Are you feeling overwhelmed by multiple debts? If so, you're not alone, and a debt consolidation loan might just be the solution you need to regain your financial footing. This type of loan allows you to combine all your existing debts into a single, manageable monthly payment, often at a lower interest rate. Curious to learn how a debt consolidation loan can simplify your life and improve your credit score? Read on!

Borrower's Personal Information

Borrowers seeking a debt consolidation loan often present important personal details essential for evaluating their eligibility and financial health. A standard profile includes full names, such as John Smith (example name for clarity), physical addresses (e.g., 123 Main Street, Springfield, IL 62701), contact numbers (e.g., (555) 123-4567), and email addresses (e.g., john.smith@email.com). Financial context requires credit scores, which typically range from 300 to 850, alongside annual incomes, like $50,000, demonstrating the borrower's ability to manage new loan repayments. Additional information may encompass outstanding debts, often aggregated into credit card balances (e.g., $10,000 total), student loans (e.g., $15,000 total), and personal loans (e.g., $5,000), providing a comprehensive picture of their financial obligations.

Loan Request Details

In a debt consolidation loan scenario, individuals seeking to merge multiple debts into a single, manageable payment often reach out to financial institutions. A typical request includes personal details such as full name, address, and contact information, along with a clear summary of existing debts, which may include credit cards, personal loans, and medical bills. The total amount of debt may exceed thousands of dollars, like an average of $30,000 among borrowers. Essential information also encompasses monthly income and employment details, providing lenders with a snapshot of repayment capability. Financial institutions consider various factors, including credit score, typically ranging from 300 to 850, and current interest rates associated with the debts, which can significantly aid in determining loan approval status and terms.

Financial Overview and Justification

Debt consolidation loans serve as a financial strategy to combine multiple debts into a single loan, simplifying repayment. A comprehensive financial overview is essential, highlighting total outstanding debts such as credit card balances (averaging over $6,000 per household in the United States), personal loans, and medical bills. Assessing monthly income, which may fluctuate due to job security or economic conditions, is critical in determining affordability. The justification for pursuing a debt consolidation loan often stems from high-interest rates typically associated with credit cards (averaging 15%-25%) compared to lower rates on personal loans, possibly below 10%. A successful consolidation plan can lead to lower monthly payments and reduced interest over time, resulting in significant savings and financial stability.

Repayment Plan and Commitment

Debt consolidation loans can simplify monthly payments by merging multiple debts into one manageable amount. Borrowers often benefit from lower interest rates, such as those between 5% to 15%, allowing for significant savings over time. Key players in this process include financial institutions like credit unions and banks, which offer tailored repayment plans to meet borrower needs. For instance, a $10,000 loan with a 7% interest rate might have a 5-year repayment term, resulting in fixed monthly payments around $198. Documentation, including credit scores and outstanding balances, is critical for assessing eligibility and determining the best loan options available. Commitment to a strict repayment schedule is essential for restoring financial health and improving credit ratings over time.

Contact Information for Follow-up

Debt consolidation loans serve as a financial solution that combines multiple debts into a single loan, typically with a lower interest rate. Borrowers often seek out this option to manage debts such as credit card balances, personal loans, or medical bills efficiently. Financial institutions, including banks and credit unions, usually require specific information to process these requests, including the borrower's credit score, income details, and existing debt amounts. The process may involve an evaluation of repayment capacity, which is crucial for determining loan terms. It's essential to provide accurate contact information, as lenders often follow up using methods like email or phone calls during the application process, affecting the speed and ease of obtaining the consolidation loan.

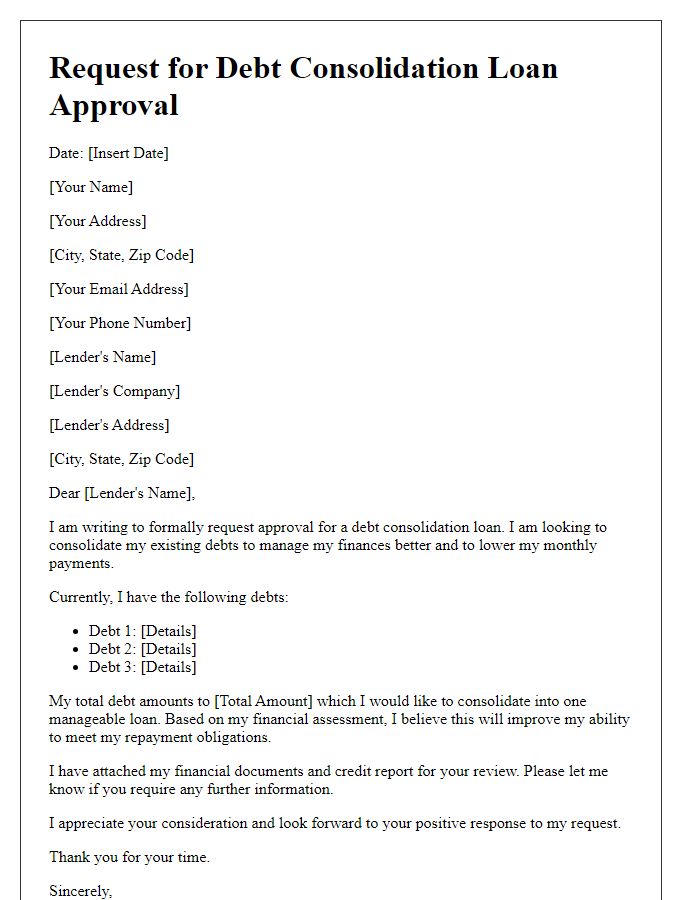

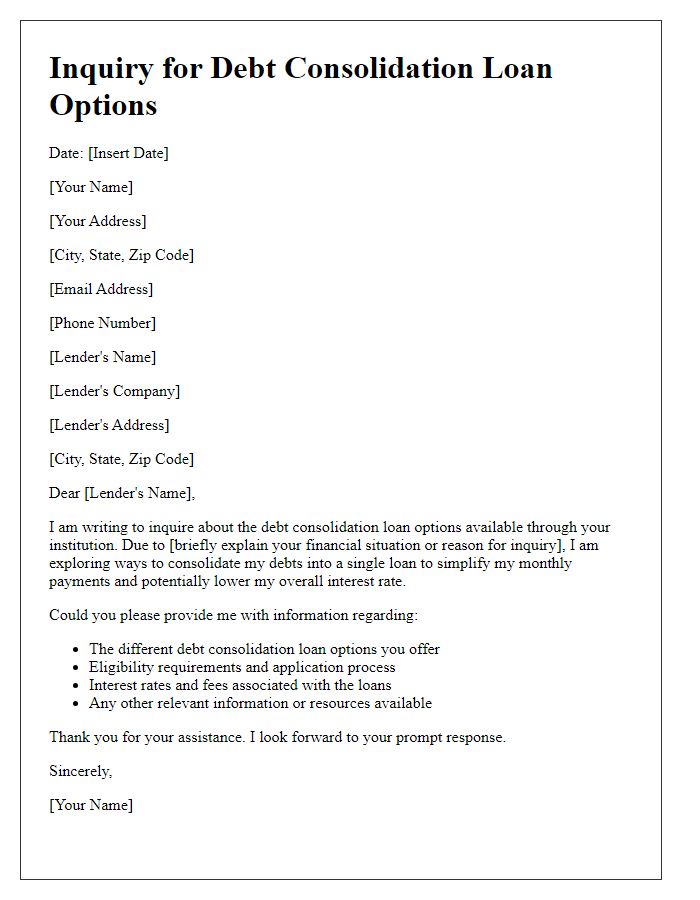

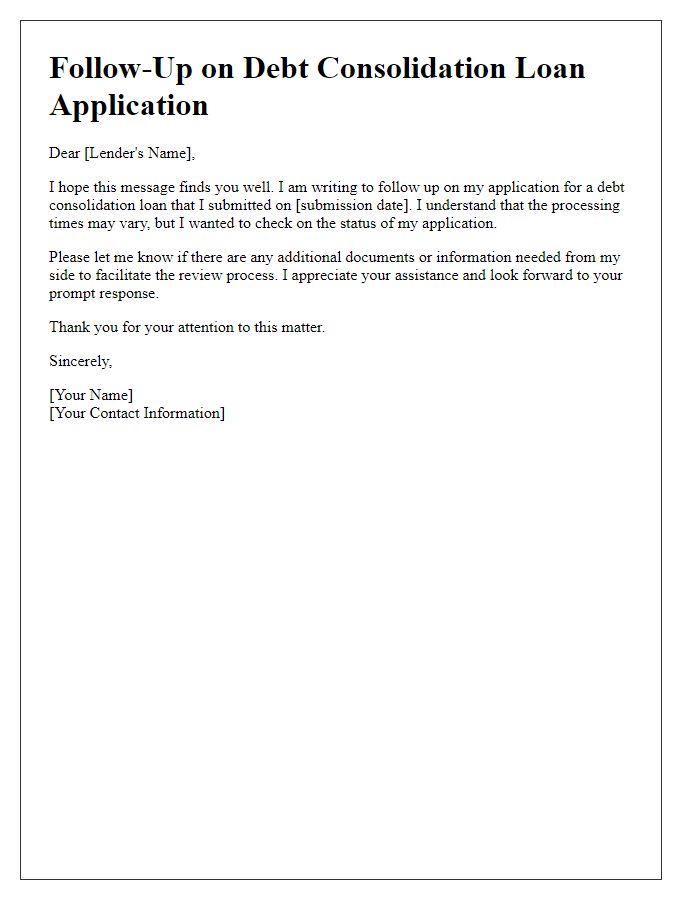

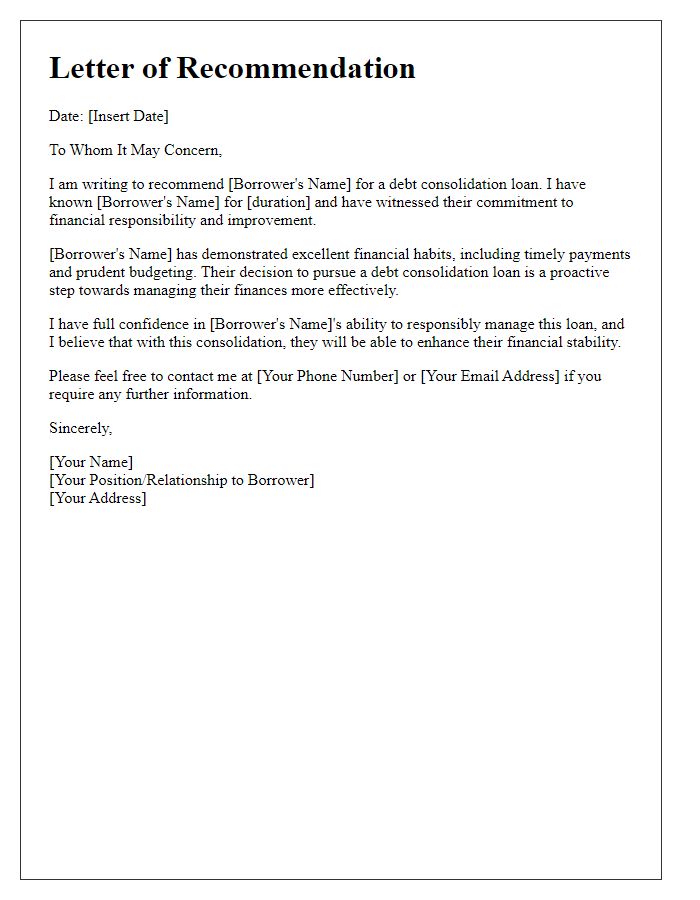

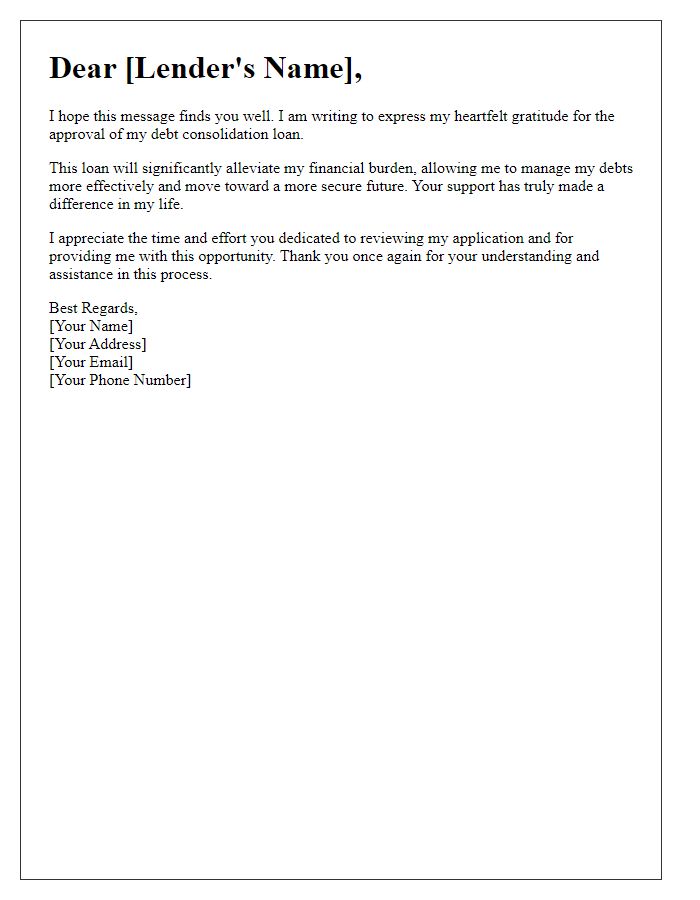

Letter Template For Debt Consolidation Loan Samples

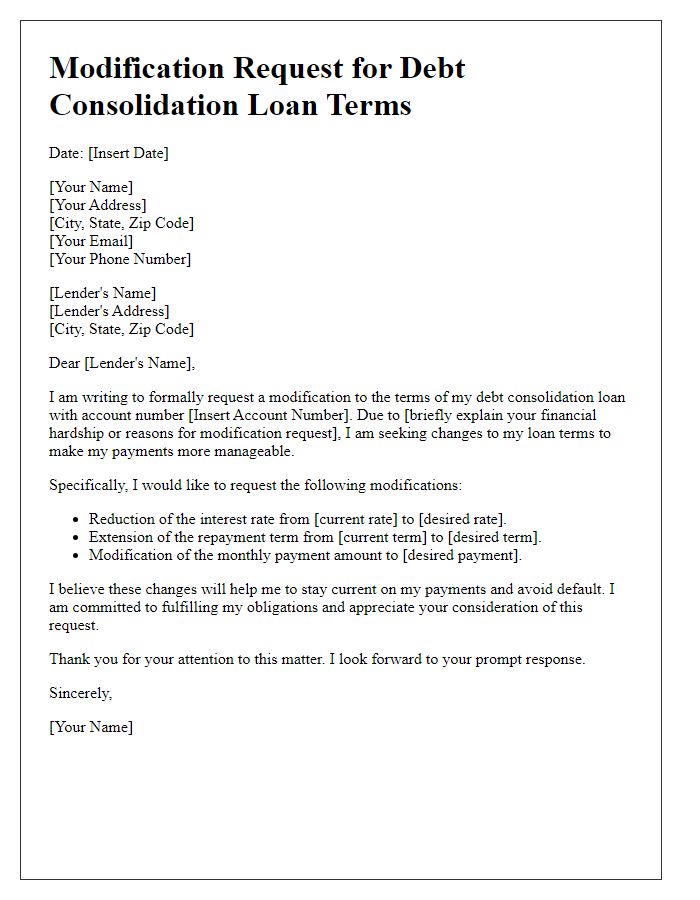

Letter template of modification request for debt consolidation loan terms

Comments