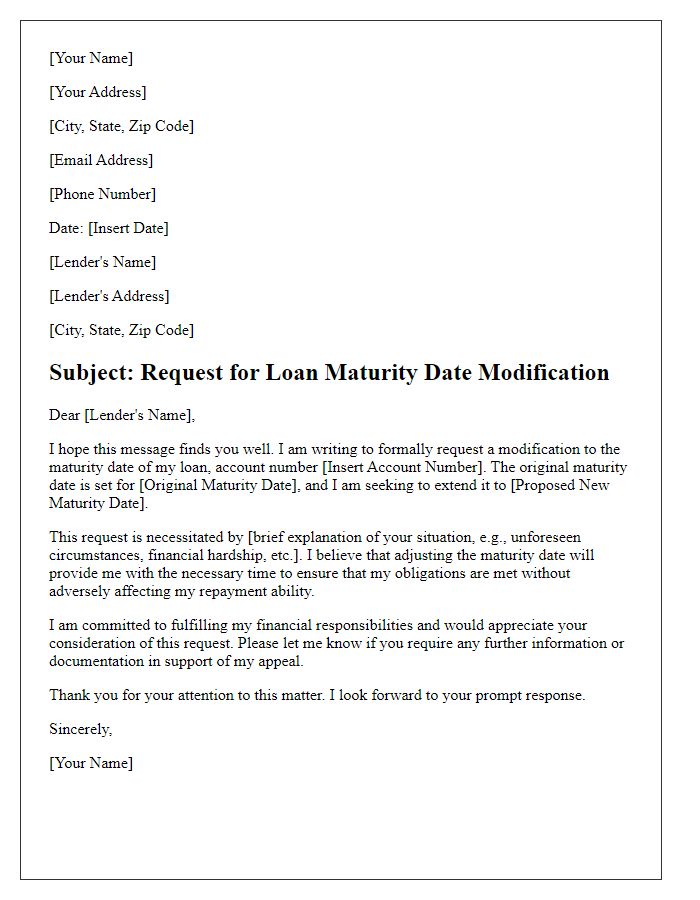

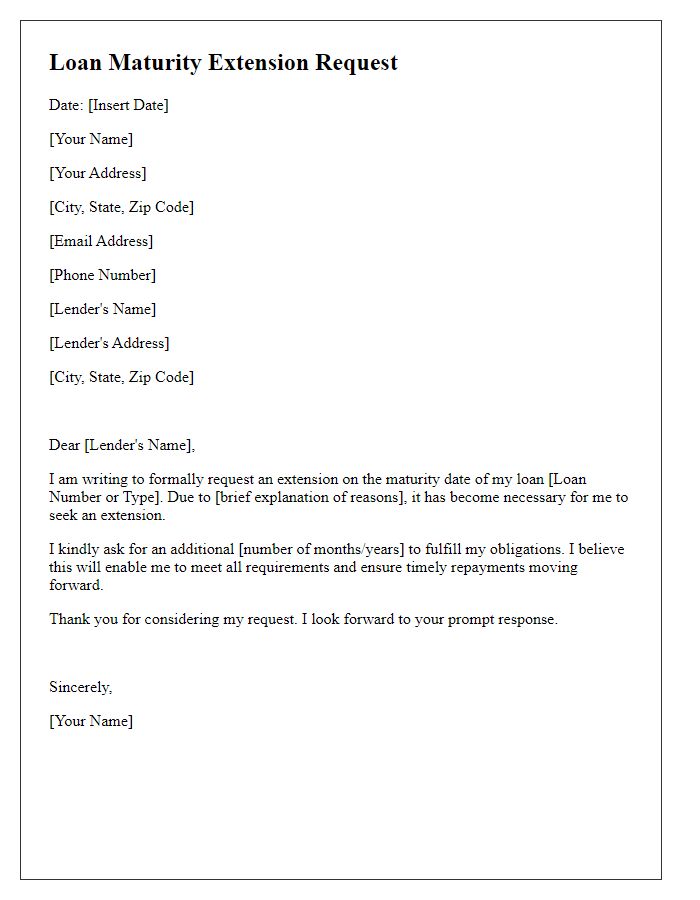

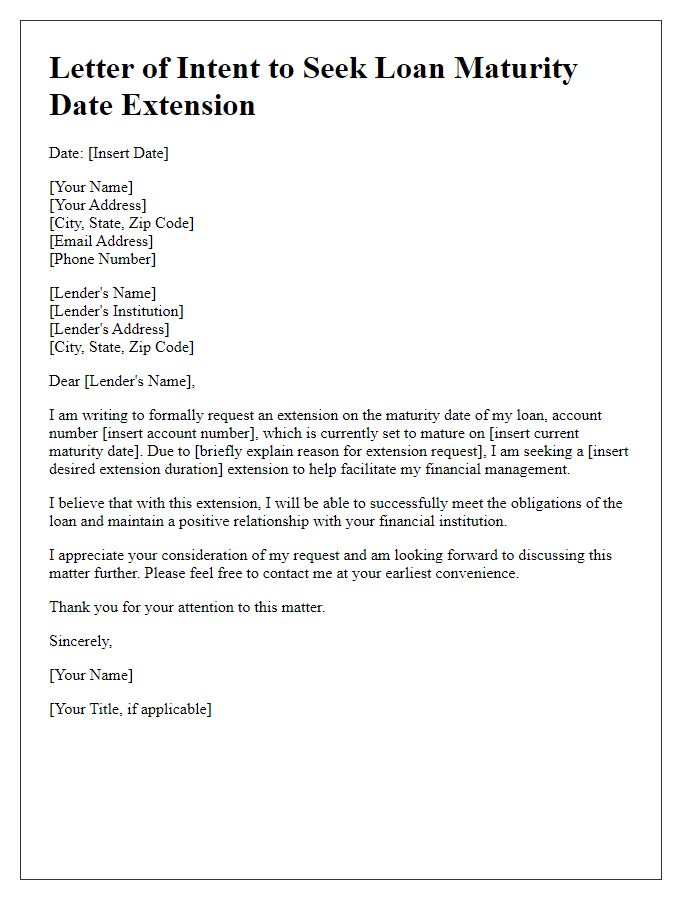

Borrower information (name, address, contact details)

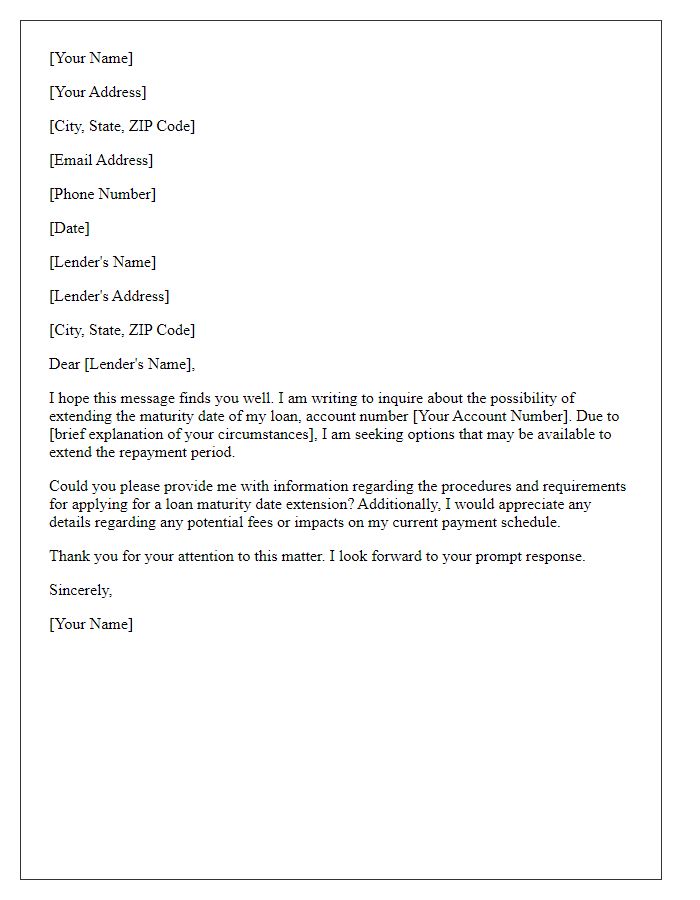

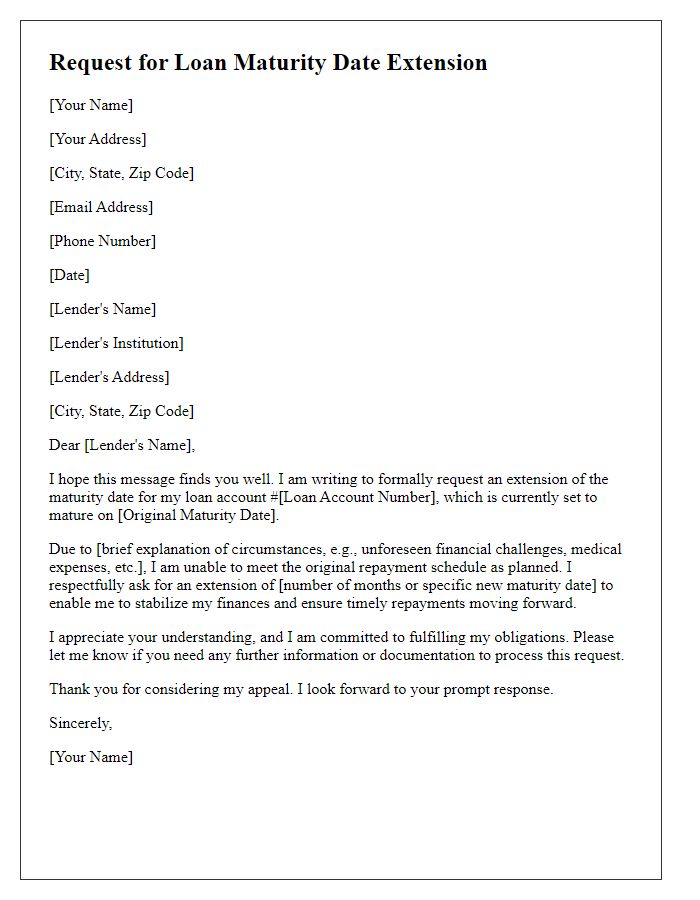

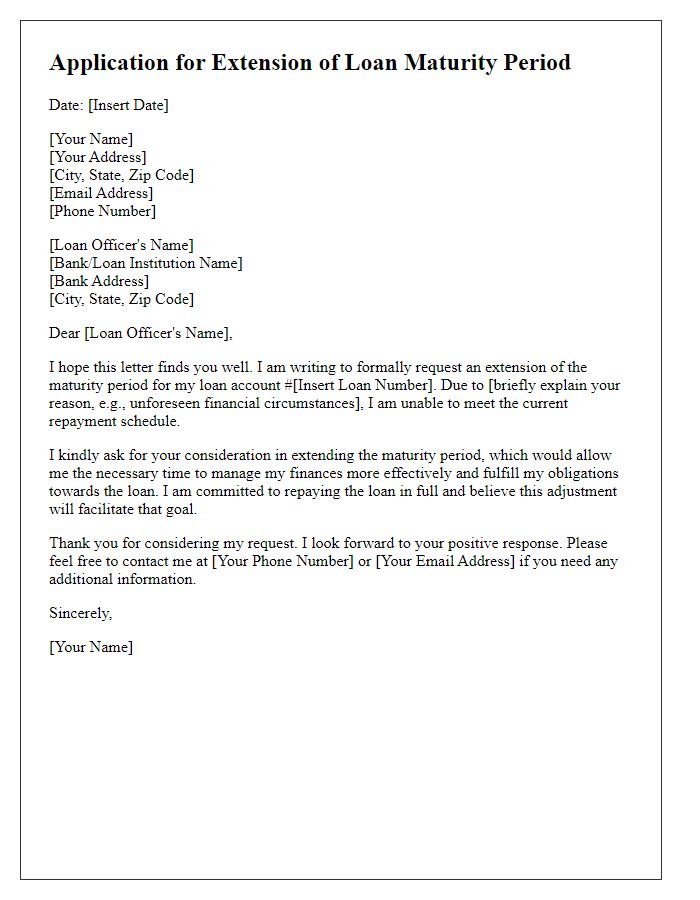

The borrower is an individual or entity seeking a loan maturity date extension, typically due to unforeseen financial circumstances. The name of the borrower, such as John Smith or Acme Corporation, should be clearly stated at the beginning. The address, including street name, city, state, and zip code, serves as the official location of the borrower, for instance, 123 Elm Street, Springfield, IL, 62704. Contact details, including phone number (e.g., (555) 123-4567) and email address (e.g., john.smith@email.com), provide a means for the lender to reach the borrower for further communication or clarification regarding the extension request. This information is crucial for processing requests and maintaining accurate records within the lending institution.

Current loan details (loan amount, original maturity date, loan number)

The current loan details include a loan amount of $150,000, an original maturity date set for November 1, 2023, and the loan number 123456789. Due to unforeseen circumstances, an extension on the maturity date is requested to allow for adequate repayment time. This request aims to facilitate financial stability and ensure the loan's responsible management.

Reason for extension request (financial challenges, unexpected circumstances)

The request for a maturity date extension on a loan stems from unforeseen financial challenges and unexpected circumstances. Situations such as job loss, medical emergencies, or significant repairs to property can severely impact one's ability to meet financial obligations. For example, a borrower might face sudden unemployment, resulting in a substantial decrease in monthly income, making it difficult to pay the loan on time. Additionally, unexpected medical expenses can divert funds away from loan repayment, posing further challenges. As a result, extending the loan maturity date would provide the necessary financial breathing room, enabling the borrower to stabilize their situation. By allowing a longer repayment period, lenders can assist borrowers in successfully navigating these obstacles, ultimately increasing the likelihood of full loan repayment.

Proposed new maturity date and repayment plan

Proposed maturity date extensions for loans are crucial in maintaining financial stability during unexpected situations. The updated maturity date might be set for 12 months beyond the original deadline, allowing for a more manageable repayment schedule. The revised repayment plan may incorporate monthly installments of $500, commencing on the first day of the month following the maturity extension, designed to accommodate potential cash flow fluctuations. Additionally, this plan often includes a 5% interest rate, reflecting current market conditions, ensuring transparency and predictability in the repayment process. Timely communication regarding such extensions can significantly alleviate financial pressure for borrowers, fostering a sustainable borrowing environment.

Expression of gratitude and willingness to provide additional information

A loan maturity date extension can significantly alleviate financial pressure for borrowers. Financial institutions often require documentation for consideration, including recent financial statements and an explanation of the need for the extension. This process allows lenders to assess the risk involved while helping borrowers manage their repayment schedules. Clear communication, timely submission of requested information, and a courteous thank-you note can foster positive relationships with lenders. A well-structured request can lead to a successful extension, providing crucial relief during challenging periods.

Letter Template For Loan Maturity Date Extension Samples

Letter template of inquiry regarding loan maturity date extension options.

Comments