Are you feeling overwhelmed after receiving a loan rejection? You're not aloneâmany individuals face this frustrating situation, but it's essential to remember that a rejection isn't the end of your financial journey. Crafting a thoughtful appeal letter can often make a difference, highlighting your circumstances and showcasing your commitment to improving your financial standing. If you're ready to learn how to effectively communicate your case, keep reading for tips on writing a compelling loan rejection appeal!

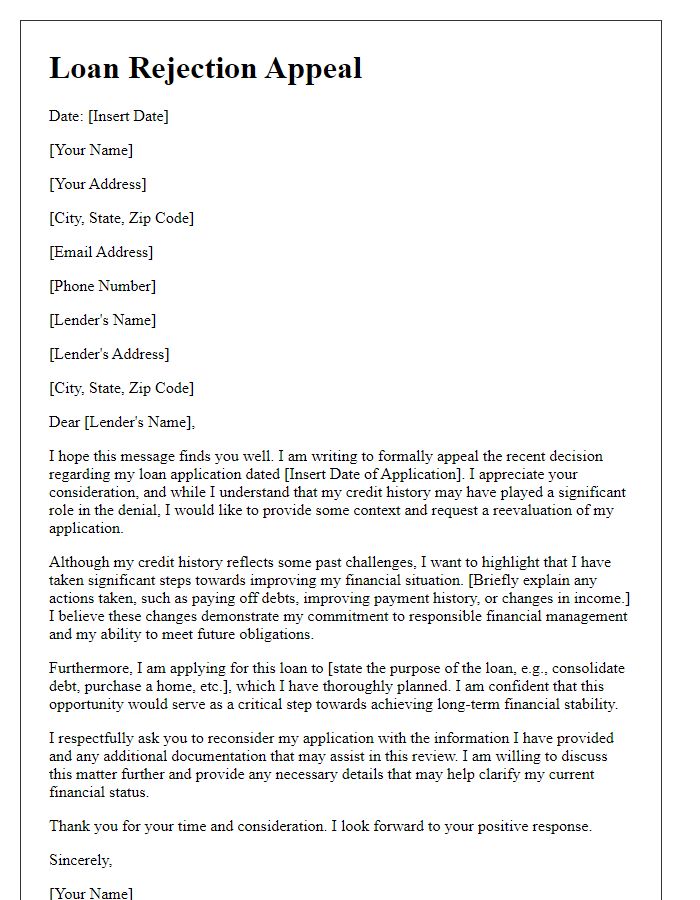

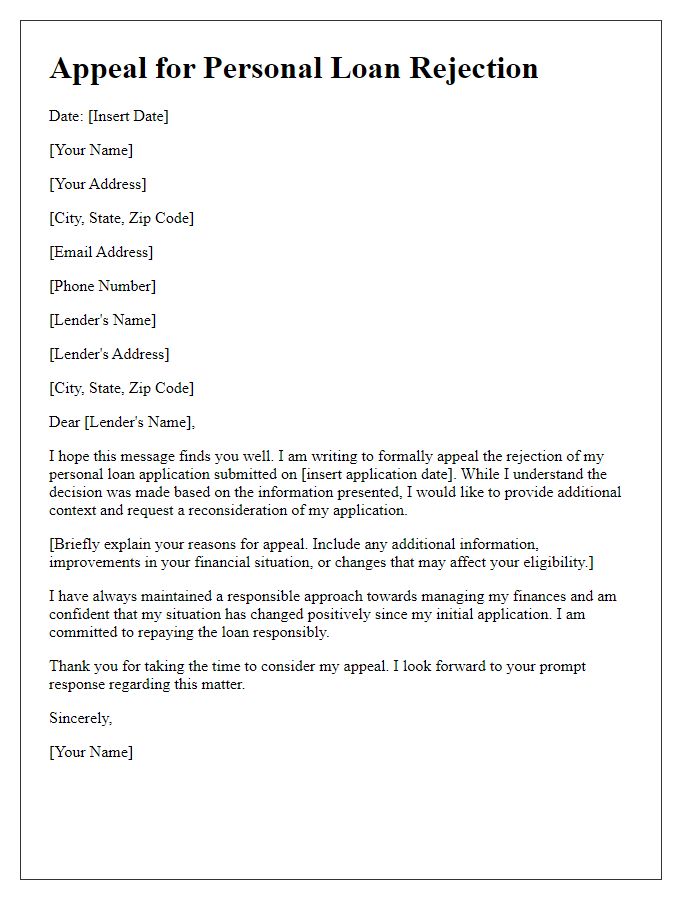

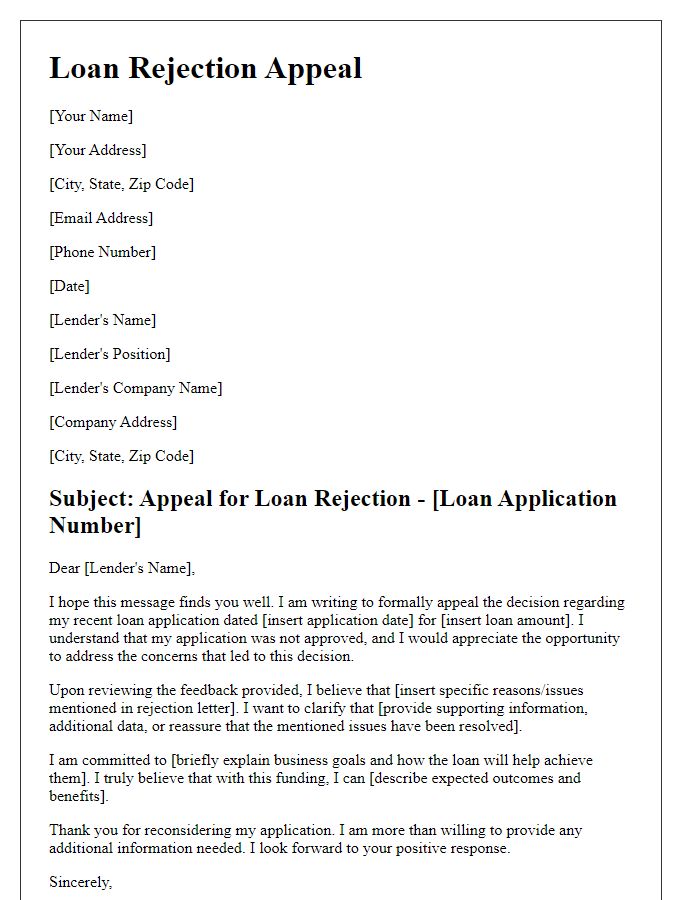

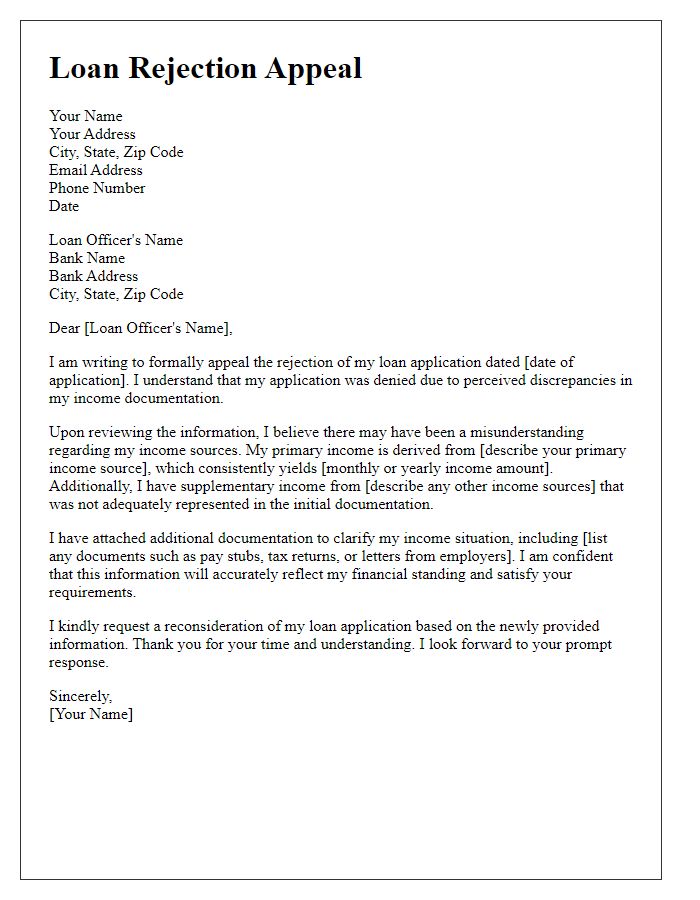

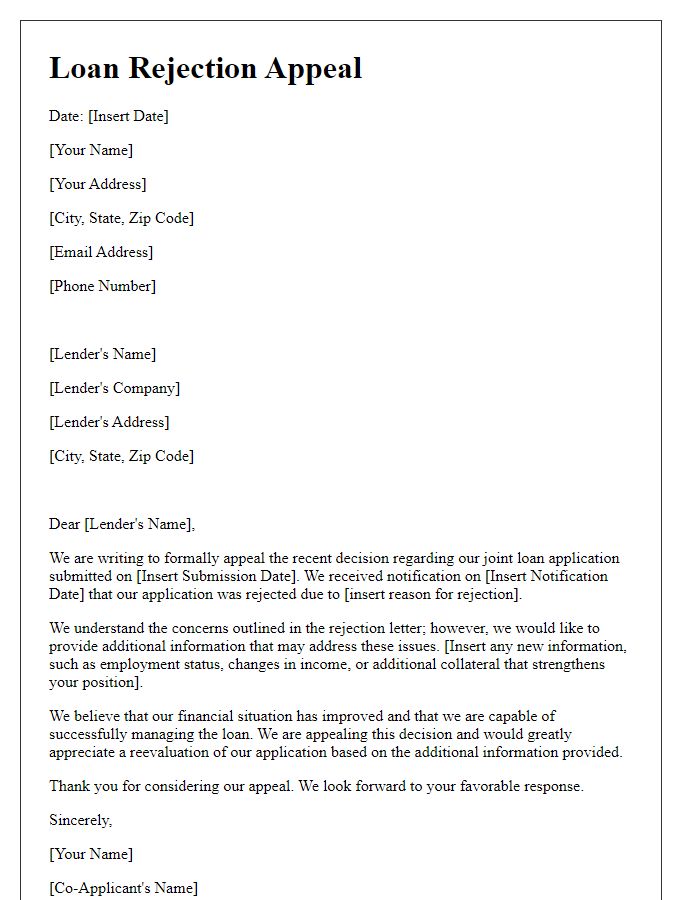

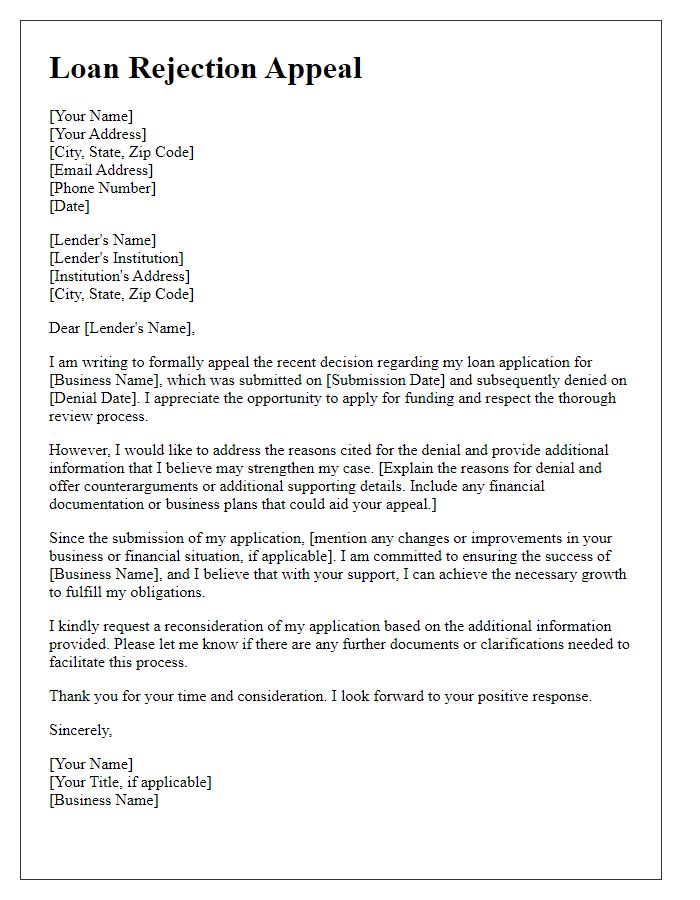

Applicant's personal information and loan application details.

The loan rejection appeal process can be intricate, involving significant details concerning the applicant's personal and financial circumstances. Key elements include the applicant's full name, address, and contact information, ensuring a clear identification of the individual involved. The loan application details should encompass the type of loan sought, such as a mortgage or personal loan, along with the amount requested, which may range from hundreds to thousands of dollars. Additional components involve the application date and any reference numbers associated with the loan file, providing context for the appeal. Emphasizing recent improvements in credit score or changes in financial status (like a new job or significant debt reduction) can strengthen the appeal and offer compelling reasons for reconsideration.

Clear reason for appealing the rejection.

An appeal against a loan rejection may focus on an overlooked credit history detail, such as an exemplary payment record on previous loans exceeding five years, or error in financial reporting indicating incorrect debt levels. Gathering comprehensive documentation, including recent pay stubs reflecting stable income (for example, a recent monthly income of $4,500), and a detailed budget illustrating monthly expenses (like $1,200 for housing, $600 for groceries) can strengthen the case. Providing additional context, such as significant life events (e.g., a job loss in March 2023) that have since stabilized may demonstrate improved financial health. Providing evidence of a consistent savings pattern (such as $10,000 in a savings account) and requesting reconsideration based on these merits can enhance the appeal's effectiveness.

Explanation of financial situation improvements or changes.

In recent months, I have experienced significant changes in my financial situation, specifically an increase in monthly income due to a recent promotion at my job as a financial analyst in New York City. This position has resulted in a salary raise of approximately 15%, as well as additional bonuses tied to performance metrics. Furthermore, I have diligently reduced my monthly expenses by implementing a strict budgeting plan, resulting in an estimated savings of 20%. I have also taken on freelance work, contributing an extra $500 each month, which has strengthened my overall financial stability. These improvements have consequently enhanced my ability to meet loan repayment requirements without undue stress. Additionally, I have been actively working to improve my credit score, which has seen a positive increase of 50 points in the last six months through timely payments and reduced credit utilization. I believe these adjustments make me a more suitable candidate for the loan I initially applied for.

Supporting documents or evidence for reconsideration.

When appealing a loan rejection to a financial institution, it is essential to include comprehensive supporting documents for reconsideration. Relevant evidence might include recent pay stubs from your employer, demonstrating consistent income over at least the past three months, alongside a detailed credit report outlining your credit history. Additionally, personal identification such as a government-issued ID and proof of residence, like a utility bill, enhances the authenticity of your application. If applicable, include evidence of asset ownership providing additional financial stability, such as bank statements showing substantial savings or investment accounts. Moreover, if there were any discrepancies or unforeseen circumstances impacting your creditworthiness, such as medical emergencies or job loss, attach documentation proving your efforts to resolve those situations. These documents significantly improve your appeal by presenting a more complete picture of your financial circumstances and credit reliability.

Professional and respectful tone throughout the letter.

Loan rejections can be disheartening, especially when the application was backed by substantial documentation. Applicants often seek clarity regarding the specific reasons for their denial, as understanding these factors can aid in addressing concerns. It is crucial to highlight relevant information, such as income statements, employment history, and credit scores, which may have been inadequately considered. Additionally, an appeal should emphasize the applicant's financial responsibility, including timely payments on previous debts and a history of savings, potentially backed by figures. Addressing the lender directly can foster a respectful dialogue, and providing updated information might enhance the chances for reconsideration.

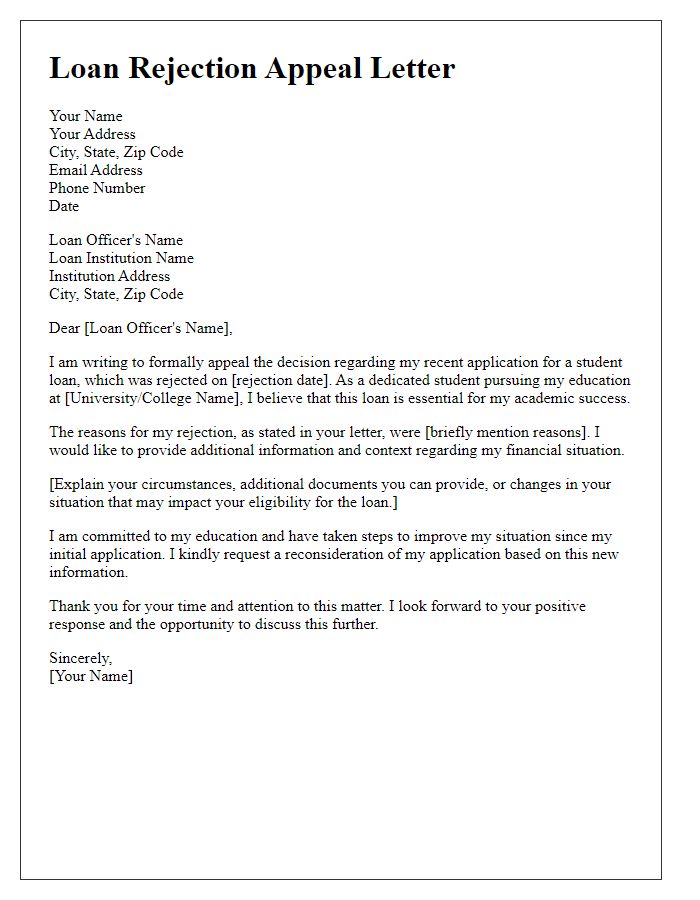

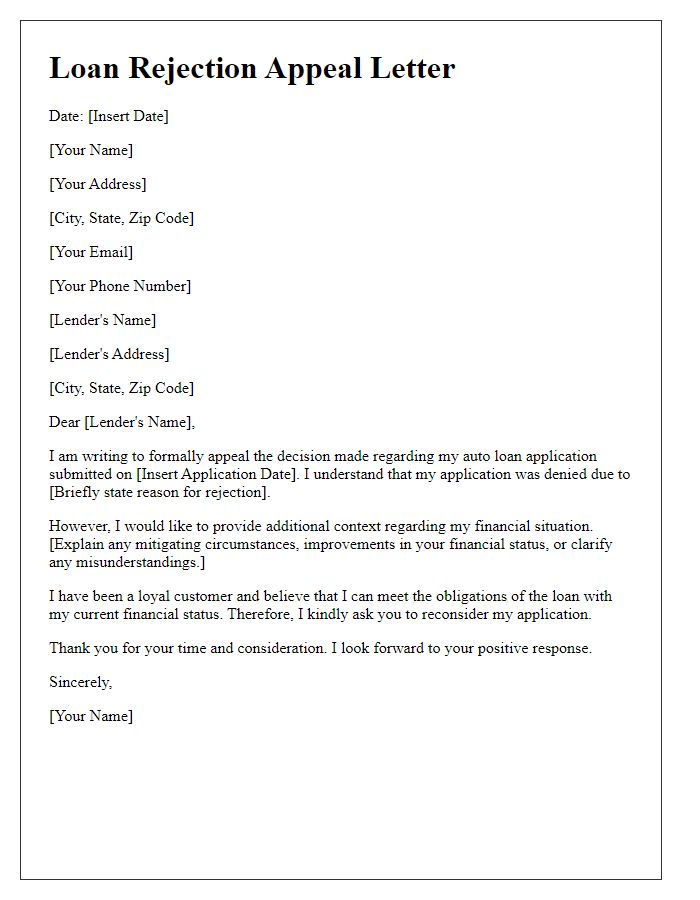

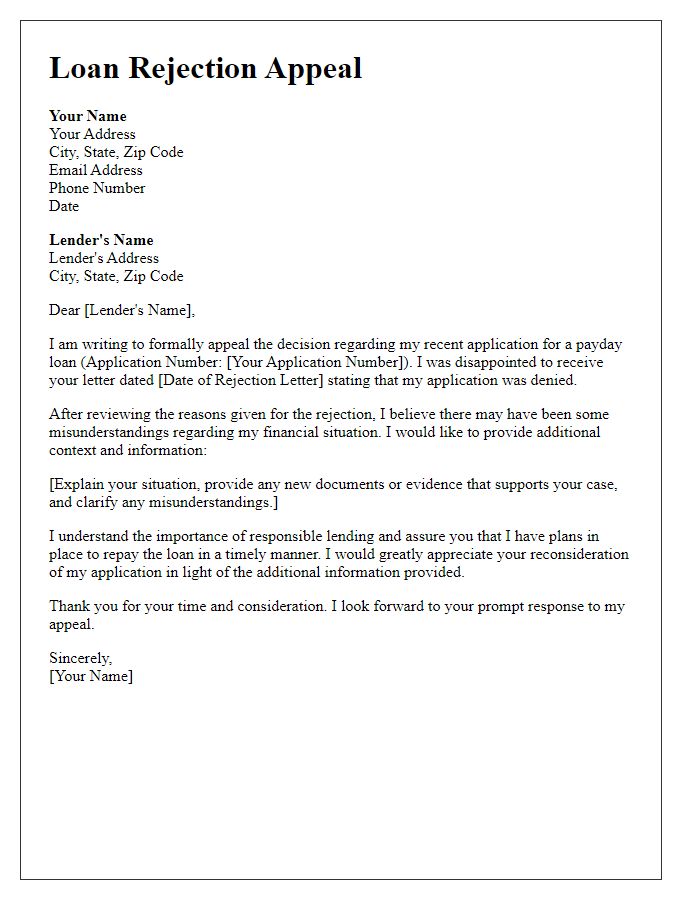

Letter Template For Loan Rejection Appeal Samples

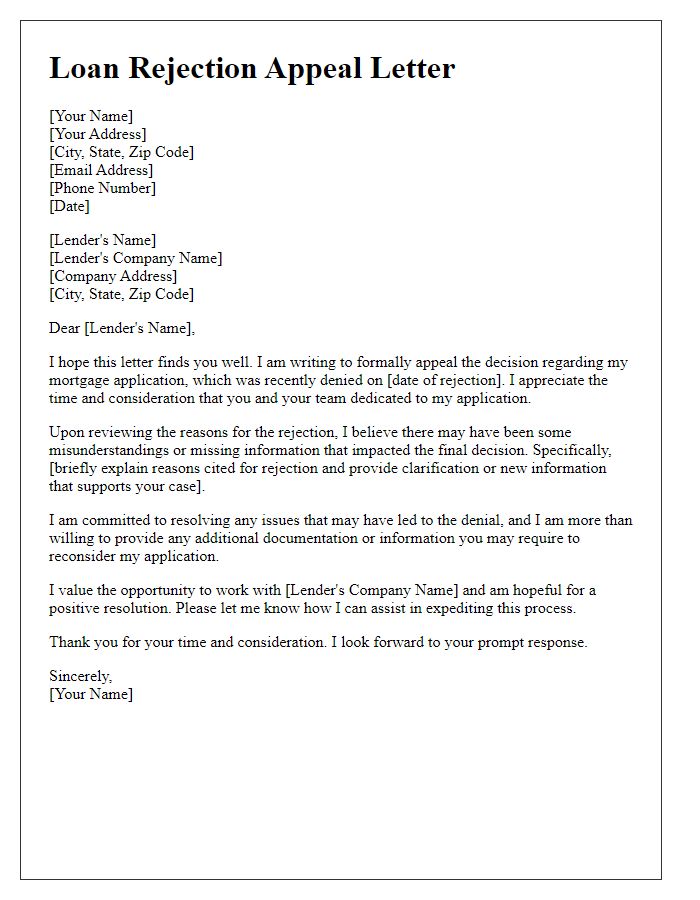

Letter template of loan rejection appeal addressing credit history issues.

Comments