Are you feeling overwhelmed by your current loan interest rate? You're not alone! Many borrowers find themselves paying more than necessary, and it's time to take action. In this article, we'll guide you through the process of negotiating a better rate with your lender, so you can save money and breathe a little easierâlet's dive in!

Precise Loan Details

Negotiating the interest rate on a personal loan can significantly impact the overall cost, especially when considering the principal amount of $15,000 over a five-year term. A high interest rate of 8% can lead to total repayments exceeding $18,000, causing an additional financial burden. By providing recent offers from competitive lenders, such as a 5% rate for similar terms, it becomes possible to illustrate the potential savings of approximately $3,000, encouraging the lender to reconsider their current proposal. Additionally, demonstrating a solid credit score of 750 can further substantiate the request for a more favorable rate, potentially leading to enhanced affordability and better financial stability.

Financial Standing and Credit Score

Negotiating a loan interest rate can significantly impact monthly payments and overall financial health. Individuals with strong financial standing, characterized by a stable income and low debt-to-income ratio (ideally below 36%), often have better leverage in discussions with lenders. A good credit score, typically regarded as 700 or above on the FICO scale, further empowers borrowers. This score reflects a history of timely payments, responsible credit utilization, and a diverse credit mix. Lenders may offer lower rates, especially if the borrower demonstrates consistent financial discipline over several years. In some cases, even a small decrease in the interest rate, for instance, from 5% to 4.5%, can lead to substantial savings over the life of a loan, especially for large amounts like $250,000 over 30 years. Thus, presenting this information effectively during negotiations can lead to more favorable loan terms.

Comparative Market Rates

Negotiating loan interest rates involves reviewing current comparative market rates to find favorable terms from lenders. Financial institutions in the United States, for instance, offer varying rates, with averages hovering around 3.5% for 30-year fixed mortgages and 2.8% for 15-year fixed mortgages as of October 2023. Factors affecting these rates include credit score (with a score above 740 typically securing better rates), down payment percentages (with 20% down often eliminating private mortgage insurance), and prevailing economic conditions influenced by the Federal Reserve's decisions. Understanding these metrics empowers borrowers to leverage competitive offers from lenders, demonstrating knowledge of the industry to negotiate a lower rate effectively. Researching local institutions and online platforms like Bankrate and Zillow can provide insight into historical trends and current offers across various regions.

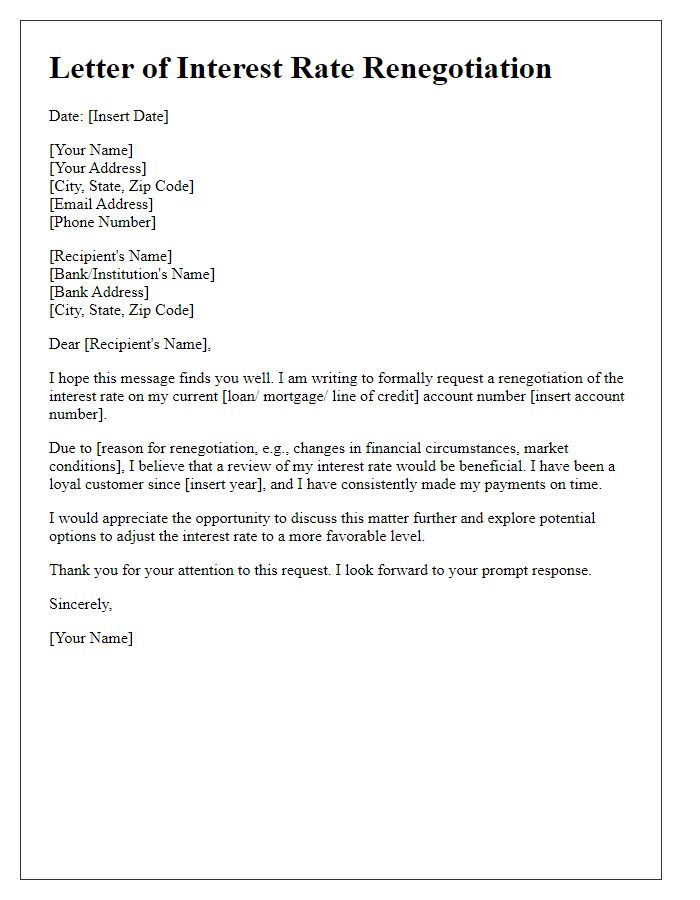

Justification for Request

Negotiating loan interest rates can yield significant financial benefits for borrowers, particularly when dealing with substantial debts such as mortgages or personal loans. Current market conditions, including the Federal Reserve's decision to lower interest rates to stimulate the economy, are affecting loan rates nationwide, making it an opportune moment for negotiations. For instance, recent reports from the Mortgage Bankers Association indicate a decrease in average mortgage rates, now hovering around 3.2% for 30-year fixed loans. By providing comparable offers from competing financial institutions, borrowers may leverage these lower rates to advocate for reduced interest rates on existing loans. Additionally, maintaining a strong credit rating, such as a FICO score above 700, further strengthens the case, as it suggests reliability in repayment. With a thorough understanding of personal financial circumstances and current economic trends, borrowers can effectively argue for more favorable loan terms that could result in substantial long-term savings.

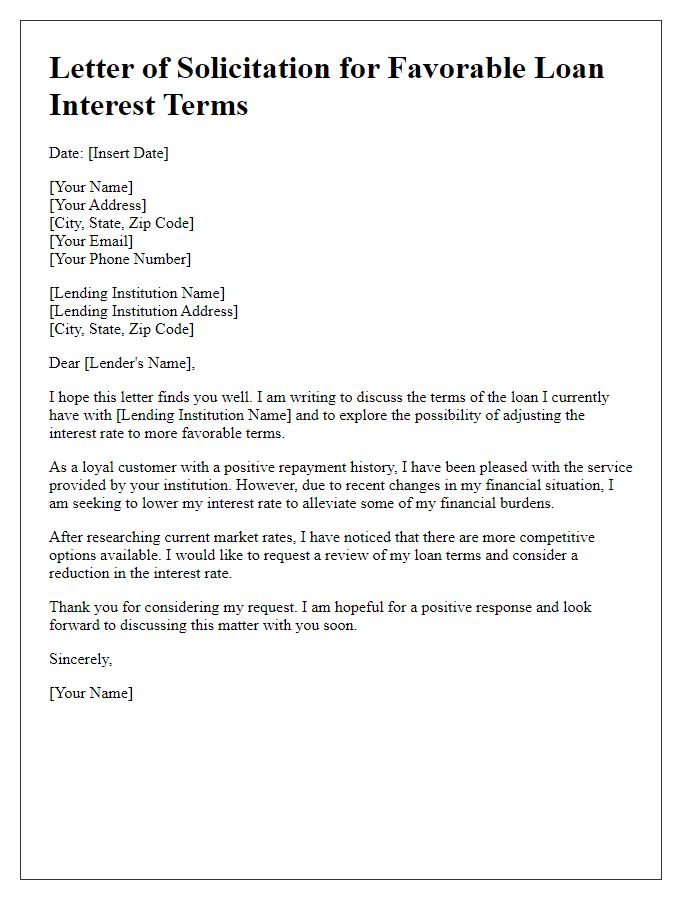

Professional Tone and Language

Negotiating a loan interest rate can result in significant savings over time, making it a crucial financial maneuver. A common point of discussion is the Annual Percentage Rate (APR), which reflects the total annual cost of borrowing expressed as a percentage. For instance, adjusting an APR from 5% to 4% can enhance overall savings, especially on large sums, such as $100,000 over a 30-year mortgage. Consideration should also be given to benchmarks like the Federal Reserve's key interest rates, which can influence lenders' terms and conditions. Engage in negotiations by presenting evidence of competitor rates, your credit score, and history of timely payments, underscoring your reliability as a borrower.

Comments