Are you struggling to manage your loan payments due to an unexpected financial setback? You're not alone, and many people find themselves in similar situations. Thankfully, adjusting your loan due date can provide the relief you need to regain control of your finances. If you'd like to learn more about how to navigate this process, keep reading!

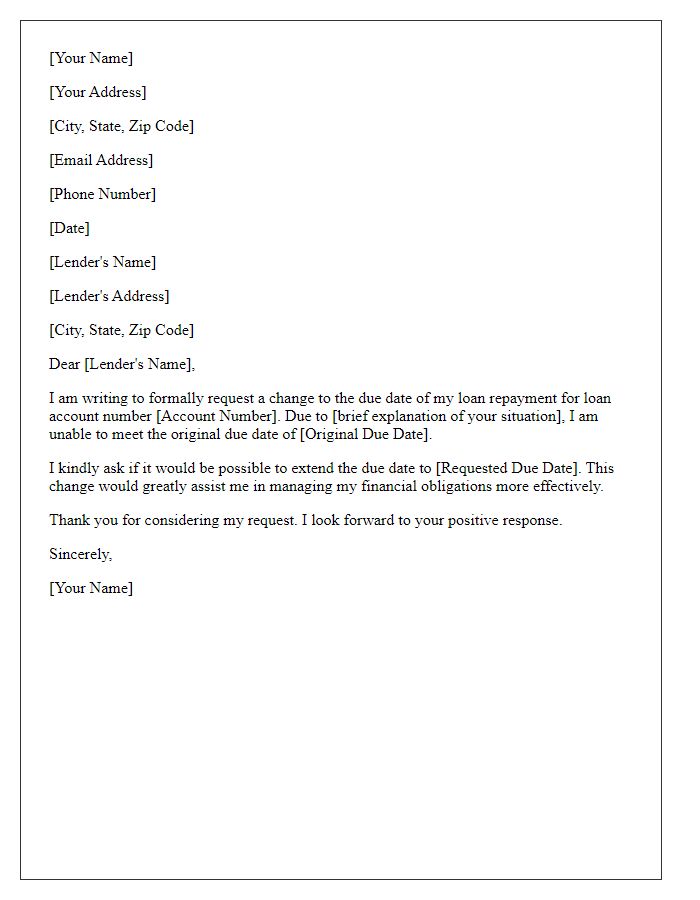

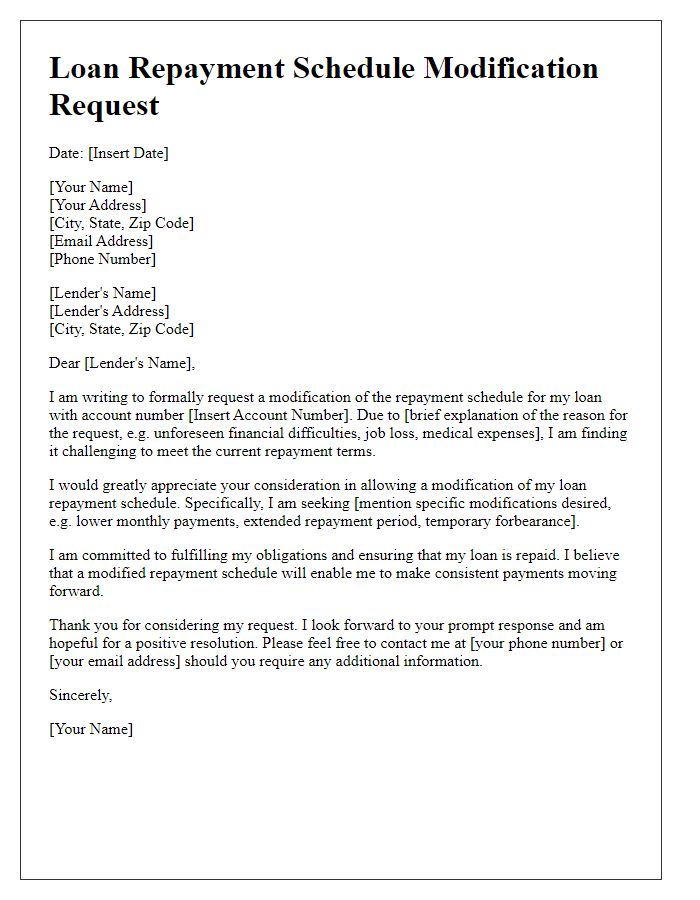

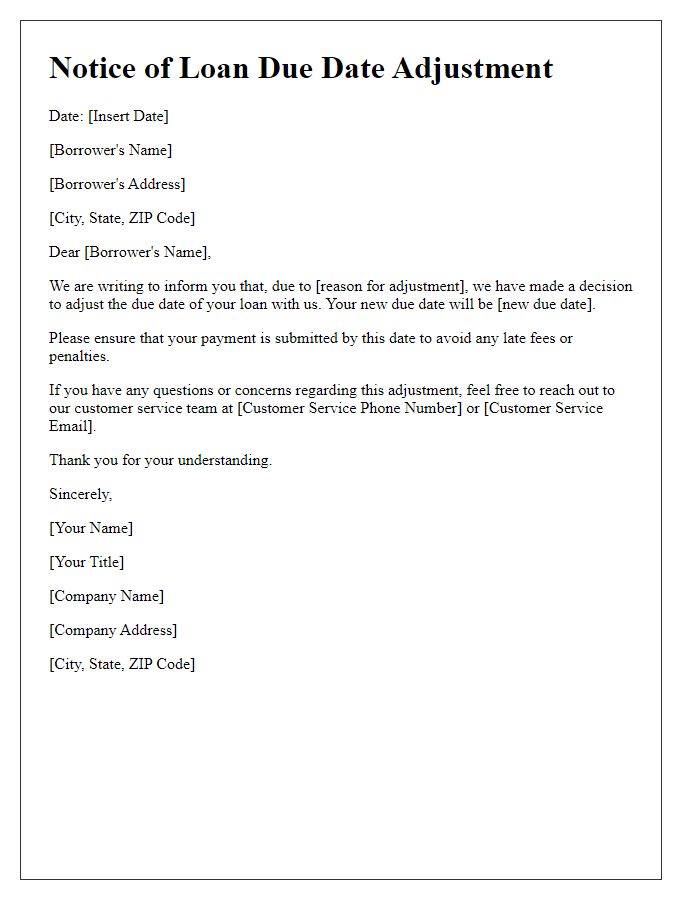

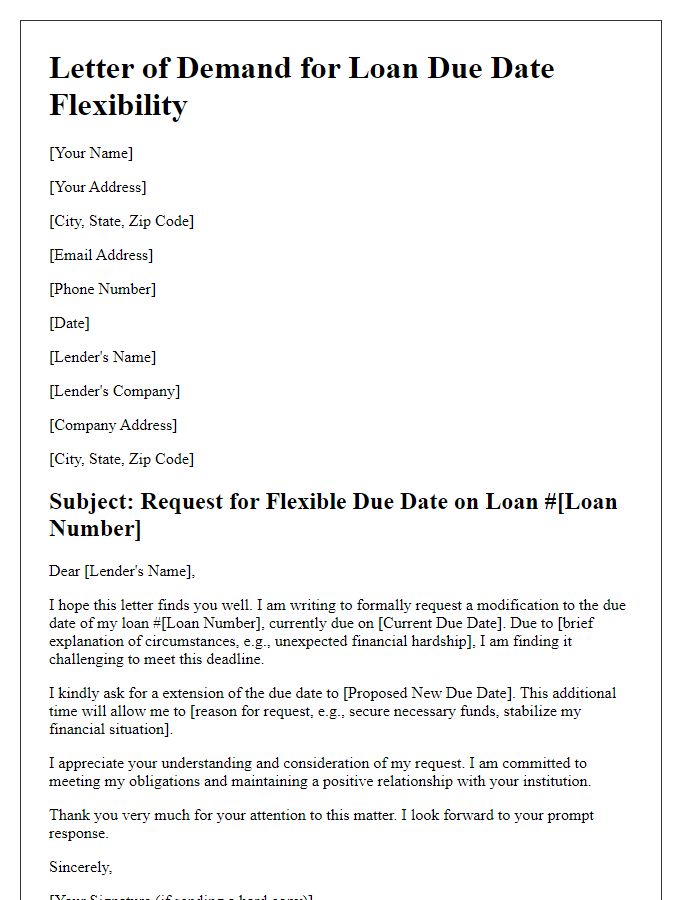

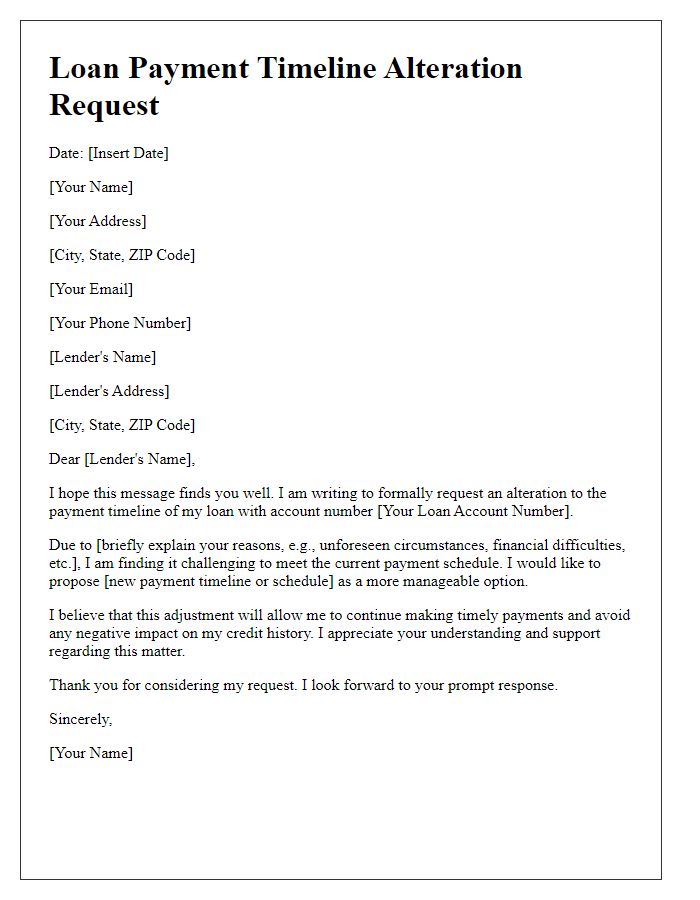

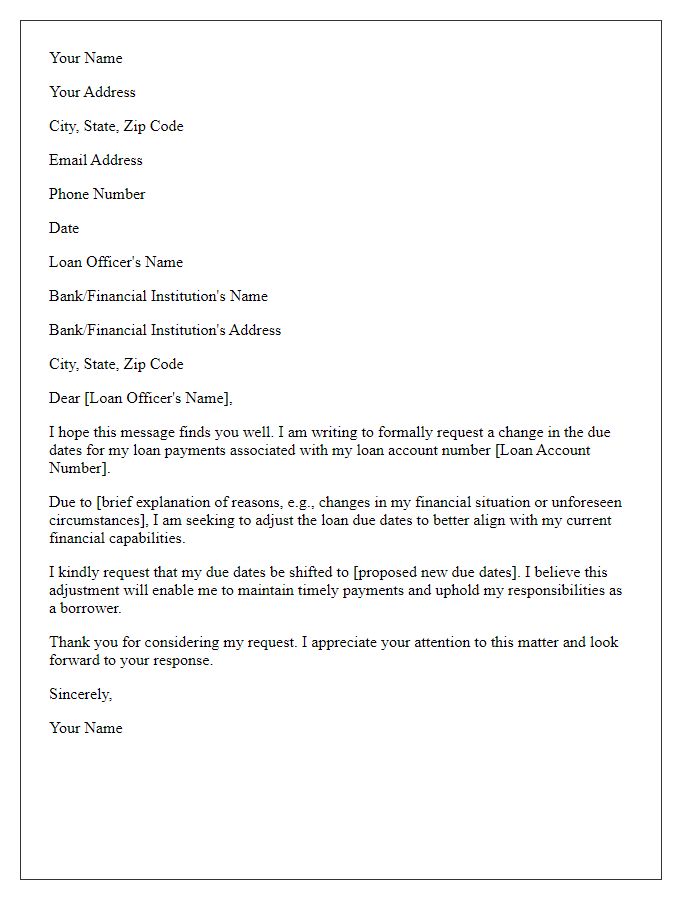

Borrower's Information

When borrowers face unexpected financial challenges, loan due date adjustments become crucial for managing repayment schedules. Borrowers, identified by details such as name, address, and account number, submit formal requests to lenders, typically through written communication. Loan contracts specify terms, including due dates and allowed grace periods, influencing the negotiation process. Effective requests often cite specific reasons, such as medical emergencies or job loss, impacting financial stability. Lenders, governed by regulations and policies from entities like the Consumer Financial Protection Bureau, may offer solutions based on borrowers' payment history and existing agreements, ultimately aiming to foster positive relations while ensuring compliance with lending laws.

Loan Account Details

Loan account details, specifically pertaining to personal loans, typically include critical information such as the account number (e.g., 123456789), borrower name (e.g., John Smith), loan amount (e.g., $10,000), interest rate (e.g., 5% annually), and repayment schedule (e.g., monthly payments of $200). Adjustments to loan due dates can be requested for various reasons, including financial difficulties, unexpected life events, or the need for a more manageable payment timeline. Contacting the lender (e.g., Chase Bank, Wells Fargo) is essential, providing all relevant details to ensure a seamless transition. Documentation, such as bank statements or proof of income, may be required to validate the request, reflecting the borrower's circumstances gradually changing over time.

Reason for Adjustment Request

A loan due date adjustment request often arises from unforeseen circumstances affecting the borrower's ability to meet repayment timelines. Financial difficulties may result from job loss, medical emergencies, or unexpected expenses. For instance, a borrower experiencing a sudden job loss can face challenges in making payments by the original due date, significantly impacting personal financial stability. The requested adjustment can provide temporary relief, allowing for better cash flow management during the transition period. Lenders may consider these requests based on the borrower's payment history, willingness to communicate, and overall credit health, ultimately working towards a mutually beneficial agreement to ensure that the borrower can meet their obligations without experiencing undue financial strain.

Proposed New Due Date

Adjusting a loan due date can significantly impact financial planning and cash flow management. A borrower might propose a new due date, such as the 15th of each month instead of the previous 1st, to better align with their income schedule, potentially improving their ability to make timely payments. This request could stem from circumstances such as a recent job change or an unexpected medical expense that has temporarily impacted their financial stability. Proper communication emphasizes the importance of maintaining a good relationship with the lender, showcasing the borrower's commitment to fulfilling their obligations while seeking a manageable payment timeline.

Contact Details for Further Communication

Adjusting loan due dates can significantly impact repayment schedules and financial planning. Notifying the lending institution, such as banks or credit unions, is essential for modifying due dates. Typically, borrowers can reach out via customer service hotlines or dedicated account manager contacts provided in loan agreements. Maintaining updated contact details, including phone numbers, email addresses, and mailing addresses, ensures effective communication regarding adjustments. Documenting conversations and keeping records of correspondence, such as confirmation emails or letters outlining adjusted terms, is advisable for further clarity and to safeguard against future discrepancies.

Comments