Are you looking to apply for a technology loan but unsure of how to draft that all-important letter? Writing a clear and concise application letter can make a significant difference in your chances of approval. From outlining your financial needs to detailing how the technology will benefit your business or education, every word counts. Ready to learn how to put together the perfect letter for your technology loan application? Read on for a helpful guide!

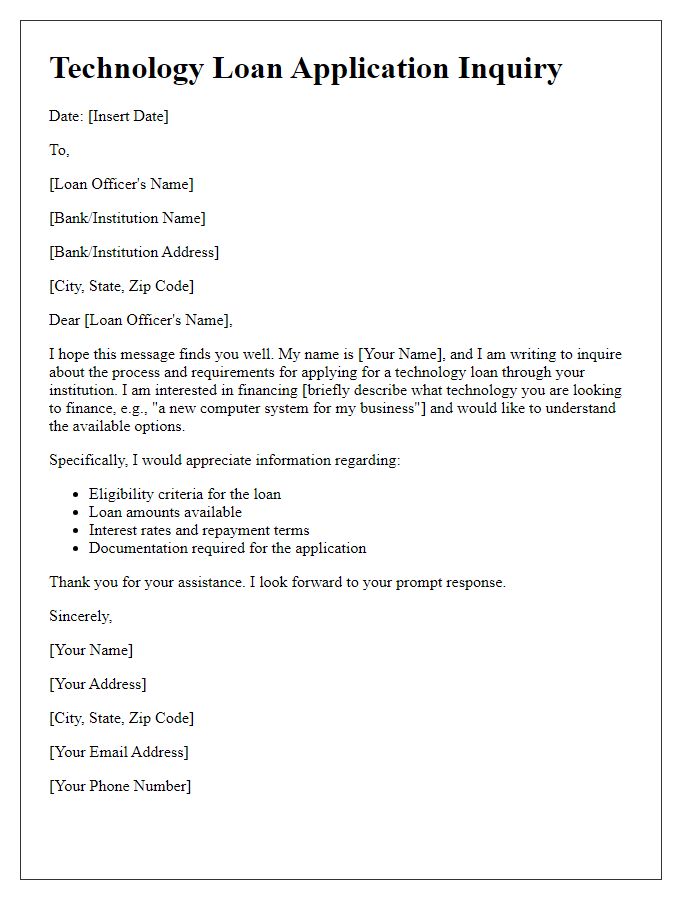

Applicant Information

The technology loan application review process begins with the assessment of applicant information, which includes essential data such as full name, address, contact number, and email address. Financial details reveal credit score (ranging from 300 to 850, where higher scores indicate better creditworthiness), annual income, and employment status, providing a comprehensive view of the applicant's financial health. The applicant must also disclose the purpose of the loan, often for purchasing specific technology items like laptops, tablets, or software necessary for educational or business purposes. Supporting documents, including pay stubs, tax returns, and bank statements, substantiate the applicant's financial claims, facilitating an informed evaluation by the loan officer. The applicant's personal background may include education level (high school, bachelor's, master's degrees) and employment history, reflecting the applicant's ability to repay the loan.

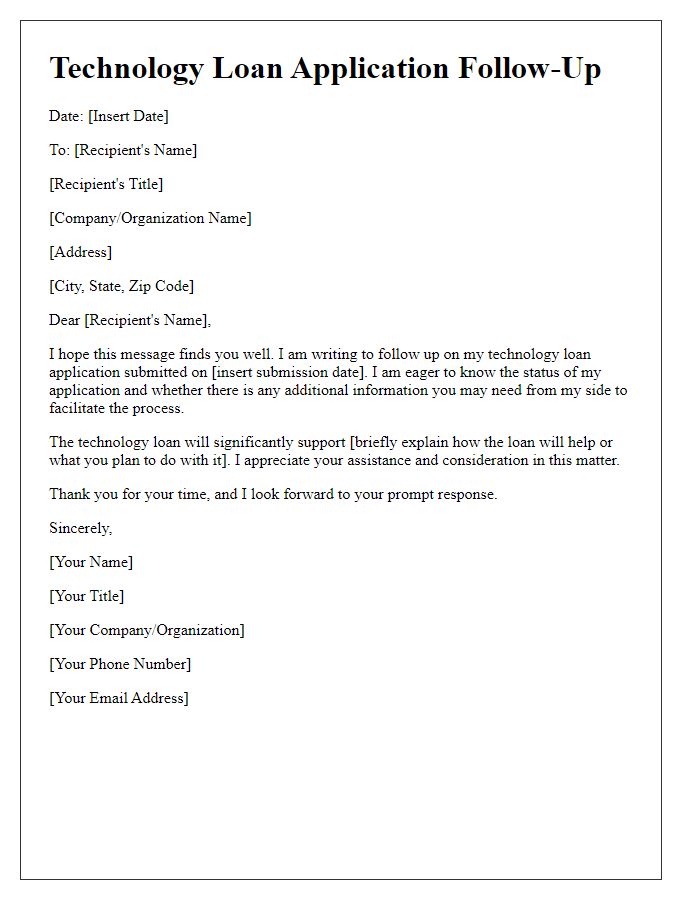

Loan Purpose and Amount

An application for a technology loan seeks financial assistance for acquiring advanced equipment, such as high-performance laptops or cutting-edge software tools. The proposed loan amount of $25,000 aims to enhance operational efficiency and improve productivity in a small business environment. This financial support is crucial for upgrading aging technology infrastructure, ensuring compatibility with the latest industry standards, and fostering innovation in digital solutions. By securing this funding, the applicant intends to invest in tools that will facilitate seamless collaboration among remote teams, enhance data security measures, and ultimately drive growth in the competitive market landscape.

Financial History and Creditworthiness

A thorough evaluation of financial history and creditworthiness is essential for technology loan applications, particularly in institutions such as banks and credit unions. Credit scores, typically ranging from 300 to 850, provide insight into the applicant's borrowing habits. A score below 600 often indicates a higher risk factor. Applicants are also assessed on their payment history, which includes details of missed payments, defaults, or bankruptcies that occurred within the past seven years. The debt-to-income ratio measures monthly obligations against gross income, ideally below 36 percent, reflecting affordability. Employment history is scrutinized, with stable jobs lasting over two years in a related technology sector adding to the applicant's credibility. Overall financial records, such as bank statements and asset holdings, play a critical role in determining loan eligibility and terms.

Technology and Market Analysis

A comprehensive technology and market analysis reveals the critical factors influencing consumer behavior in the rapidly evolving tech sector. The global market for artificial intelligence was valued at $62.35 billion in 2020 and is projected to expand at a compound annual growth rate (CAGR) of 40.2%, reaching a staggering $997.77 billion by 2028. Key players such as Google, Microsoft, and IBM dominate this space, continually innovating with products leveraging machine learning and data analytics. Regional insights indicate a significant growth in North America and Asia-Pacific, fueled by increased investment in smart technology and strong demand for automation solutions in industries like healthcare and finance. Emerging trends reveal a rising emphasis on sustainability, with tech companies seeking eco-friendly practices and products as consumers prioritize environmental responsibility. Additionally, challenges such as data privacy concerns and regulatory hurdles remain critical considerations for businesses navigating this competitive landscape.

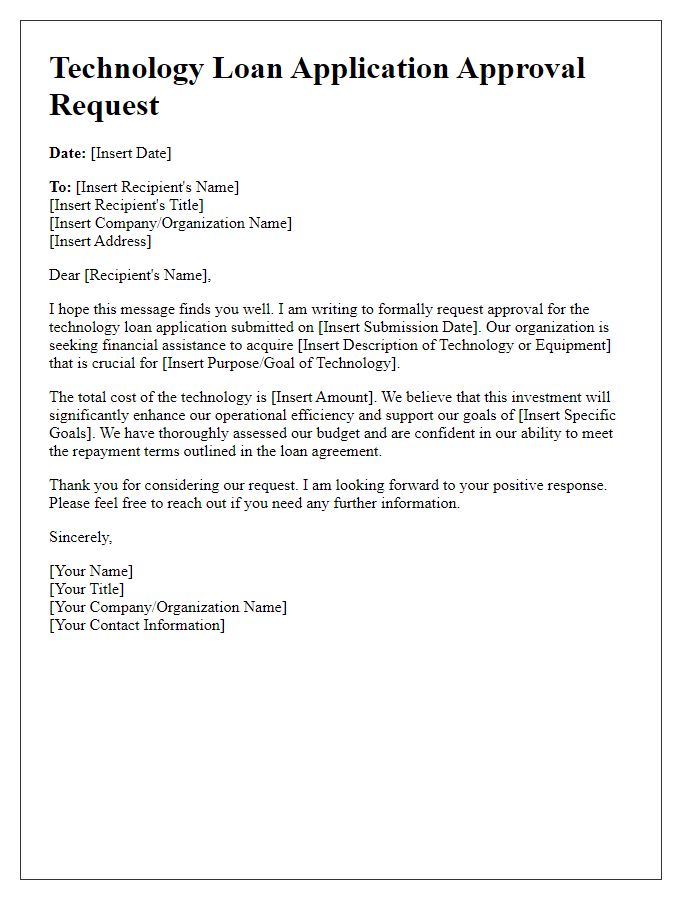

Terms and Conditions

The terms and conditions of technology loan applications often include several key components that clearly define the responsibilities of both the borrower and the lender. The application process typically requires applicants to provide detailed information about their financial status, technology needs, and the intended purpose of the loan, whether for purchasing devices like laptops or software licenses. Loan amounts can range from a few hundred to several thousand dollars, and repayment terms usually vary between six months to several years, often depending on the total amount borrowed. Interest rates, which may be fixed or variable, play a significant role in determining the overall cost of the loan. Additionally, borrowers must comply with criteria such as timely payments and maintaining the condition of the purchased technology to avoid penalties or additional fees. Defaulting on the loan can lead to serious consequences, including negative impacts on credit scores and potential legal action by the lender. Understanding these conditions is essential for ensuring a smooth borrowing experience.

Comments