Are you considering securing your financial future with a loan insurance policy? Understanding the ins and outs of this important coverage can provide peace of mind, ensuring that you and your loved ones are protected in unforeseen circumstances. In this article, we'll explore the benefits of having a loan insurance policy, how to request one, and tips for getting the best deal. So, if you're ready to delve deeper into this essential topic, keep reading!

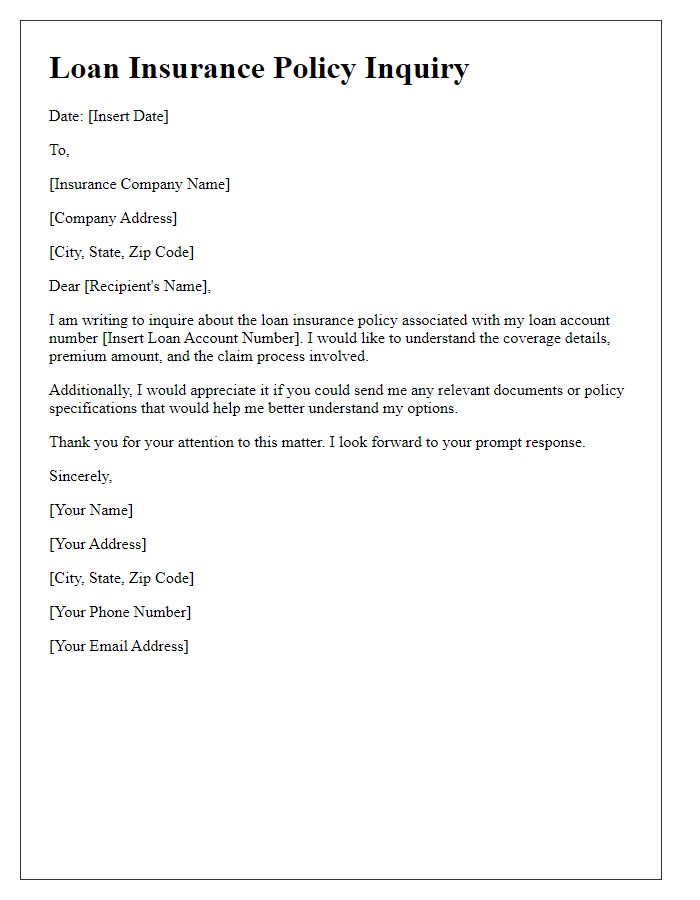

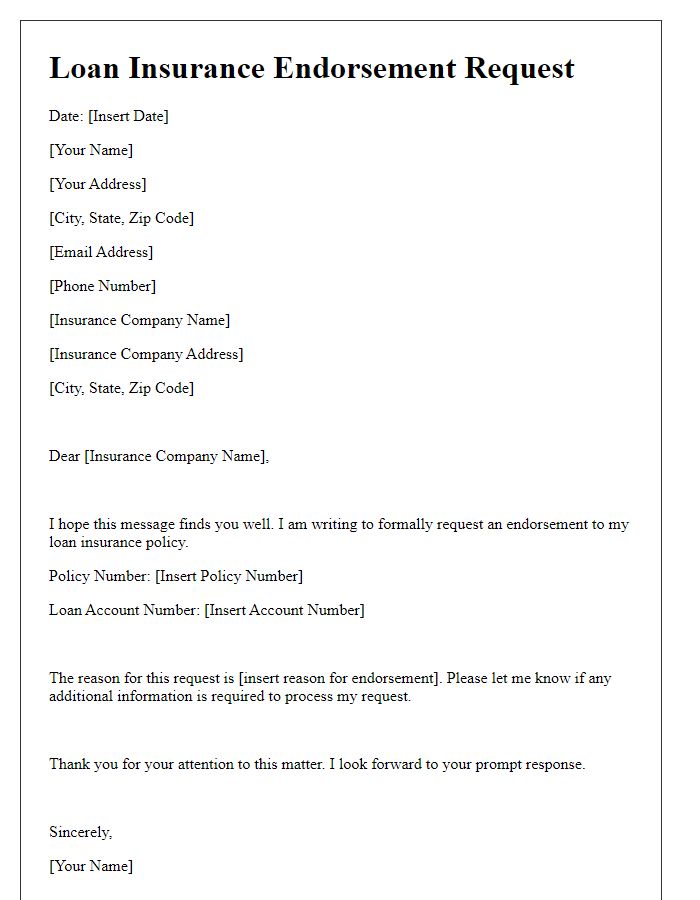

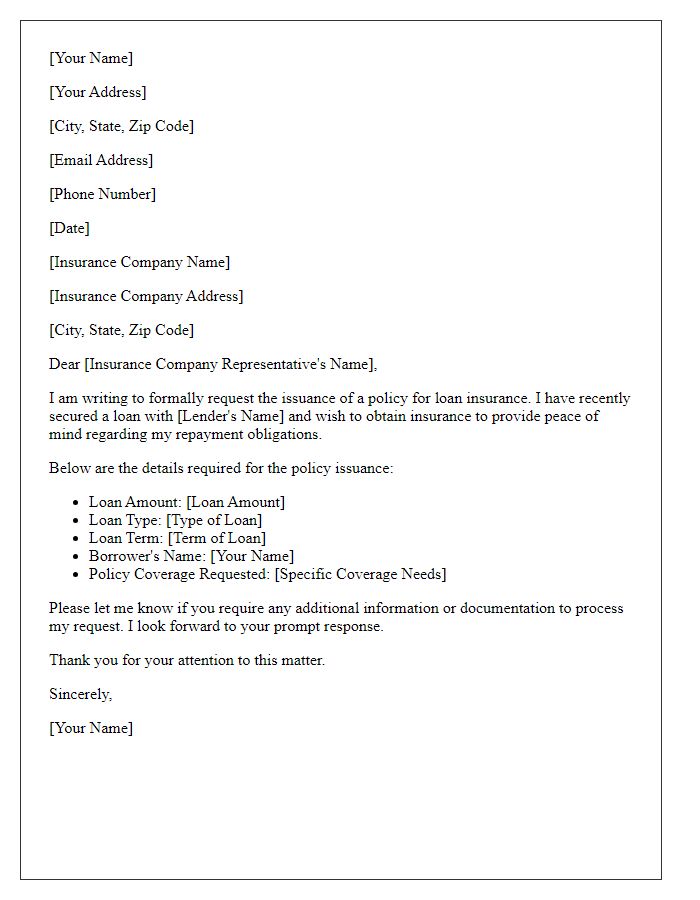

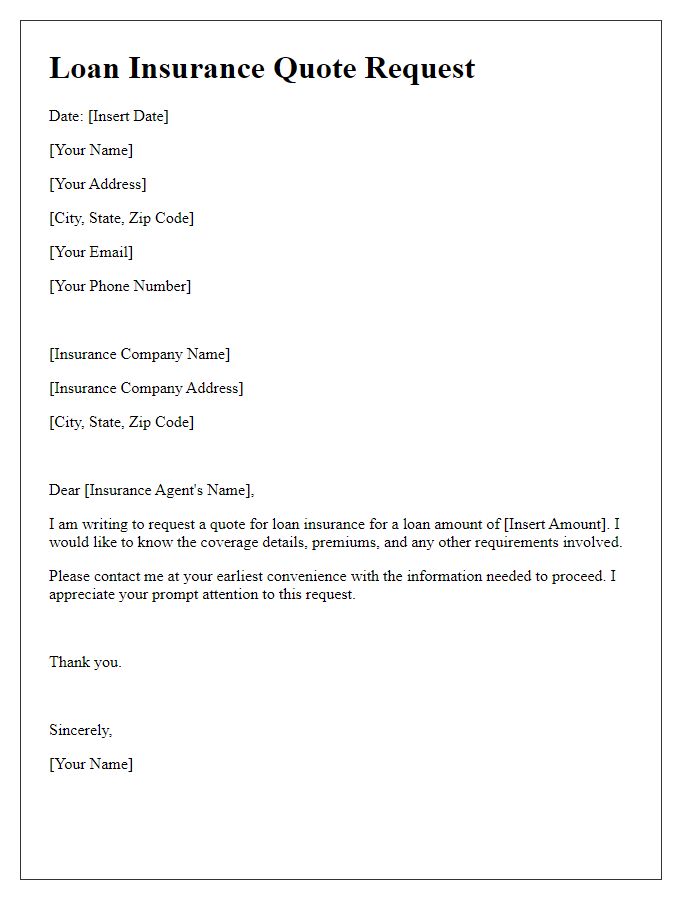

Contact Information

Contact information for a loan insurance policy request includes essential details such as the full name of the applicant, residential address (including city, state, and zip code), phone number, and email address. It is important to provide the date of the request to establish a timeline for processing. The name of the lending institution, along with the specific loan type (for example, mortgage, auto, or personal loan), ensures clarity in correspondence. Including the loan number (if applicable) allows the insurance provider to quickly identify the relevant account. Proper formatting and accuracy in these details facilitate efficient communication and expedite the request process.

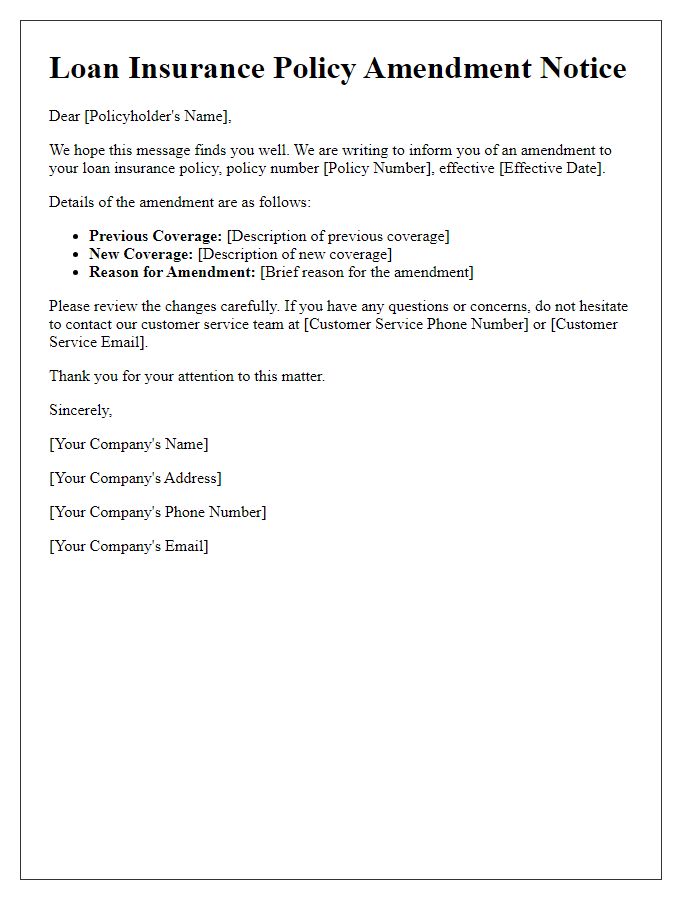

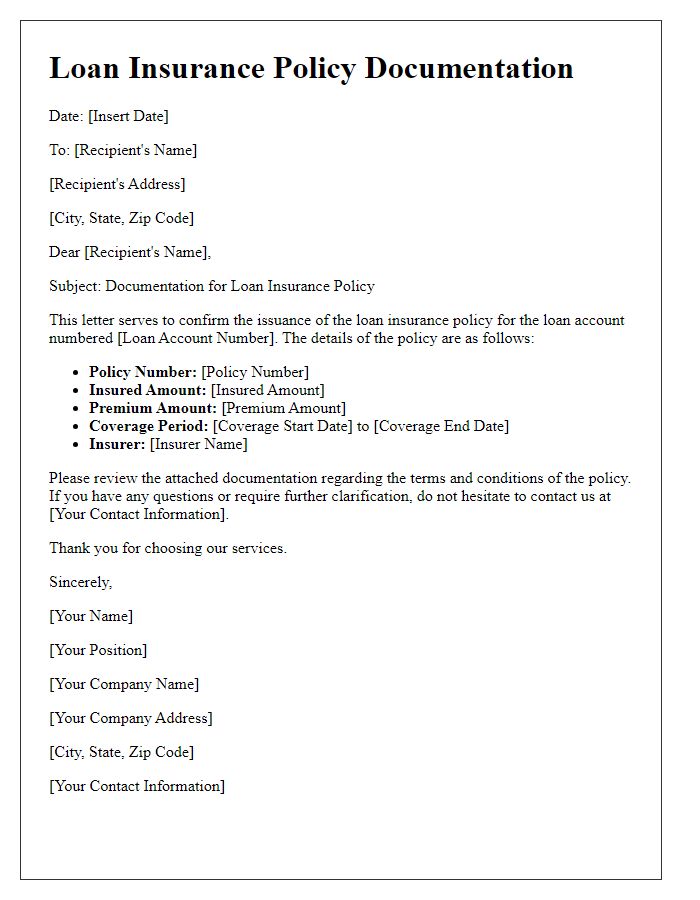

Policy Details

The loan insurance policy serves as a financial safeguard ensuring repayment obligations are met in the event of unforeseen circumstances. Standard elements of the policy include coverage limits, typically ranging from $20,000 to $500,000, depending on the loan amount. Premium costs often vary based on the applicant's age, health status, and occupation, averaging between 0.5% to 3% of the total loan. The policy's effective date aligns with the loan disbursement date while the term matches the duration of the loan, often spanning from 5 to 30 years. Additionally, exclusions may apply, such as pre-existing health conditions or specific hazardous occupations, necessitating a careful review of policy terms to ensure comprehensive coverage. It is crucial to assess the cost-benefit ratio of such policies against potential risks associated with defaulting on loan payments.

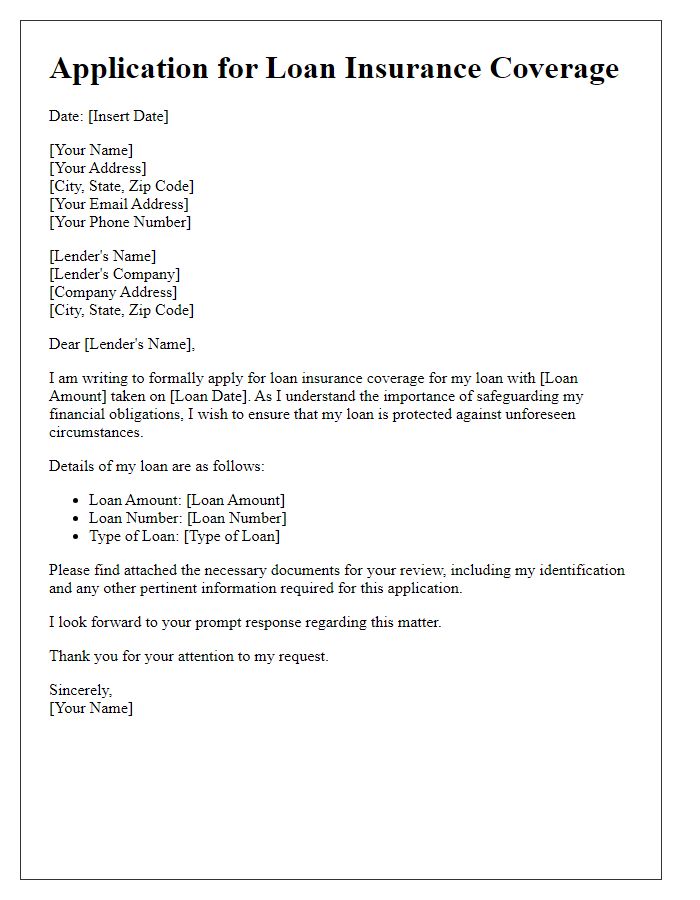

Loan Specifics

A loan insurance policy plays a crucial role in safeguarding borrowers against unforeseen circumstances that might hinder repayment. Specifics include the loan amount, which may range from a few thousand to several million dollars, often contingent on personal financial factors such as credit score and income level. The loan term typically spans between 5 to 30 years, with varying interest rates depending on the lender, market conditions, and individual borrower profiles. It is essential to highlight the type of loan, such as a mortgage for property acquisition or an auto loan for vehicle financing, as this informs the necessary insurance coverage options. Additionally, the loan's repayment structure (fixed or variable rates) might influence insurance costs and terms. Borrowers should also consider factors like the insurance premium, often calculated as a percentage of the loan amount and payable monthly, when assessing the overall financial commitment associated with the loan insurance policy.

Purpose of Loan

A loan insurance policy request serves as a critical document for individuals seeking financial assistance, particularly in securing a mortgage for their home. This policy can cover various scenarios, including job loss, disability, or death, ensuring that loan payments remain manageable even during unforeseen circumstances. For instance, a policy covering a $200,000 home mortgage can provide peace of mind and financial security over a loan term typically spanning 15 to 30 years. The borrower, who may be located in a high-growth real estate market such as Austin, Texas, must highlight the purpose of the loan, such as purchasing a first home or refinancing an existing mortgage. Any specific benefits offered by the insurer, like premium waivers or added coverage for critical illnesses, should also be included to highlight the necessity and potential advantages of obtaining the insurance policy.

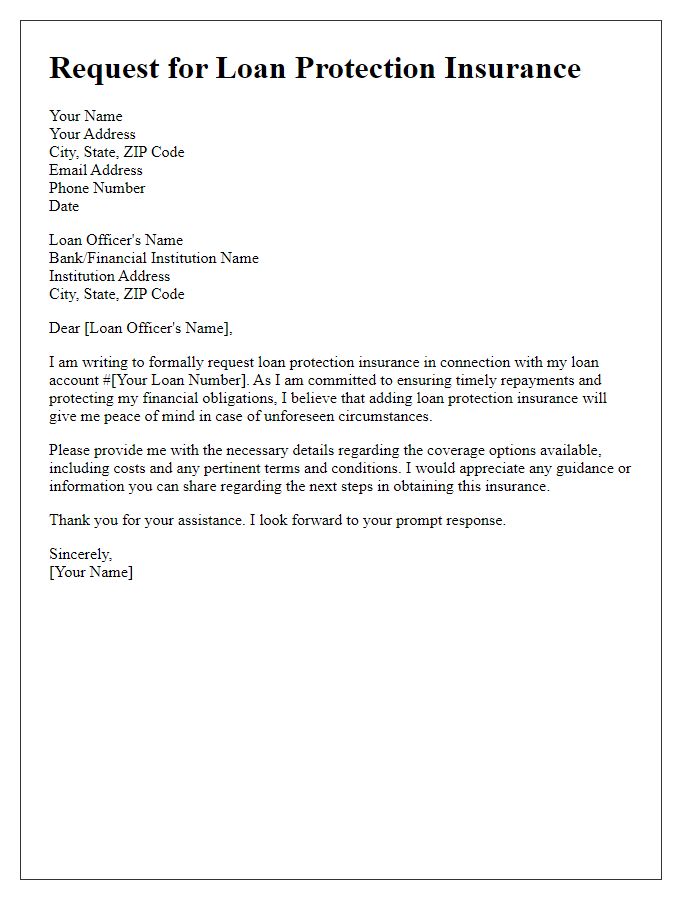

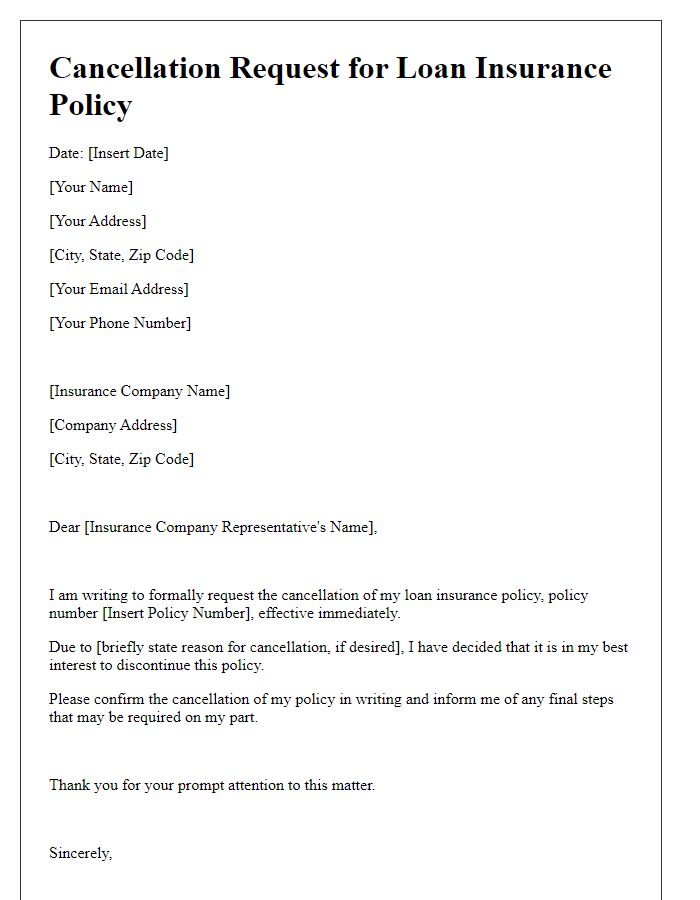

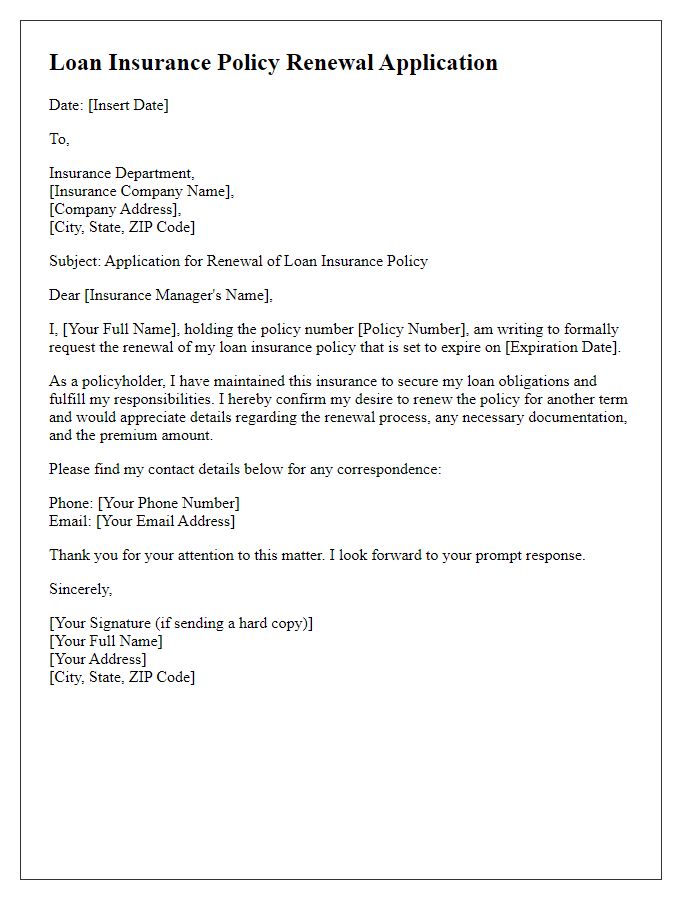

Request Statement

A loan insurance policy serves as financial protection for borrowers, ensuring that their loan obligations are met in unforeseen circumstances, such as job loss or serious illness. This type of policy typically covers the outstanding balance of personal loans, which can be as much as $50,000 or more, depending on the lender's terms. For instance, XYZ Financial Institute offers flexible premium rates based on individual risk assessments, while also ensuring that policyholders can access necessary support during their financial hardship. In addition, many lenders require documentation of the request to initiate coverage, necessitating a formal statement that outlines the specific loan details, the insured amount, and personal identification documentation. This process can significantly simplify recovery efforts for both the borrower and the lending institution, promoting financial stability and peace of mind.

Comments