Are you in a situation where you need to make a partial loan payment but aren't quite sure how to communicate that to your lender? Writing a letter can seem daunting, but it's a great way to clearly express your intentions and maintain a good relationship with your financial institution. In this article, we'll walk you through a simple template to help you draft your letter while ensuring it conveys your message effectively. So, let's dive in and explore how to make your partial loan payment request as smooth as possible!

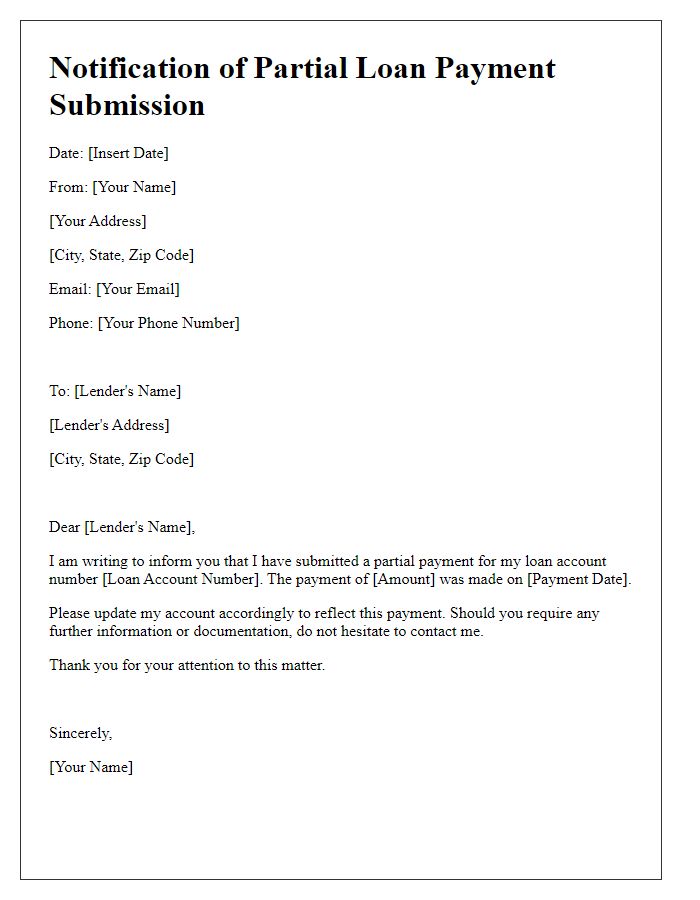

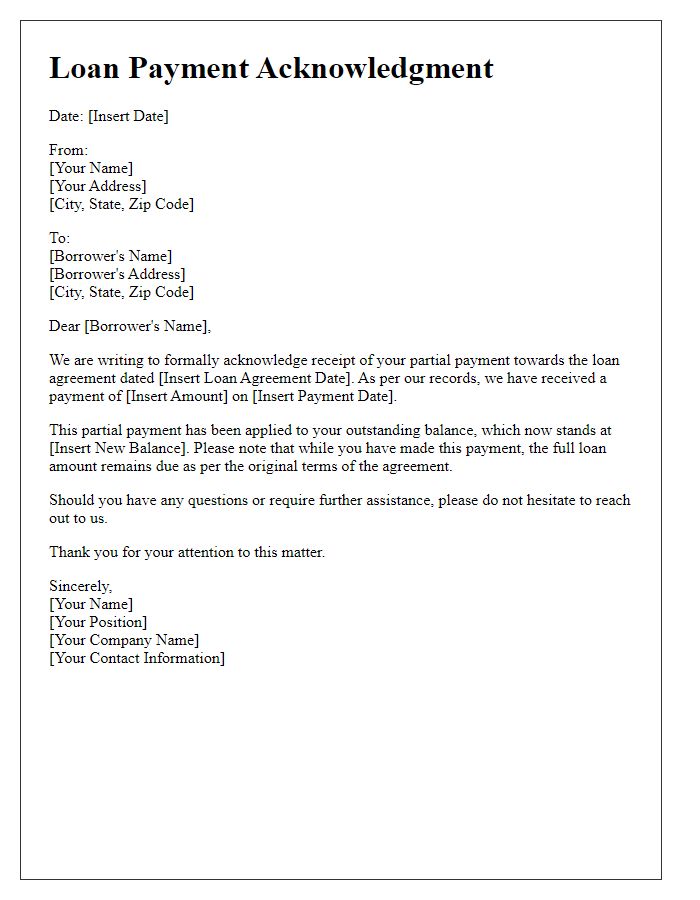

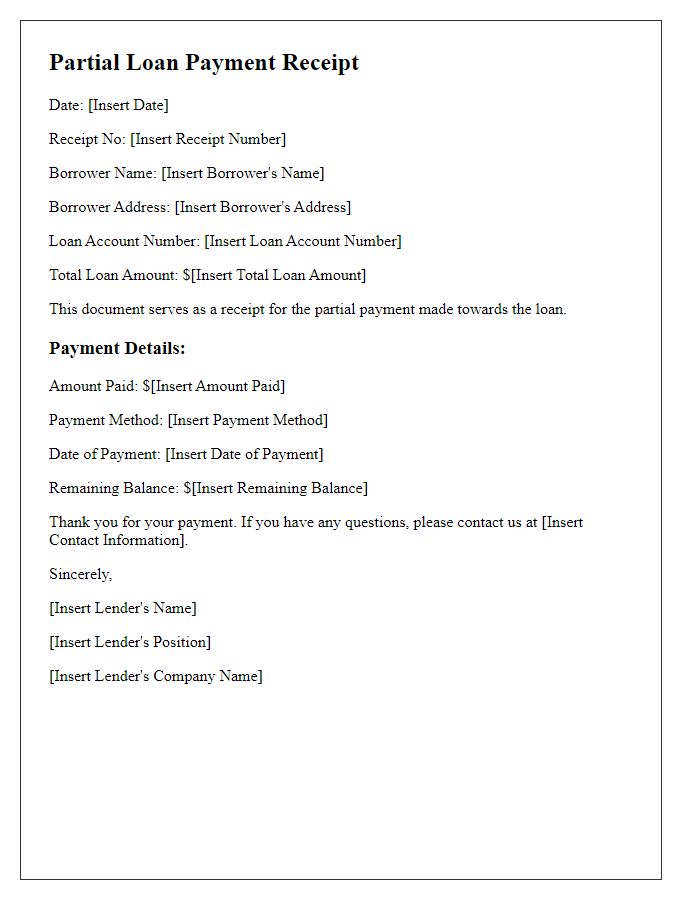

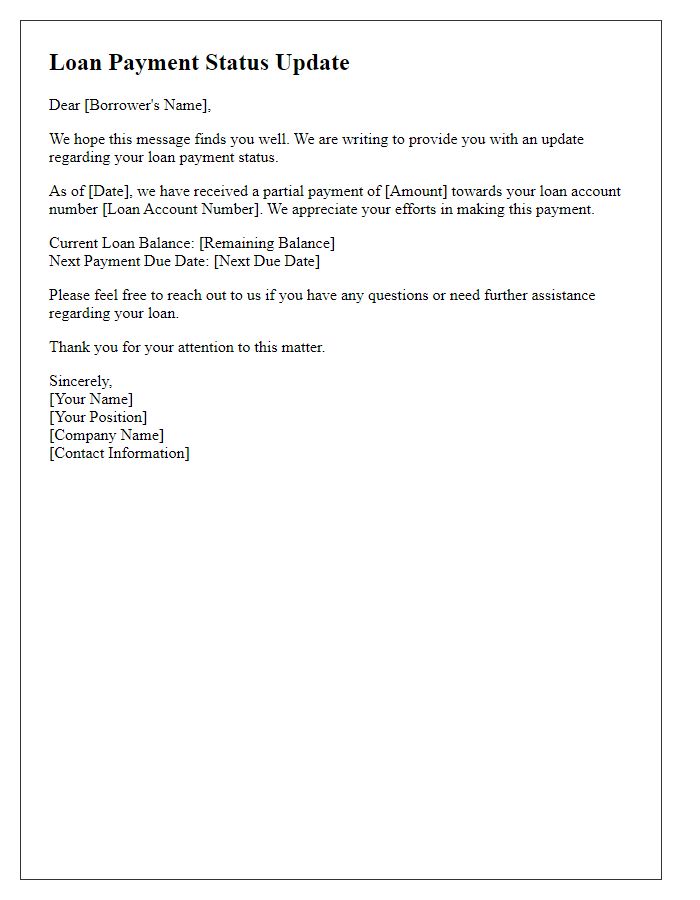

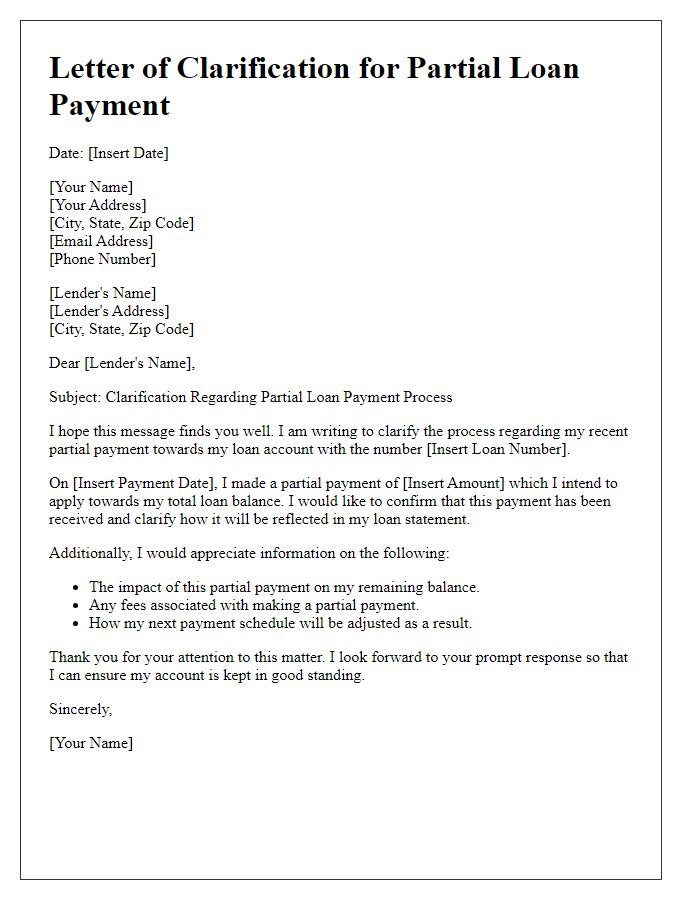

Payment Details: Amount paid, payment date, and remaining balance.

A partial loan payment, of $3,000, was executed on August 15, 2023, towards a home mortgage managed by Bank of America, with the original loan amount set at $250,000. Following this transaction, the remaining balance stands at $247,000, reflecting the commitment to reducing overall indebtedness. Such payments can positively impact interest accrued over time, potentially shortening the loan term and reducing total interest payments.

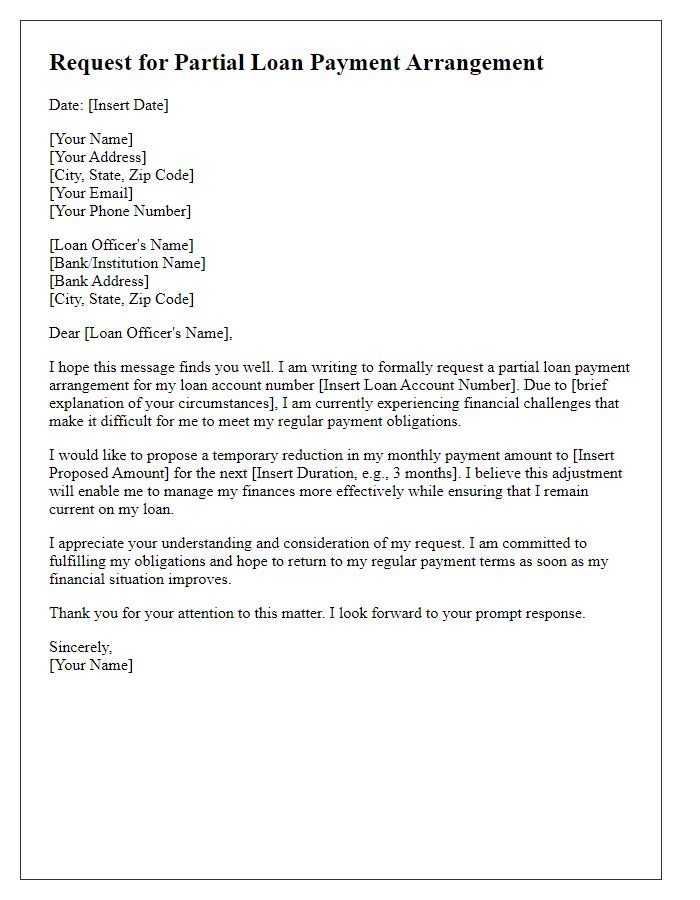

Loan Account Information: Loan number, borrower name, and loan type.

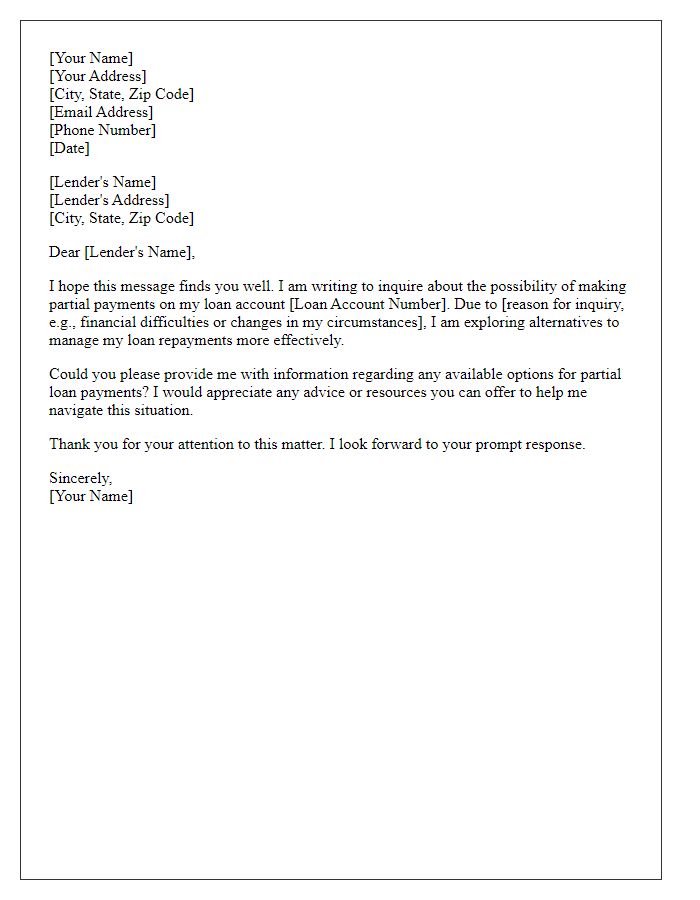

Partial loan payments can help manage outstanding debt effectively, particularly for personal loans or mortgages. A loan account, identified by a unique loan number, serves as an essential reference for tracking payments and balances. Borrower names must be clearly stated to avoid confusion, ensuring the payment is credited correctly. Common loan types include secured loans, such as home equity loans, or unsecured loans, like personal loans. Following prompt communication about changes in payment schedules or amounts can prevent penalties and maintain a positive relationship with lenders.

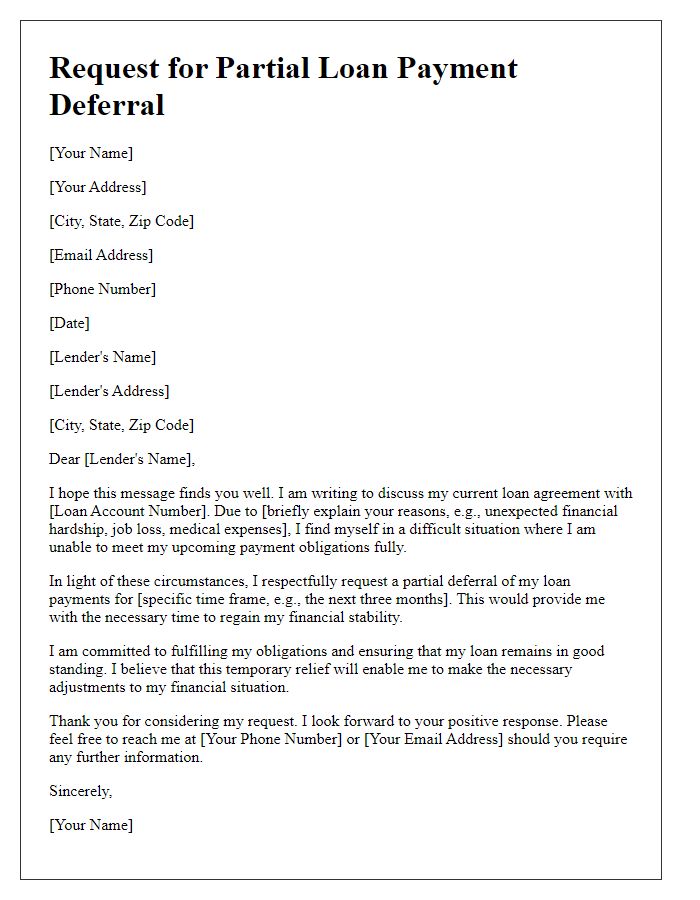

Reason for Partial Payment: Brief explanation for the partial payment.

Partial loan payments, often referred to as reduced payments, can be due to various financial circumstances. For example, a temporary job loss can result in a decreased income, leading to a partial payment instead of the full monthly obligation. Medical expenses may also arise unexpectedly, consuming disposable income and affecting conventional financial commitments. Personal financial strategies may dictate prioritizing essential expenses such as housing or groceries over debt payments, causing borrowers to opt for partial payments. Another reason might be the transition periods, such as awaiting a new job or re-financing a loan, which can briefly hinder the ability to meet full payment obligations.

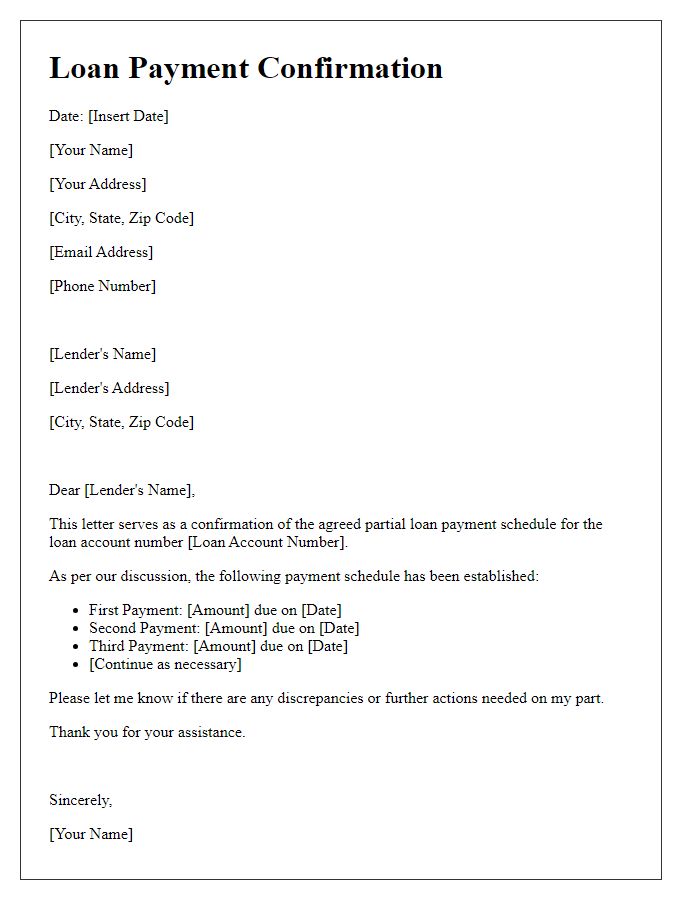

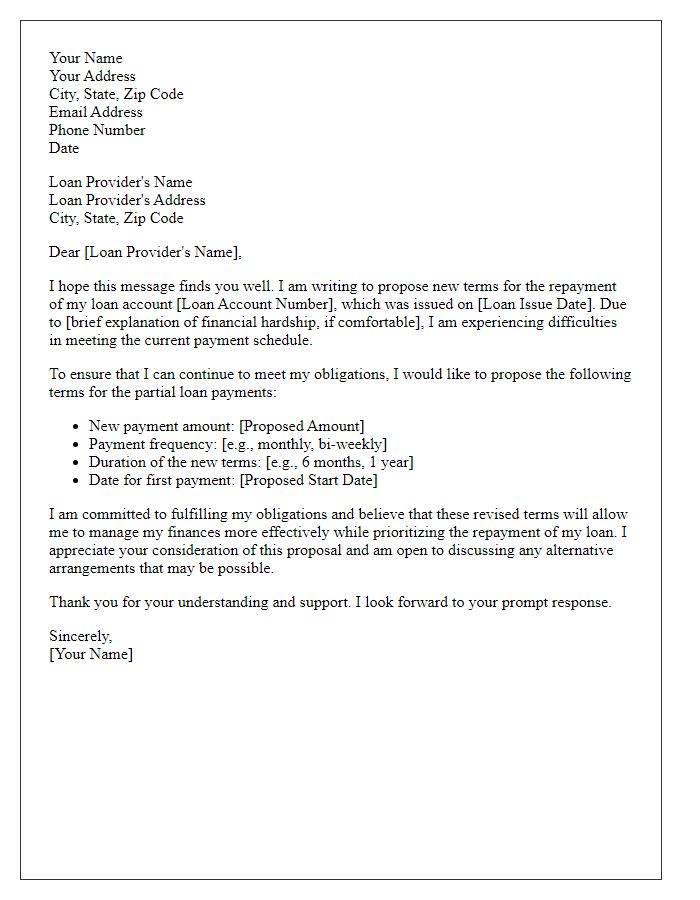

Future Payment Plan: Proposed schedule or plan for upcoming payments.

A partial loan payment plan requires a thoughtfully structured approach to ensure the borrower manages their finances effectively while meeting lender obligations. A proposed schedule may include significant dates, such as initiating the partial payments alongside key loan terms, specifying the amount (for instance, $500 monthly) until the full amount is settled. The plan can incorporate specific milestones such as reducing the remaining balance by 30% within six months or outlining specific deadlines like the next payment due on March 1st, 2024. Clarity on interest implications is crucial, highlighting how the interest rates (e.g., 5% per annum) will affect the total repayment amount over the course of the plan. Documentation should also include details such as communication channels with the lender, ensuring transparency and accountability throughout the repayment period.

Contact Information: Borrower's contact details for further communication.

Borrower's contact details, including the full name, phone number, and email address, are crucial for efficient communication regarding the loan account. Providing an accurate address ensures that any correspondence related to the loan, such as billing statements or payment confirmations, reaches the borrower promptly. Additionally, including the loan account number facilitates quick reference and processing, allowing the lender to track payment history accurately. Effective communication helps in discussing payment terms, addressing inquiries, or negotiating future payment arrangements.

Comments