Are you facing a delay in your loan payments and unsure how to communicate this to your lender? Don't worry; you're not alone in this situation, and it's essential to be clear and concise when reaching out. A well-structured letter can help you explain your circumstances and request a convenient arrangement. If you're looking for tips on crafting that perfect letter, keep reading for a comprehensive guide!

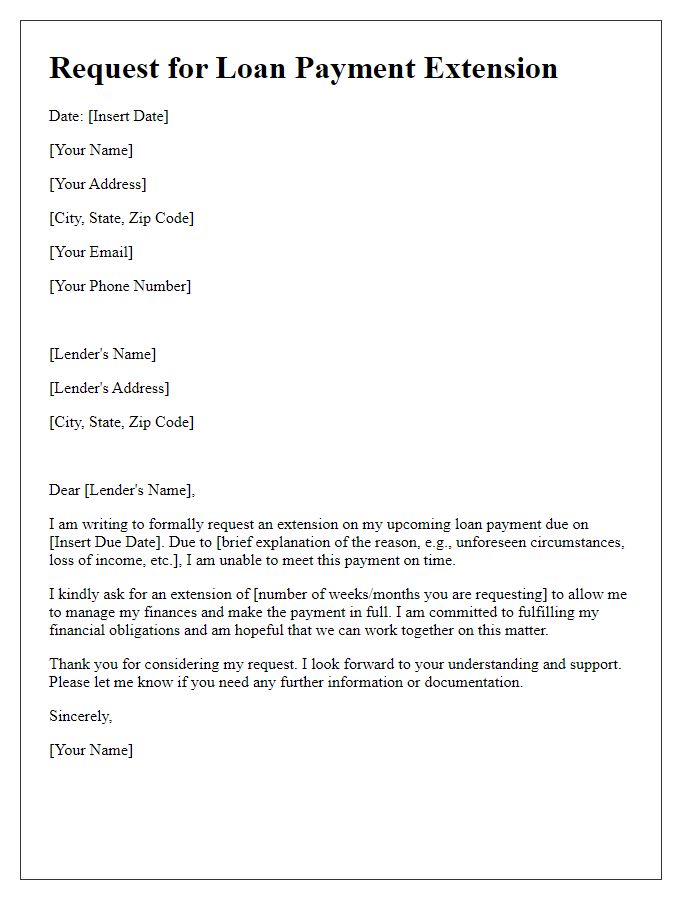

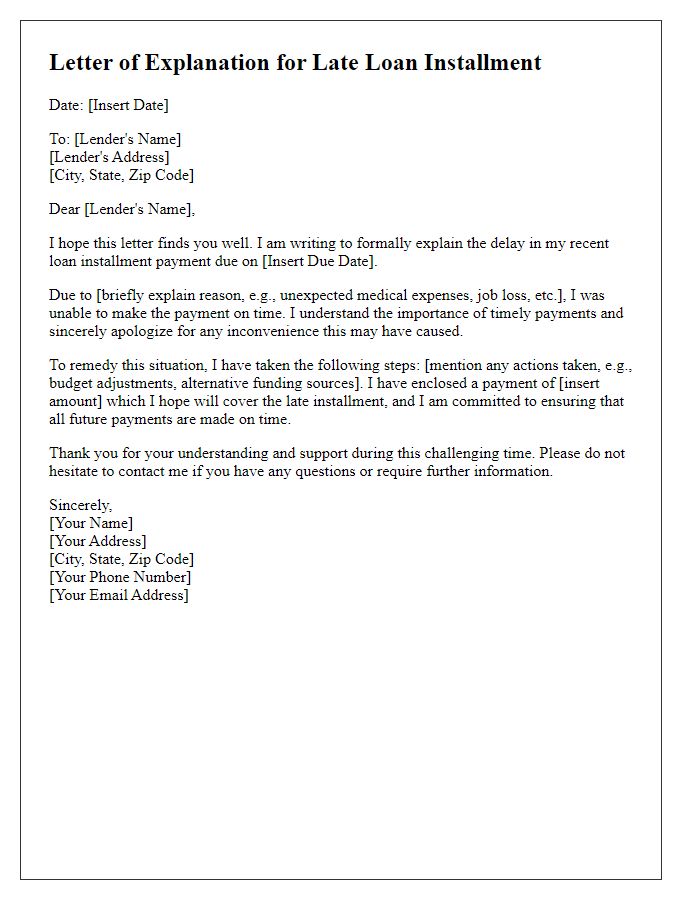

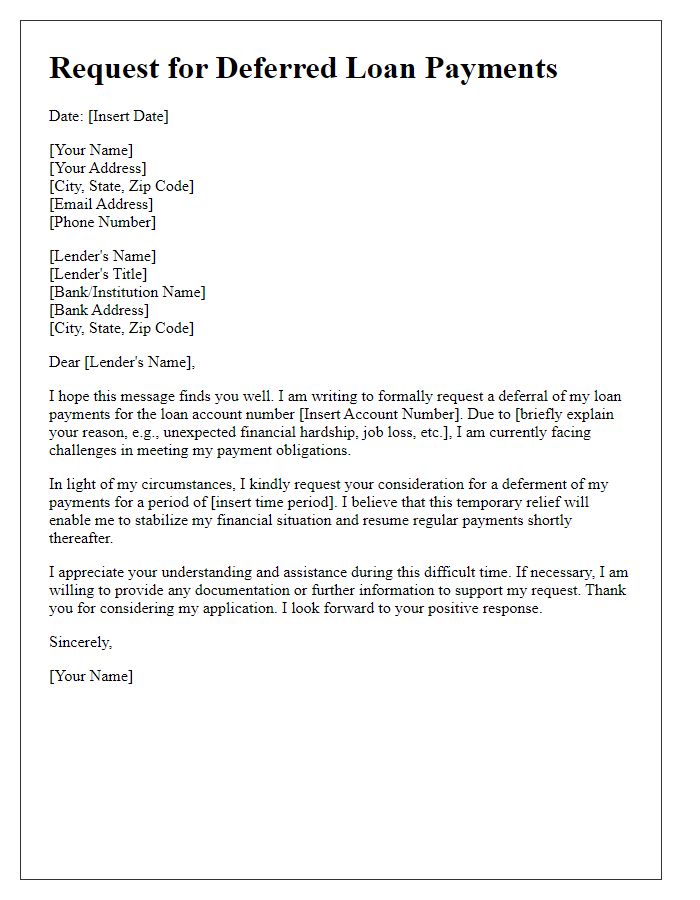

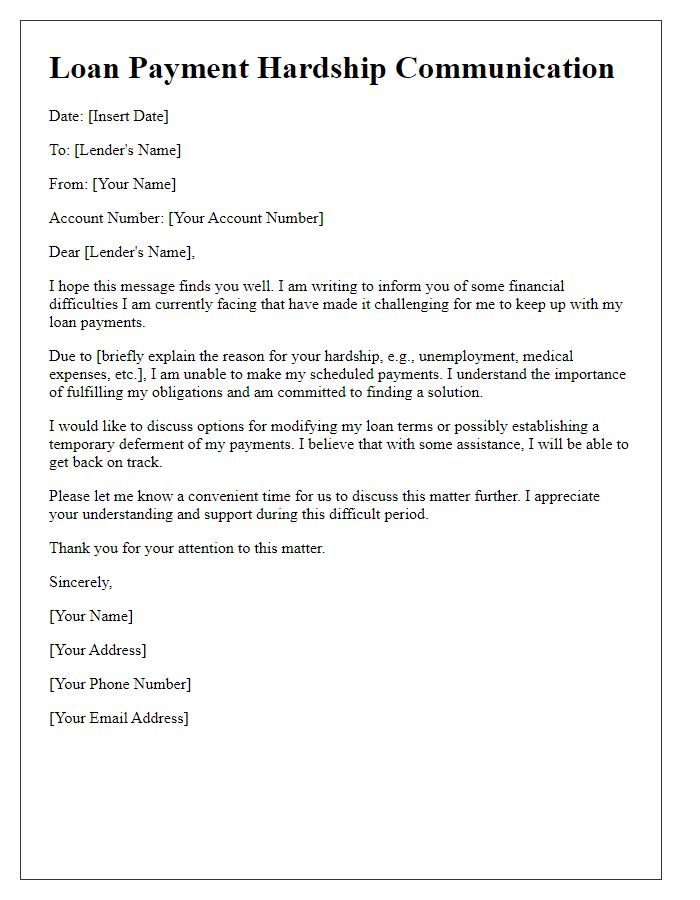

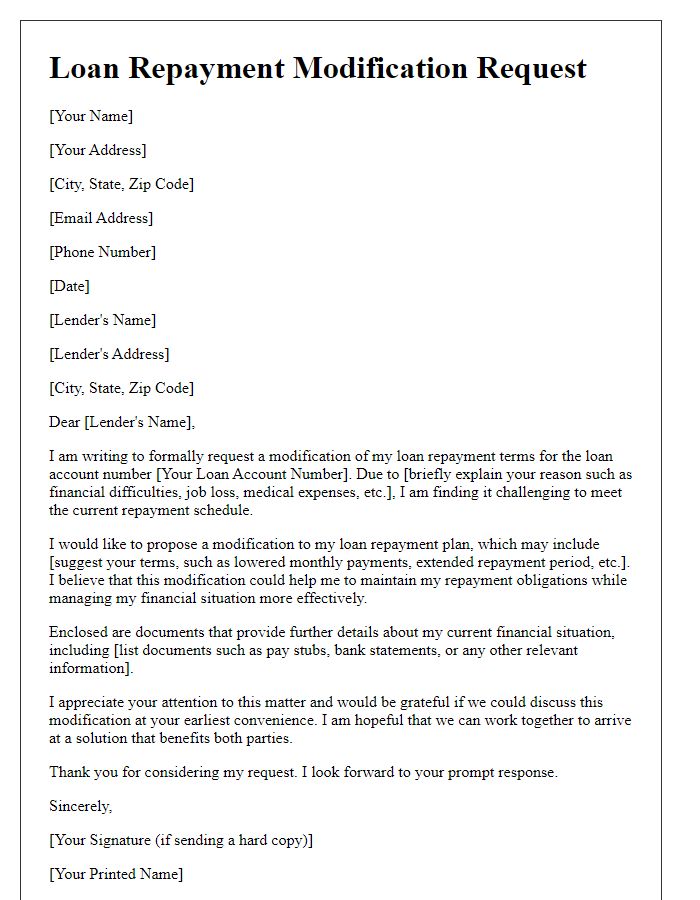

Borrower's Contact Information

In cases of financial hardship, borrowers often require adjustments to loan repayment schedules. A borrower's contact information, including full name, address, phone number, and email, serves as an essential reference for communication regarding any payment delays. This information allows lenders to discuss specific loan details, such as account number and outstanding balance, facilitating clear and efficient conversations. Timely updates from borrowers can help mitigate potential late fees or negative impacts on credit scores. Additionally, awareness of state laws, which may provide protections for borrowers facing temporary financial difficulties, is crucial during this process.

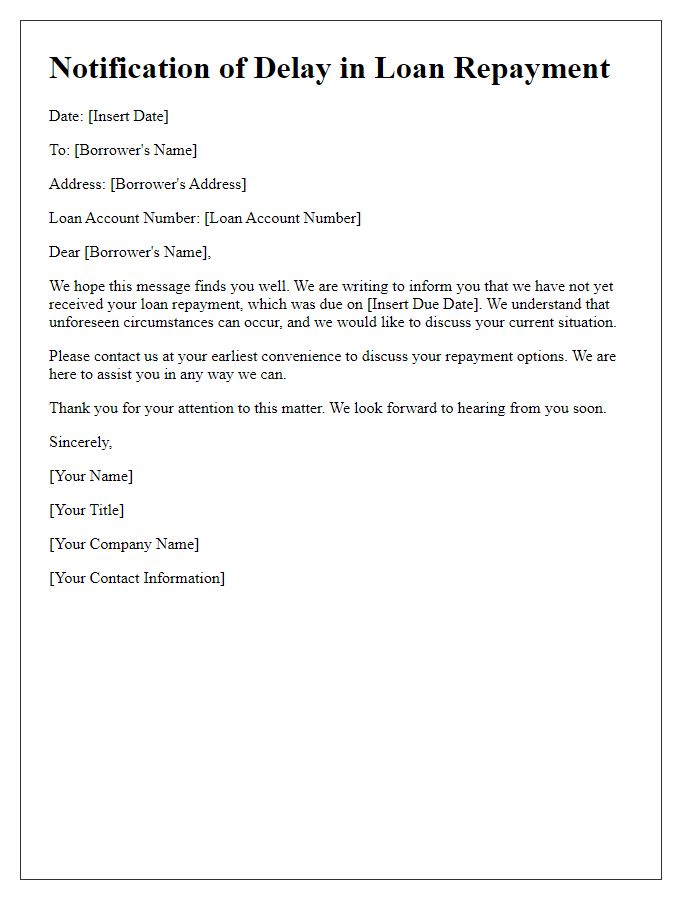

Loan Account Details

Loan account details typically include specific numerical identifiers such as account number (e.g., 123456789), outstanding balance (e.g., $5,000), and scheduled payment date (e.g., June 15, 2023). Borrower identification is essential, including name (e.g., John Doe), address (e.g., 123 Elm Street, Springfield), and contact information (e.g., (555) 123-4567). Payment history may show missed payments and corresponding dates (e.g., February 2023). Loan type is significant, indicating the nature of the financing (e.g., personal loan, mortgage). Financial institution details usually encompass the lender's name (e.g., First National Bank), loan officer's contact information, and customer service availability. Additional elements might include a reference to the loan agreement date (e.g., January 5, 2022) and any applicable late fees or penalties associated with delay.

Reason for Payment Delay

Unexpected financial hardships can lead to delays in loan payment obligations, particularly for individuals facing job loss or medical emergencies. In October 2023, an increasing number of borrowers reported challenges stemming from rising inflation rates and increased living costs. Many customers in urban areas, like New York City, struggle with high rent and utility bills, impacting their ability to allocate funds towards loan repayments. Additionally, unforeseen circumstances, such as car repairs or necessary home maintenance, can divert essential resources, creating cash flow issues. Lenders often assess these cases on an individual basis, considering the broader economic landscape when determining options for deferment or restructuring loan terms.

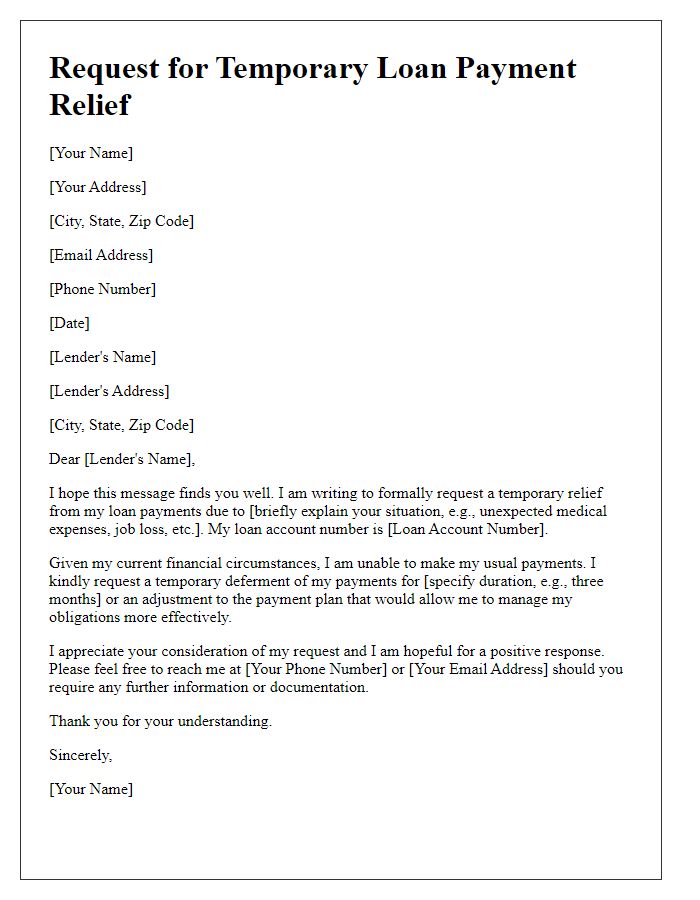

New Proposed Payment Date

In recent financial transactions, borrowers may encounter unforeseen circumstances, such as job loss or medical emergencies, impacting their ability to meet deadlines for loans. For example, an individual facing a delay in their loan payment due to unexpected medical expenses could benefit from proposing a new payment date to their lender. This revision might be essential for a mortgage loan of $200,000 initially due on January 1st, 2024, requesting a new payment date of March 1st, 2024. Clear communication with lenders, like Bank of America or Wells Fargo, detailing the reason for the delay and outlining a feasible repayment plan conveys intention and responsibility. Including specific figures regarding previous payments made (e.g., $1,500 monthly) reinforces the borrower's commitment to fulfilling their financial obligations. Thus, addressing payment delays proactively can help maintain a positive relationship with lending institutions while navigating financial challenges.

Request for Waiver or Support

Delays in loan payments can occur due to various factors, such as unexpected financial hardships or health emergencies. Borrowers facing these challenges often reach out to lenders for assistance. A timely communication detailing the specific reasons for the delay, such as a job loss affecting monthly income or medical bills amounting to thousands of dollars, can be vital. Including concrete information, like a request for a temporary grace period or reduced payment plans, allows lenders to understand the situation better. Providing supporting documents, such as pay stubs or medical invoices, can strengthen the appeal, enhancing the chances of receiving a waiver or alternative support. Clear and respectful language is essential when addressing loan officers or customer service representatives in these situations.

Comments