Are you considering low-interest financing options for your next big project? Whether it's a home renovation or a new vehicle, finding the right financial solution can make all the difference. It's essential to explore your options and understand the benefits they could bring. Join us as we delve deeper into the world of low-interest financing and uncover the best strategies for securing your dream investment!

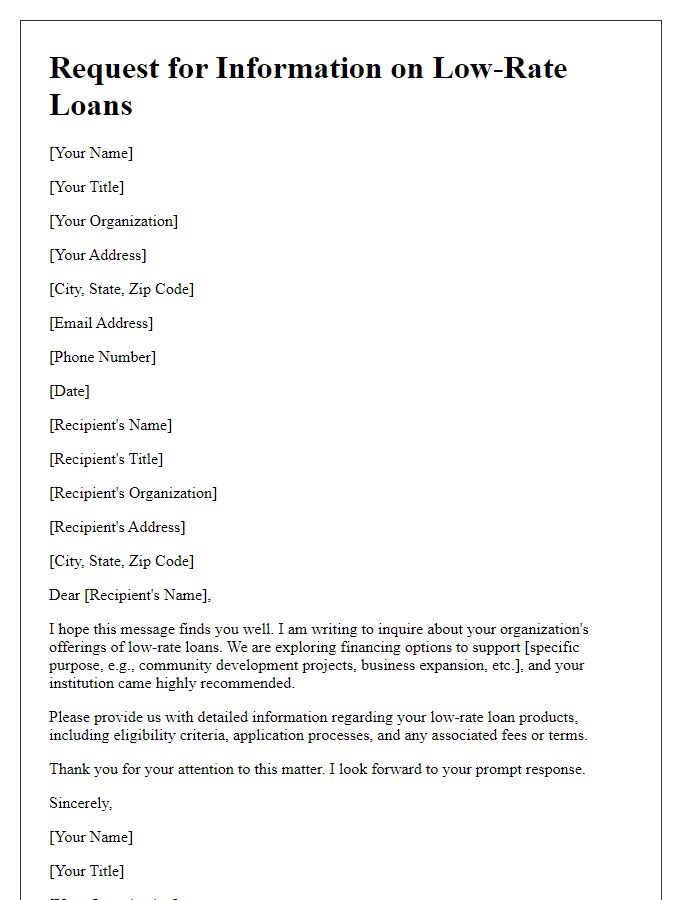

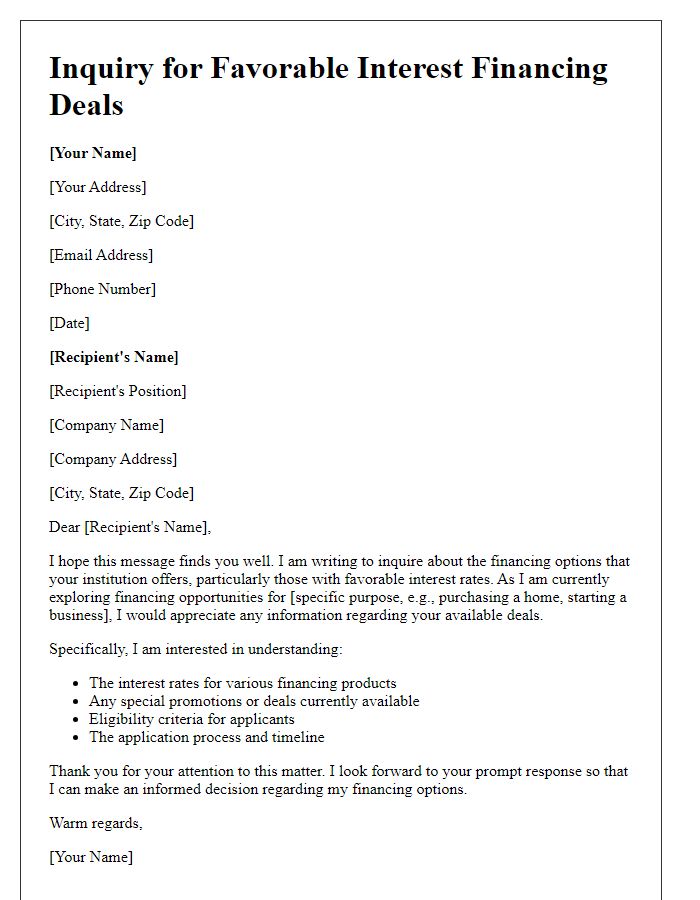

Company Contact Information

Low-interest financing can significantly benefit businesses seeking capital for expansion or operational costs. Many financial institutions, like banks or credit unions, often offer rates lower than 5% for qualified borrowers. Various programs, such as Small Business Administration (SBA) loans, cater specifically to small businesses within the United States, providing access to funds for equipment purchases or business upgrades. Companies must research potential lenders located in their area, considering factors like application processes, repayment terms, and eligibility requirements, which can vary greatly among institutions. Additionally, tailored financing solutions can also be found through alternative lenders, offering more flexible terms than traditional banks, thus allowing businesses to meet their financial needs effectively.

Purpose of Inquiry

Individuals often seek low-interest financing options to achieve significant financial goals, such as purchasing a home, funding education, or consolidating existing debts. Financial institutions and lenders offer this type of financing to help clients manage repayments more conveniently while minimizing interest expenses. Specific terms, such as a fixed annual percentage rate (APR) typically ranging from 3% to 7%, can vary based on credit scores and market conditions. For example, individuals with higher credit scores often receive more favorable rates, making their financing options more accessible. Proper documentation, including income verification and credit history reports, is required for consideration in the application process, which usually takes place through an online platform or in-person at financial institutions. Ultimately, these inquiries aim to facilitate better financial management by reducing the cost of borrowing for essential and life-changing investments.

Desired Financing Terms

An inquiry regarding low-interest financing options can yield significant savings for individuals or businesses seeking to manage expenses more effectively. Specific financing terms, such as an interest rate below 5%, can provide a favorable environment for repayment. The loan amount, potentially ranging from $10,000 to $50,000, should align with the borrower's needs, whether for home improvements or small business capital. Additionally, considering loan duration, typically between 3 to 7 years, will impact monthly payment amounts, allowing for better financial planning. Different financial institutions, including credit unions and banks, may offer unique advantages, such as flexible repayment plans or reduced fees, further enhancing the appeal of low-interest financing.

Business Background and Credentials

When seeking low-interest financing, it is essential to present your business background and credentials effectively. Company foundation year, for instance, showcases stability, while a detailed overview of core services (e.g., retail, manufacturing) illustrates operational scope. Financial performance, particularly annual revenue figures (e.g., $500,000), and consistent profitability over the past three years should be highlighted to instill confidence in lenders. Credentials such as industry certifications (e.g., ISO 9001) or awards (e.g., Small Business of the Year 2022) signify a commitment to quality and excellence. Additionally, mention of a strong credit score (preferably above 700) reinforces reliability, while showcasing a diverse customer base (e.g., clients from tech, healthcare, and finance sectors) indicates market resilience and business adaptability.

Call to Action and Contact Details

Low-interest financing options are crucial for individuals seeking affordable financial solutions for significant investments, such as purchasing a home, financing educational pursuits, or acquiring a vehicle. Lending institutions often provide options with Annual Percentage Rates (APRs) ranging from 3% to 7%, depending on credit scores and market conditions. Prospective borrowers are encouraged to contact local banks, credit unions, or online lenders for personalized quotes and detailed information. Important details like the loan term (typically spanning from 12 months to 30 years) and specific repayment plans can significantly influence overall costs. Contacting a financial advisor to discuss eligibility and potential offers can further enhance understanding of available choices.

Comments