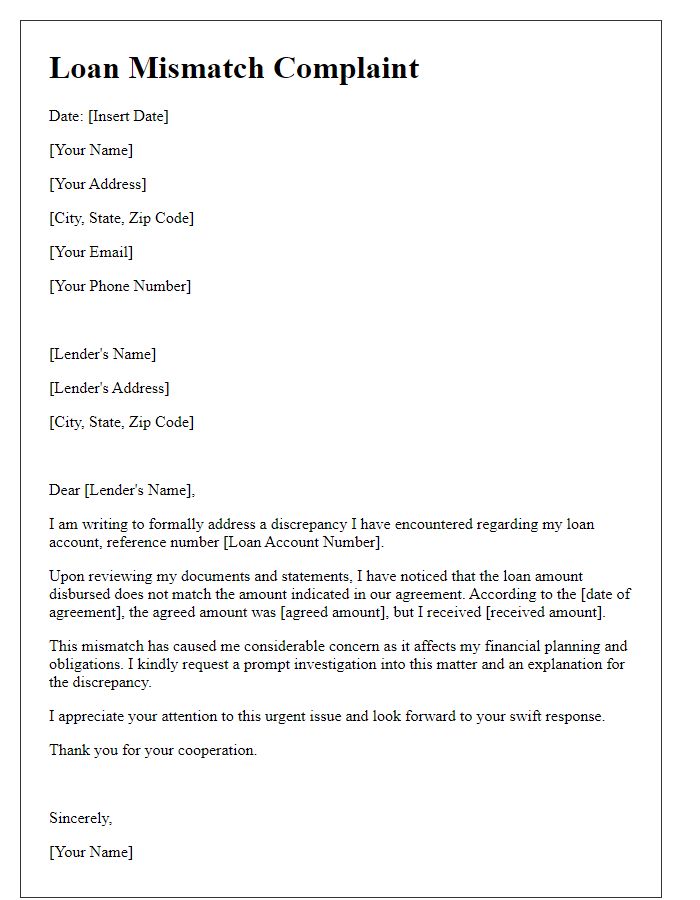

Hey there! If you've ever found yourself puzzled over a loan discrepancy, you're not alone. Navigating the world of finance can be tricky, and sometimes numbers just don't seem to add up. In this article, we'll guide you through a simple letter template that can help you clarify any confusion with your loan provider. So, let's dive in and get you back on track!

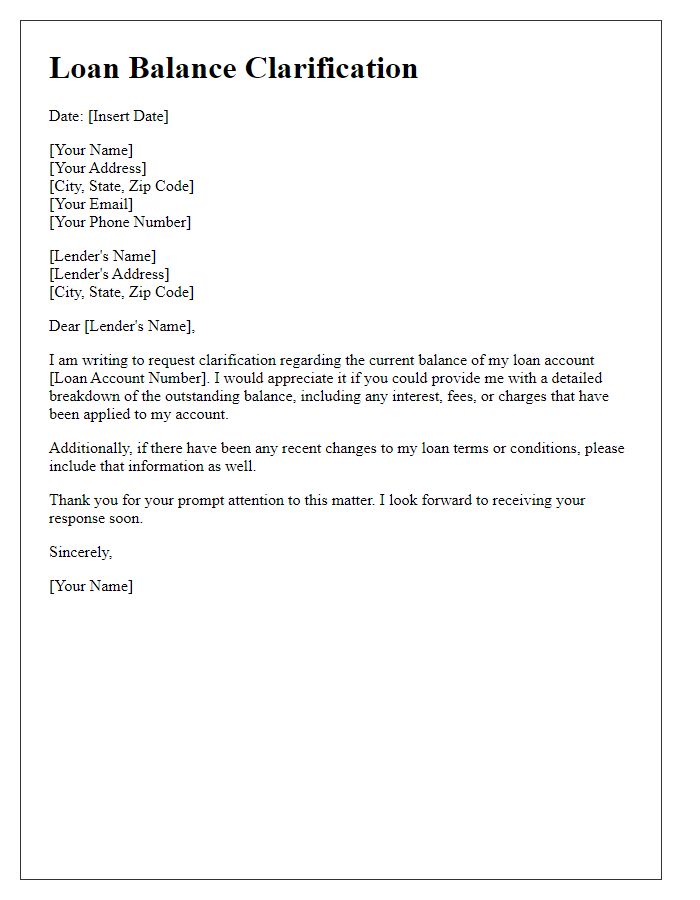

Accurate identification details (name, account number, loan reference)

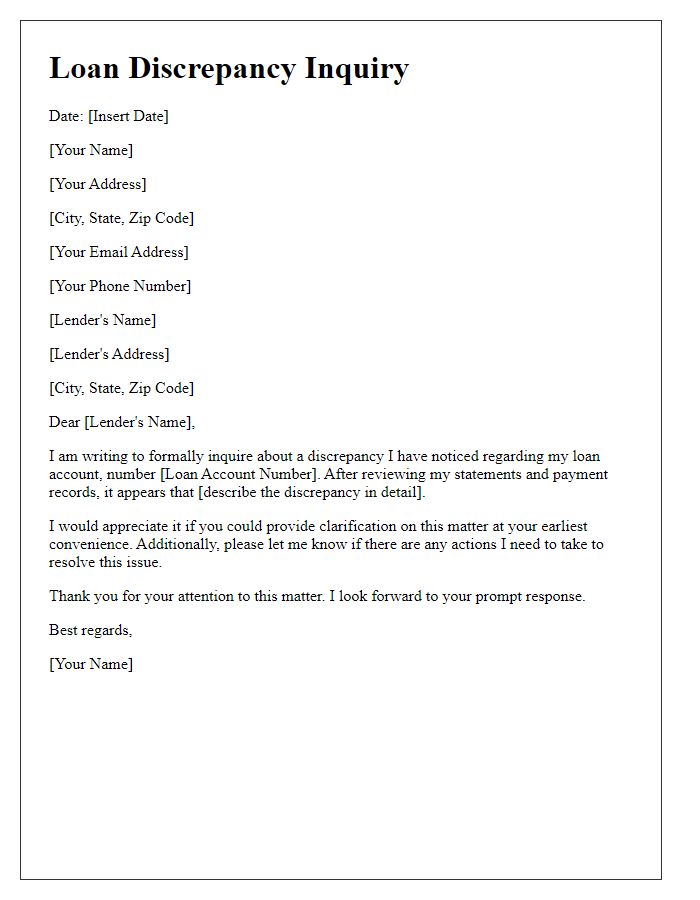

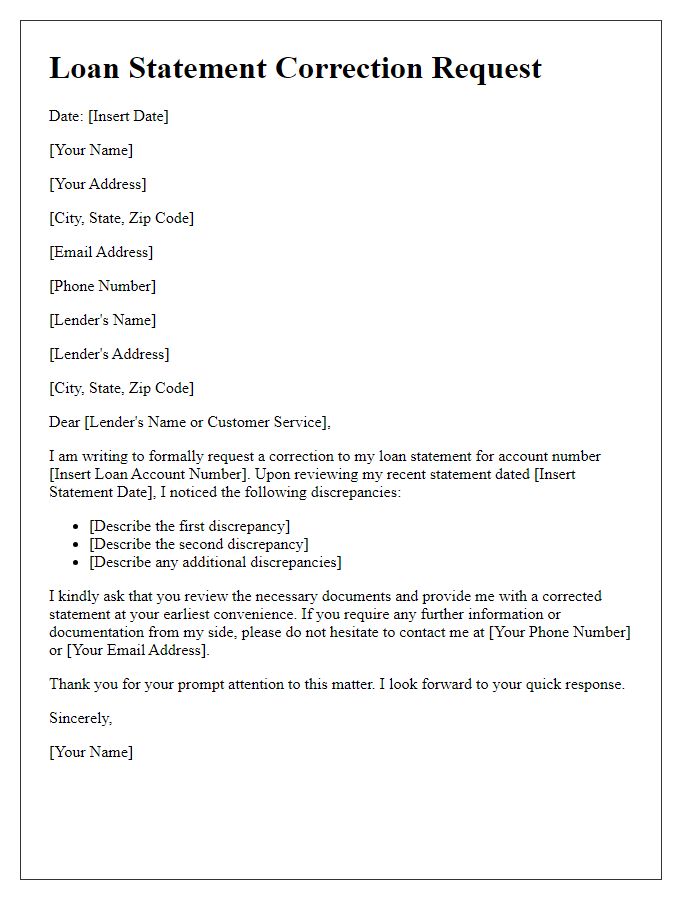

Loan discrepancies often arise from inaccurate identification details that include critical elements such as full name (first and last), unique account number (specific to the financial institution), and distinct loan reference number (associated with the particular loan agreement). These identifiers (given the unique nature of each account) are essential for banks and lending institutions to trace the correct records, ensuring timely resolution of discrepancies. Missing or incorrect information can lead to delays, misunderstandings, and even potential disputes regarding loan terms, payments, or outstanding balances. Therefore, accurate submission of these details is paramount to facilitate efficient communication and clarification of any loan-related issues.

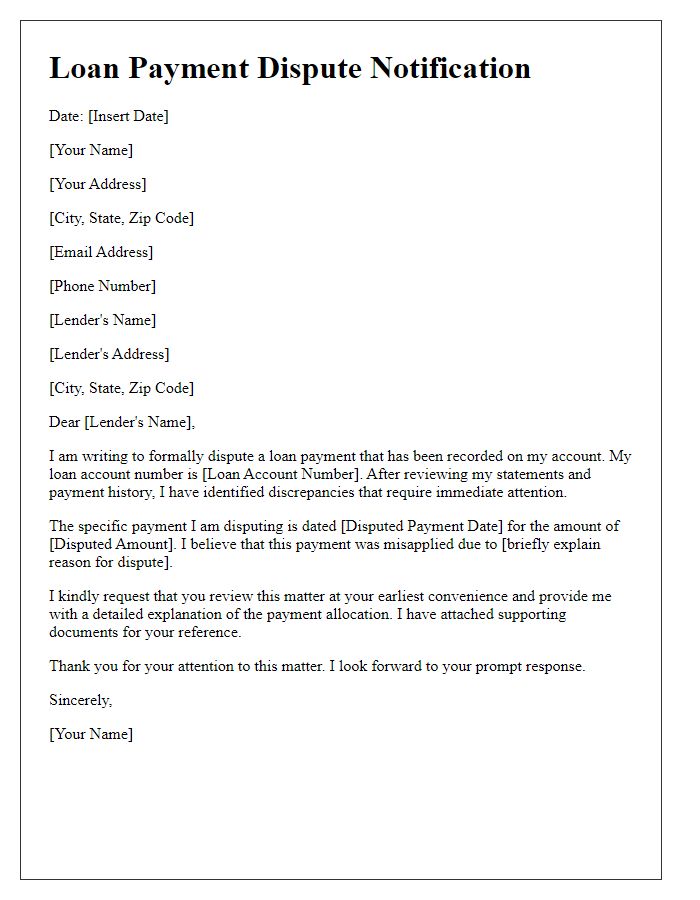

Clear explanation of the discrepancy

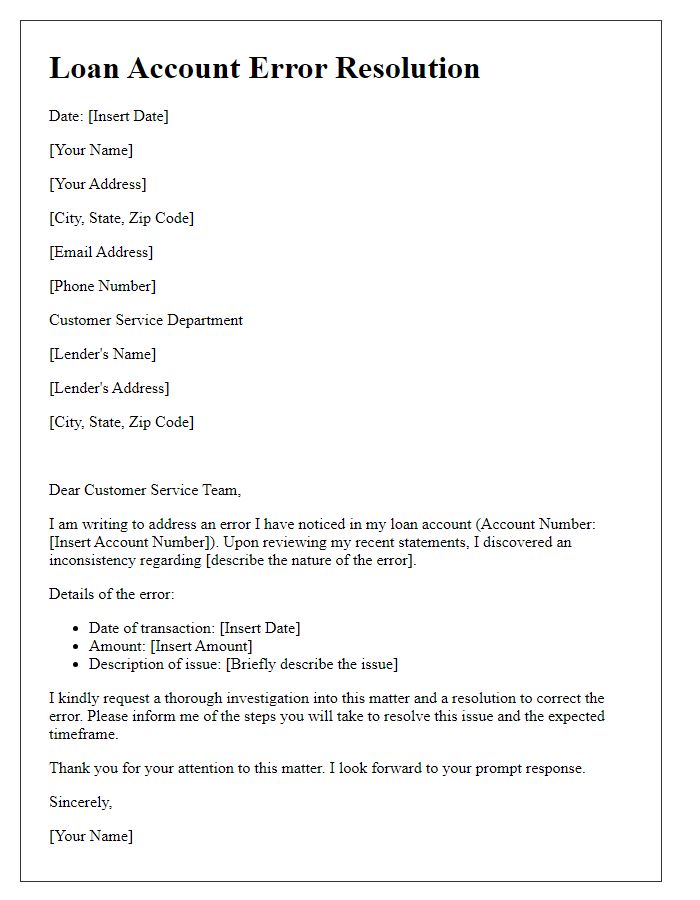

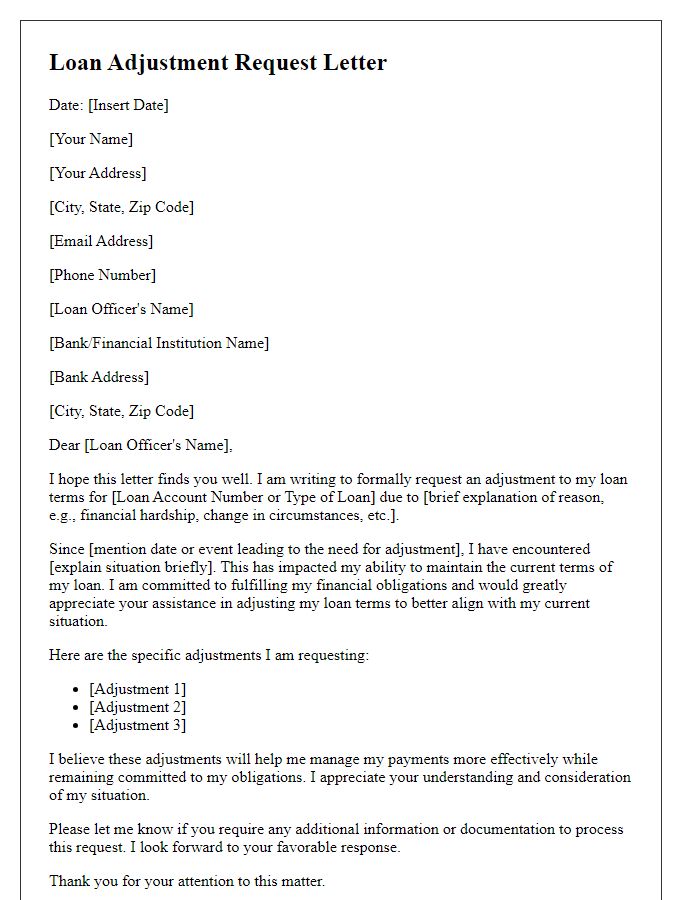

Loan discrepancies can arise from various factors, such as interest rate miscalculations, payment application errors, or incorrect principal amounts. Reviewing loan statements from financial institutions reveals specific inconsistencies, such as a stated interest rate of 5% versus an effective rate of 6%, leading to unexpected payment figures. Additionally, discrepancies can occur if payments made in previous months are not accurately reflecting on the balance, potentially due to clerical errors by the loan servicing department. Addressing such discrepancies requires detailed examination of each transaction, comparing them against original loan agreements, and consulting with customer service representatives for clarification and resolution of the issues presented.

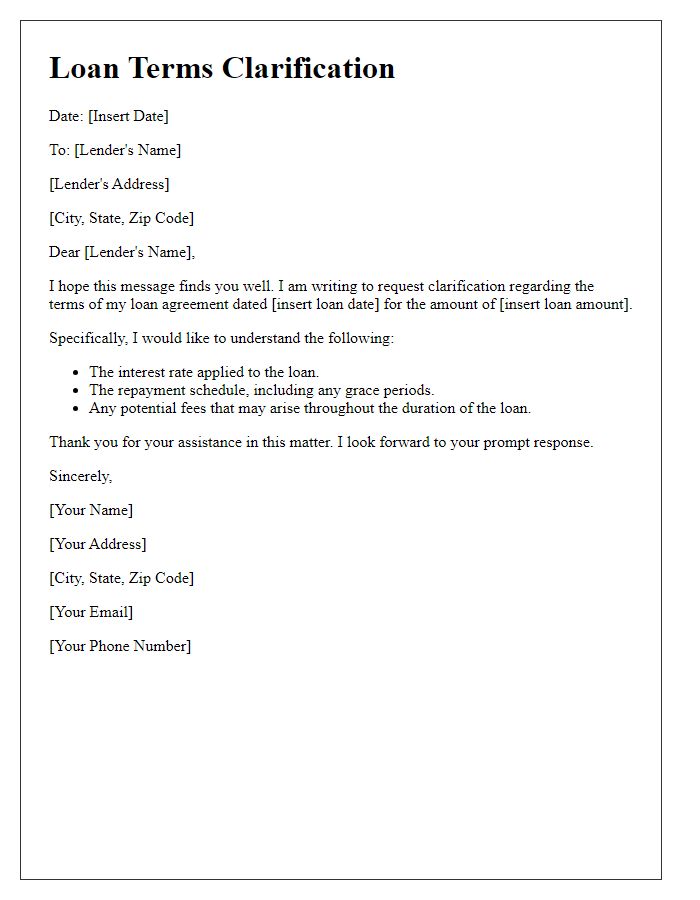

Supporting documents or evidence

Loan discrepancies can lead to significant misunderstandings between financial institutions and borrowers. Detailed supporting documents, such as loan agreements, payment history statements, and bank records, are essential for clarifying these discrepancies. A borrower must present accurate evidence including credit reports, income verification letters, and identification to substantiate their claims. The process may involve analyzing interest rates, payment timelines, and account numbers associated with the loan in question. Additionally, gathering correspondence records, such as emails or letters exchanged with the lender, can provide context for the misunderstanding, ensuring a comprehensive review of the situation. Proper documentation and organization of information can expedite resolution and restore clarity to the financial agreement.

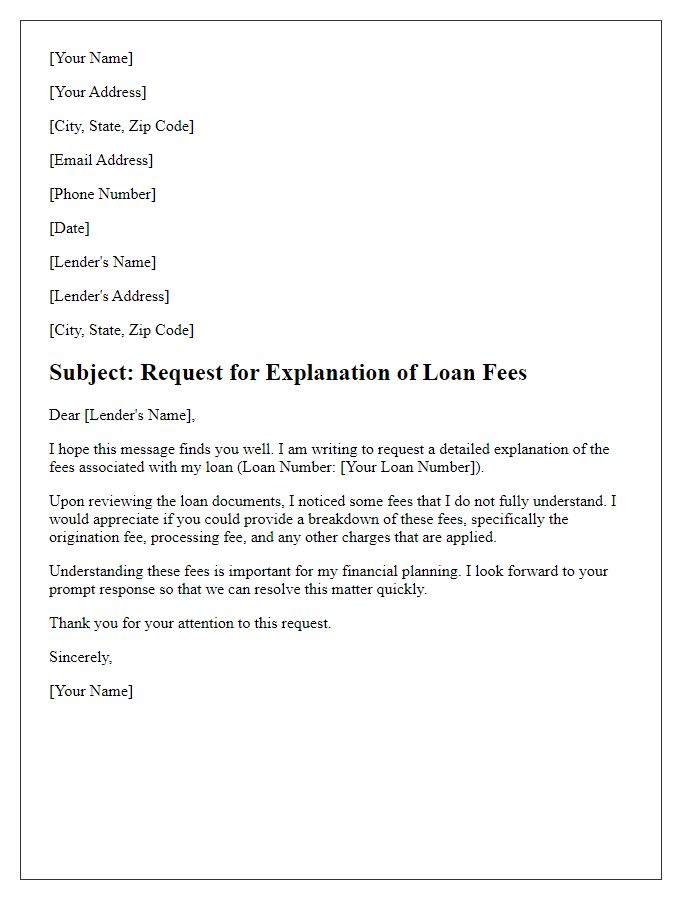

Request for resolution or next steps

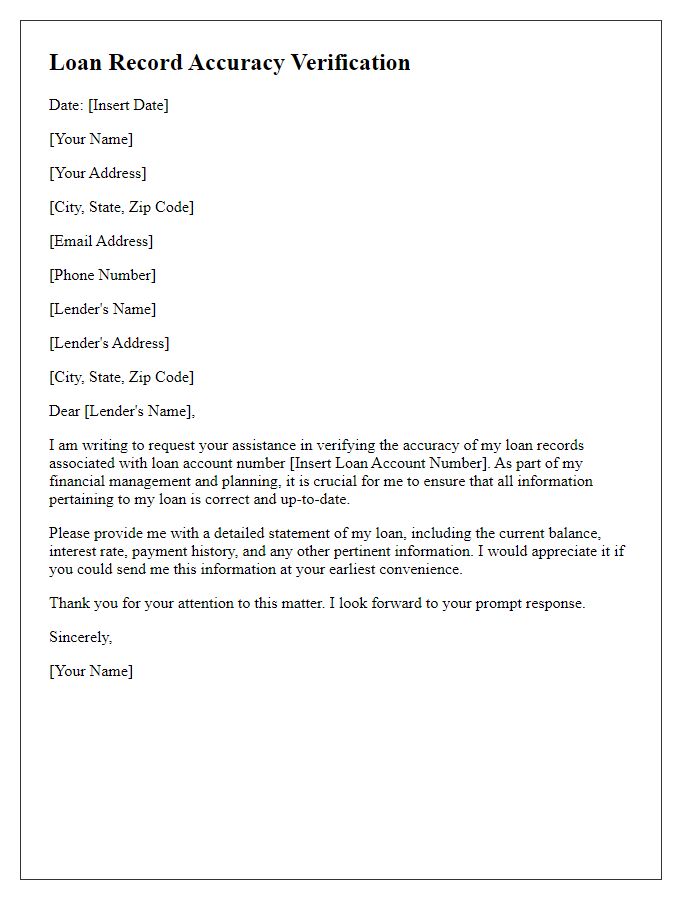

Loan discrepancies can significantly impact financial planning and credit scores. Borrowers noticing differences between expected loan payment amounts and actual statements should first gather relevant documents such as loan agreements, payment history, and bank statements from the financial institution, which may include entities like banks or credit unions. Detailed examination of these records often reveals misunderstanding or errors in interest calculations, fees, or payment allocations. Following this, reaching out to the lender's customer service department in a structured manner is crucial. A clear request for clarification, specifying the loan type (like personal loan or mortgage), reference numbers, and dates of transactions ensures efficient resolution. Documenting the interaction with representatives, including names and times, creates a comprehensive record for any necessary follow-up on unresolved issues.

Contact information for follow-up

Inaccurate loan documentation can lead to discrepancies in financial records, impacting credit scores and future borrowing capabilities. Interest rates, typically ranging from 3% to 36% depending on the lender and borrower's creditworthiness, can vary significantly. Loan agreements often include a grace period of 15 to 30 days for missed payments, allowing borrowers to rectify issues without penalty. Contacting the loan servicing company, often listed on monthly statements or the lender's website, is crucial for clarifying discrepancies. It's essential to maintain a record of all communication, including names, dates, and any reference numbers provided during the discussion.

Comments