Are you considering applying for a federal loan but feeling overwhelmed by the process? You're not alone; many people find it challenging to navigate the paperwork and requirements involved. This guide will walk you through a clear and efficient letter template tailored specifically for federal loan applications, ensuring you present all necessary information professionally. So, let's dive in and simplify your application journey togetherâread on to discover our comprehensive template!

Personal Identification Information

Personal identification information is critical in federal loan applications, ensuring accurate processing of applications. Key components include the full legal name (first name, middle initial, last name), Social Security number (a nine-digit number issued by the U.S. government), date of birth (format MM/DD/YYYY), and permanent address (specific street number and name, including city, state, and ZIP code). Additional details may include contact information such as a phone number (preferably a mobile number for quick communication) and email address (for electronic correspondence). Applicants must also provide their citizenship status, indicating whether they are U.S. citizens, permanent residents, or eligible noncitizens. Accurate and complete submission of this information is vital for loan eligibility and approval.

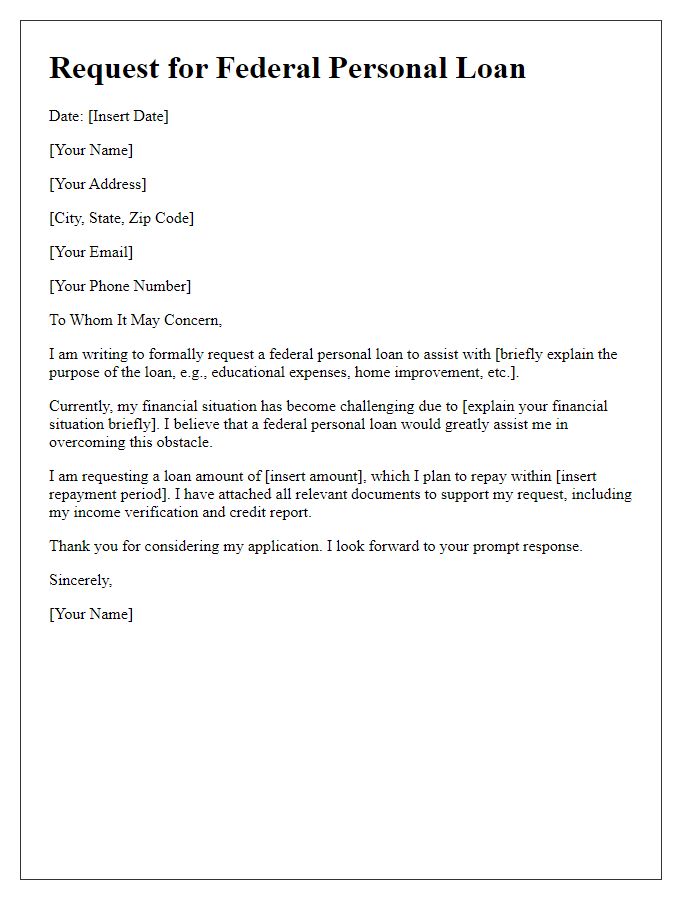

Loan Purpose and Justification

A federal loan application requires a clear articulation of the loan purpose and justification. An applicant may seek funding for educational expenses, such as tuition fees at accredited institutions, like State University, with a total cost of approximately $25,000 for a four-year program. Additionally, the applicant may outline living expenses, including rent for housing in urban areas averaging $1,200 per month, as well as necessary materials and supplies for coursework. Justification for this loan may include the potential for increased earning capacity upon graduation, highlighted by a projected salary increase from $30,000 to $50,000 annually, thus demonstrating the investment's importance in achieving long-term financial stability and career advancement in fields like engineering or healthcare.

Financial Status and Credit History

Financial status plays a crucial role in federal loan applications, impacting approval rates and loan terms. Applicants should provide detailed income information, including monthly earnings ($3,500 average for individuals in the U.S.), employment stability, and any additional sources, such as social security benefits or child support. Credit history, including credit scores (with scores above 700 considered good), credit cards, past loans, and any bankruptcy filings, influences lender perceptions significantly. A clean credit report demonstrates responsibility, while outstanding debts or late payments may indicate financial risk. Summarizing assets, liabilities, and savings accounts provides further context for overall financial health, which lenders in Washington D.C. or California particularly scrutinize during the evaluation process.

Requested Loan Amount and Terms

The requested loan amount of $35,000 (USD) aims to support the establishment of a small business in downtown Salt Lake City, Utah. The proposed terms include a repayment period of 10 years, with an interest rate of 4% (annual percentage rate) to ensure manageable monthly payments. This funding will facilitate the acquisition of essential equipment valued at $15,000, securing inventory, and covering operating expenses for the initial six months of business operations. Additionally, the financial request includes a contingency fund of $5,000 to address any unforeseen costs that may arise during the startup phase, ensuring a solid financial foundation for sustainable growth and development.

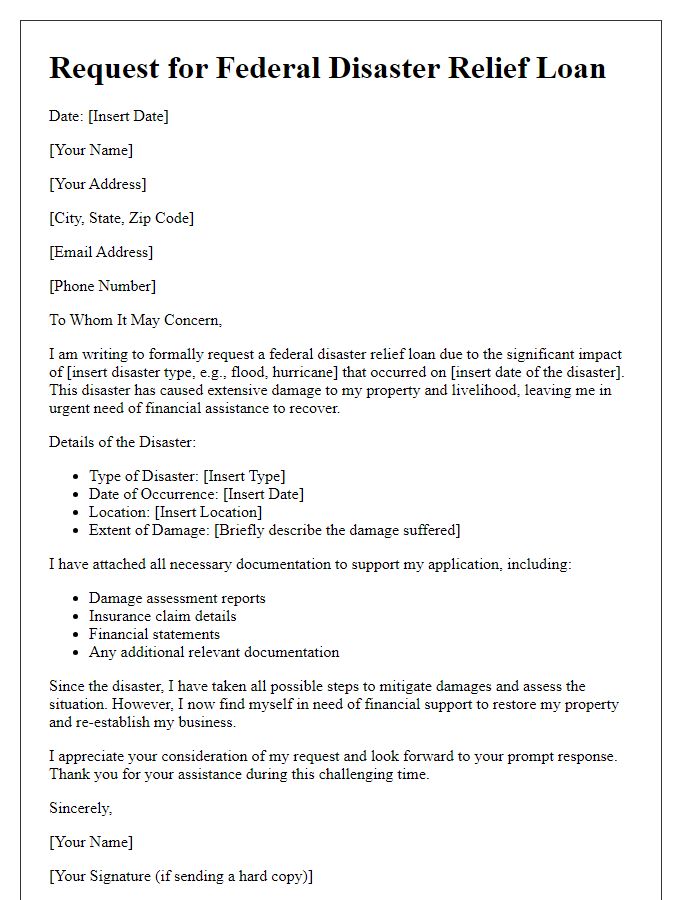

Acknowledgment of Terms and Regulations

Navigating federal loan applications requires a clear understanding of the terms and regulations outlined by the U.S. Department of Education. Applicants must acknowledge critical information, including repayment schedules, interest rates (typically ranging from 3.73% to 6.28% for federal student loans), and eligibility criteria, which vary based on the borrower's financial situation and academic enrollment status. Each loan type, such as Direct Subsidized Loans or Direct Unsubsidized Loans, comes with specific conditions related to deferment and forbearance options, impacting future repayment flexibility. Failure to adhere to these regulations can lead to consequences, including default, which affects credit ratings and financial opportunities. Understanding the total loan amount requested, anticipated disbursement dates, and the implications of the borrower's commitment is essential for informed decision-making in this financial process.

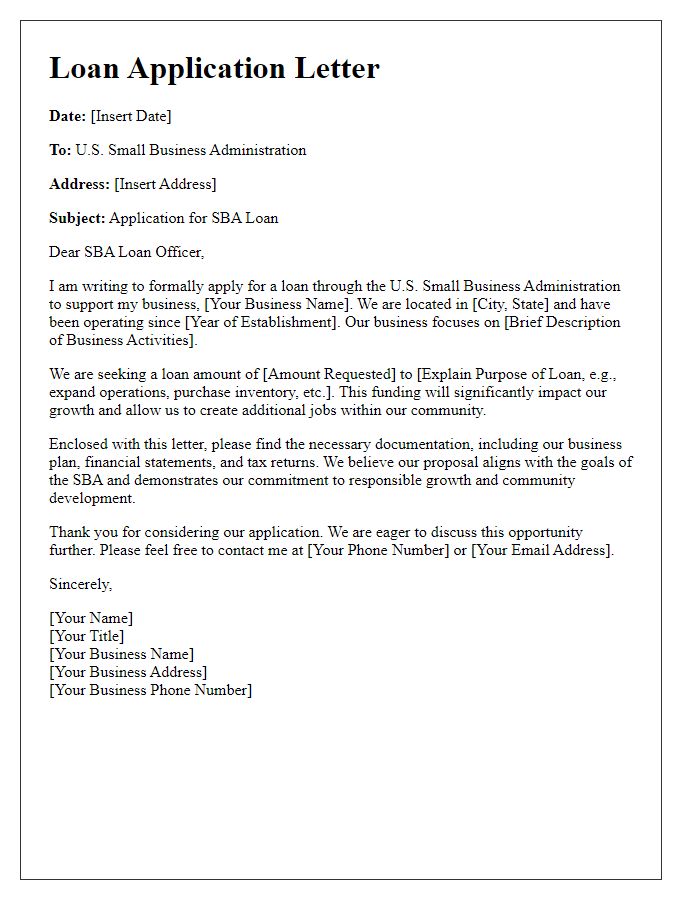

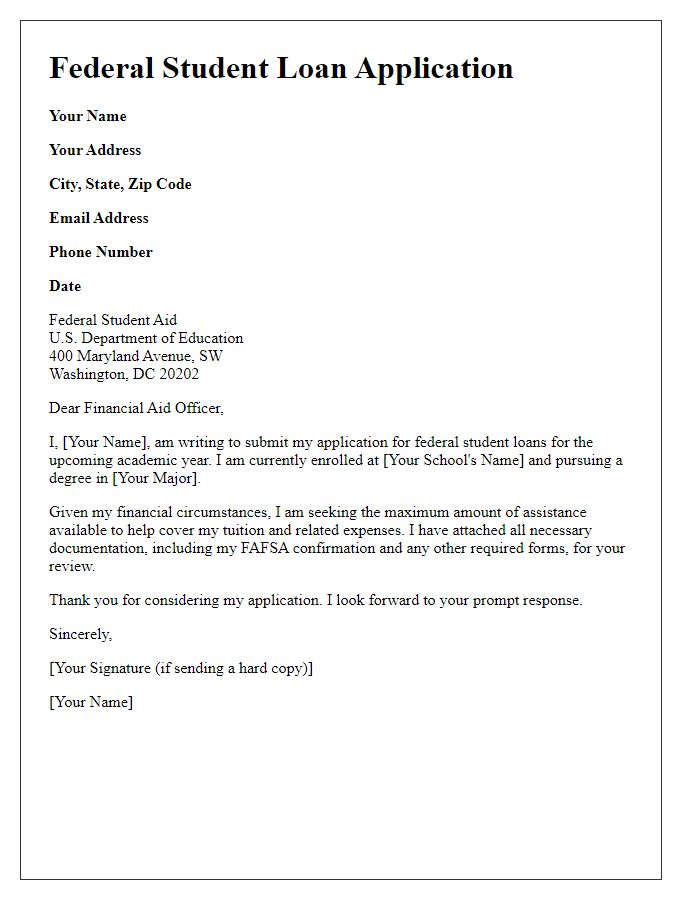

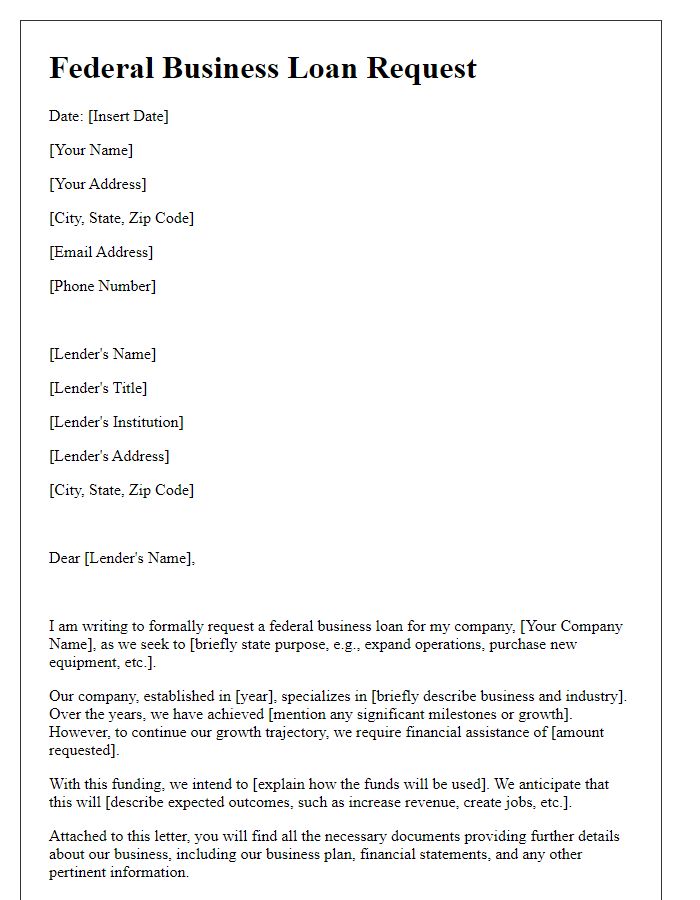

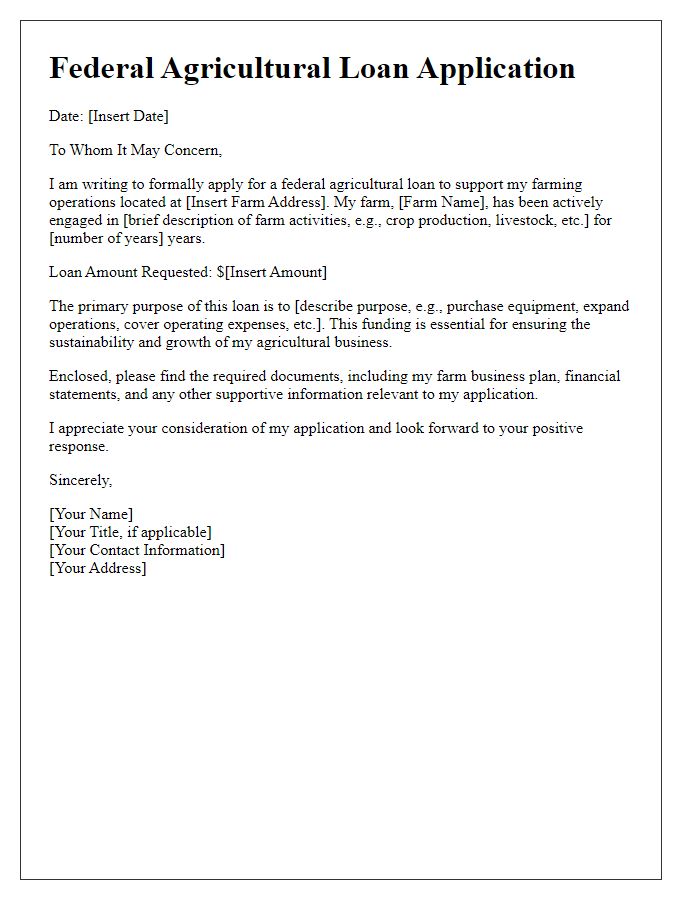

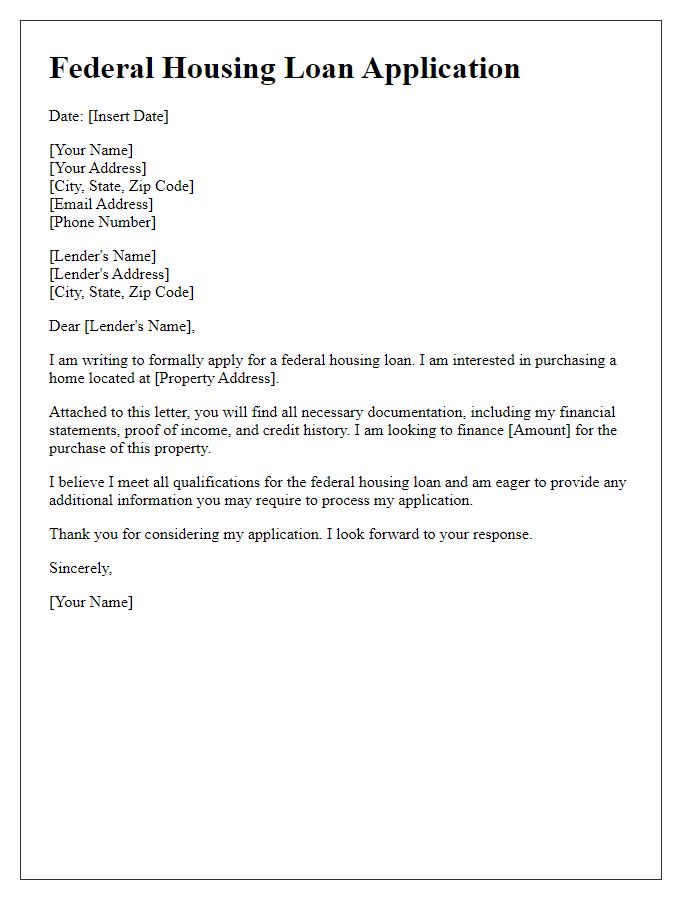

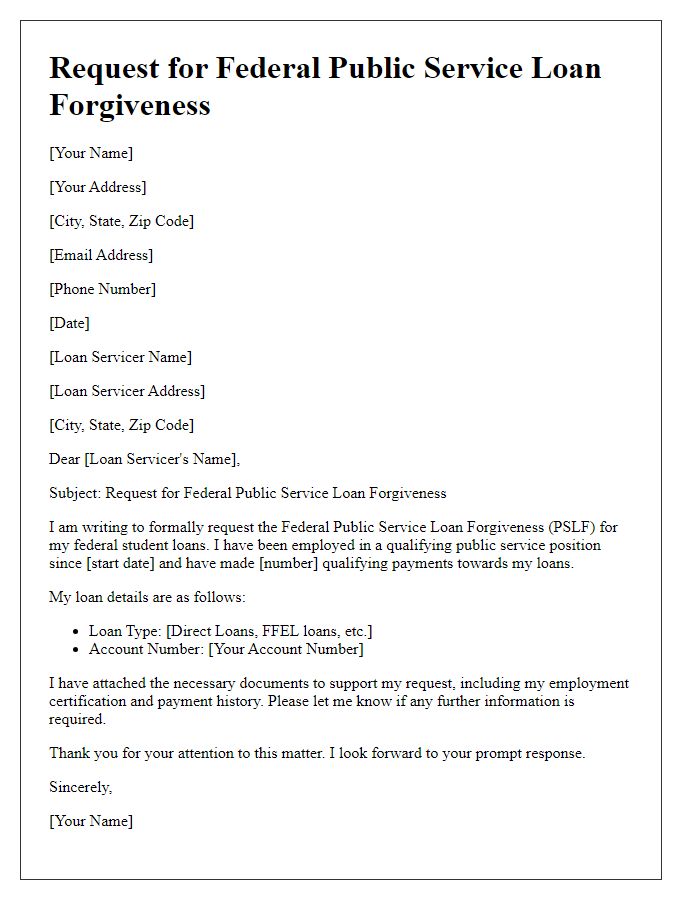

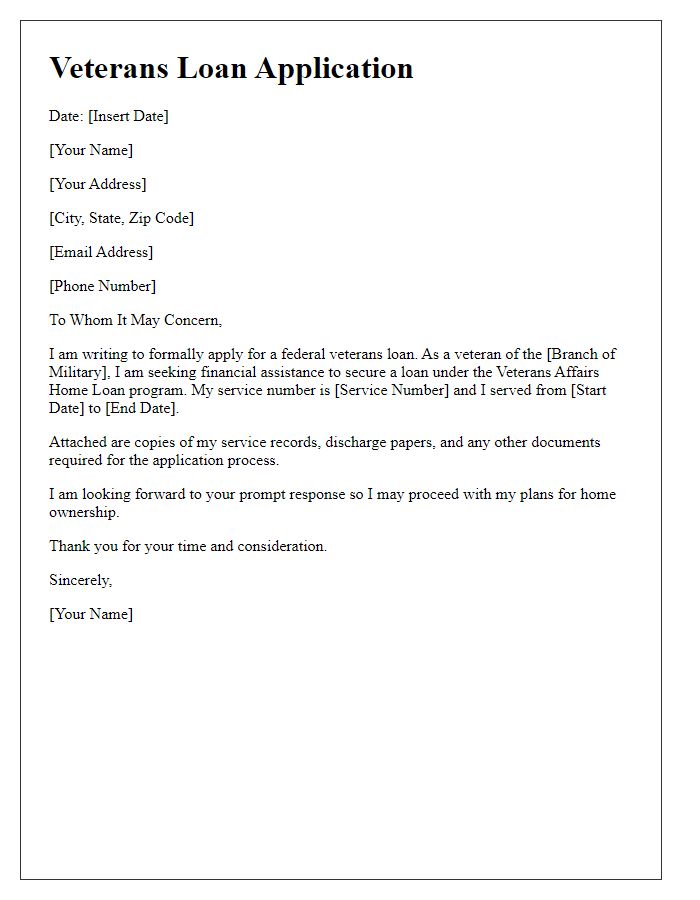

Letter Template For Federal Loan Application Samples

Letter template of federal small business administration loan application.

Comments