When applying for a loan, it's essential to clearly articulate the purpose in your request; this not only shows transparency but also helps lenders understand your financial goals. Whether you're funding a home renovation, consolidating debt, or starting a new business, outlining specific intentions can strengthen your application. In addition, demonstrating how the loan will benefit your long-term financial health can make a compelling case for your approval. Ready to dive deeper into crafting the perfect loan purpose letter? Keep reading for tips and a helpful template!

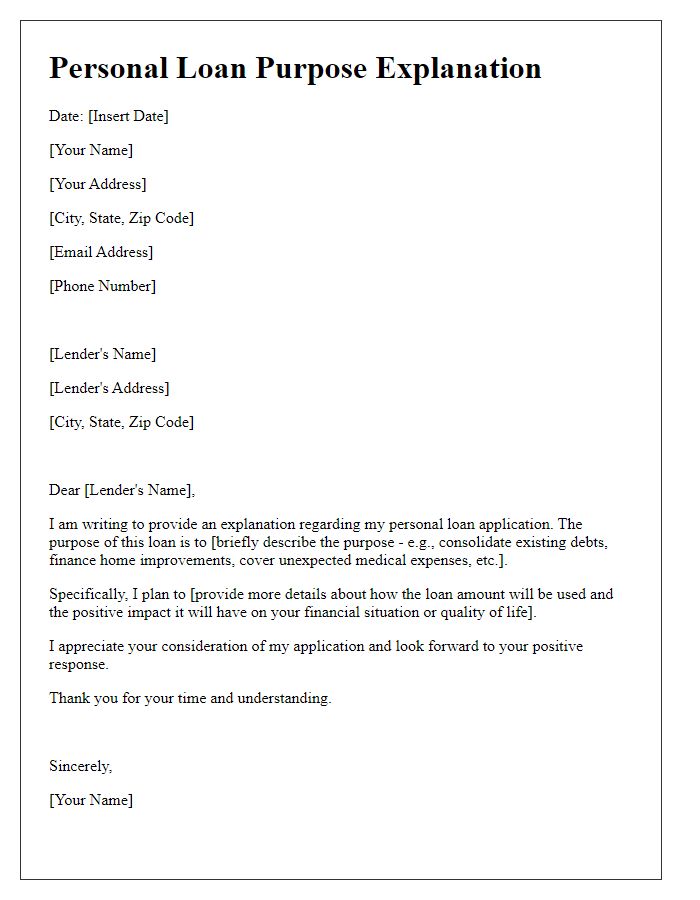

Clear and Specific Loan Purpose

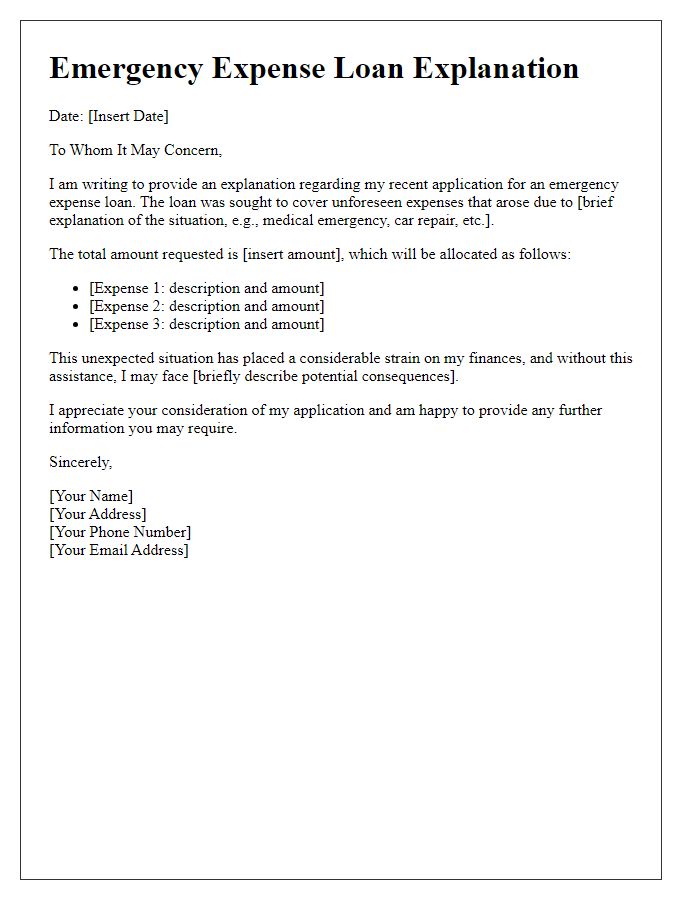

Securing a loan for specific uses significantly enhances financial planning. A personal loan, typically ranging from $1,000 to $50,000, can be utilized for diverse purposes, including debt consolidation, home improvements, or emergency expenses. For instance, consolidating credit card debt averaging 18% interest into a personal loan with a fixed rate may reduce monthly payments. Additionally, home improvements, such as renovating a kitchen or adding energy-efficient windows, can increase property value substantially. Lastly, securing funds for unexpected medical expenses, which can average over $10,000, ensures peace of mind in financial stability. Clarity in articulating the purpose of a loan fosters transparency and aligns expectations with lenders.

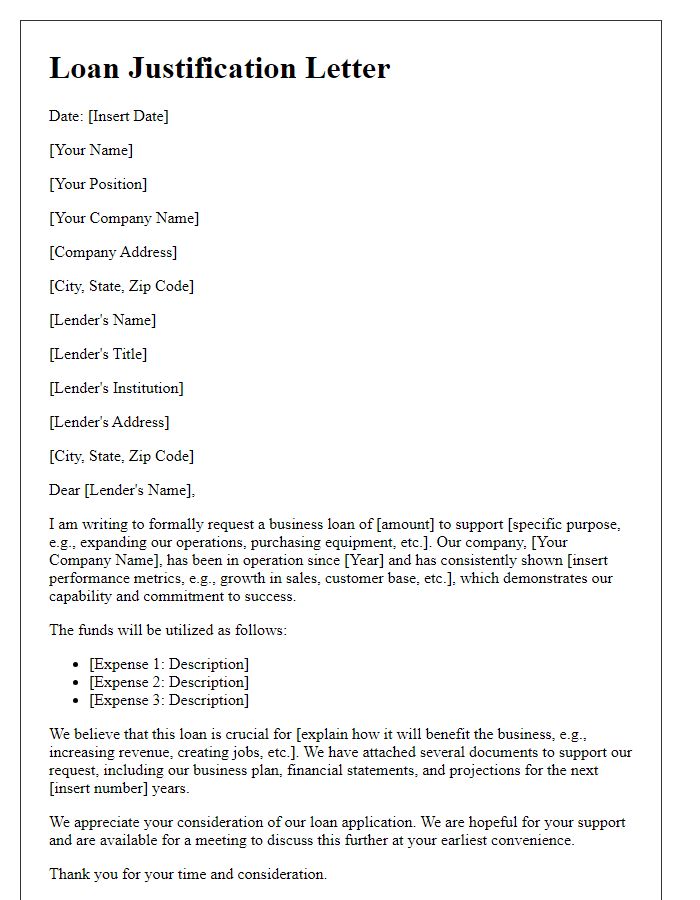

Detailed Financial Breakdown

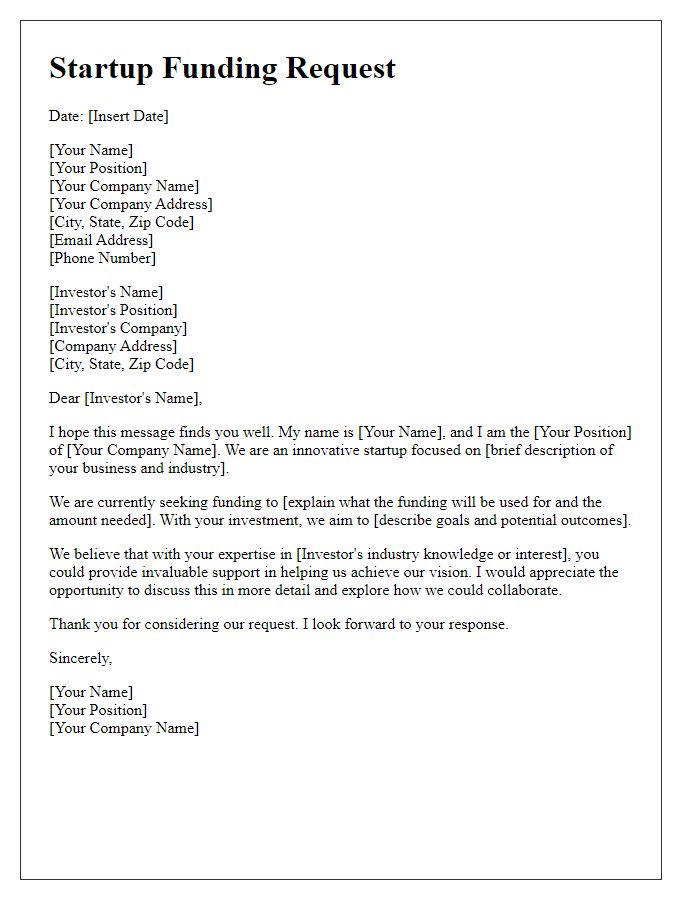

A detailed financial breakdown clarifies the purpose of a loan, highlighting key expenditures and expected outcomes. For instance, acquiring a loan of $50,000 to fund a small business startup involves specific allocations: $20,000 designated for equipment purchase, including computer systems and machinery; $15,000 reserved for lease arrangements on a commercial property located in downtown San Francisco; $10,000 intended for initial inventory procurement, crucial for establishing a market presence; and $5,000 allocated for marketing campaigns to attract customers. These strategic investments are essential for achieving the projected five-year growth rate of 25%, ensuring sustainability and profitability in a competitive market.

Positive Financial History

Demonstrating a positive financial history is crucial when applying for a loan, particularly for significant financial commitments such as a mortgage or business expansion. A track record of on-time payments across various credit accounts, including credit cards (which typically report monthly), auto loans, and student loans, can significantly enhance an applicant's credibility. Additionally, maintaining a low credit utilization ratio, usually below 30%, indicates responsible credit management. Regular savings deposits and a solid employment record, particularly in stable sectors like healthcare or technology with average annual salaries reaching above $70,000, further bolster one's financial profile. Furthermore, an applicant's ability to provide detailed financial statements that showcase assets, liabilities, and a consistent income flow can set them apart from others in the competitive loan market.

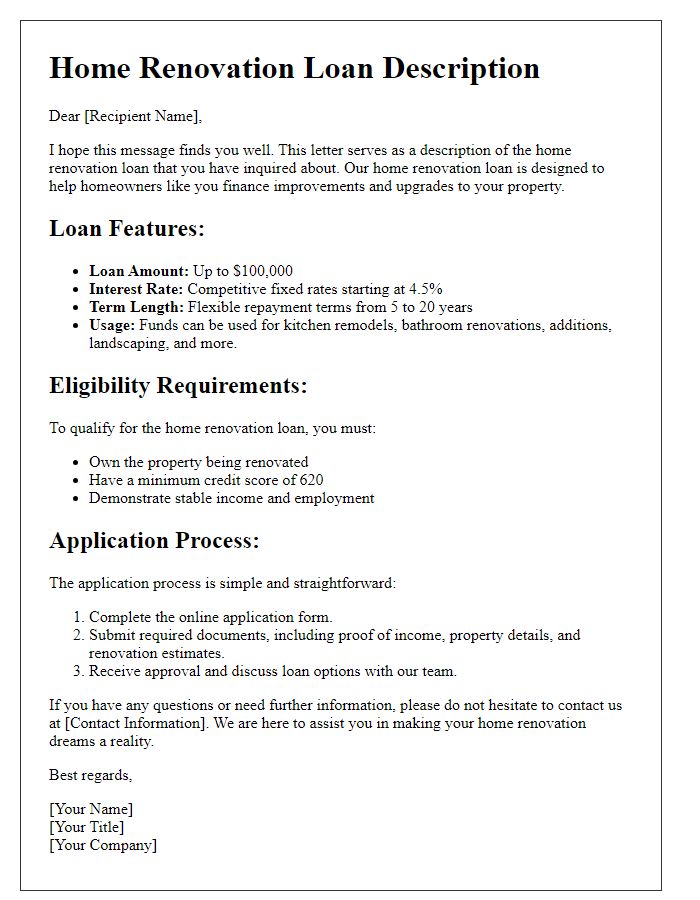

Repayment Plan Overview

A loan purpose overview provides crucial details about the intended use of funds, outlining repayment strategies for financial stability. For instance, individuals may seek loans for consolidating high-interest debt, which is an effective approach to managing monthly payments and reducing overall interest paid. Moreover, small business owners may utilize funding to acquire new equipment, which can enhance productivity and operational efficiency. A repayment plan typically includes a schedule detailing monthly installments, interest rates, and total duration. Financial institutions often assess borrower profiles based on credit scores (usually within the range of 300 to 850), income levels, and existing financial obligations to customize repayment options. Additionally, borrowers should consider potential economic fluctuations, such as changes in market interest rates or unexpected expenses, which may influence their ability to adhere to the repayment plan. Properly managing this process is essential for maintaining creditworthiness and ensuring a sustainable financial future.

Contact Information and Credentials

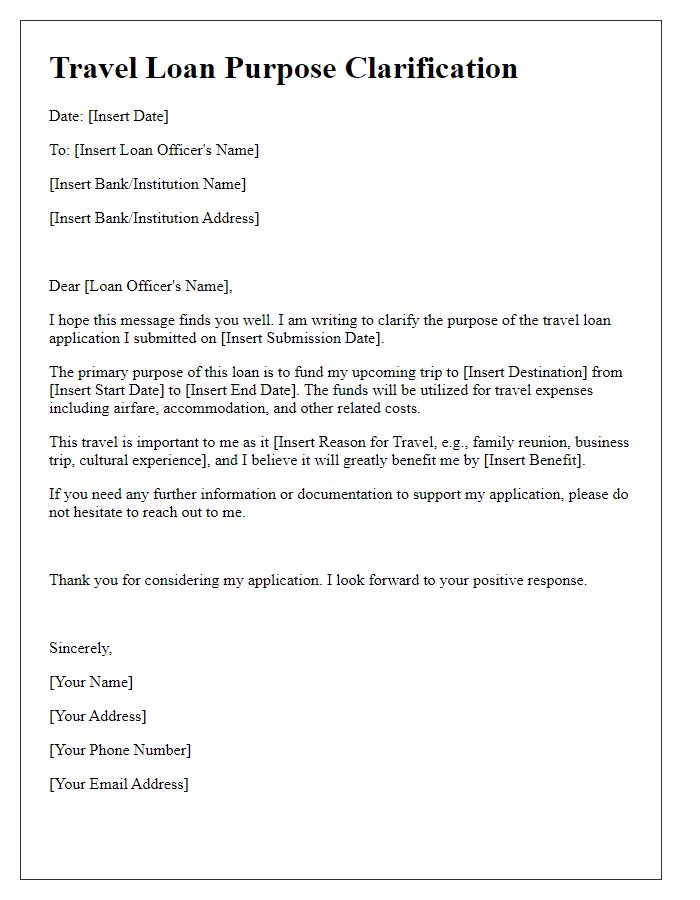

Contacting a financial institution to request a personal loan requires clear communication regarding the loan purpose. A concise overview of the purpose for applying is essential to build credibility. Applicants should detail specific plans for the funds, such as financing a home renovation or consolidating debt. Stating the amount requested alongside the intended use clarifies the request. Including relevant credentials, such as employment information, credit score, and income level, supports the application by demonstrating financial responsibility. Highlighting any experience in managing past loans or credit accounts adds further assurance of repayment capability, promoting trustworthiness in the lender's eyes.

Comments