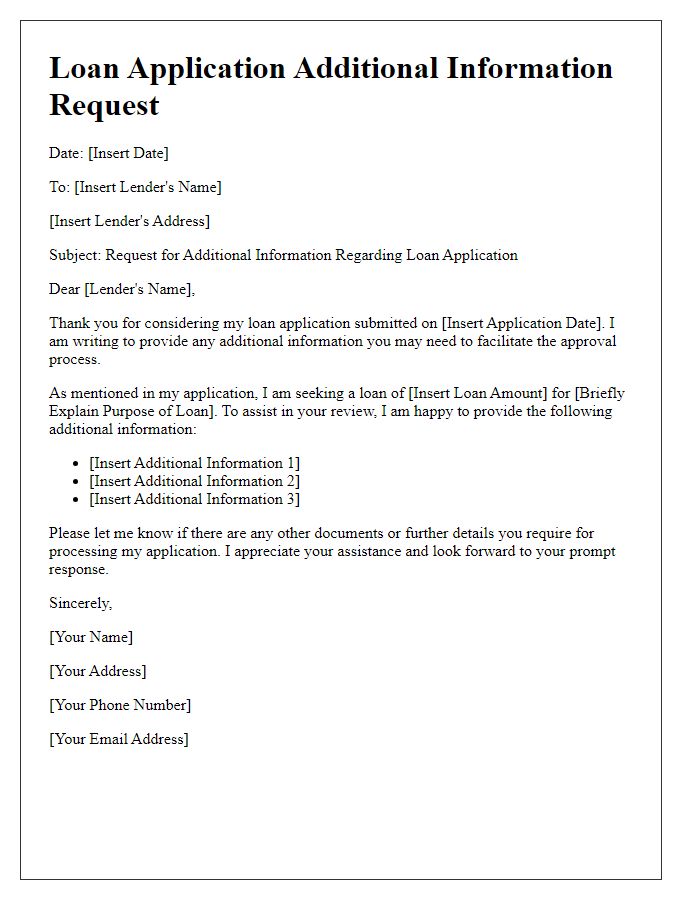

Are you in the process of applying for a loan and looking for the perfect way to convey your situation? Crafting a loan application verification letter can seem daunting, but it doesn't have to be! This letter serves as your opportunity to provide essential information to the lender, ensuring they have all they need to process your application smoothly. Curious about how to write a compelling letter that stands out? Read on for our detailed guide!

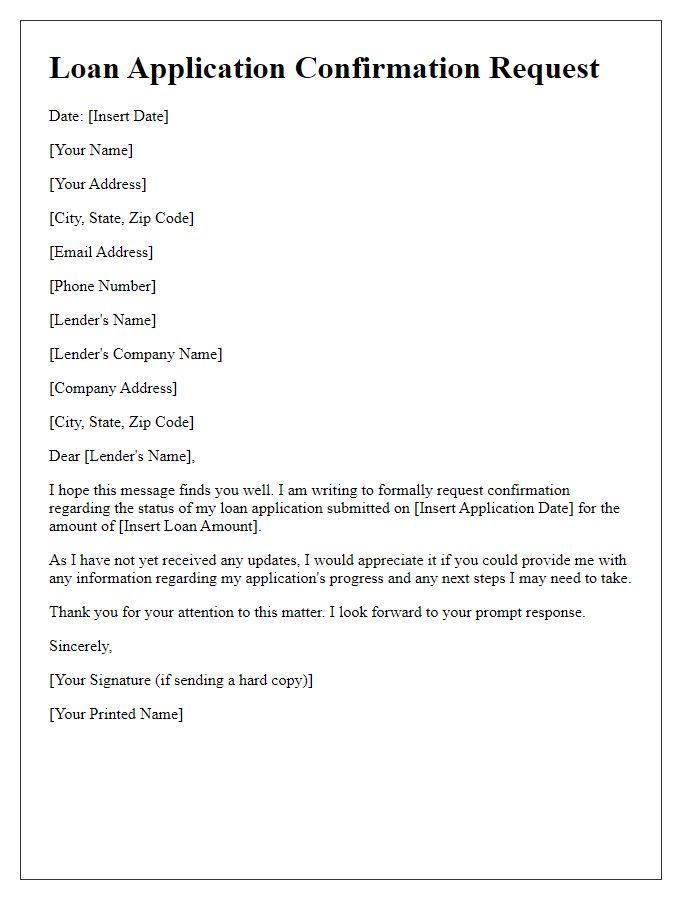

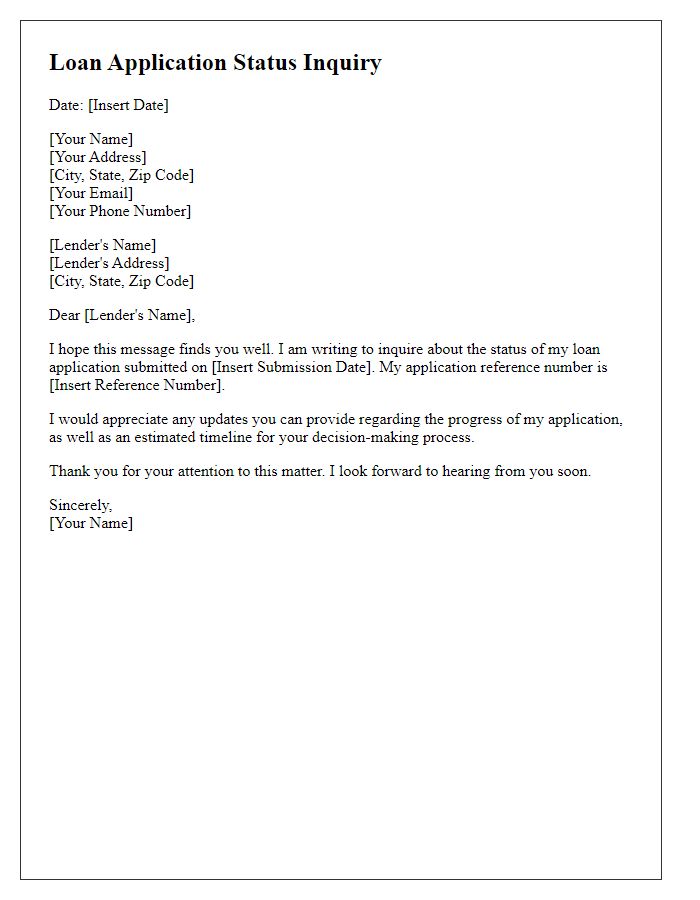

Applicant's Personal Information: Name, Address, Contact Details

Loan application verification involves confirming the credentials of applicants to ensure their eligibility for borrowed funds. Personal information like the applicant's name (including first, middle, last), address (with city, state, zip code), and contact details (phone number, email) plays a pivotal role in this process. Verification seeks to prevent fraudulent activities by cross-checking these details against official databases or credit records. Accurate information is crucial since discrepancies can delay processing times or lead to loan denial. Each key piece of information must align with government-issued identification for proper verification.

Loan Details: Loan Amount, Purpose, Terms

A loan application verification process typically involves assessing various factors associated with the loan details, including the loan amount, purpose, and terms. A commonly requested loan amount can range from $5,000 to $250,000, depending on the financial institution and the borrower's needs. Common purposes for loans include home renovations (with an average cost of renovations in the U.S. around $15,000), vehicle purchases, education expenses (average annual tuition for public colleges at approximately $10,000), or medical bills. Terms can vary, often extending from one to seven years, with interest rates typically fluctuating between 3% to 15%, influenced by factors such as credit score and current market conditions. Each aspect of the loan plays a crucial role in the lender's decision-making process regarding creditworthiness and repayment capacity.

Income Verification: Employment Status, Income Documents

Income verification is a critical step in the loan application process, providing financial institutions with assurance of an applicant's ability to repay. Employment status is confirmed through official documents, such as an employment verification letter from the employer. This letter typically includes crucial details like the applicant's job title, length of employment (often a minimum of six months), and salary information, which can range significantly based on industry standards. Additional income documents might include recent pay stubs (usually covering the last three months) and tax returns (Form 1040 for the previous year) to provide a comprehensive view of the applicant's financial stability. Accurate income verification ensures lending institutions in cities like New York or Los Angeles make informed decisions regarding loan approvals.

Credit History: Credit Score, Previous Loan Information

A comprehensive loan application verification involves examining crucial elements such as credit history, overall credit score, and previous loan details. A credit score, typically ranging from 300 to 850, serves as a numerical representation of an individual's creditworthiness, with scores above 700 often considered favorable for loan approvals. Analyzing previous loan information, including types of loans (such as personal loans, auto loans, or mortgages), payment history, and outstanding balances, provides insight into the applicant's financial behavior and reliability. Financial institutions use these data points to assess risk and determine eligibility for the requested loan amount. Additionally, they may consider defaults or late payments recorded in the applicant's credit report, impacting the overall assessment of loan approval potential.

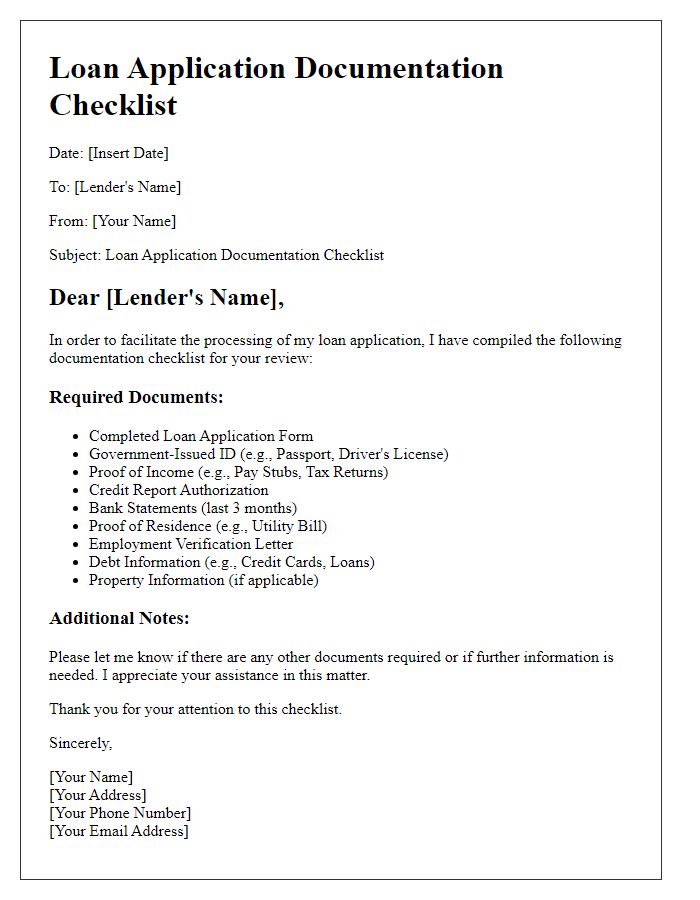

Supporting Documents: ID Proof, Address Proof, Bank Statements

Loan application verification requires a thorough review of supporting documents to confirm the applicant's identity and financial credibility. ID Proof, such as a government-issued photo identification (e.g., passport or driver's license), verifies the individual's identity. Address Proof (e.g., utility bills or lease agreements) provides confirmation of the applicant's residence, essential for assessing the stability of living circumstances. Additionally, recent Bank Statements (typically the last three months) illustrate the applicant's financial behavior, showcasing income patterns, expenditure habits, and overall financial health, crucial for responsible lending decisions.

Comments