Are you struggling to keep track of your loan payment history? It can be challenging to stay organized and ensure your records are accurate, especially when you're juggling multiple financial commitments. Whether you're preparing for a mortgage application or just want to verify your payment records, obtaining a comprehensive loan payment history is essential. Dive into our article to discover a simple letter template you can use to request this vital information seamlessly!

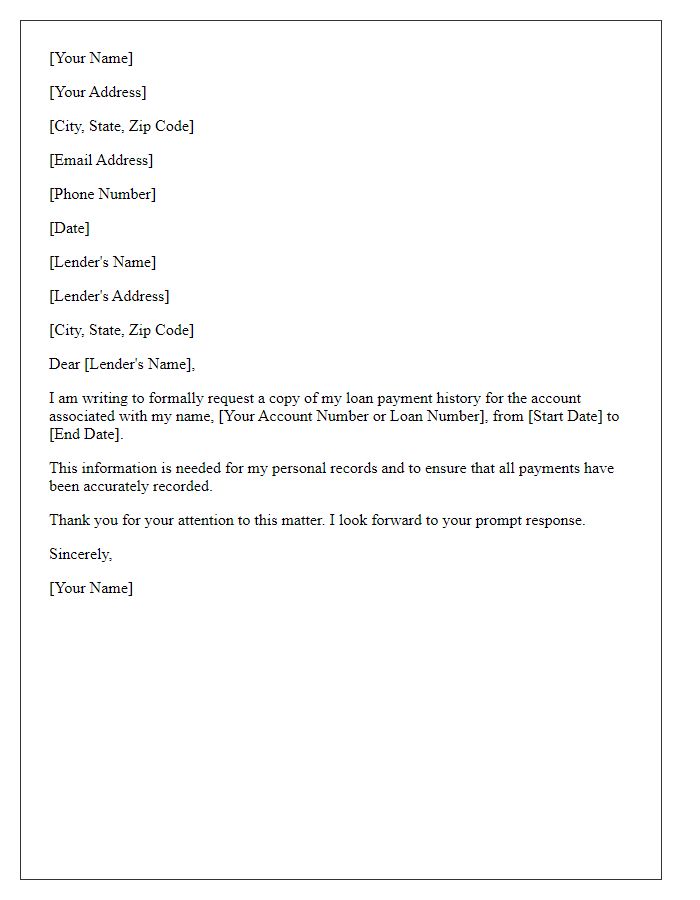

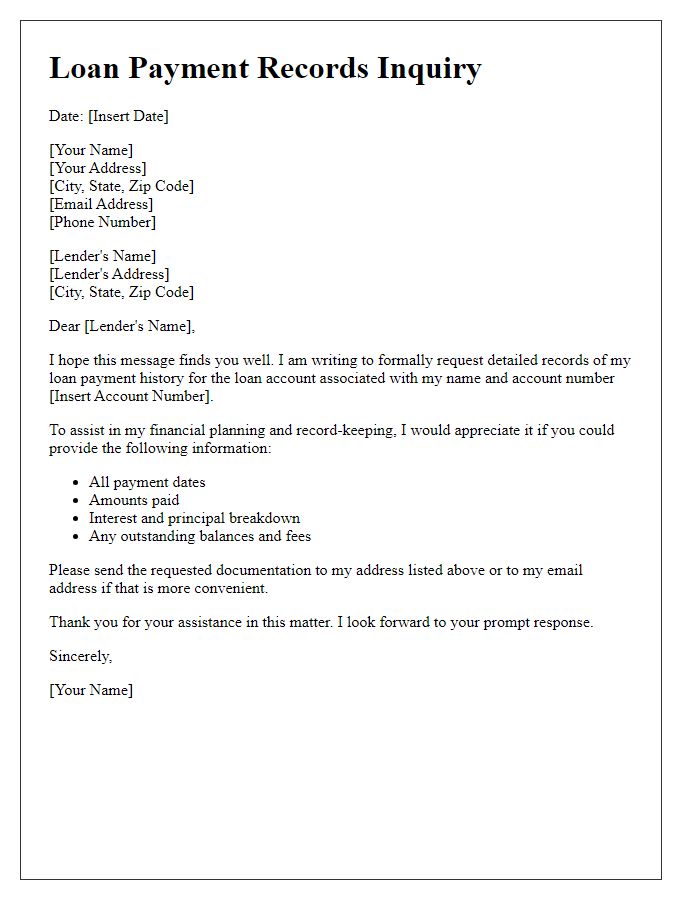

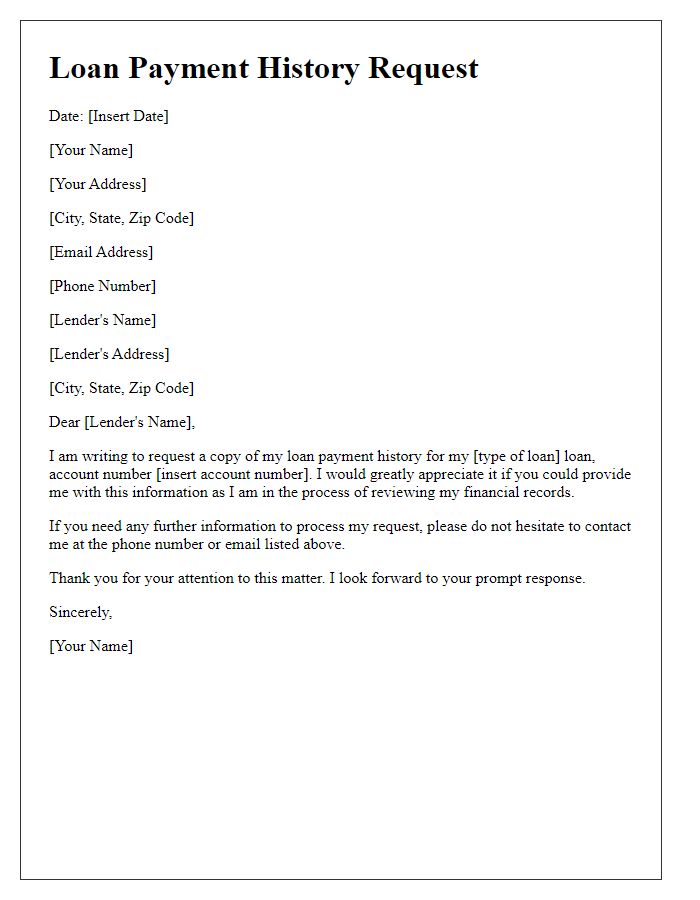

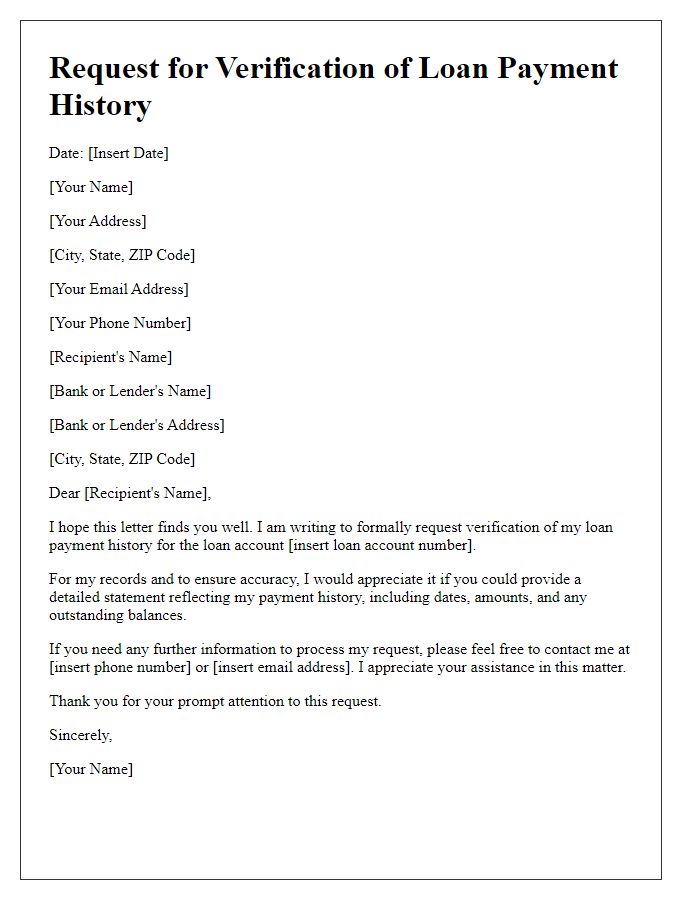

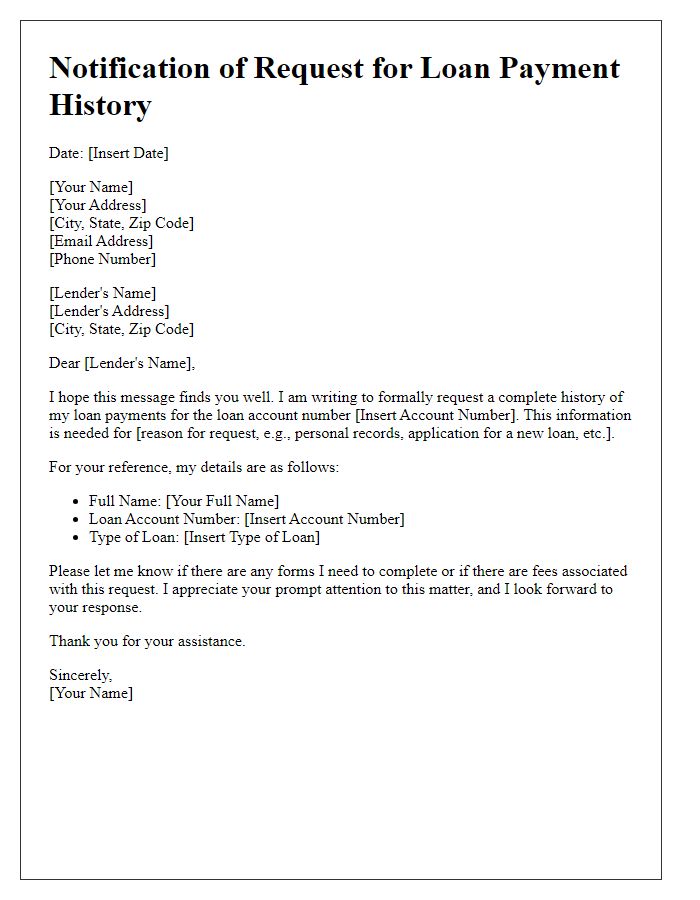

Borrower's Full Name and Contact Information

Borrower's Full Name is an essential identifier, often required for processing requests. Contact Information, including phone number and email address, allows financial institutions to verify identity and communicate effectively. The loan payment history represents a comprehensive record of payments made, including dates, amounts, and outstanding balances, crucial for assessing financial reliability or applying for future loans. Detailed loan account number, typically consisting of multiple digits, ensures accurate retrieval of the specific loan information. Requesting this document can aid in financial planning, credit assessments, or dispute resolutions, enhancing transparency in financial transactions.

Loan Account Number

Loan payment history provides essential information regarding the status of repayment on a financial obligation. This document outlines details such as the loan account number, which uniquely identifies the loan agreement between the borrower and the lender. Payment history typically includes the dates of each transaction, amounts paid, and any outstanding balance. Accumulated data from this history can impact credit scores significantly, as timely payments often contribute to a positive credit profile. Furthermore, discrepancies in payment records may necessitate immediate correction to prevent further financial complications. Often, this history is used for future loan applications, particularly for large amounts in institutions like banks or credit unions.

Specific Timeframe for Payment History

Individuals seeking a loan payment history often require detailed records for a designated timeframe, commonly spanning the last twelve months. Loan servicers maintain comprehensive databases that track individual account activities, including payment dates, amounts, and any instances of missed payments during this period. Requesting this information can assist borrowers in managing their finances effectively and ensuring their credit reports reflect accurate payment behaviors. Relevant details, such as the loan account number and borrower identification details, should be included in the communication to facilitate a prompt and precise response.

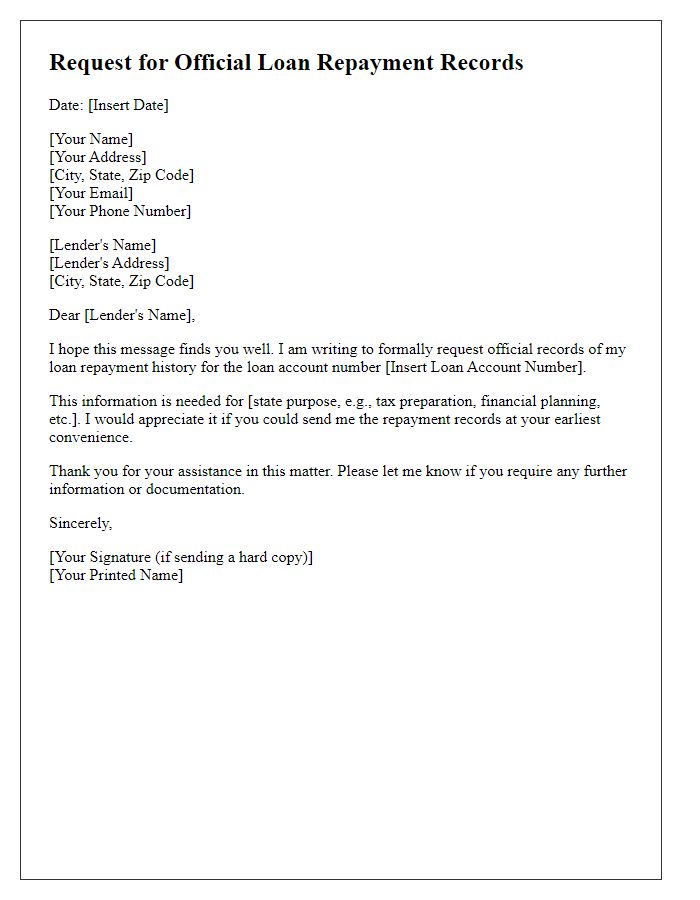

Request for Official Documentation

Banks often require official documentation for loan payment history to clarify account statuses. This document typically includes vital information such as transaction dates, payment amounts, outstanding balances, and interest rates associated with the loan. Requests should specify the account number, type of loan (e.g., mortgage, personal, student), and the range of dates required for accurate processing. Official loan payment history significantly aids in financial planning, credit reporting, and compliance with fiscal responsibilities. Timely receipt of this information, usually within 15 business days, is essential for maintaining accurate financial records.

Signature and Date

Loan payment histories serve as crucial documents for borrowers, reflecting their financial responsibility over time. Typically, these records include detailed transaction dates, amounts paid, and remaining balances. Loan servicers, such as bank branches or online financial institutions, maintain this information for various loans, including mortgages and personal loans. Regulatory compliance, such as adherence to the Fair Credit Reporting Act (FCRA) ensures accurate reporting to credit bureaus (like Experian or TransUnion). A formal request for this history can involve stipulating an exact timeframe, such as the past 12 months, to aid in loan refinancing or mortgage applications. It is essential to include personal identifiers like loan account numbers for accurate retrieval.

Comments