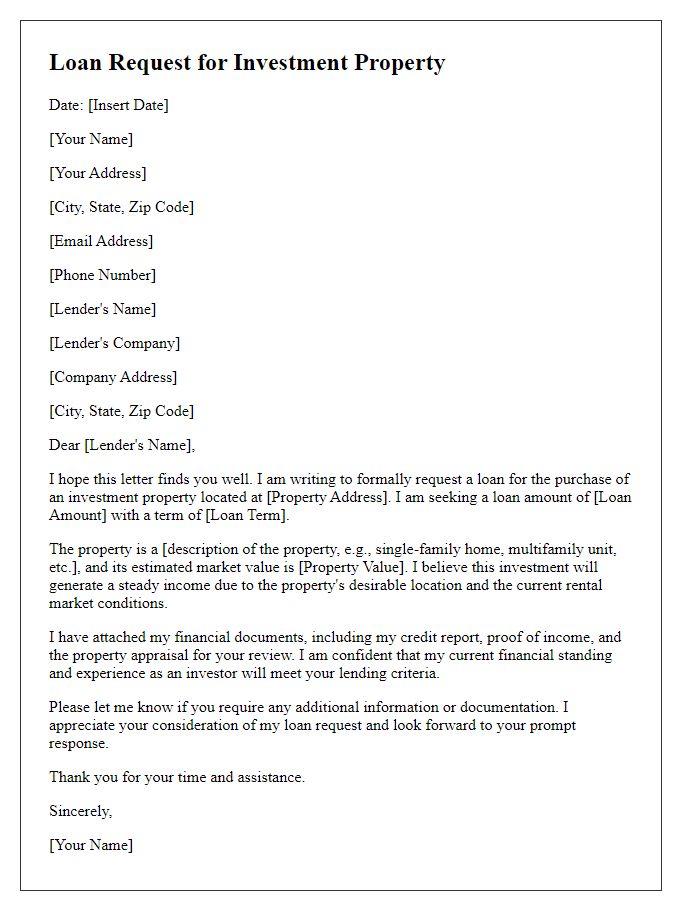

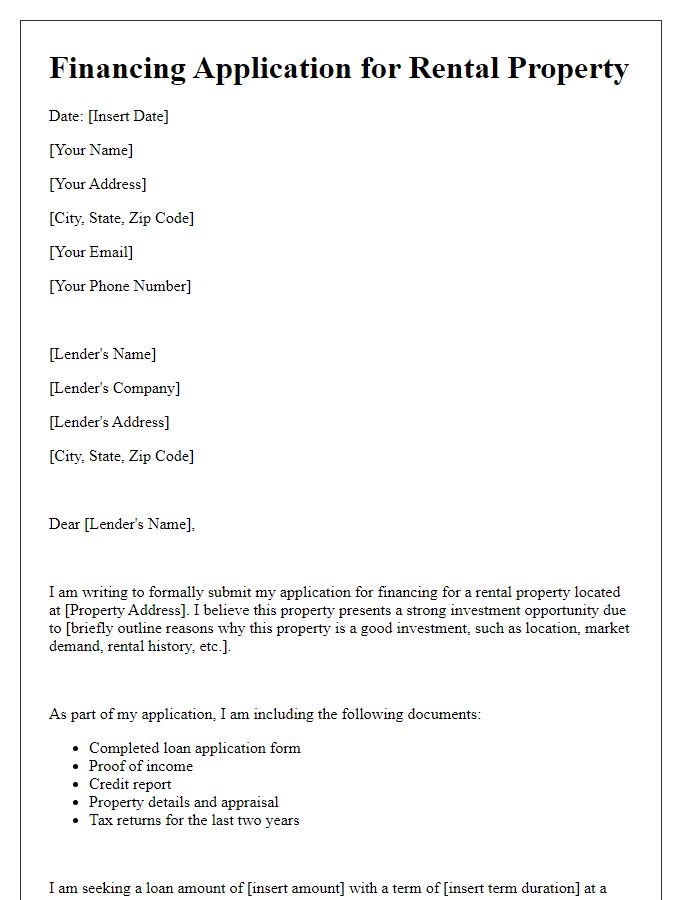

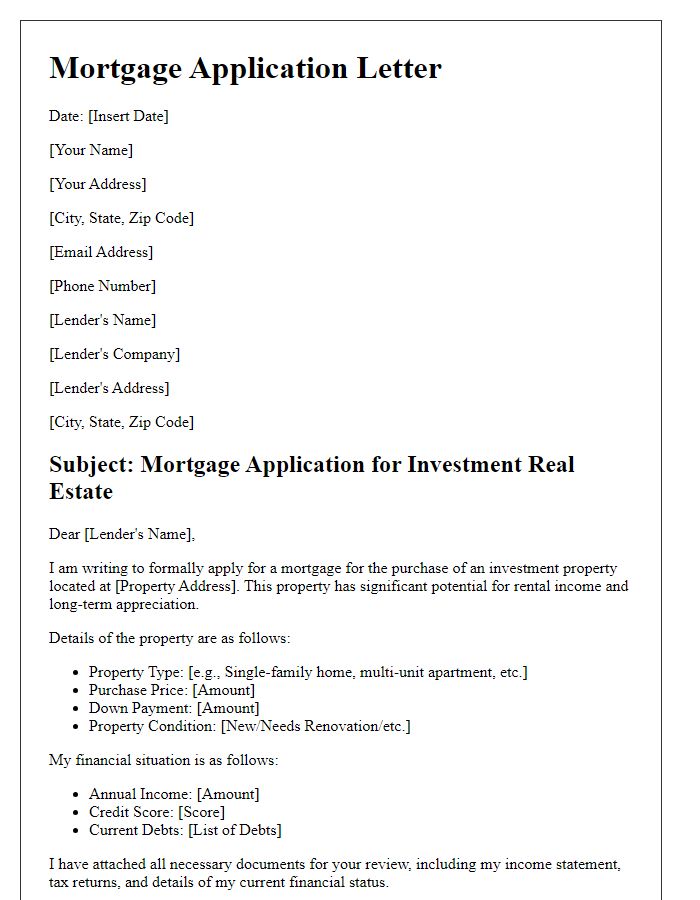

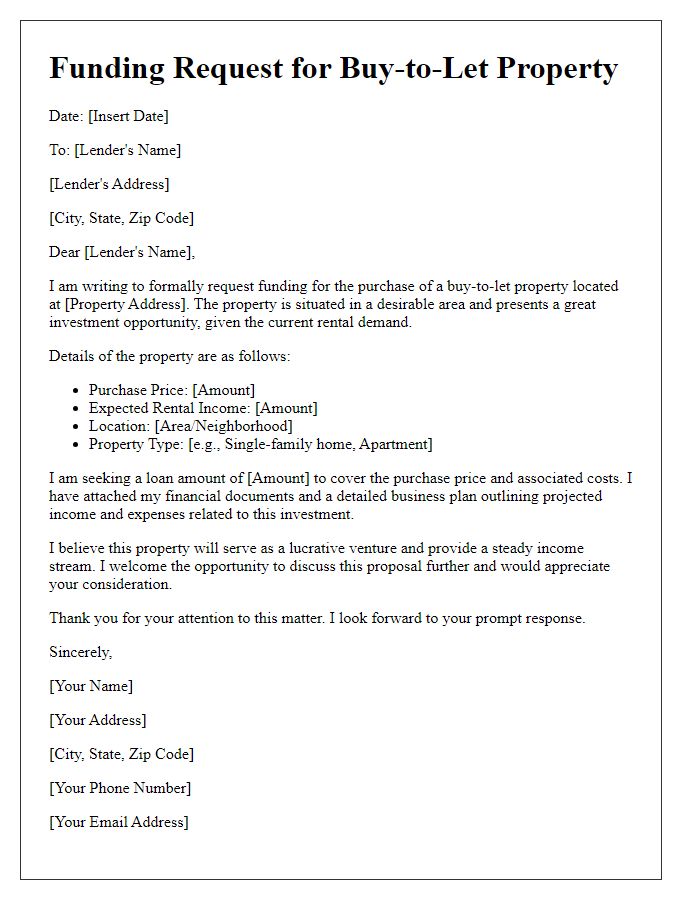

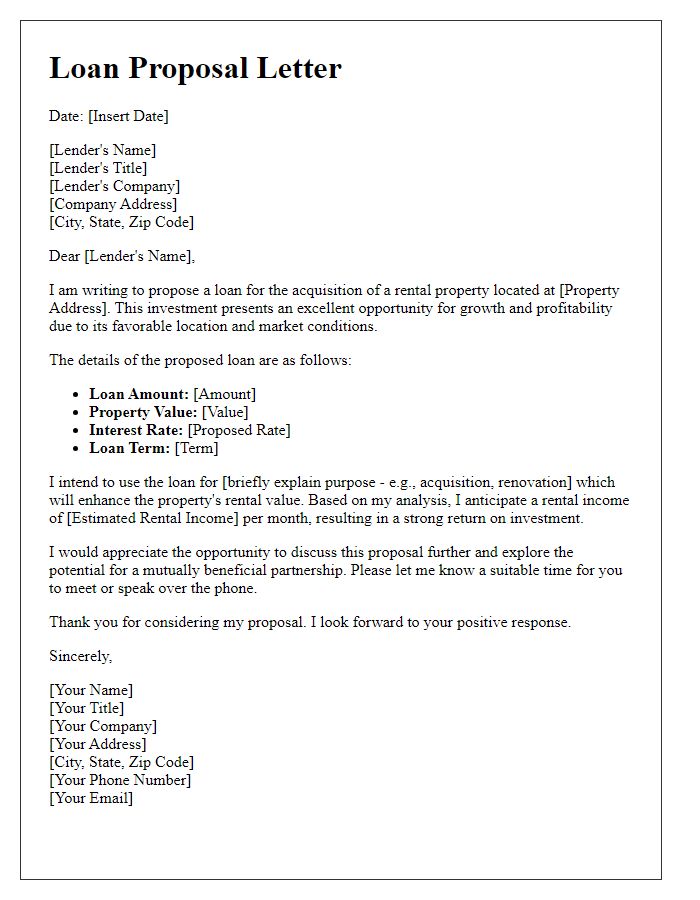

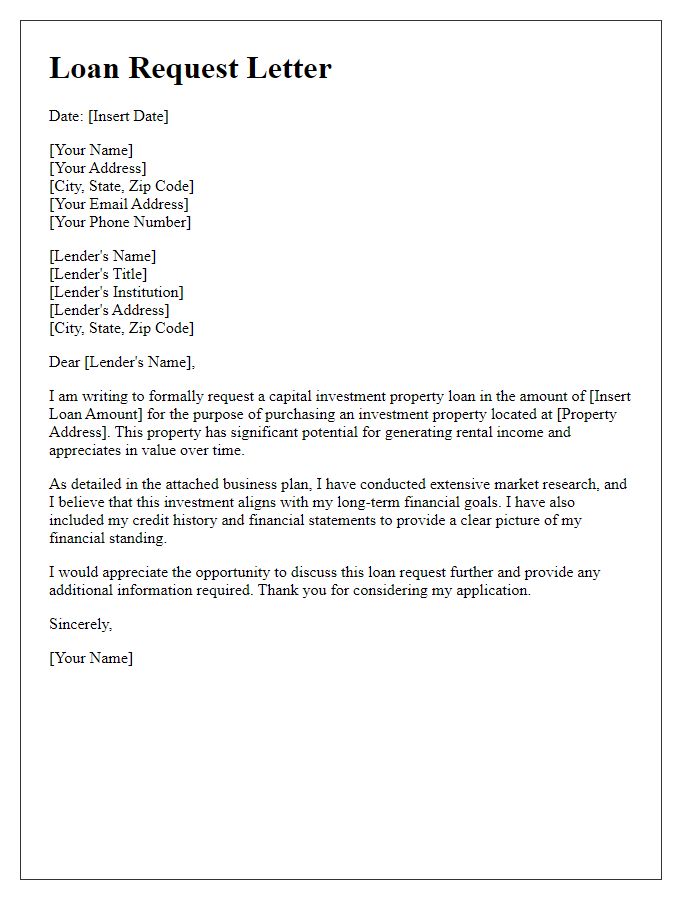

Are you considering taking the plunge into real estate investing? Securing a loan for an investment property can feel overwhelming, but having the right letter template at your fingertips can make all the difference. This letter not only communicates your financial intentions clearly, but it also showcases your professionalism to potential lenders. So, let's dive into the essential elements of a compelling investment property loan application letter!

Borrower's Personal Information

A comprehensive investment property loan application requires detailed information about the borrower, encompassing personal identity, financial stability, and background. Include full name, complete address, and contact number to establish primary identity. Date of birth and Social Security number are essential for credit history assessment and verification. Employment details, including job title, employer name, and duration of employment, provide insight into income stability, while monthly income should be clearly stated, supplemented by additional income sources if available. Financial obligations such as monthly debts including credit card payments, car loans, and existing mortgages must be disclosed for accurate debt-to-income ratio evaluation. Lastly, a brief explanation of the borrower's investment experience, including years in real estate and types of properties owned, adds depth to the application narrative.

Property Details

Investment properties, ideal for generating rental income and long-term appreciation, often require detailed documentation for financing. Key aspects include the property location, such as 123 Main Street, Los Angeles, CA, which is situated in a high-demand neighborhood known for its proximity to schools and public transport. The property's purchase price, valued at $600,000, should be highlighted, alongside estimated rental income, projected at $3,500 per month. Additionally, property characteristics such as square footage (2,000 sq. ft.), number of bedrooms (4), and bathrooms (3) are crucial in assessing investment viability. The report should also address any necessary repairs or upgrades, servicing a potential increase in property value, and local market trends that affect rental demand and property appreciation rates. Lastly, include relevant property management plans that detail tenant sourcing and upkeep schedules, ensuring steady cash flow and asset enhancement.

Loan Amount and Terms

When applying for an investment property loan, the specified loan amount typically ranges from $100,000 to $2,000,000, depending on property value and investment potential. The loan terms can vary, often offering fixed-rate options between 15 to 30 years or adjustable-rate mortgages (ARMs) with initial fixed periods followed by variable rates. The interest rates, influenced by market fluctuations and borrower creditworthiness, may range from 3% to 6%. Additionally, lenders may require a minimum down payment of 20%, ensuring alignment with investment risk assessments. Monthly payments will be derived from principal and interest calculations while factoring in property taxes and insurance, essential components for maintaining cash flow projections on investment properties.

Financial Information and Income Sources

Investment property loans require comprehensive financial information to assess eligibility and repayment capacity. Essential documents include recent tax returns, typically the last two years, and pay stubs (covering at least four weeks of income) from salaried employment. Bank statements, usually the last two or three months, reveal available liquid assets. Additionally, details of other income sources, such as rental income from existing properties, should be included, ensuring documentation like lease agreements and tenant payment histories are attached. Credit scores, ideally above 700, play a crucial role in determining loan terms. Debt-to-income ratio, typically not exceeding 43%, is also a critical factor in demonstrating financial stability.

Purpose of the Investment Property

The purpose of the investment property, located in the thriving real estate market of Austin, Texas, is to generate rental income and capital appreciation. This residential property, a three-bedroom single-family home, situated in a highly sought-after neighborhood with a school district ranking in the top 10% (based on Texas Education Agency reports), aims to attract young families and professionals. The target rental income is projected at approximately $2,500 per month, based on current market trends and comparable property rentals in the area. Potential appreciation is supported by the city's robust economic growth and ongoing infrastructure developments, including the expansion of the local tech industry, which has seen a 25% increase in job opportunities over the last two years. Furthermore, the property will feature sustainable upgrades such as energy-efficient appliances and solar panels, appealing to environmentally-conscious tenants and enhancing long-term profitability.

Comments