Are you feeling overwhelmed by your current loan repayment terms? You're not alone, as many find themselves seeking more flexible options to better manage their finances. Fortunately, understanding your rights and available alternatives is crucial in navigating this landscape. If you're interested in discovering how to inquire about flexible loan repayment options effectively, keep reading for some helpful insights!

Personal Details: Full Name, Contact Information.

Inquiring about flexible loan repayment options often involves detailed personal information, such as a borrower's full name, necessary for identification and record-keeping; contact information, which includes telephone numbers and email addresses for seamless communication; and specific loan details like the account number, which facilitates accurate assessment of repayment terms. Understanding these options can help borrowers manage their financial commitments more effectively, particularly in circumstances such as income fluctuations or unexpected expenses that may affect their ability to meet standard repayment schedules. Accessing this information could greatly enhance overall financial stability and provide peace of mind.

Loan Account Information: Account Number, Loan Type.

Flexible loan repayment options can significantly ease financial burdens for borrowers managing mortgages, personal loans, or student loans. For instance, with adjustable-rate mortgages, loan account information, including the account number and loan type, plays a crucial role in determining eligibility for repayment flexibility. Many financial institutions offer tailored programs that enable borrowers to adjust payment schedules or amounts based on their changing financial situations, which can vary significantly depending on income fluctuations or unexpected expenses. Maintaining a detailed record of loan account information, such as interest rates and remaining balance, allows borrowers to make informed inquiries regarding potential adjustments, directly impacting their financial health and overall repayment strategy.

Reason for Flexibility Request: Financial Hardship, Temporary Setback.

Financial hardship often necessitates flexibility in loan repayment schedules. Individuals facing temporary setbacks, such as job loss or unforeseen medical expenses, may struggle to meet their monthly obligations. In such cases, adjusting the payment terms can alleviate stress and prevent defaults. For example, a borrower with a personal loan through a credit union may request a temporary reduction in monthly payments for three months, allowing sufficient time to regain financial stability. This approach not only benefits the borrower but also protects the lender's interest by reducing the likelihood of non-payment and potential collection actions.

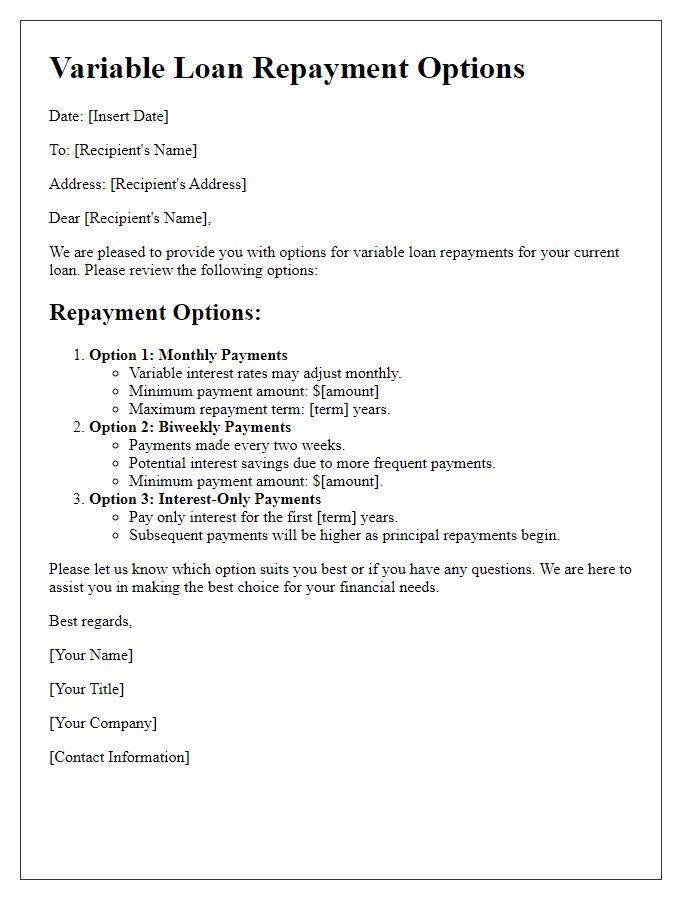

Proposed Repayment Plan: Adjusted Terms, Timeline.

Inquiring about flexible loan repayment options is essential for borrowers facing financial challenges. A proposed repayment plan may include adjusted terms such as reduced interest rates, which could lower monthly payments significantly. Additionally, extending the repayment timeline from a typical five years to up to seven years might ease the financial burden on borrowers. Clarity on the timeline for restructuring payments is critical, as it could define the amount due each month and the total cost of the loan. Engaging with financial institutions about these details ensures a more manageable approach to fulfilling loan obligations while maintaining financial stability.

Request for Confirmation: Acknowledgment, Next Steps.

Flexible loan repayment options offer borrowers the ability to adjust payment schedules based on financial circumstances, providing the potential for reduced stress during economic unpredictability. Institutions like banks or credit unions often provide terms that accommodate changes in income or unexpected expenses, especially during events like economic downturns or personal crises. Understanding the specific repayment terms, such as interest rates and penalties for missed payments, is crucial for borrowers considering these options. These details ensure informed decision-making and effective financial planning.

Letter Template For Flexible Loan Repayment Inquiry Samples

Letter template of seeking information on tailored loan payment schedules

Comments