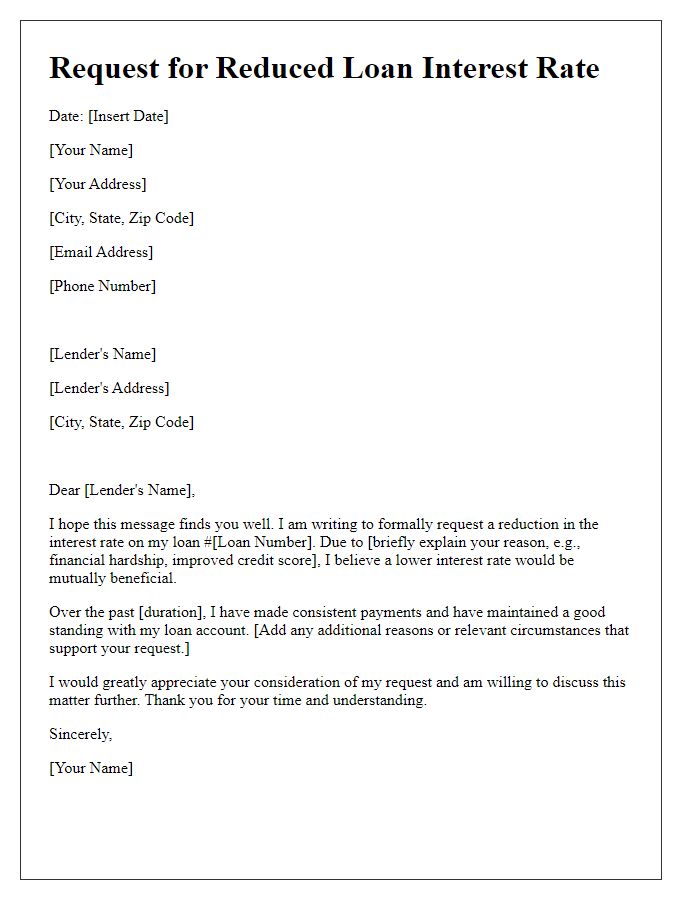

Are you feeling the pinch of high loan interest rates? You're not aloneâmany borrowers are seeking relief from cumbersome financial burdens. Writing a request for lower loan interest can feel daunting, but it's a straightforward process that can potentially save you a significant amount of money. If you're curious about how to craft an effective letter to your lender, read on for helpful tips and a practical template.

Personal financial situation

Navigating challenging personal financial situations demands careful consideration, especially when it comes to loan repayments. For individuals facing economic hardships, like decreased income or unexpected expenses, the burden of high loan interest rates can become overwhelming. Many lenders assess the borrower's current financial status by reviewing factors such as income levels, debt-to-income ratios, and credit scores. When requesting a reduction in loan interest rates, borrowers can provide insights into their financial difficulties, including job loss, medical expenses, or family-related costs. Documented evidence, such as pay stubs or medical bills, can help substantiate claims. A well-articulated request emphasizing transparency and a willingness to maintain a positive lender-borrower relationship can increase the likelihood of a favorable response.

Current interest rate details

Currently, prevailing interest rates on personal loans, such as 7.5% annually for a five-year term, can significantly impact monthly payments and overall repayment costs. Many financial institutions, including major lenders like Bank of America and Wells Fargo, offer competitive rates based on creditworthiness and economic factors. Borrowers with excellent credit scores (above 750) might qualify for lower rates, potentially around 5% or less. Requesting a review of the interest rate can lead to significant savings, especially for loans exceeding $10,000, where even a 1% reduction can save hundreds of dollars over the loan duration. Financial markets remain fluid; therefore, staying informed about market trends and maintaining a strong credit profile can enhance the likelihood of obtaining favorable loan terms.

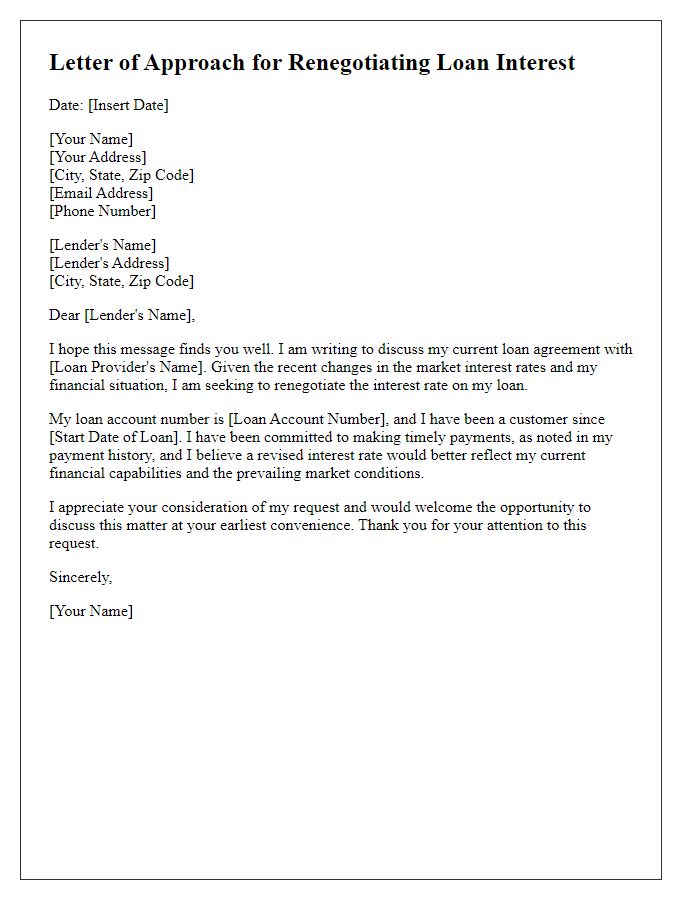

Specific request for rate reduction

A lower loan interest rate can significantly reduce the overall financial burden on borrowers, providing substantial savings. Financial institutions, such as banks or credit unions, typically offer various loan products, including personal loans or mortgages, with interest rates influenced by market conditions and individual credit scores. In a competitive market environment, potential borrowers may qualify for better rates, stimulating a request for a rate reduction. This request usually highlights factors such as consistent payment history, improved credit score (for instance, a score increase from 650 to 720), or a recent drop in prevailing interest rates (down by 0.5% in recent months) as justification. A successful negotiation can lead to lower monthly payments, making financial obligations more manageable for individuals and families.

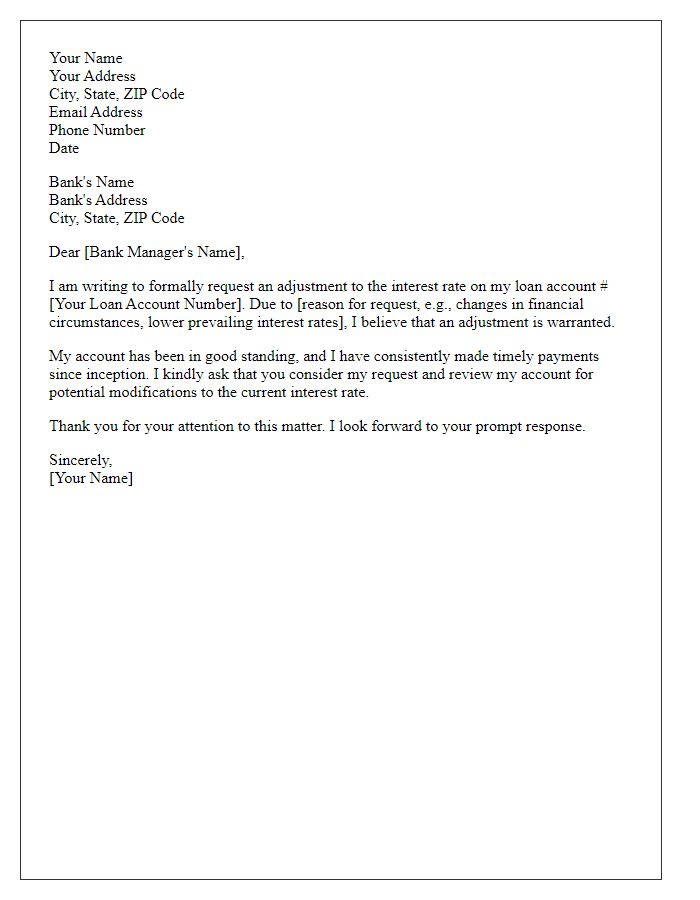

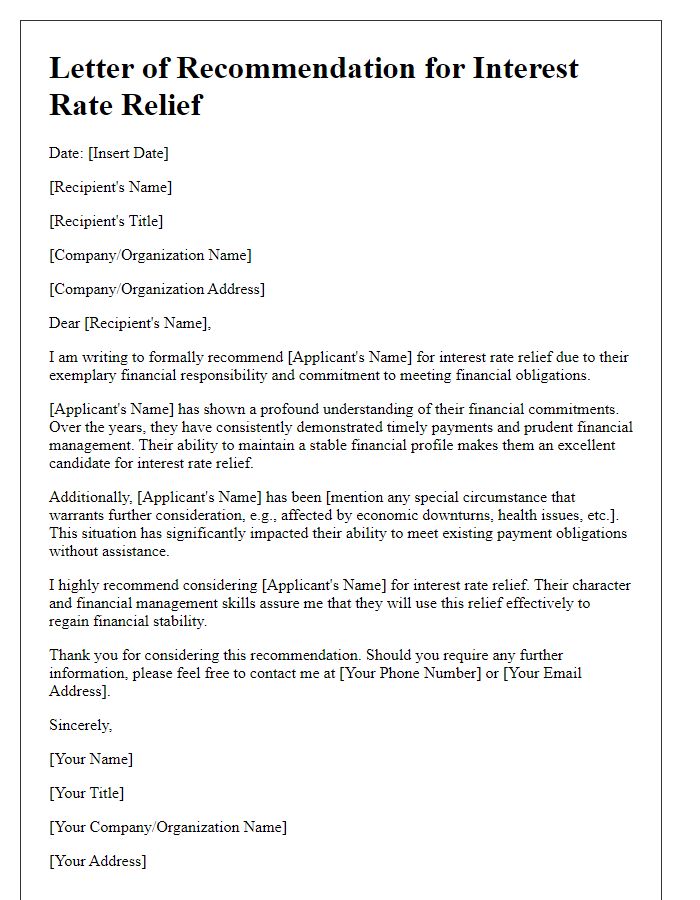

Justification and supporting documentation

In many cases, borrowers seek to lower their loan interest rates in order to manage financial costs more effectively. A strong justification often includes relevant financial documents, such as credit reports reflecting improved credit scores, recent employment verification indicating stable income, and debt-to-income ratios demonstrating responsible financial management. Additionally, market comparisons showcasing lower rates from competitors - specific banks or credit unions influencing local lending practices - can support the request. A detailed history of prompt payments on existing loans also adds weight; highlighting the significance of consistent payment patterns encourages lenders to reconsider loan terms favorably. Engaging in this process could lead to substantial savings over the life of the loan, enhancing financial stability for the borrower.

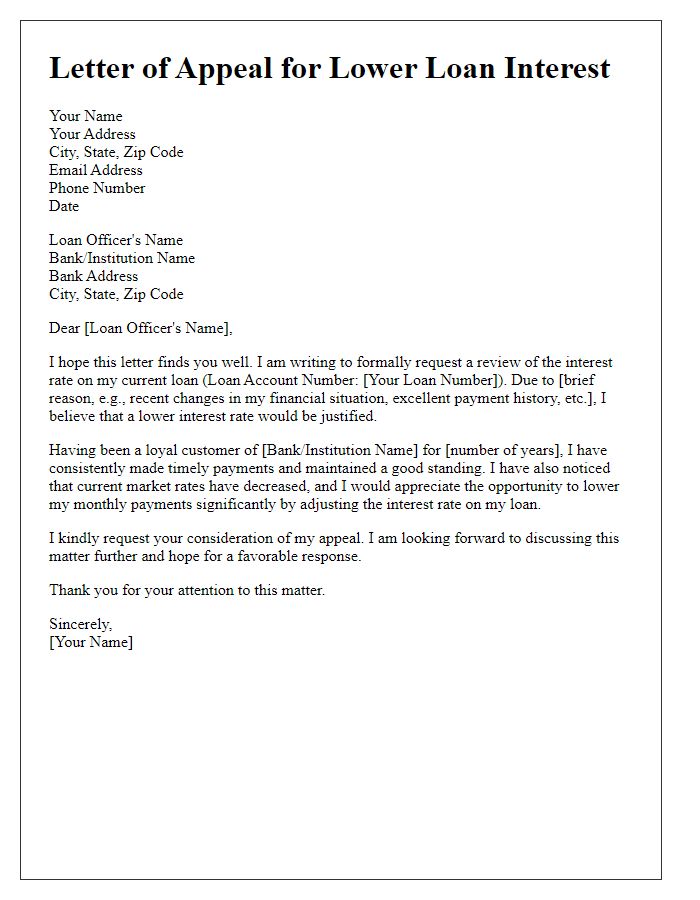

Appreciation and future financial reliability statement

High-interest rates can significantly impact monthly payments on personal loans, often leaving borrowers in a financial strain. Current average personal loan interest rates in the United States hover around 10.5% to 36%, depending on creditworthiness and lender policies. By demonstrating a sustained record of on-time payments and an improving credit score (above 700 is typically considered good), borrowers can position themselves favorably for negotiations. Furthermore, mortgage rates (currently around 6-7%) and other benchmarks can provide context for discussions about securing lower rates. Financial institutions may appreciate the stability of a long-term relationship with customers who exhibit consistent income and responsibly managed debt, reflecting a potential for reliable future repayments.

Comments