Are you looking to amend a loan contract but unsure how to start? Crafting a well-structured letter is key to ensuring your request is taken seriously and processed smoothly. In this article, we'll guide you through a simple yet effective template that you can customize to suit your situation. So, let's dive in and discover how to articulate your amendment request with clarity and confidence!

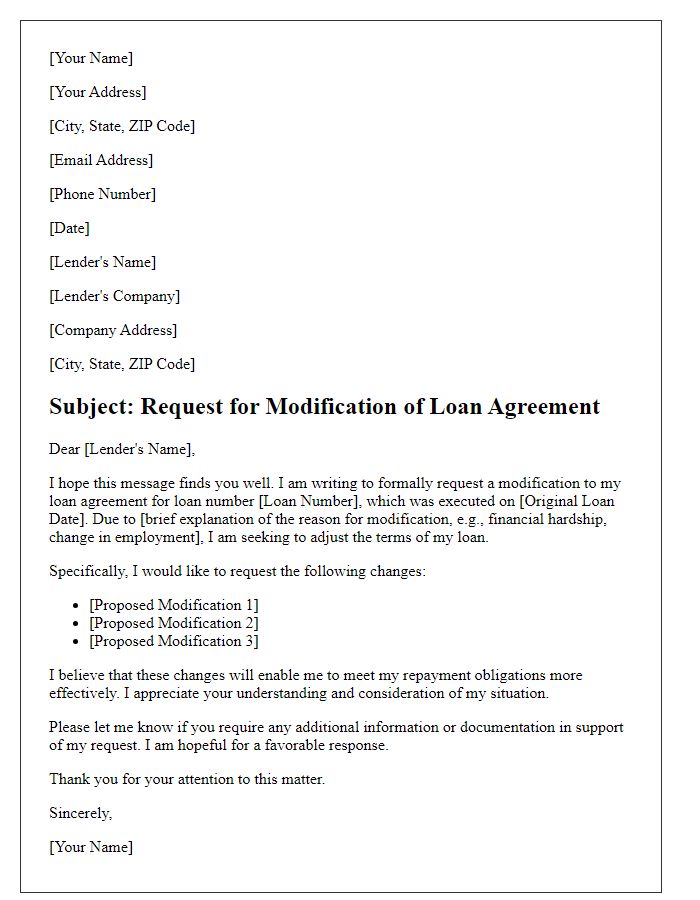

Borrower and lender contact information

A loan contract amendment request typically includes the contact information for both the borrower and lender to facilitate communication. The borrower's information should encompass full name, mailing address, phone number, and email address. The lender's details usually consist of the company's name, the specific contact person, their mailing address, phone number, and email address. Including this essential data ensures that both parties can address any issues or finalizations related to the amendment process seamlessly, enhancing clarity and reducing potential misunderstandings.

Original loan terms and agreement details

A loan contract amendment request typically involves specific details about the original loan terms and the agreement. This includes loan amounts, interest rates, payment schedules, and the lender's information. For instance, original loan agreements may specify a principal amount of $50,000, an interest rate of 5% per annum, and a repayment schedule over 15 years. Amendments might be requested due to financial hardship, changes in interest rates, or altered repayment terms. Important details might also include the loan number for identification, the original date of the agreement (e.g., January 10, 2020), and the contact information of both the borrower and the lender for seamless communication throughout the amendment process. Keeping precise records ensures clarity and legality in any amendments sought.

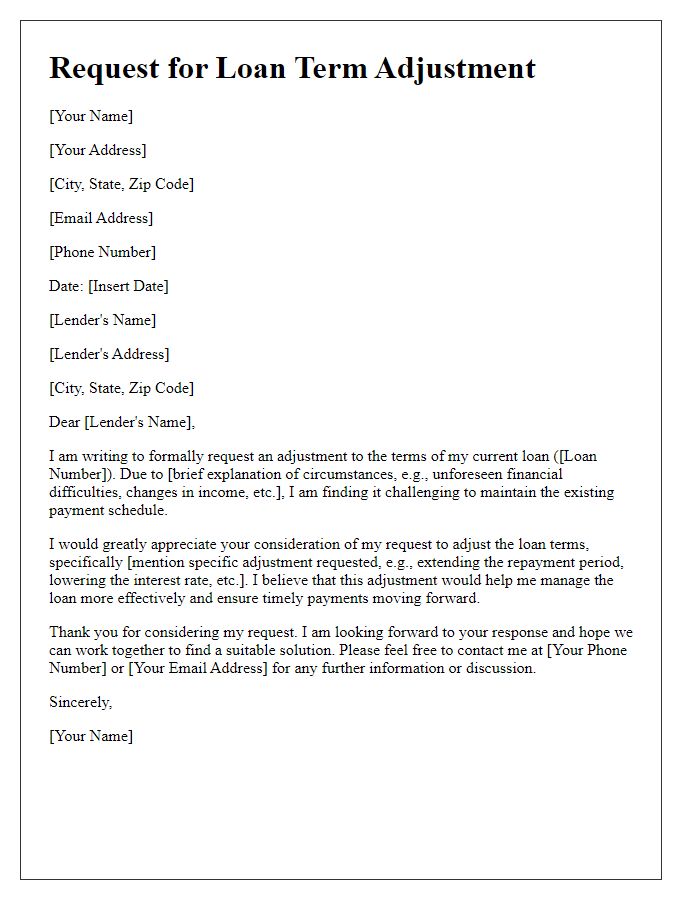

Specific amendment request and rationale

The loan contract amendment request addresses the need to revise the interest rate on the existing loan agreement originally set at 5% due to the recent significant decline in the market rates, with current average rates falling to approximately 3% across major lending institutions. This amendment will not only align the loan terms with prevailing market conditions but also improve financial sustainability for the borrower. It is essential to provide documentation illustrating the market rate changes, including recent Federal Reserve announcements, economic reports from the Bureau of Economic Analysis, and a comparative analysis of similar loan agreements. Such adjustments aim to enhance repayment feasibility and foster continued positive relations between the lender, [Lender's Name, e.g., ABC Bank], and the borrower, [Borrower's Name, e.g., John Doe].

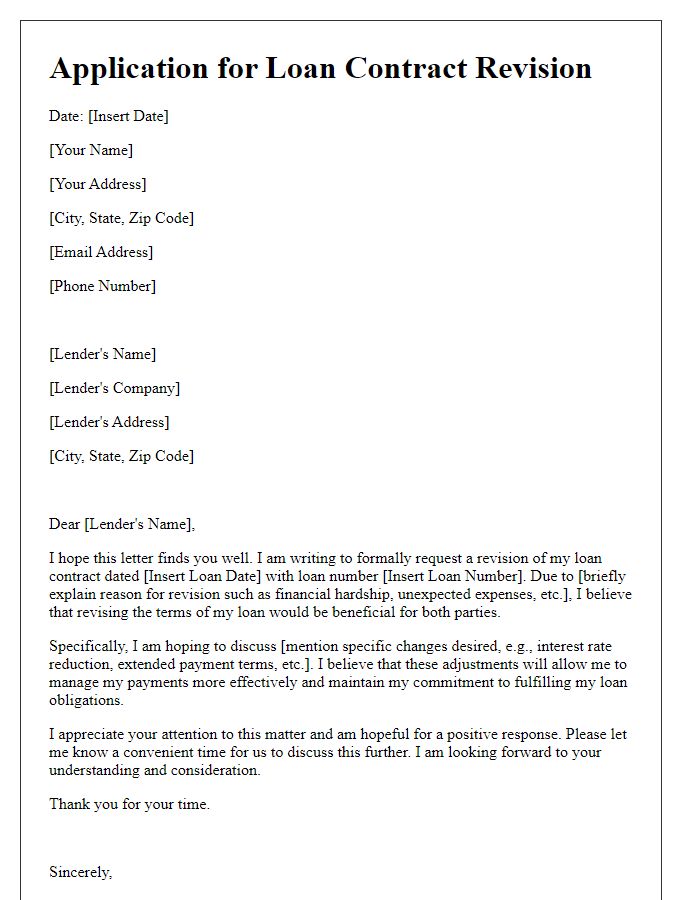

Proposed new terms

In the realm of financial agreements, a loan contract amendment request details proposed new lending terms for an existing agreement. The borrower, usually an individual or a business entity, presents this request to the lender, often a financial institution or bank, seeking adjustments such as a change in interest rates, repayment duration, or payment schedule. Specific figures, such as the current interest rate (for example, 5.5% APR) and the proposed new rate (such as 4%), are highlighted to indicate the desired changes. Additionally, references to the original contract's issue date, loan amount, and remaining balance provide essential context. If applicable, the borrower may include explanations for the request, such as changes in financial circumstances or market conditions that prompted the need for modification. Proper documentation enhances the credibility of the request, ensuring a clearer dialogue between involved parties.

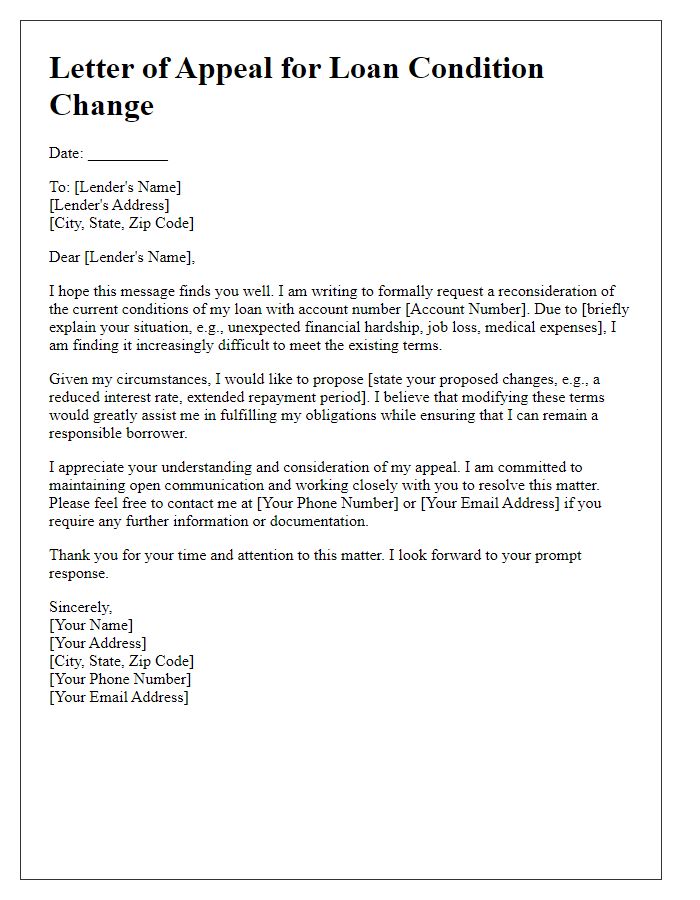

Signature lines for authorization and acknowledgment

A loan contract amendment request involves important legal modifications that require formal acknowledgment and authorization from both parties involved. The signature lines will typically include spaces for the names, titles, and dates of the authorized signatories representing both the lender and the borrower. It is essential that each party clearly delineates their consent to the amendments outlined in the request so that the contract remains binding and enforceable. Proper identification of all parties and clear references to the original loan agreement will ensure the integrity of the amended terms.

Comments