Are you feeling overwhelmed by your student loans and considering applying for a discharge? You're not aloneâmany individuals are grappling with similar financial burdens and are seeking ways to lighten their load. Crafting a well-structured loan discharge application can make all the difference in your journey towards financial relief. Ready to learn the key steps and tips for submitting an effective application? Read on for more insights!

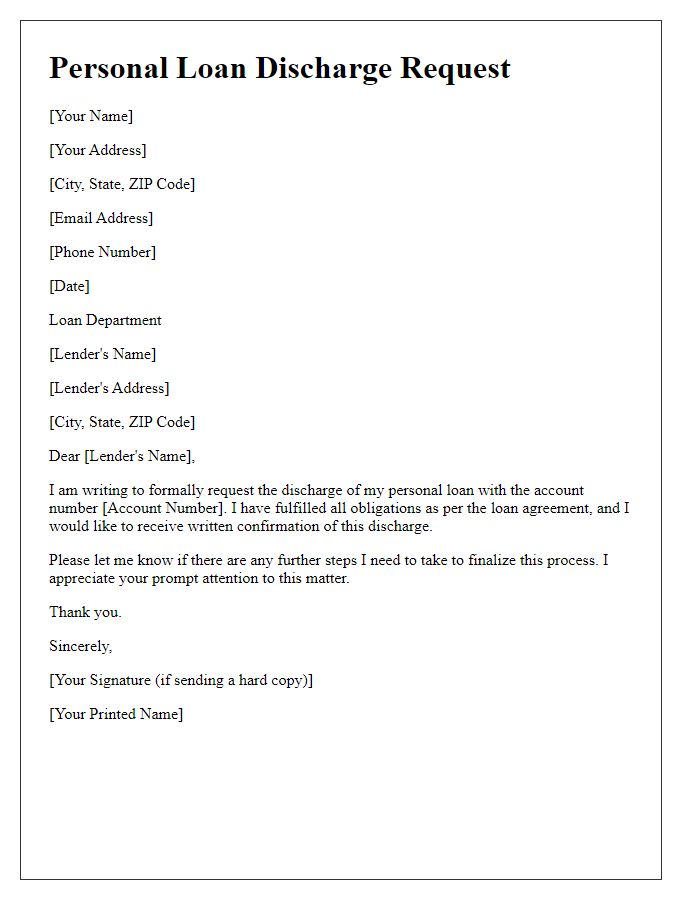

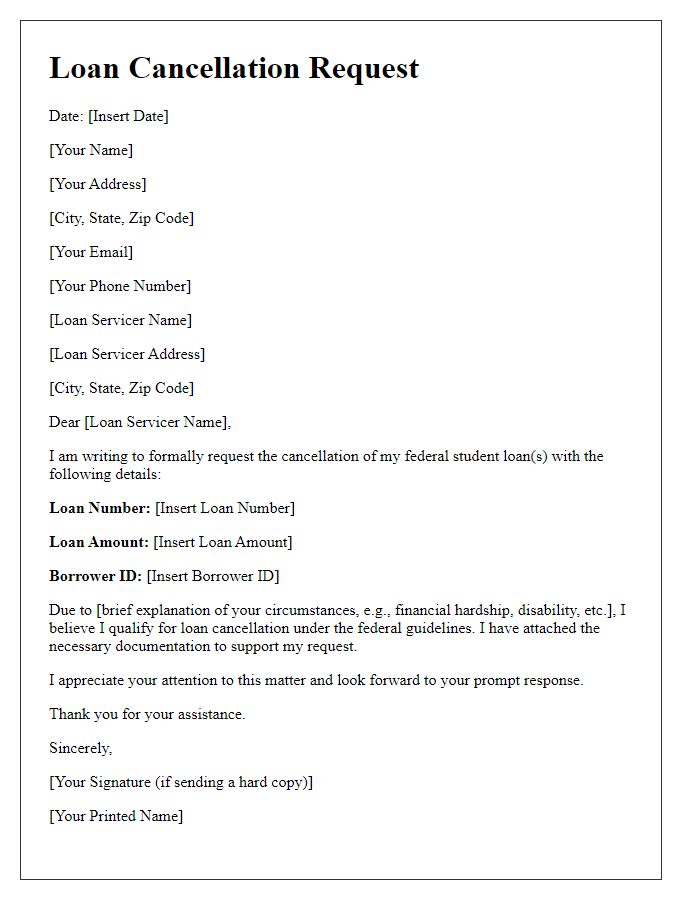

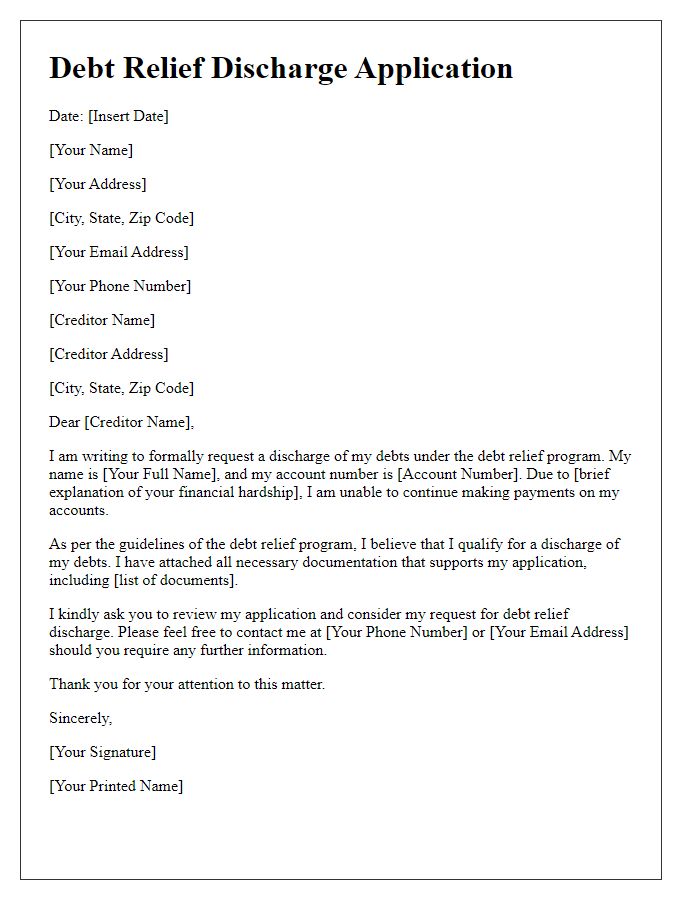

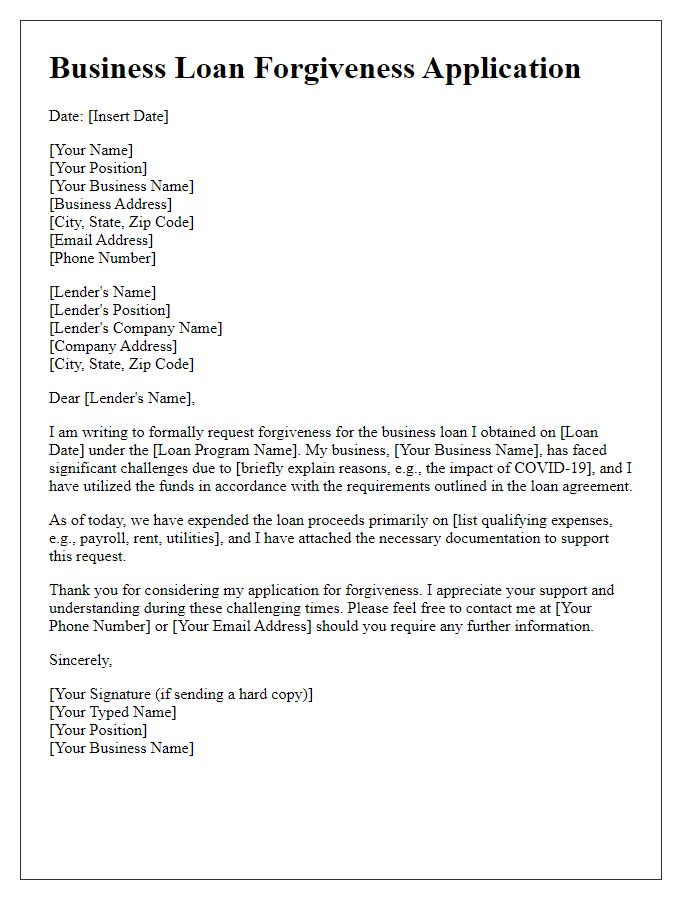

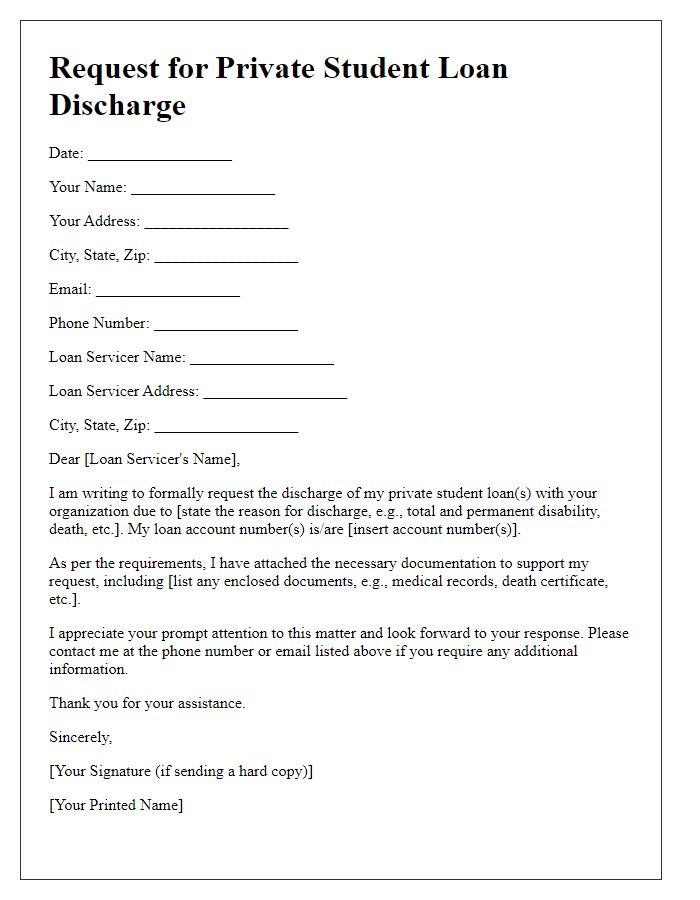

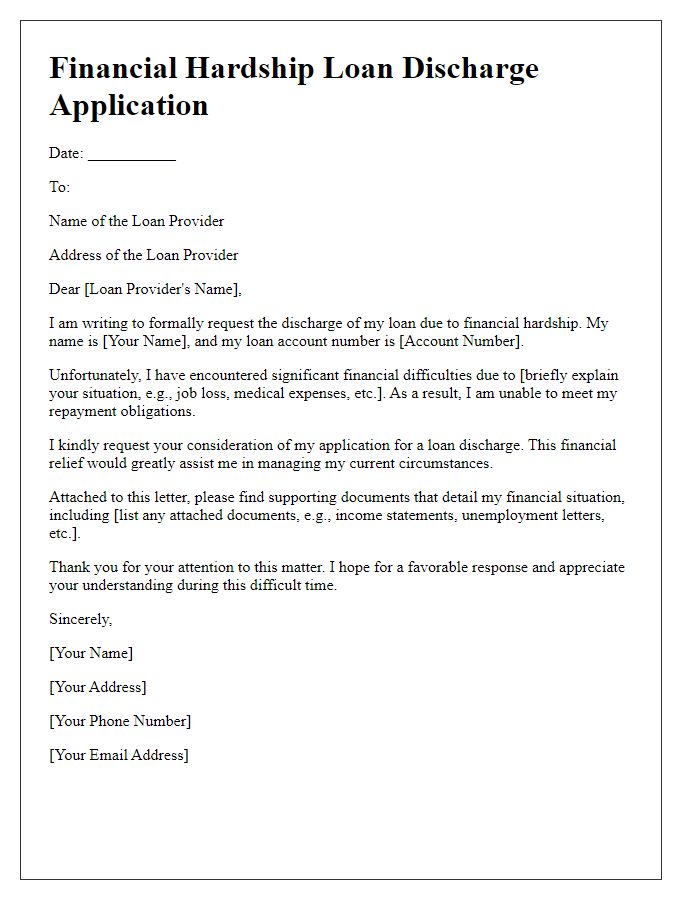

Personal Information

Personal information in a loan discharge application typically includes essential identifying details for proper processing. Full legal name is crucial for verification, including any middle names. Social Security Number (SSN) provides a unique identifier linked to the borrower's financial history. The mailing address ensures that the lender can reach the borrower for any correspondence or updates regarding the discharge process. Contact number, both mobile and home, facilitates direct communication, and email address offers an efficient way to send digital notifications. Additionally, loan account number acts as a reference point for the specific loan being referenced in the application, ensuring clarity in the administrative process.

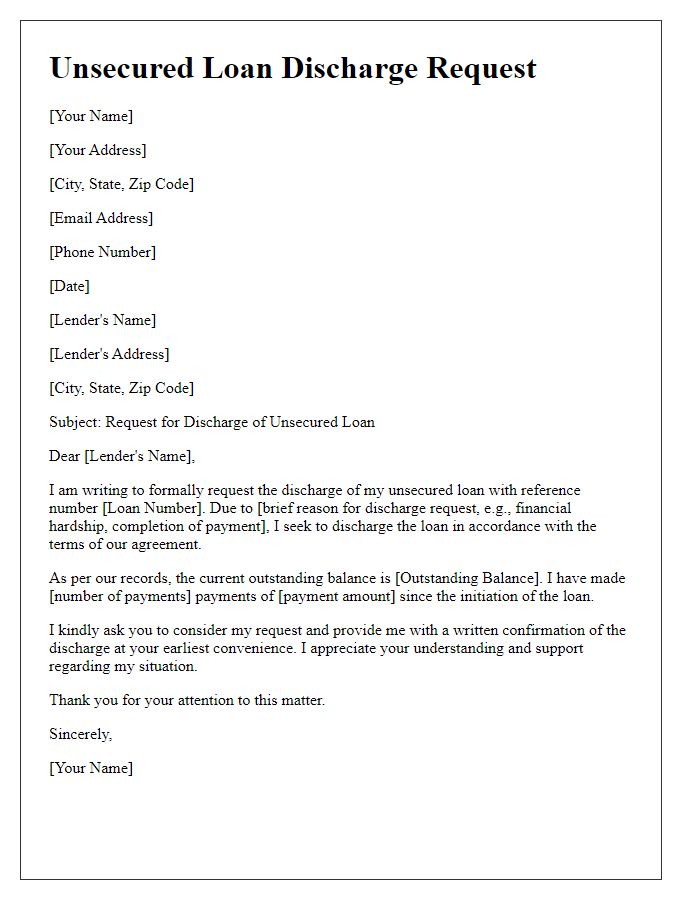

Loan Account Details

Loan discharge applications are crucial for borrowers seeking closure on their loan accounts. Account details such as Loan Account Number serve as identifiers for financial institutions. Loan Amount, the total borrowed sum, typically influences the discharge process. Interest Rate, expressed as a percentage, impacts the overall repayment amount. The Borrower's Name provides essential identification for processing requests. The Servicing Institution indicates the bank or lender managing the loan, ensuring a streamlined communication channel. Additionally, Date of Discharge marks the official closure of the loan, necessary for financial records. Complete and accurate details enhance the efficiency of loan discharge applications.

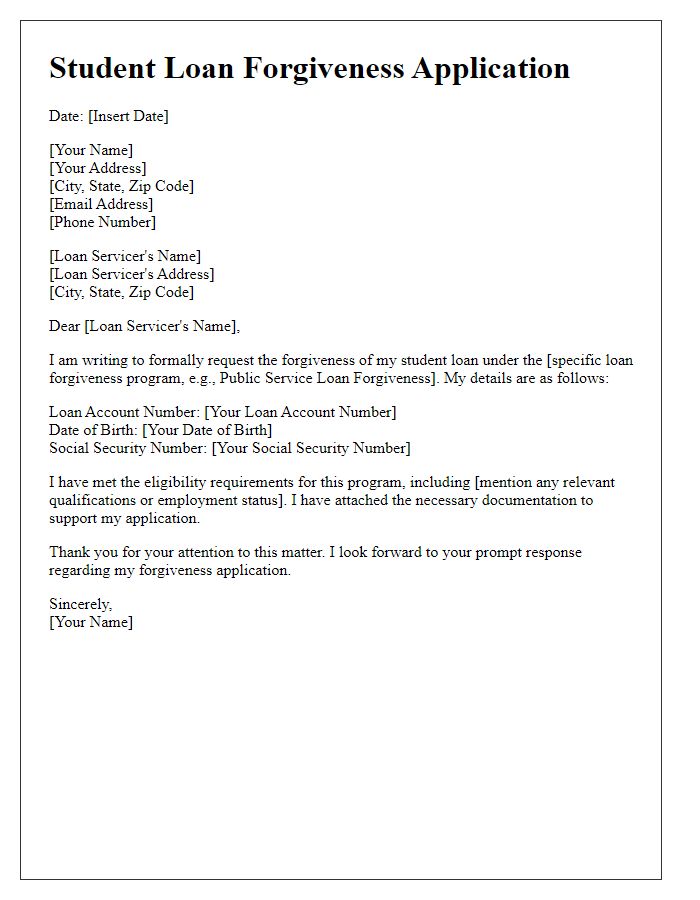

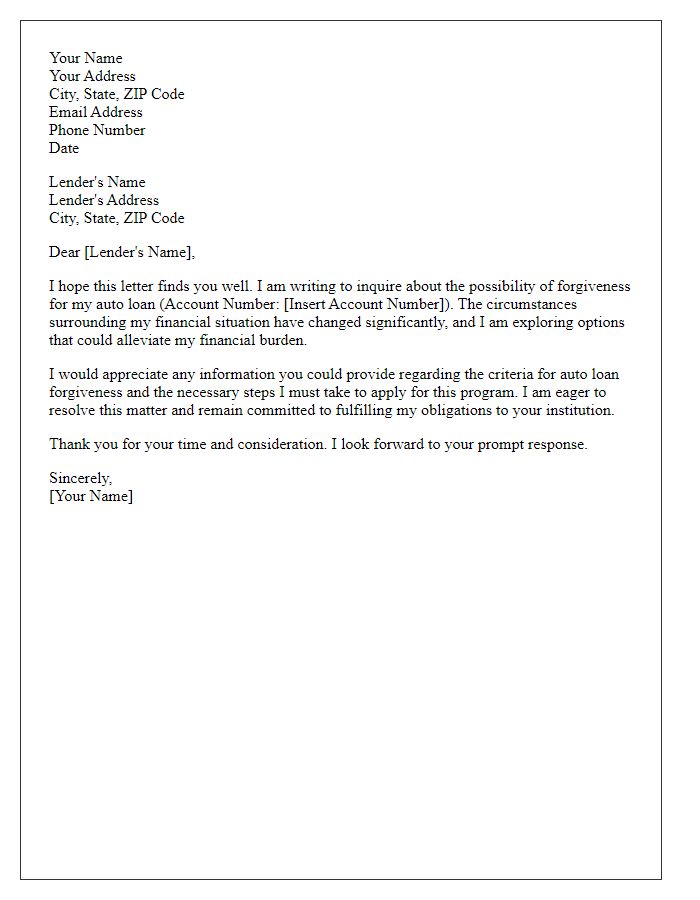

Reason for Discharge Request

Submitting a loan discharge application is a crucial step for borrowers seeking relief from financial obligations due to circumstances such as total and permanent disability, death of the borrower, or significant financial hardship. A thorough explanation of these reasons is essential in establishing the legitimacy of the request, especially in cases like the Department of Education loan forgiveness programs for federal student loans. Borrowers must provide specific documentation to support their claims, including medical records or death certificates, alongside their application form. Accurately detailing these events not only clarifies the context but also enhances the chances of approval from the lending institution, allowing borrowers to alleviate their financial burdens effectively.

Financial Status Explanation

Loan discharge applications require a clear explanation of financial status, detailing one's current economic conditions. An individual experiencing consistent unemployment, such as job loss due to the pandemic, may find themselves overwhelmed by debt, significantly affecting their ability to make monthly payments. For instance, a household income dropping from $75,000 annually to $30,000 highlights the drastic change in financial stability. Additionally, mounting medical debt, with averages reaching $4,000 per individual, can further strain finances. It is crucial to include specific numbers and percentages when representing mortgage obligations, credit card debts, and student loans, ensuring the reviewing body understands the deepening financial crisis. These elements provide clarity to the circumstances necessitating loan discharge, allowing consideration for leniency based on genuine hardship.

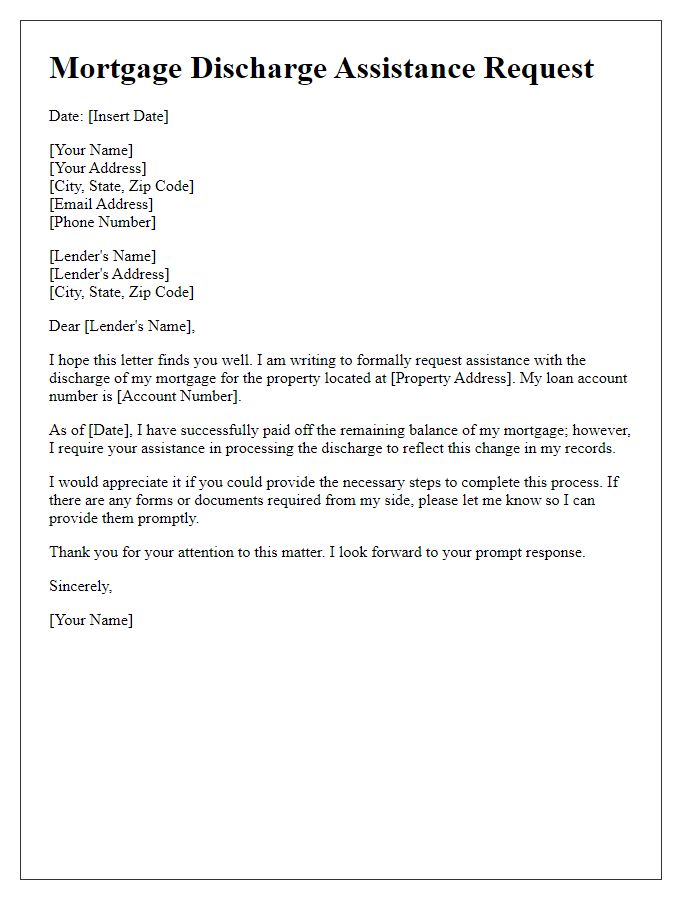

Supporting Documents List

In the process of a loan discharge application, it is essential to gather an organized set of supporting documents to facilitate approval from the lending institution. Key items include identification proof (such as a government-issued photograph ID like a passport or driver's license), loan documentation (the original loan agreement detailing terms and conditions), financial statements (recent bank statements or pay stubs demonstrating current income), and discharge application form (specifically filled out according to lender requirements). Additionally, tax returns (the last two years for comprehensive income verification), hardship letter (explaining the circumstances leading to the discharge request), and any communication with the lender (emails or letters that outline prior discussions or agreements) should be included. These documents ensure a thorough review process, ultimately aiding in the loan discharge outcome.

Comments