When it comes to securing an unsecured loan, understanding the application process can seem daunting. However, with the right guidance and a well-structured approach, you can simplify the experience and increase your chances of approval. In this article, we'll walk you through a comprehensive letter template that outlines all the key elements lenders typically look for in an unsecured loan application. So grab a cup of coffee and let's dive into the details to help you get closer to reaching your financial goals!

Borrower's personal and financial information

The unsecured loan application process requires comprehensive documentation of the borrower's personal and financial information. Full name, including middle initial, should be presented alongside a current address for a precise location verification. Date of birth indicates eligibility age, while Social Security Number (SSN) is crucial for credit history assessment. Employment details, such as employer name, position, and duration of employment, provide insight into job stability. Monthly income statements, including gross income before taxes and net income, illustrate financial capacity for loan repayment. Additionally, listing existing debts, such as credit card balances and other loans, helps lenders evaluate the borrower's overall financial obligation. Providing a contact number and email address ensures timely communication during the application process.

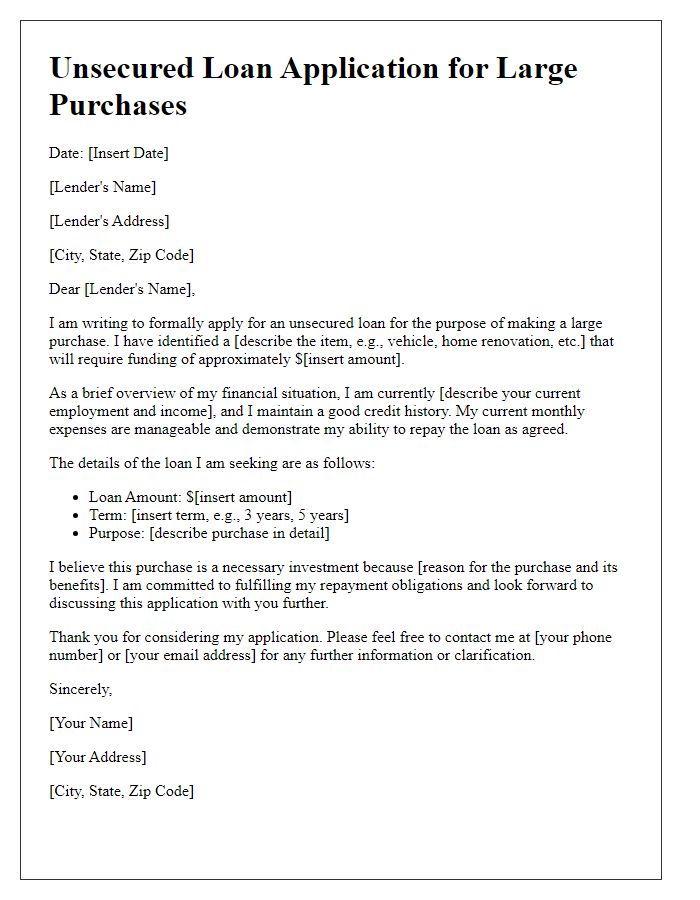

Loan amount and purpose

When applying for an unsecured loan, it is crucial to clearly outline the requested loan amount and the specific purpose for which the funds will be utilized. Many lenders typically emphasize the significance of demonstrating a responsible approach to borrowing. This involves detailing the desired loan amount--such as $10,000--and specifying how these funds will be allocated, whether for consolidating existing debt, financing home improvements, or covering unexpected medical expenses. Providing a thorough explanation helps lenders understand the applicant's financial needs and future repayment capabilities, ultimately influencing the approval process and loan terms.

Repayment terms and timeframe

Repayment terms for an unsecured loan typically range from 12 to 60 months, depending on the lender's policies and the borrower's creditworthiness. Monthly payments are calculated based on the principal amount borrowed, the interest rate (often between 5% to 36%), and the repayment period chosen. For instance, if an individual borrows $10,000 at an interest rate of 10% over 36 months, the monthly payment would be approximately $322. Successful repayment can enhance the borrower's credit score, potentially unlocking better terms for future loans or credit opportunities. Timeliness in payments is crucial, as missed payments can lead to late fees and negative impacts on personal credit history.

Employment and income details

When applying for an unsecured loan, it is essential to provide comprehensive employment and income details to demonstrate financial stability. Applicants should include their current job title, such as Software Engineer at Tech Innovations Inc., with a start date of March 15, 2020. Monthly income, including a base salary of $5,000 and additional bonuses averaging $500 per month, should be specified. Supporting documents, such as recent pay stubs and a letter of employment verification, can validate the income claim and enhance credibility. A thorough explanation of other income sources, such as freelance work or rental income, should also be included. Overall, clear and precise employment and income details establish a solid foundation for the loan application process.

Credit history and score

A strong credit history and score are essential factors in the evaluation of an unsecured loan application. A credit score typically ranges from 300 to 850, with scores above 700 generally considered good. Lenders examine credit reports from major bureaus, such as Experian, TransUnion, and Equifax, to assess an applicant's repayment behavior, outstanding debts, and payment history. A history of on-time payments significantly boosts the credibility of the applicant, while missed payments or bankruptcies, especially those registered within the last seven years, can severely diminish one's chances of approval. Additionally, the credit utilization ratio, which should ideally remain below 30%, further influences a lender's decision.

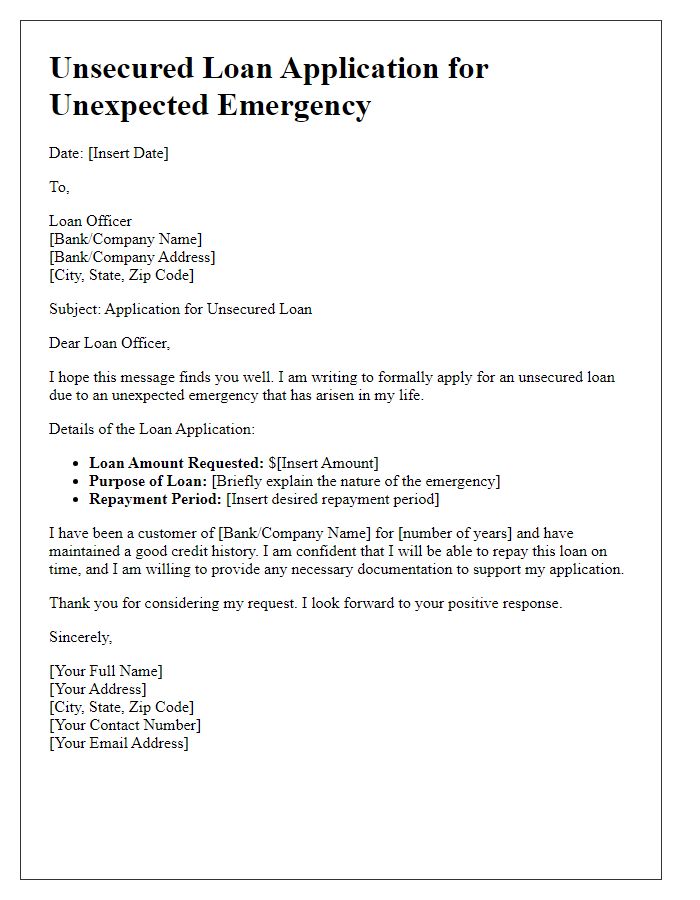

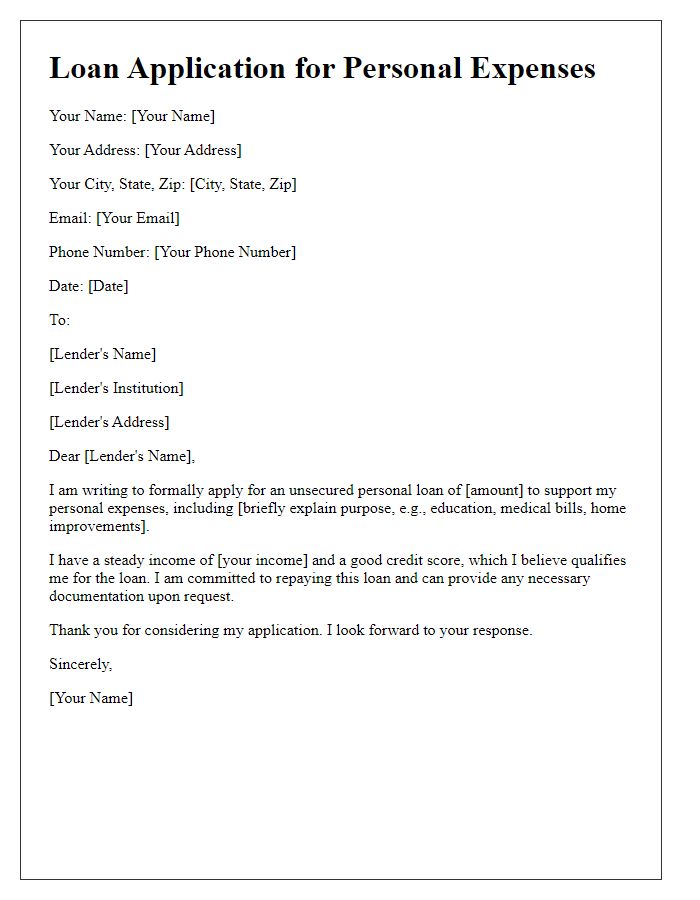

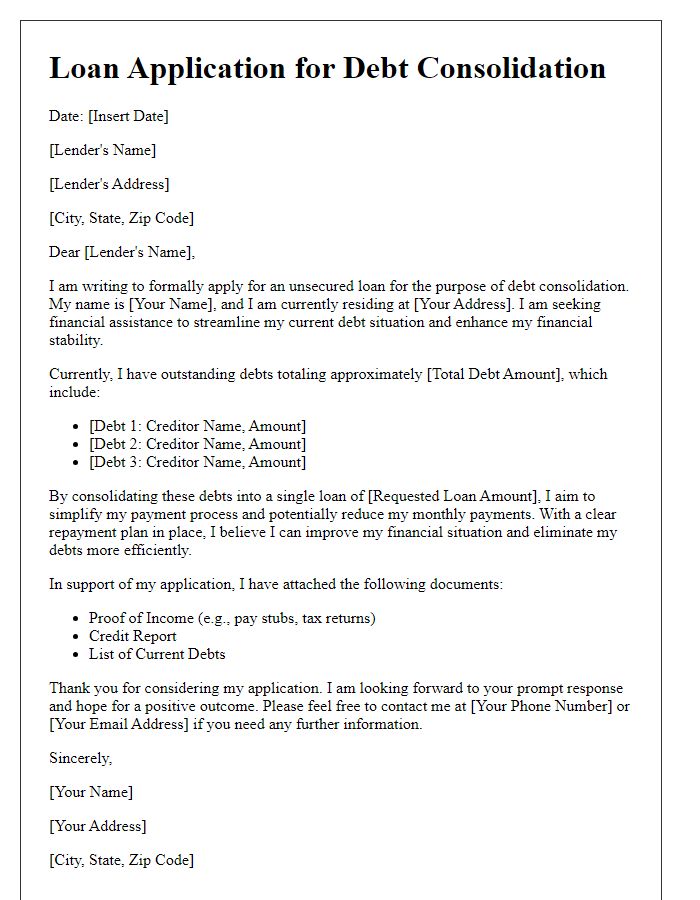

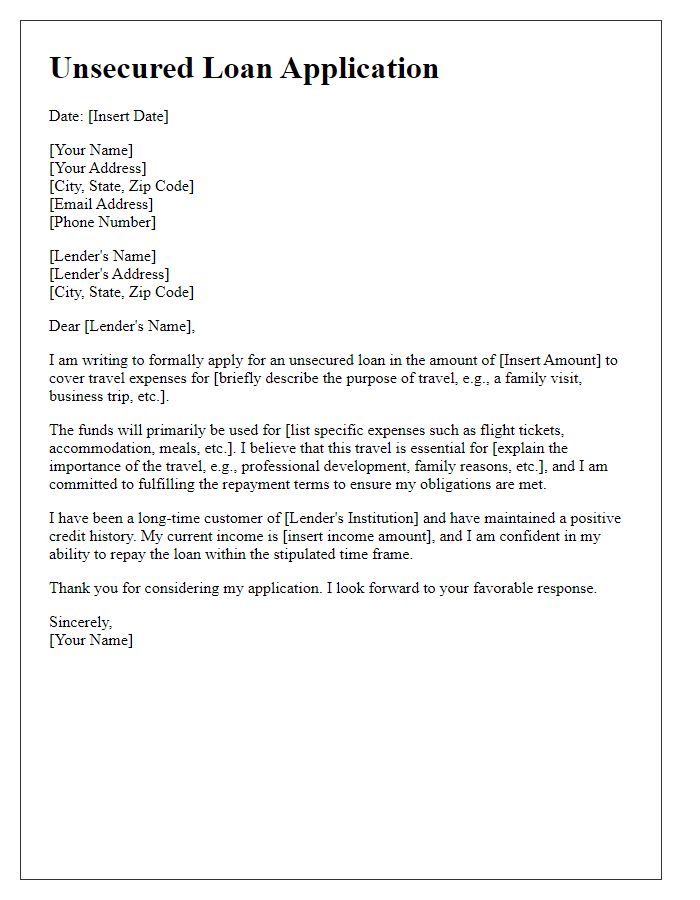

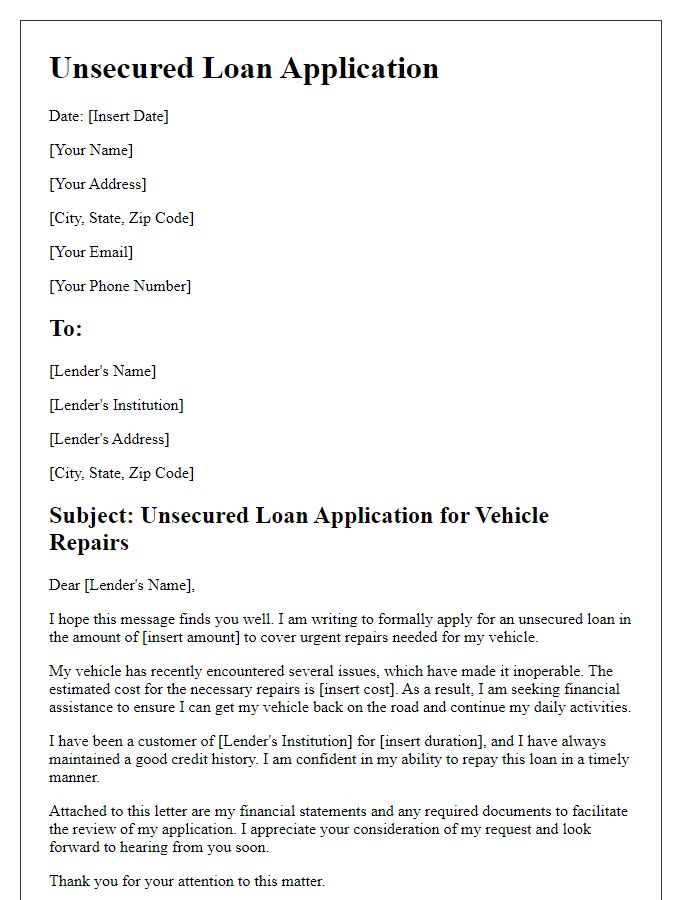

Letter Template For Unsecured Loan Application Samples

Letter template of unsecured loan application for unexpected emergencies.

Comments