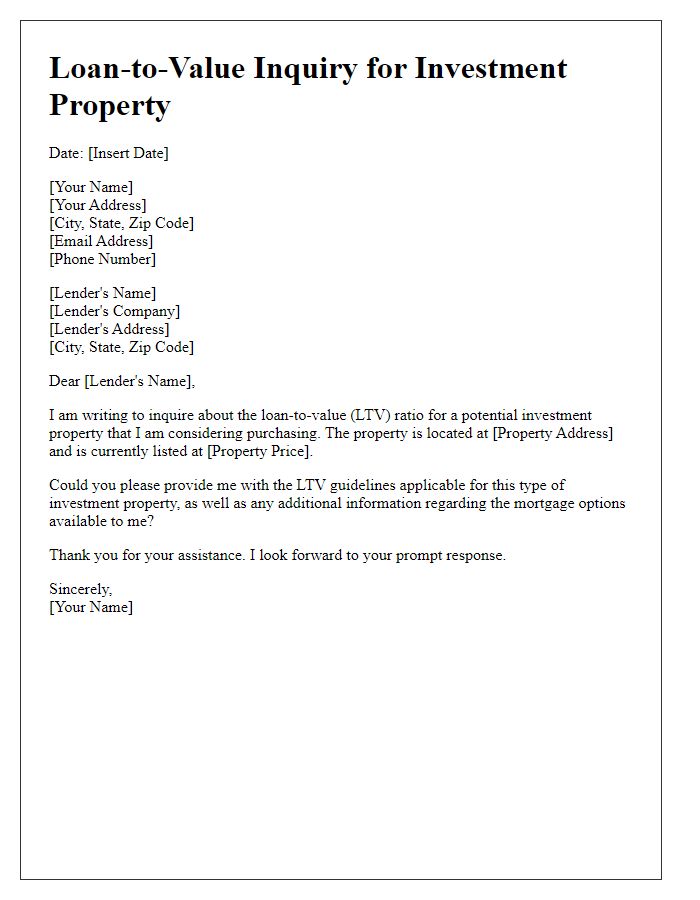

Are you curious about how to determine the loan-to-value (LTV) ratio for your property? Understanding this crucial calculation can greatly impact your financing options and help you make informed decisions. Whether you're a first-time homebuyer or looking to refinance, knowing how LTV works can empower you in your financial journey. Keep reading to discover helpful insights and practical steps for calculating LTV effectively!

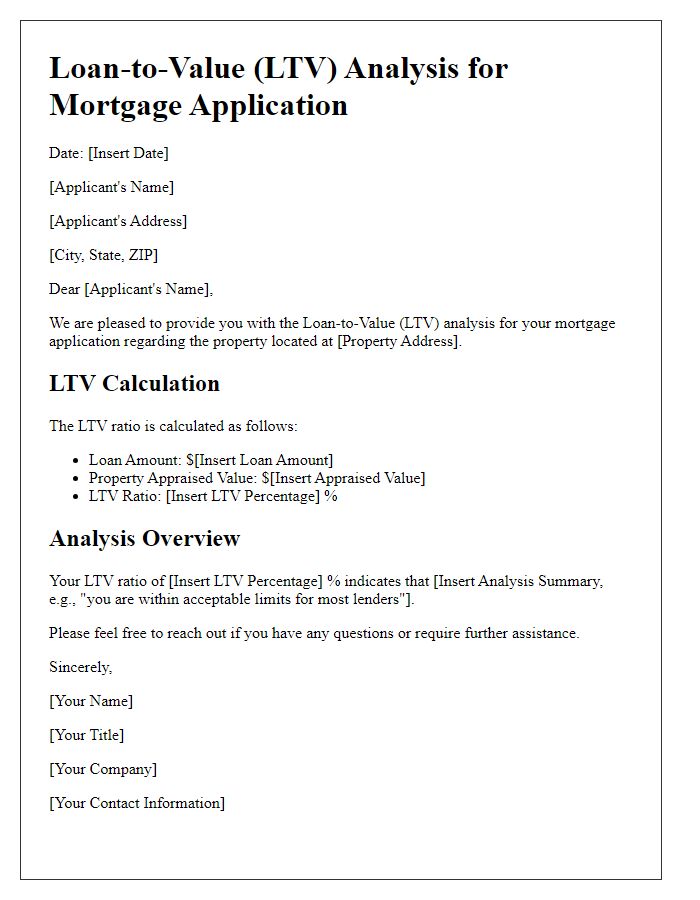

Loan Amount

The loan-to-value (LTV) ratio is a critical financial metric used by lenders to assess the risk associated with a loan. For a loan amount of $250,000, which may be typical for a residential property in metropolitan areas, the LTV ratio is calculated by dividing the loan amount by the appraised value of the property. For example, if the property is appraised at $350,000, the LTV would be approximately 71.43%. This ratio is essential as it impacts interest rates, mortgage insurance requirements, and the overall approval process. Higher LTV ratios, typically above 80%, indicate greater risk, potentially resulting in higher interest rates or the necessity of private mortgage insurance (PMI). Understanding this ratio is crucial for borrowers looking to secure favorable financing terms.

Property Appraisal Value

A property appraisal value plays a crucial role in loan-to-value (LTV) calculations, commonly used by mortgage lenders to assess borrowing risk. An accurate property appraisal, conducted by a certified appraiser, determines the current market value of the real estate, accounting for factors such as location, size, condition, and recent sales of comparable properties in neighborhoods like suburban Washington, D.C. Appraisals often range significantly, with values in urban areas typically surpassing those in rural settings. For instance, an apartment in downtown Chicago might appraise at $400,000 compared to a single-family home in a small town at $250,000. LTV ratio, derived from dividing the loan amount by the property appraisal value, influences terms like interest rates and required down payments. A higher LTV, often exceeding 80%, may necessitate private mortgage insurance (PMI), protecting lenders against potential defaults.

LTV Ratio Formula

The Loan-to-Value (LTV) ratio is a critical financial metric used in assessing the risk associated with a mortgage loan application. The LTV ratio formula is defined as the loan amount divided by the appraised value of the property, expressed as a percentage. For example, if a borrower seeks a $200,000 mortgage on a home valued at $250,000, the LTV ratio calculates to 80% (i.e., $200,000 / $250,000 = 0.80 or 80%). This ratio provides invaluable insight to lenders and influences interest rates, mortgage insurance requirements, and borrowing limits. High LTV ratios may indicate greater risk, while lower ratios often reflect a more secure investment for lenders. Understanding LTV ratios helps borrowers make informed decisions on loan eligibility and financial planning.

Borrower Information

Loan-to-value (LTV) ratio is a financial term used by lenders to assess risk when issuing a mortgage. The LTV is calculated by dividing the amount of the loan by the appraised value of the property. For example, if a borrower seeks a loan of $200,000 for a home valued at $250,000, the LTV ratio would be 80%. In this context, key references include the loan amount ($200,000), property value ($250,000), and LTV percentage (80%). Understanding this calculation is crucial for borrowers, as a higher LTV ratio may result in higher interest rates and the requirement for private mortgage insurance (PMI) in markets like the United States or Canada. Additionally, this calculation helps banks and financial institutions mitigate potential losses by ensuring that borrowers have adequate equity in their properties.

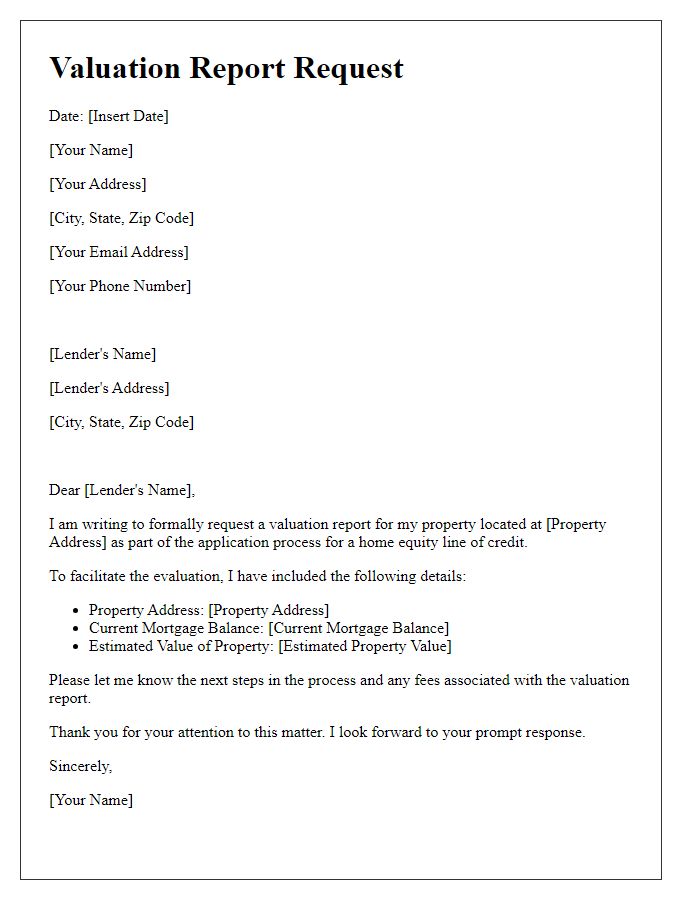

Lender Contact Details

Lender contact details are crucial for processing a loan-to-value calculation, which determines the loan amount relative to the property value. Essential components include the lender's name, typically a financial institution like Chase Bank or Wells Fargo, and physical address, often accompanied by a zip code for precise identification. Additionally, a contact phone number (ten digits), email address, and possibly a dedicated website URL are necessary for seamless communication. Including the lender's licensing information, such as an NMLS number, can enhance credibility and assist borrowers in verifying legitimacy. Accurate lender contact details ensure efficient processing of loan applications, essential for real estate transactions in bustling markets like New York City or Los Angeles.

Comments