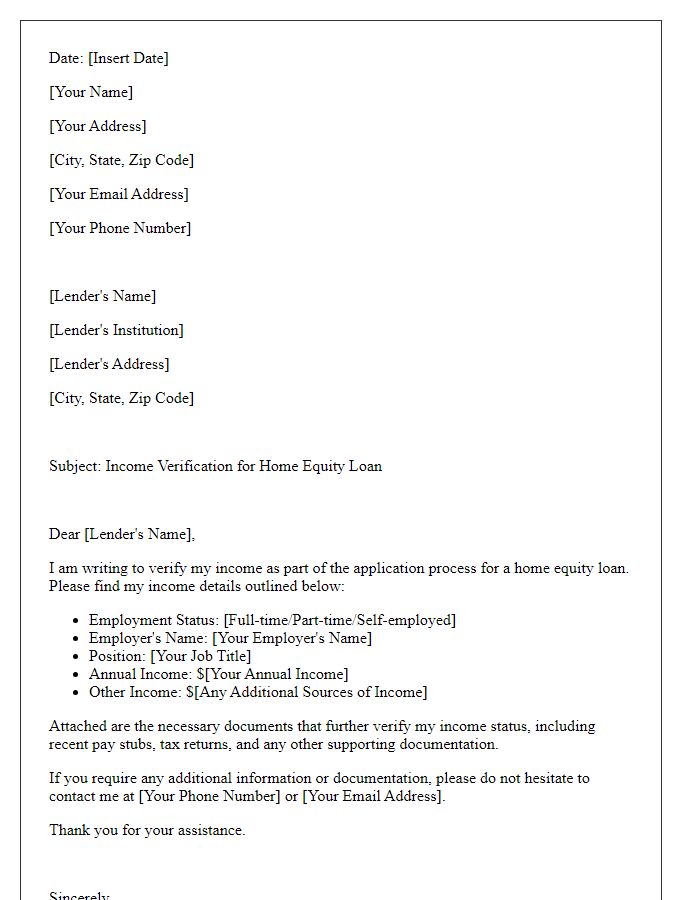

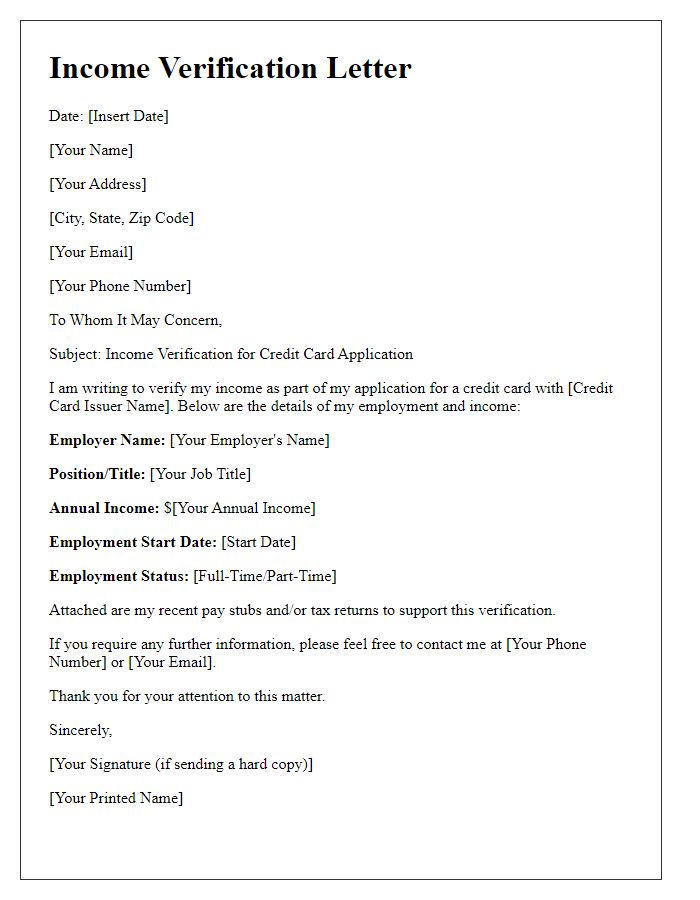

When it comes to securing a loan, one of the essential steps is providing proof of income, and that's where an income verification letter comes into play. This letter serves as a formal document that outlines your earnings, helping lenders assess your financial stability and ability to repay the loan. Crafting a precise and professional income verification letter can make a significant difference in your loan approval process. Curious about the specifics of writing one? Read on to discover our handy tips and templates!

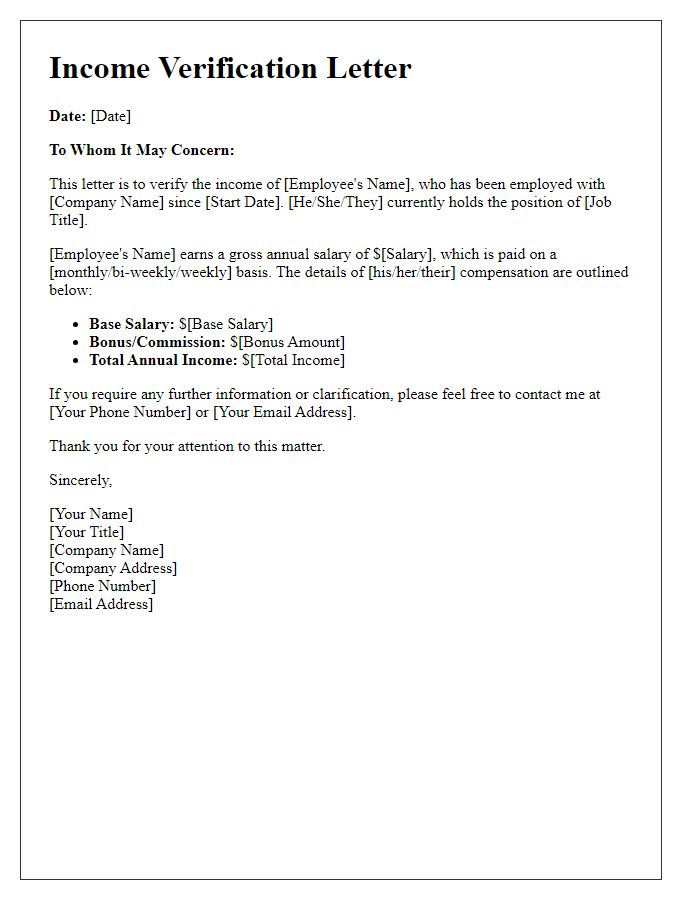

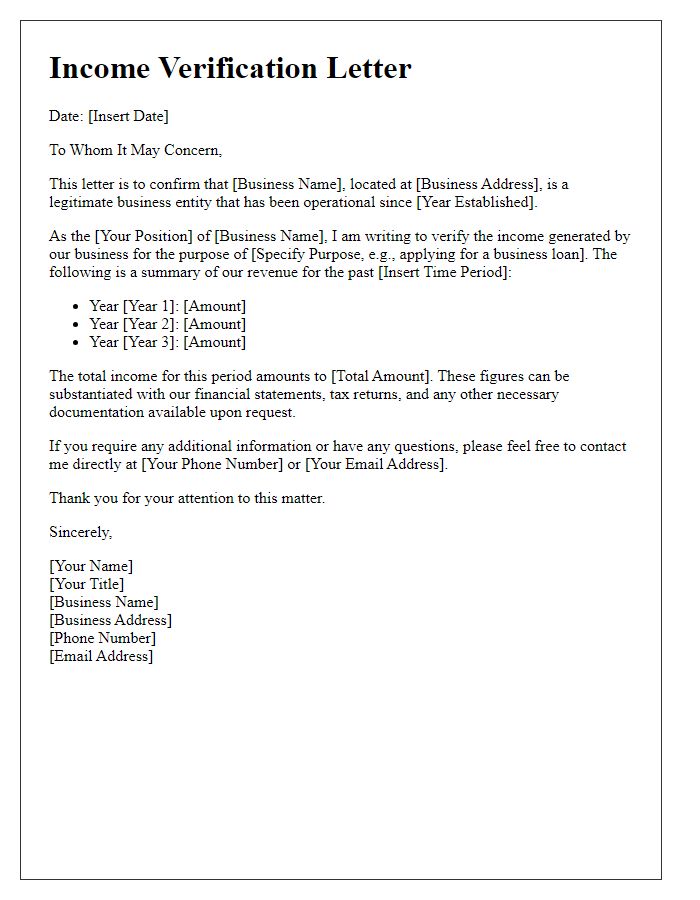

Employer's Information

A thorough income verification for loan applications requires detailed employer information, encompassing crucial elements such as company name, physical address, and contact number. The company name, for instance, identifies the employment entity, while the physical address (including street, city, state, and zip code) provides a location reference, which is essential for validation. Contact number facilitates direct communication for any employment verification queries. Additional specifics like the type of business or industry, number of employees, and tenure of the employer can enhance credibility in assessing financial stability. Having a printed letterhead can serve as official documentation, lending additional trust to the verification process.

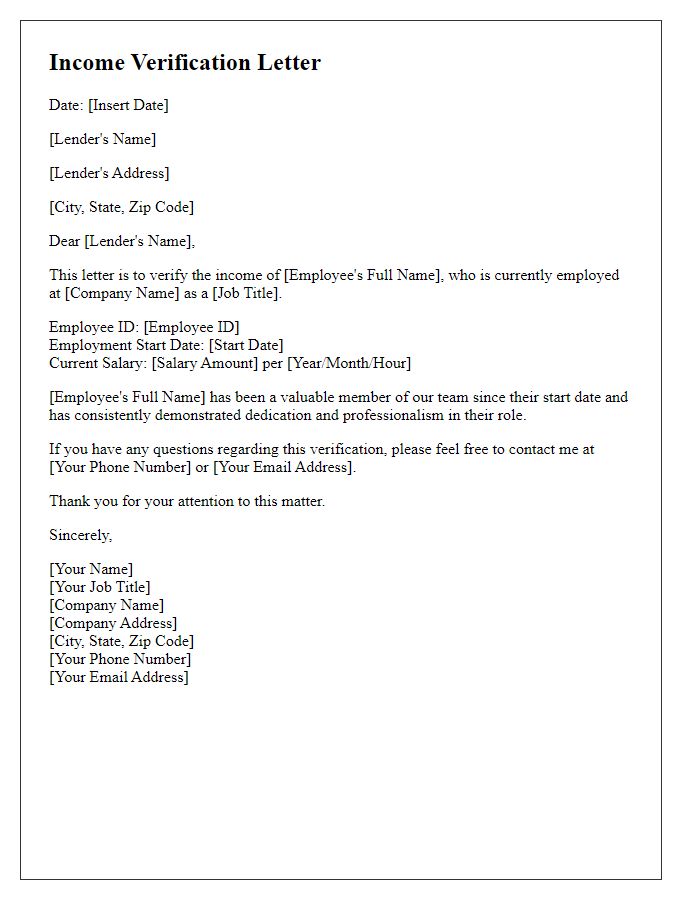

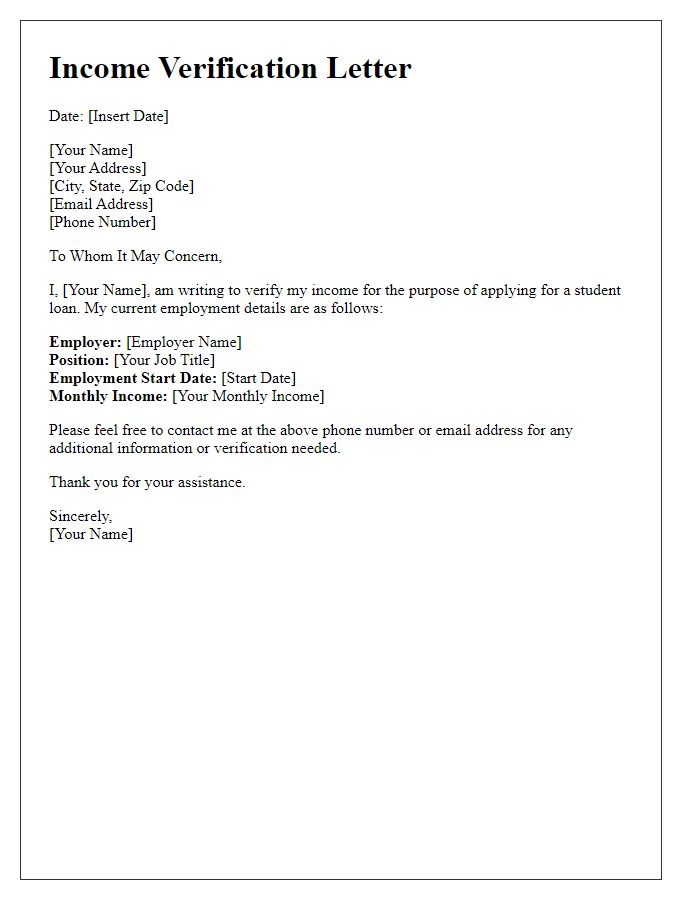

Employee's Details

Employee income verification is a crucial step in the loan application process. Key components in this verification include employee name, which identifies the individual, employee ID number, providing a unique identifier within the organization, job title, reflecting the current position within the company, and employment start date to confirm duration of service. Employer name and contact details establish the legitimacy of the income source. Documentation may also include gross monthly salary, net income indicating take-home pay after deductions, and year-to-date earnings reflecting total income received since the beginning of the year. Additional information such as bonuses, commissions, or overtime may enhance the financial profile of the employee and provide a fuller picture of their income. Lastly, employer signature and date validate the authenticity of the statement, ensuring that all figures are accurate and reliable for loan processing.

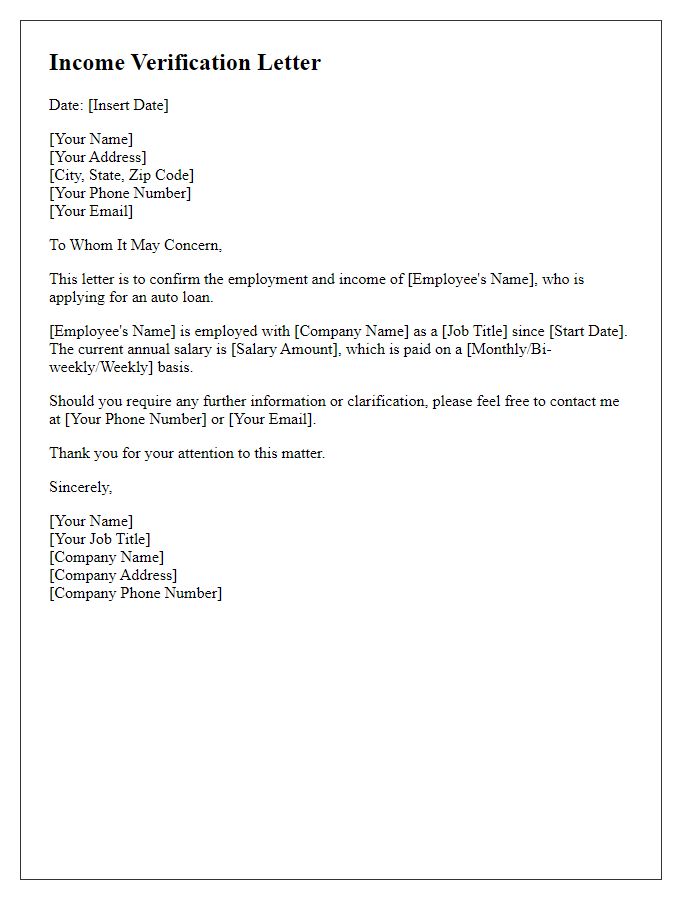

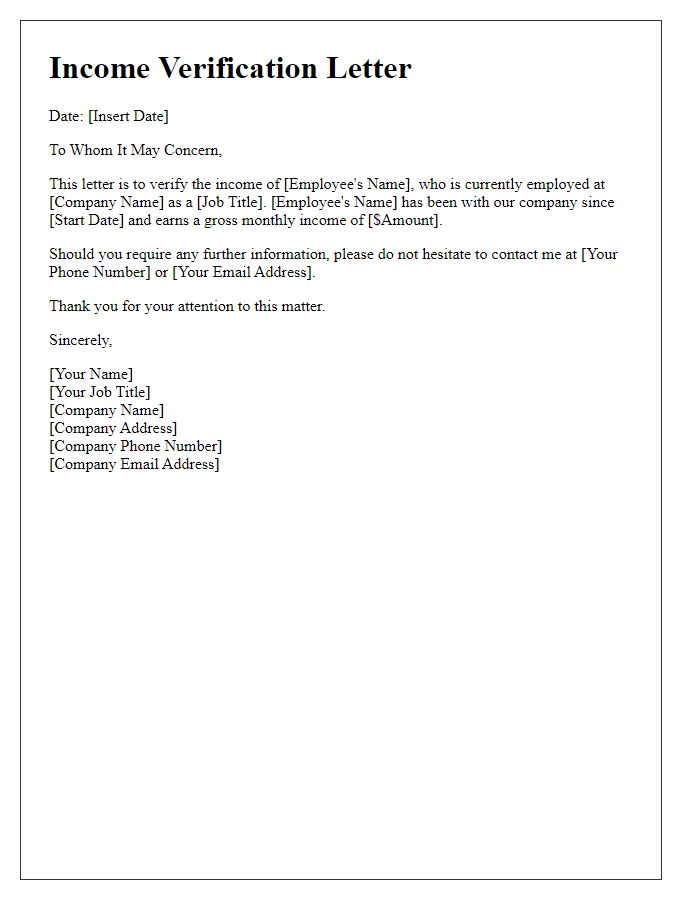

Employment Confirmation

Income verification is a critical component in the process of securing loans, especially for individuals applying for mortgages or personal loans. Employment confirmation letters serve as formal documentation, validating an individual's income and employment status. Typically, these letters include essential details such as the employee's name, job title, employment start date, and annual or hourly salary figures. For example, many lenders require information about the average monthly income over the past year, which can vary significantly based on employment type. A common benchmark in the United States is a maximum debt-to-income ratio of 43%, which lenders consider when assessing loan applications. This confirmation can also aid in providing additional context, such as length of employment, part-time or full-time status, and whether the income is guaranteed or commission-based, ensuring a comprehensive evaluation of the applicant's financial stability.

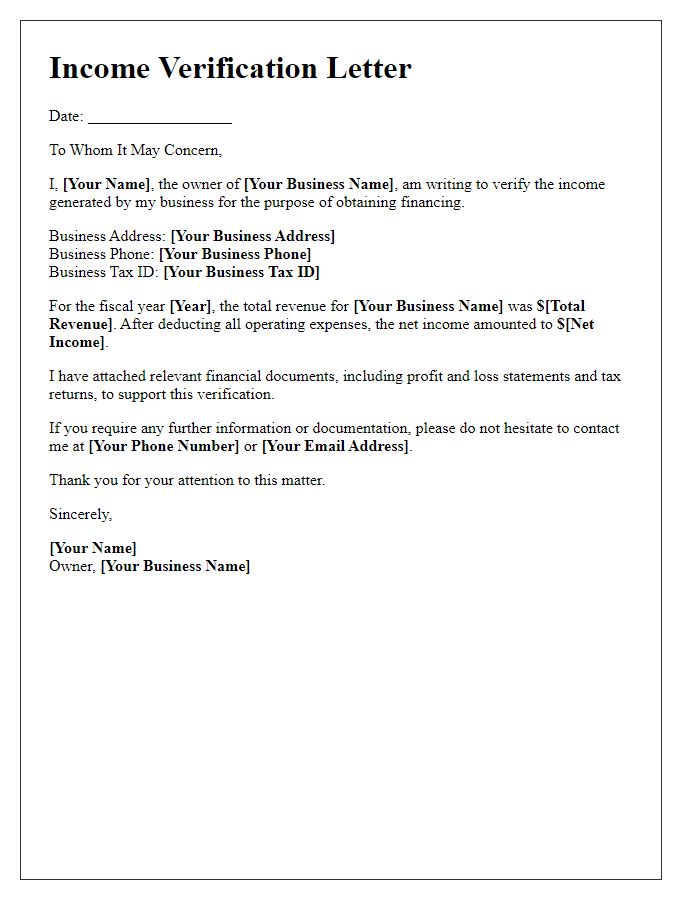

Salary Details

To obtain a loan approval, applicants often need to provide detailed income verification. For salaried employees, this typically includes comprehensive documentation such as pay stubs from the previous three months, W-2 forms for the last two years, and an employment verification letter from the employer. These documents should clearly state the gross monthly salary, year-to-date earnings, and any additional bonuses or commissions that may enhance the applicant's financial profile. Lenders may also require bank statements reflecting regular salary deposits, ensuring a complete understanding of the applicant's financial stability. It is important for applicants to ensure these documents are accurate and consistent, as discrepancies can lead to delays in the loan approval process.

Contact Information for Verification

A comprehensive income verification process can significantly impact loan eligibility for applicants seeking financial assistance from institutions such as banks, credit unions, or mortgage companies. Essential components include providing accurate employment details, such as the company name (e.g., ABC Corp), job title (e.g., Sales Manager), and duration of employment (e.g., 2 years). Critical income proof documents, such as recent pay stubs (ideally from the last three months) and W-2 forms (typically from the last two years), should be prepared for submission. Furthermore, financial institutions may require additional information like tax returns, bank statements, and proof of supplementary income sources (e.g., rental income or freelance work). Proper documentation ensures efficient processing and helps applicants secure necessary funds for major purchases like homes or vehicles.

Comments