Are you considering a mortgage loan but not sure where to start? Crafting the perfect letter to request a mortgage can make all the difference in your application process. In this article, we'll guide you through the key components to include, ensuring you present yourself in the best possible light. So, let's dive in and simplify your journey towards homeownership!

Applicant's personal financial information

A mortgage loan request requires comprehensive personal financial information from the applicant. The primary components include annual income, detailing sources such as salary, bonuses, or self-employment earnings, which typically range from $50,000 to over $150,000 depending on the profession and location. Additionally, monthly expenses must be documented, including housing costs (rent or prior mortgage), utilities, and debt payments (credit cards, student loans), generally totaling between $2,000 to $5,000. The applicant's credit score, a crucial three-digit number affecting approval chances, should ideally exceed 700 for favorable terms. Documentation of assets, such as savings accounts, investment portfolios, or inherited properties, is essential, with total assets often exceeding $50,000. Furthermore, recent pay stubs and bank statements, typically covering the last two months, are necessary for lenders to verify financial stability during the underwriting process.

Detailed property information

A mortgage loan request requires specific and detailed property information to ensure the lender has all necessary context for evaluation. Property type, such as single-family home or condominium, directly influences loan terms and eligibility criteria. Location details, including street address, city (for example, San Francisco) and zip code (e.g., 94103), establish the property's market area and potential value trends. Square footage measurements (like 2,500 square feet) provide insight into property size and livability. Year built (e.g., 1995) informs the lender about the property's age and associated maintenance requirements. Lot size, stated in acres (for instance, 0.25 acres), affects outdoor space and potential development. Unique features, such as a finished basement or swimming pool, can enhance property value and attractiveness to buyers. Recent appraised value, typically obtained from licensed appraisers, serves as a benchmark for loan approval amounts. Any existing liens or encumbrances must also be disclosed to provide a complete financial picture for the lender's consideration.

Loan amount and purpose

A mortgage loan request typically involves a specific financial need, such as purchasing residential properties or refinancing existing loans. A common loan amount might range from $100,000 to $500,000, depending on the property's location, market conditions, and buyer qualifications. The purpose of the loan could be to acquire a single-family home in suburban areas like Maple Grove, Minnesota, or to consolidate debt through refinancing in cities like San Francisco, California. Approaching a lender with detailed information about the desired property, the borrower's financial history, and an explanation of how the loan will be utilized increases the likelihood of approval.

Credit history and score

A strong credit history can significantly impact mortgage loan approval, with scores calculated using a range of data points. The FICO score, commonly used by lenders, ranges from 300 to 850. Higher scores above 740 typically qualify borrowers for better interest rates. Payment history constitutes approximately 35% of the score, emphasizing the importance of timely payments. Credit utilization, the ratio of current credit card balances to limits, should ideally remain below 30%. Credit inquiries from lenders, particularly hard inquiries, can also influence overall scores. Maintaining a varied credit mix, including loans and credit cards, helps build a positive credit profile. A comprehensive understanding of these factors is essential for potential borrowers seeking mortgage approval.

Employment and income verification

Employment verification and income confirmation are critical components of the mortgage loan application process. Lenders require documentation such as recent pay stubs or W-2 forms to ensure the borrower's financial stability. In some cases, a verification of employment (VOE) letter from the employer is necessary to validate the borrower's current job position at companies like Google and Amazon. Annual income levels, which often exceed $100,000 for many applicants in the tech industry, must be demonstrated consistently over the previous two years to satisfy lender guidelines. This verification process assures lenders of the borrower's ability to make timely mortgage payments, directly impacting loan approval rates.

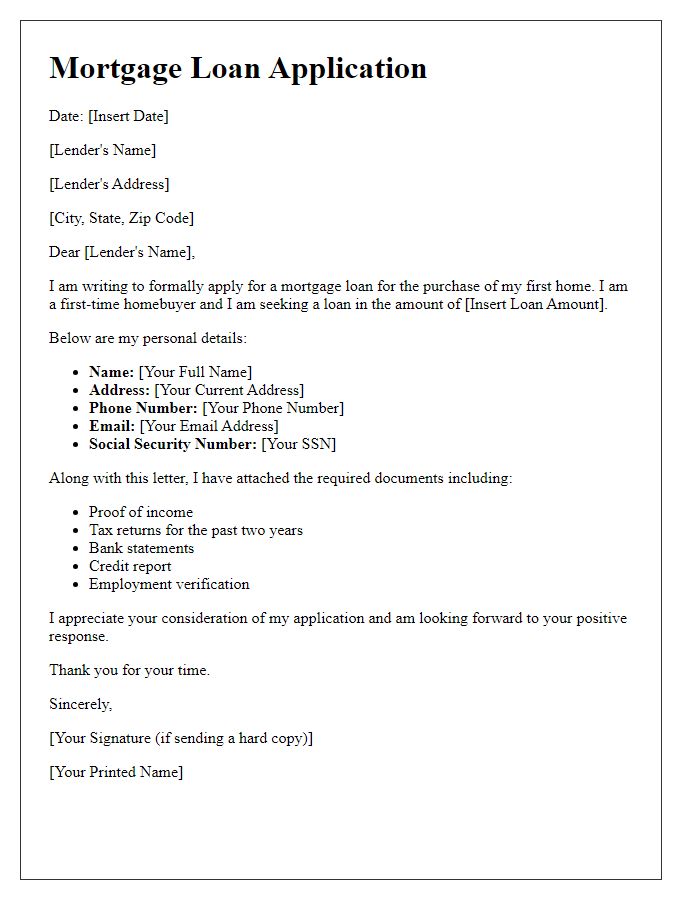

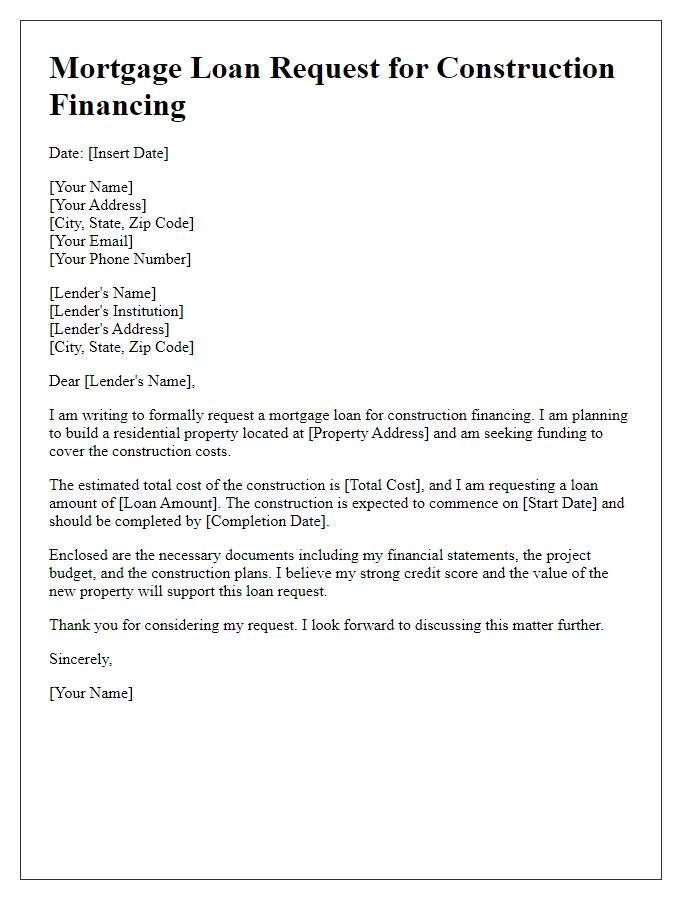

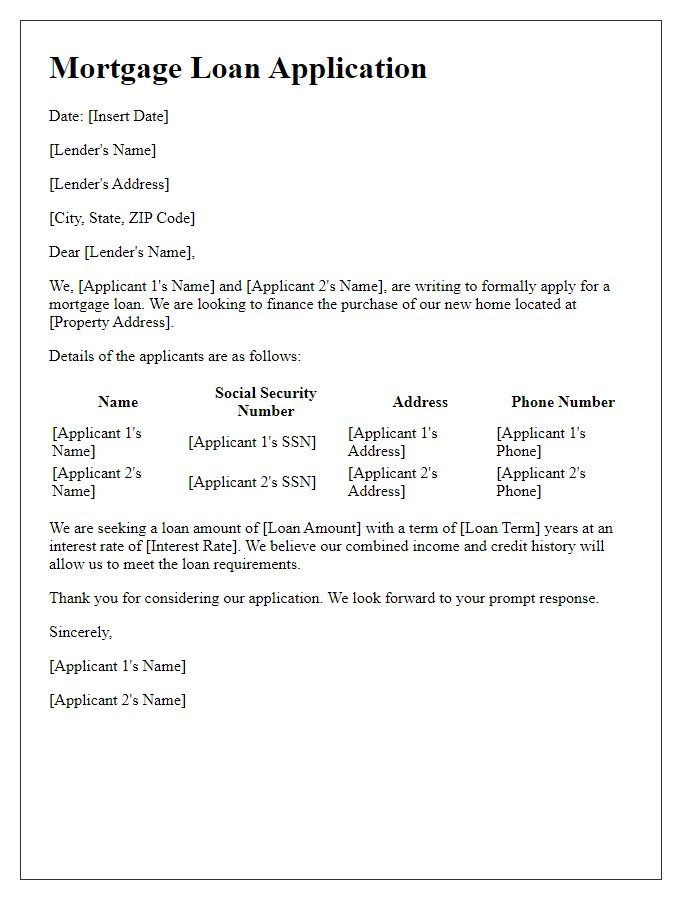

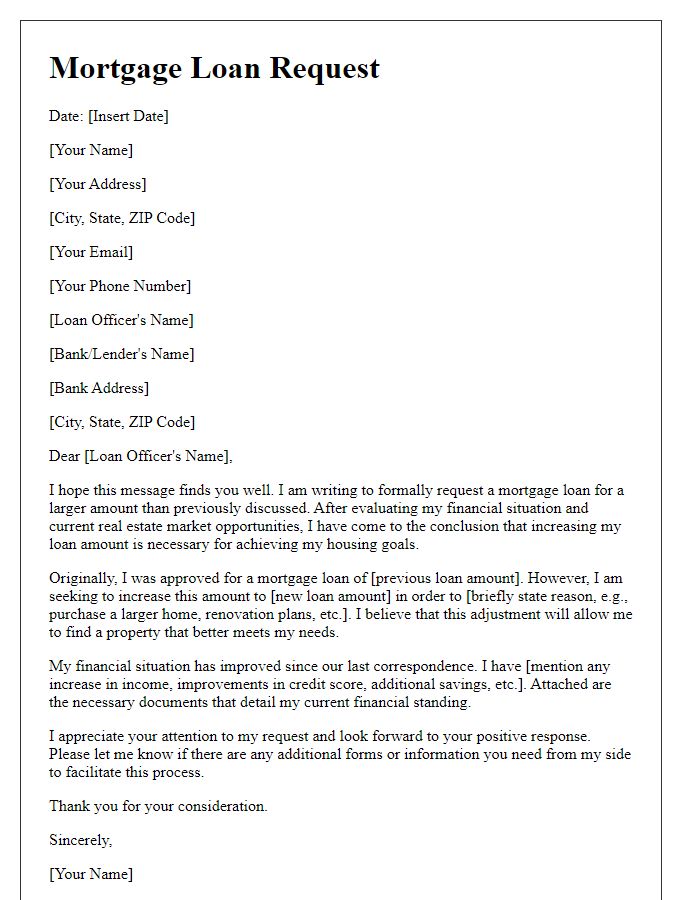

Letter Template For Mortgage Loan Request Samples

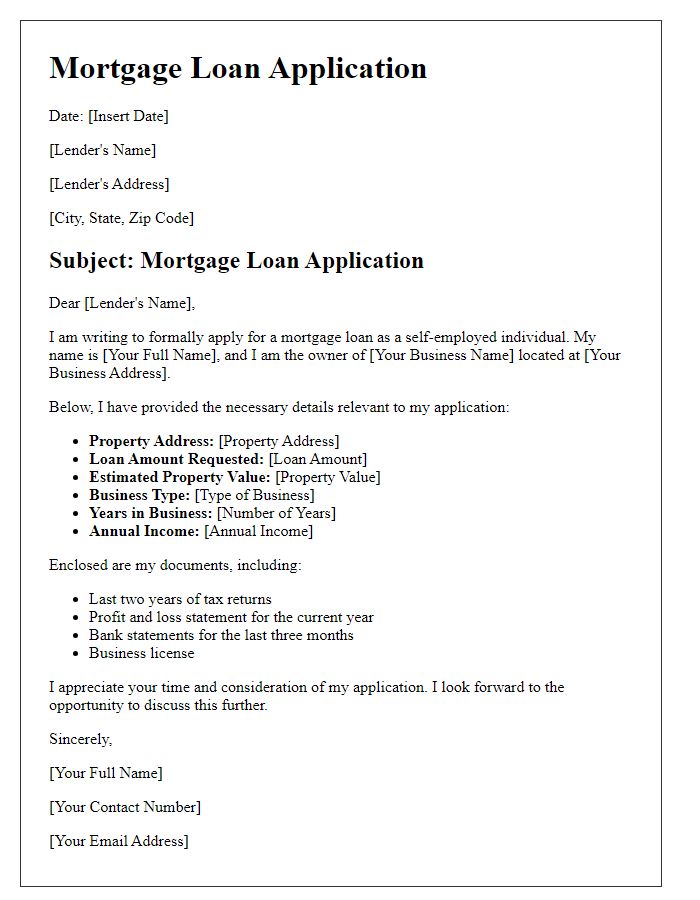

Letter template of mortgage loan application for self-employed individuals

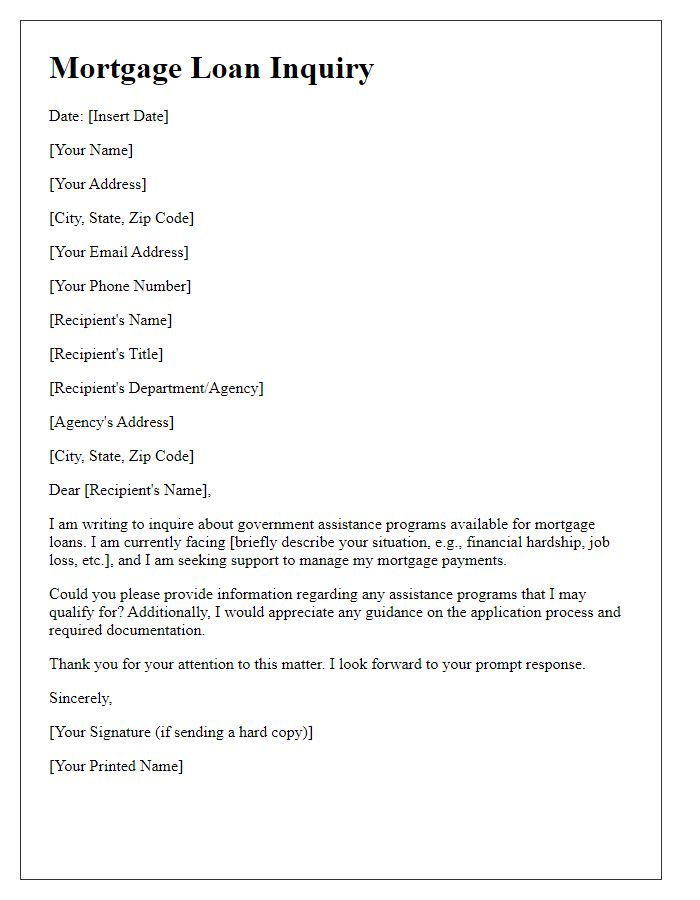

Letter template of mortgage loan inquiry for government assistance programs

Comments