Are you considering taking out a seasonal loan to help with your financial needs during this busy time of year? Whether it's preparing for holiday expenses or managing cash flow for your business, a well-structured loan application can make all the difference. In this article, we'll guide you through a simple and effective letter template that can streamline your application process. So, let's dive in and explore how you can increase your chances of securing that seasonal loan!

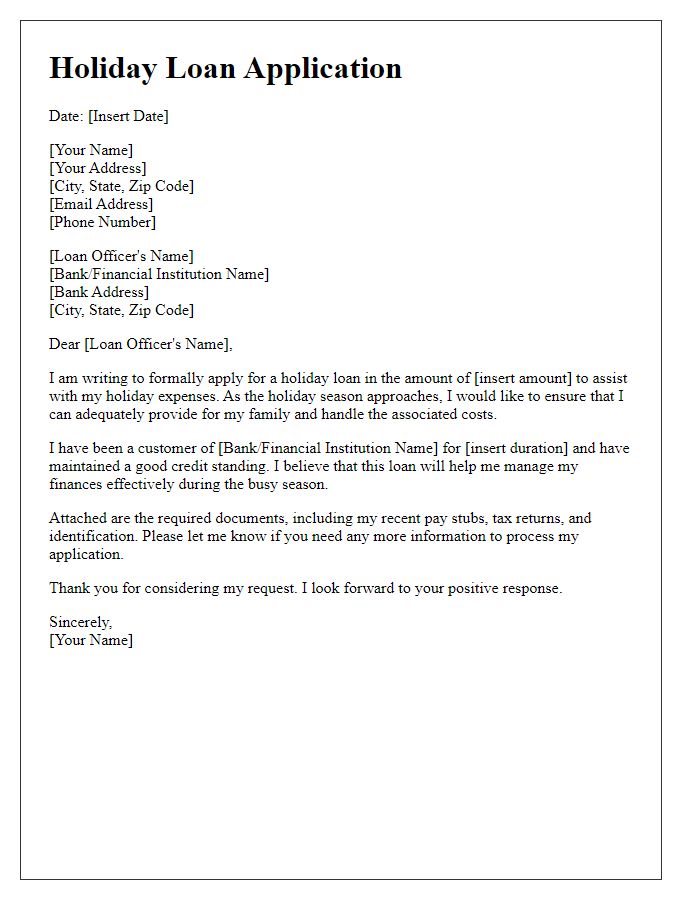

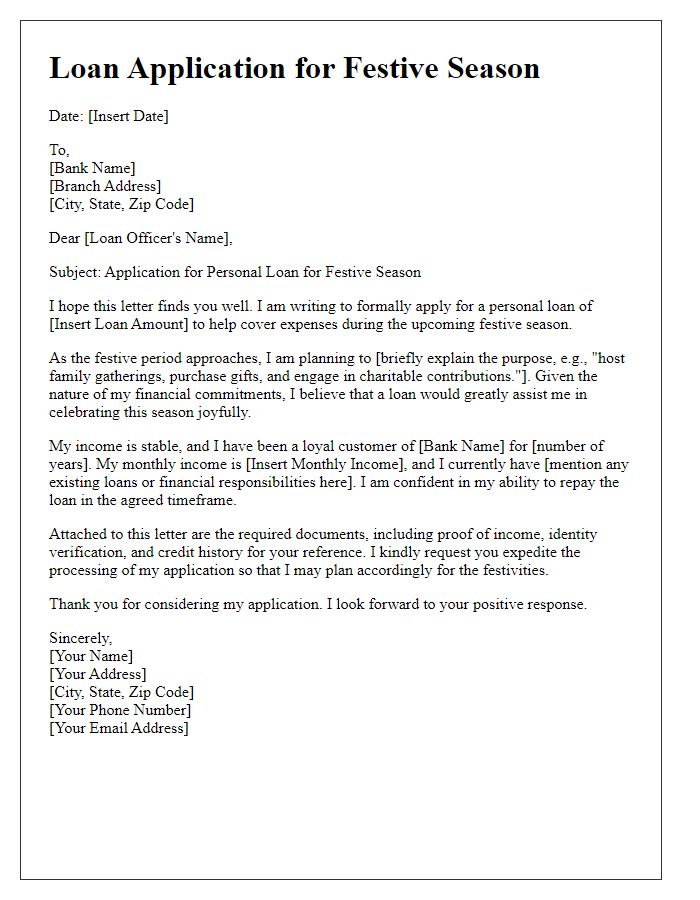

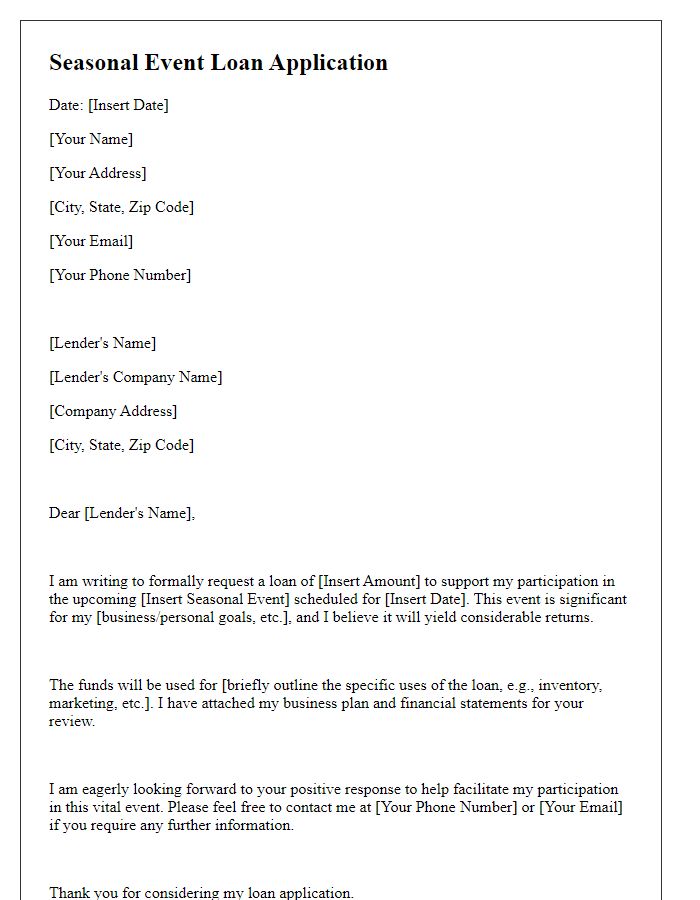

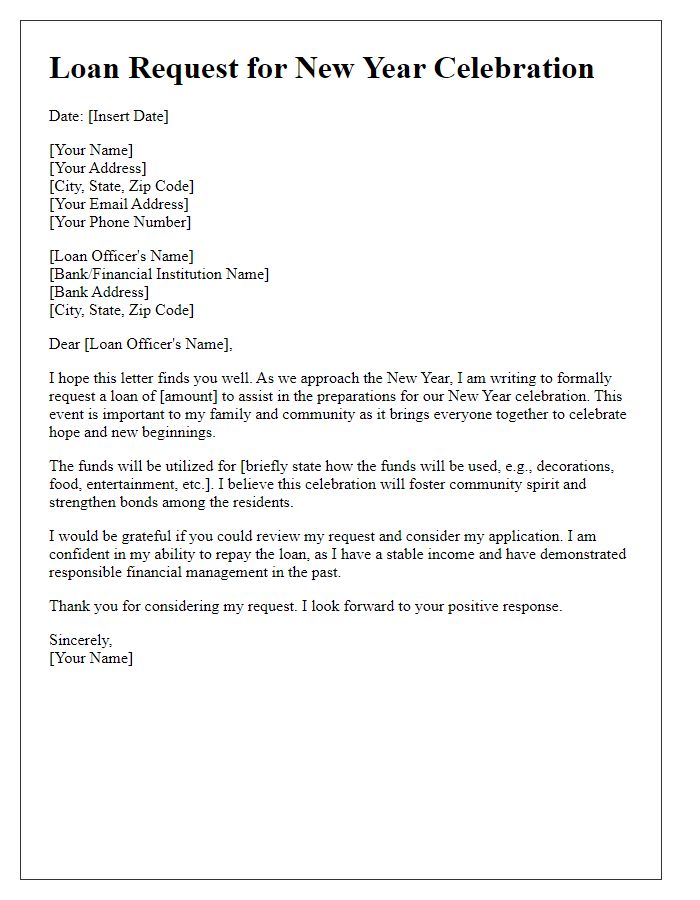

Greeting and loan officer's details

Seasonal loan applications often require specific attention to detail and clarity to ensure smooth processing. Lenders, such as banks or credit unions, request essential information to evaluate the borrower's financial situation. Key elements include the applicant's identification, loan amount, and purpose of the loan, commonly associated with seasonal business needs like holiday inventory purchases. Additionally, the loan officer's details, including name, title, and contact information, are crucial to establish a direct line of communication for follow-ups. Crafting a clear, concise introduction enhances professionalism and sets the tone for the application process.

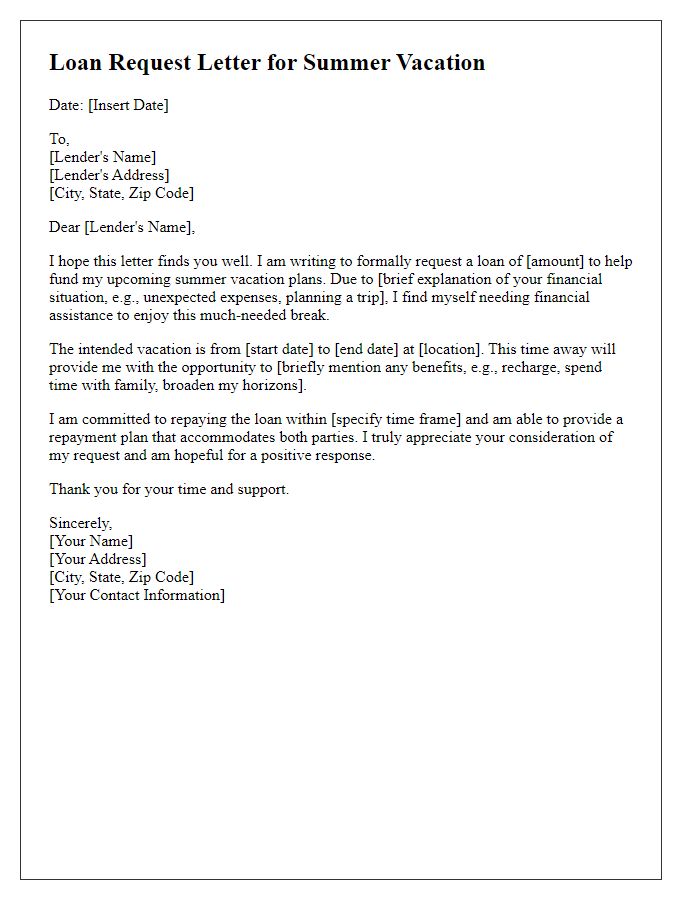

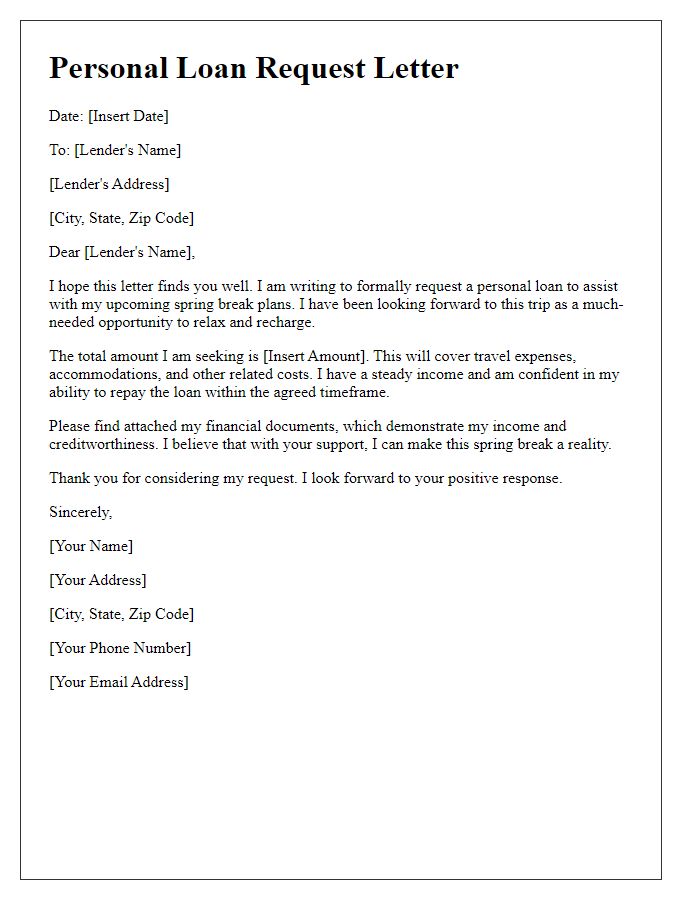

Purpose of the loan

Seasonal loans, often sought by agricultural businesses or retail companies, provide critical financial support during peak seasons, such as harvest time or holiday shopping periods. These loans are typically designed to cover operational costs, including purchasing inventory, hiring additional seasonal staff, or investing in marketing initiatives to boost sales. For example, farmers may apply for loans to buy seeds, fertilizers, and equipment before sowing crops, ensuring a fruitful yield in summer months while managing cash flow gaps. In retail, businesses may seek funds to stock up for Black Friday or Christmas sales to meet increased consumer demand. Seasonal loans are essential for maintaining liquidity and ensuring that businesses can operate efficiently during peak revenue-generating periods, thus contributing to overall economic stability.

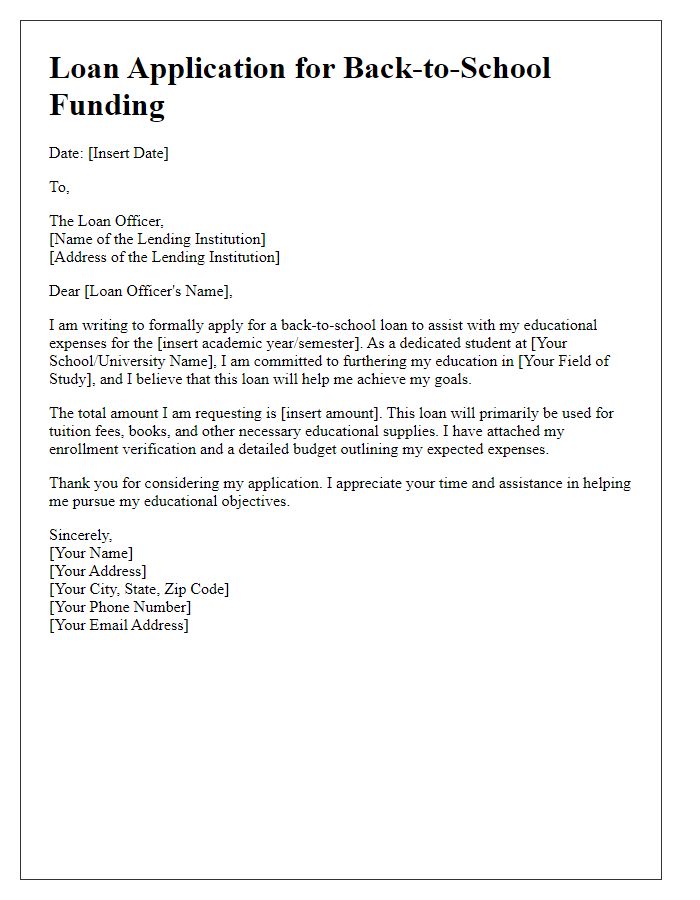

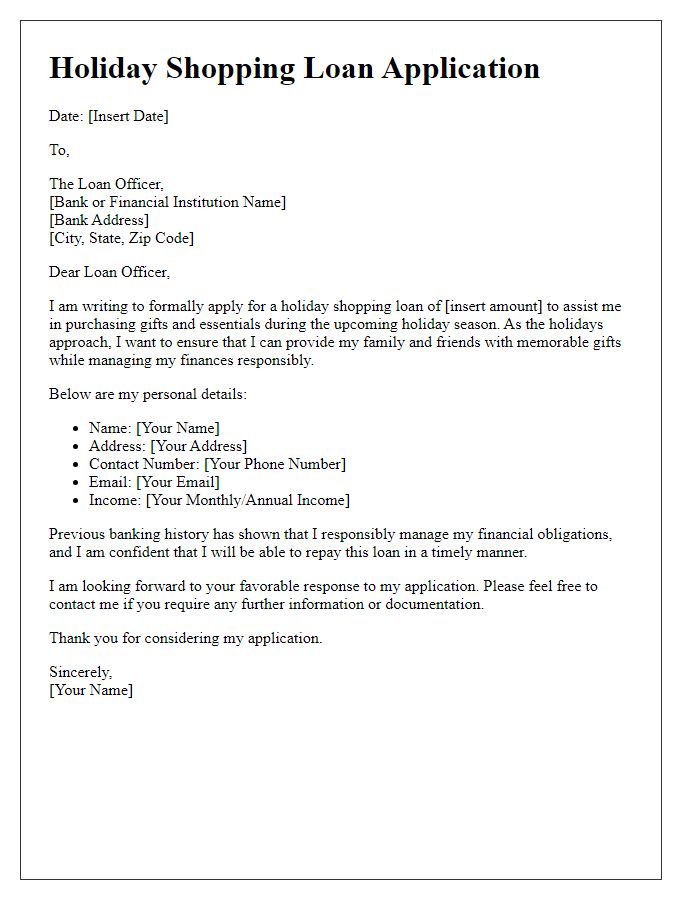

Amount and repayment plan

Seasonal loans, commonly utilized by small business owners, typically involve amounts ranging from $5,000 to $150,000, depending on the financial needs and the specific business cycle. A repayment plan often spans six months to two years, with options for monthly or bi-weekly payments to accommodate the cash flow variability associated with seasonal businesses. Borrowers might expect interest rates ranging from 7% to 12%, influenced by credit scores, loan amounts, and the lender's terms. Applications often require financial documentation, including profit and loss statements, tax returns, and projected cash flows, to substantiate the business's ability to repay the loan.

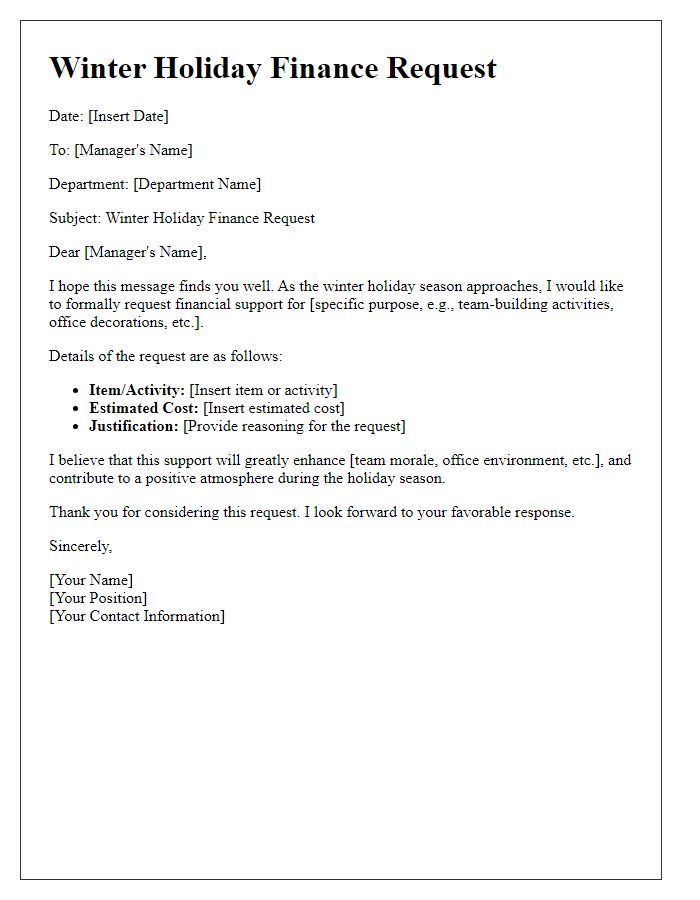

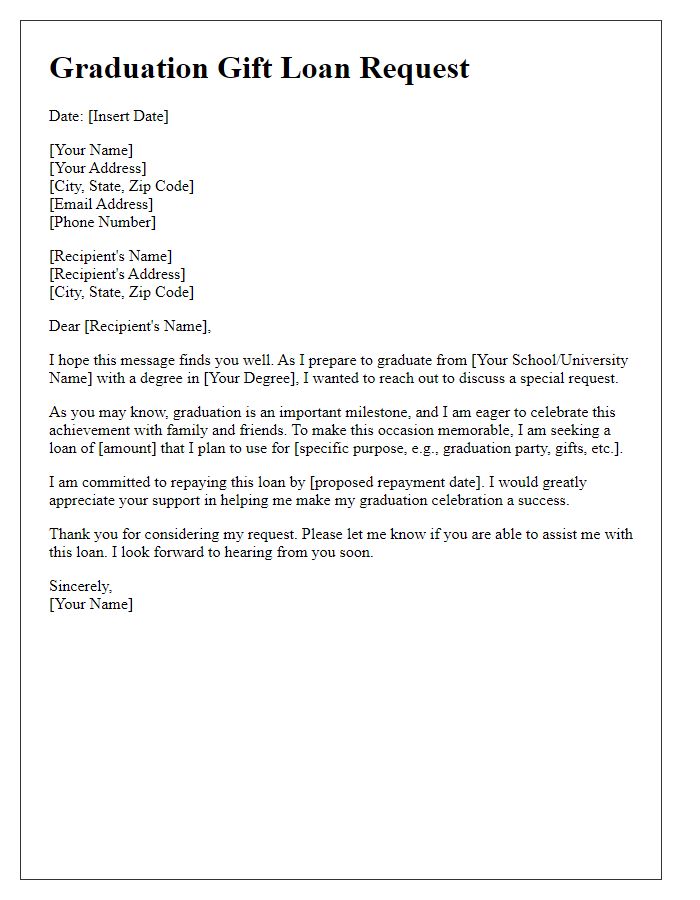

Financial stability and creditworthiness

Financial stability and creditworthiness play crucial roles in the evaluation of seasonal loan applications from individuals seeking temporary financial assistance. Assessing financial stability involves examining an applicant's income sources, such as salaries, bonuses, or seasonal employment earnings, particularly during peak periods like holiday seasons or harvest times. Creditworthiness is typically determined by credit scores, which range from 300 to 850, reflecting an individual's credit history, outstanding debts, and payment behaviors. Lenders also consider debt-to-income ratios, ideally below 36%, indicating the proportion of income dedicated to debt repayment. Documentation of assets, liabilities, and employment verification, often requiring recent pay stubs or tax returns, further confirm financial health. Specific lenders may also review historical borrowing patterns, ensuring previous loans were repaid responsibly, which fosters trust in their willingness to extend new credit lines.

Contact information and closing statement

Seasonal loans, often designed for businesses needing financial support during peak times, can offer flexible repayment options. Proper documentation is essential when applying for a seasonal loan, including accurate contact information such as the applicant's business name, address, phone number, and email address. A strong closing statement reiterates the purpose of the loan, emphasizing how the funds will assist in managing seasonal fluctuations, improving cash flow, or expanding operations during busy periods. Clear communication of intent and financial needs helps lenders evaluate the application effectively.

Comments