When considering a home equity loan, crafting the perfect letter can make all the difference. Whether you're looking to fund a renovation, consolidate debt, or cover an unexpected expense, a well-written request sets the tone for a positive response. It's essential to clearly articulate your needs and demonstrate your financial responsibility in this correspondence. Ready to learn how to create an impactful letter that captures your intention? Let's dive into the details!

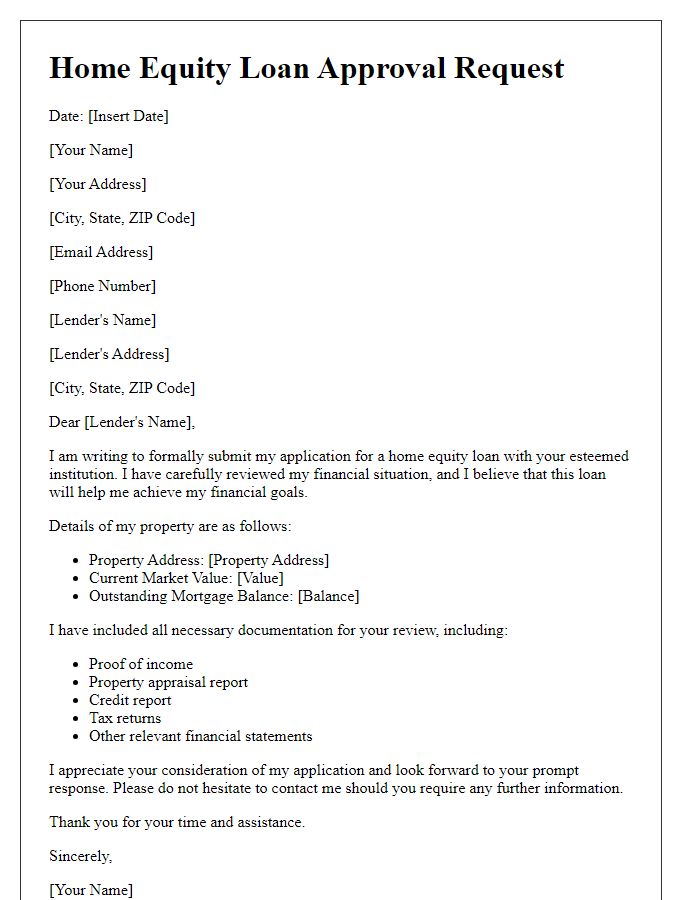

Personal Information

Home equity loan requests require specific personal information to assess eligibility and determine loan options. Borrowers typically start with their full name, such as John Doe, and current residential address, including city, state, and zip code (e.g., Springfield, IL, 62704). They must also provide contact details, including phone numbers (home and mobile) and email addresses for communication purposes. Financial details play a significant role; applicants need to disclose their Social Security numbers (like 123-45-6789) and annual income figures (e.g., $75,000) to evaluate their financial situation. Additionally, information regarding employment history, such as employer names and job titles, helps lenders assess job stability and repayment capability. Quality of credit, reflected in credit score ranges (300-850), also factors into the approval process for home equity loans.

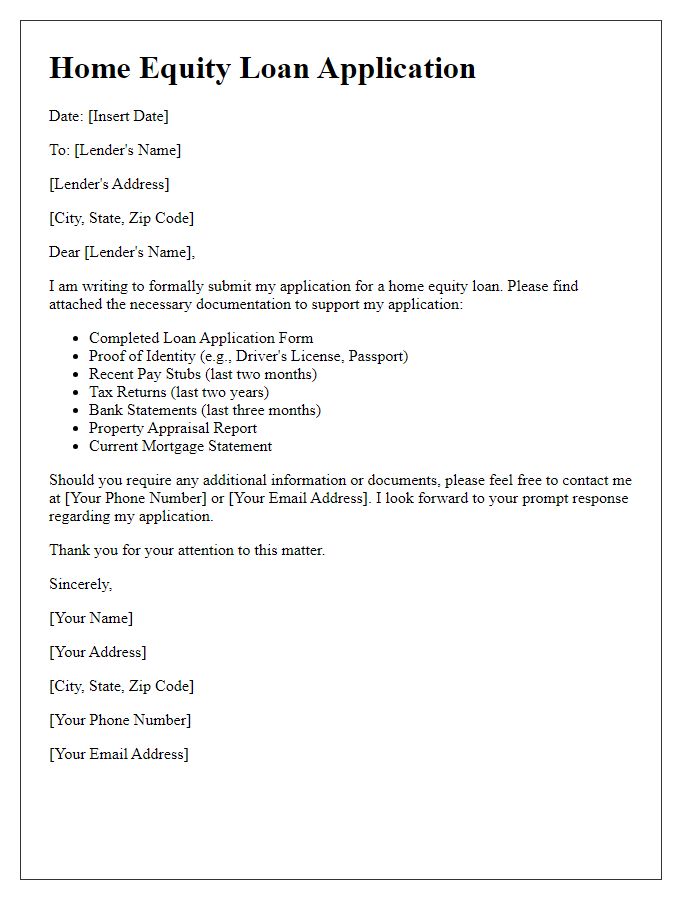

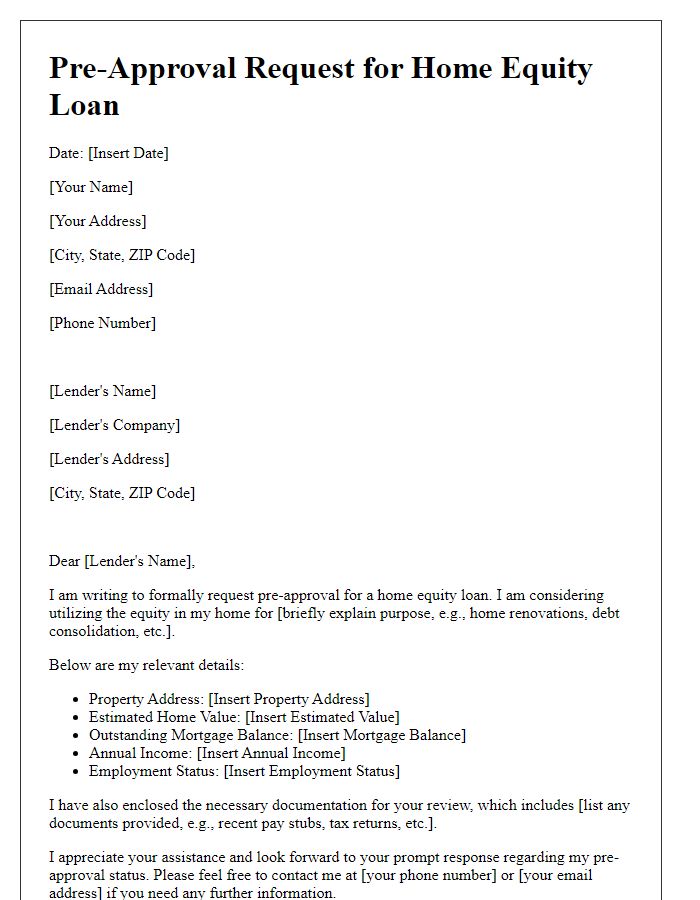

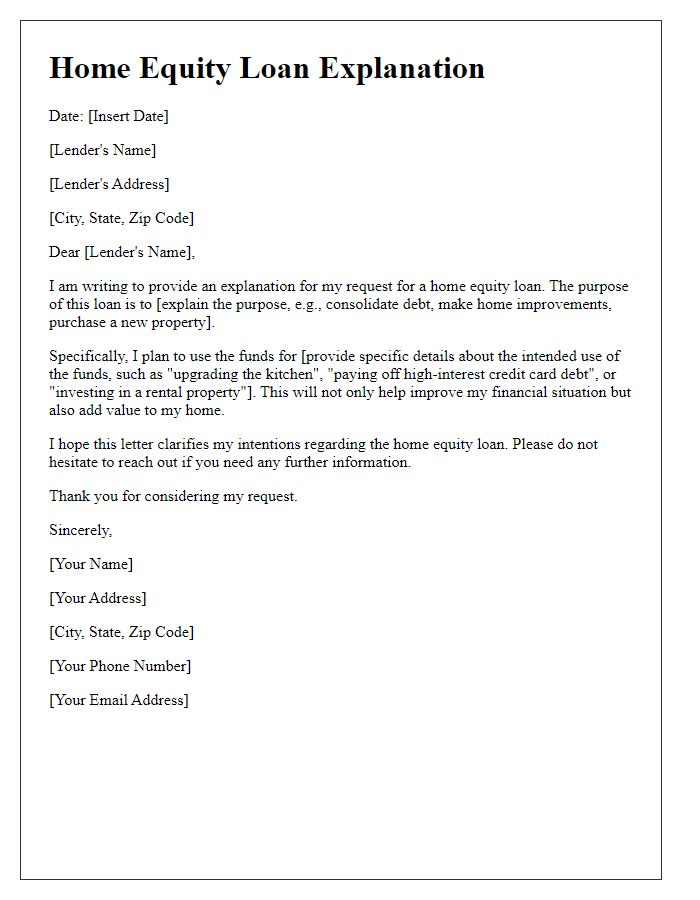

Loan Amount and Purpose

Home equity loans enable homeowners to access funds by leveraging their property's equity, which is the difference between the home's current market value and the outstanding mortgage balance. For instance, a homeowner with a property valued at $300,000 and an existing mortgage balance of $200,000 possesses $100,000 in equity. Many individuals utilize home equity loans for significant expenses, such as home renovations, debt consolidation, or funding education costs. The amount requested generally varies based on individual financial needs, often ranging from $10,000 to $100,000 or more, contingent upon the equity available and lender policies. Understanding the purpose behind this loan application is crucial, whether it's enhancing property value through renovations or managing existing debt responsibilities effectively.

Property Details

Home equity loans offer homeowners access to cash by leveraging the equity built in their property, often used for significant expenses like renovations or debt consolidation. Property details can include the address, such as 123 Maple Street, Cityville, ensuring accurate appraisal and assessment. The home value, as determined by recent market evaluations, can be crucial; for instance, an estimated market value of $300,000 allows for calculations on available equity. Current mortgage details, including principal amount of $150,000 and interest rate of 3.5%, play a vital role in determining the loan-to-value ratio. Additional information such as age of the property (built in 2005), square footage (1,800 sq. ft.), and neighborhood amenities further enrich the context, illustrating the property's appeal to potential lenders.

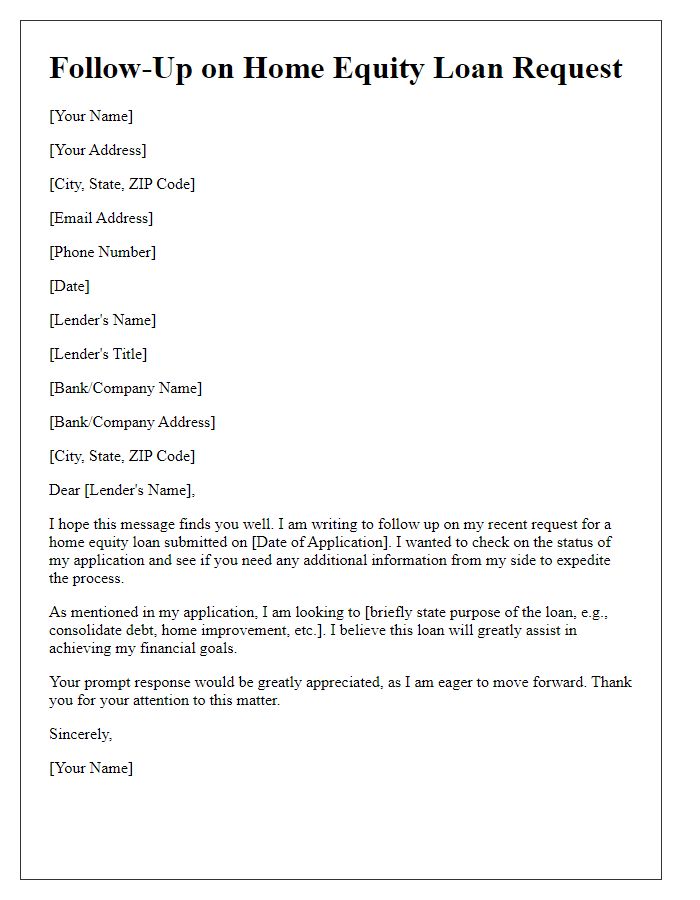

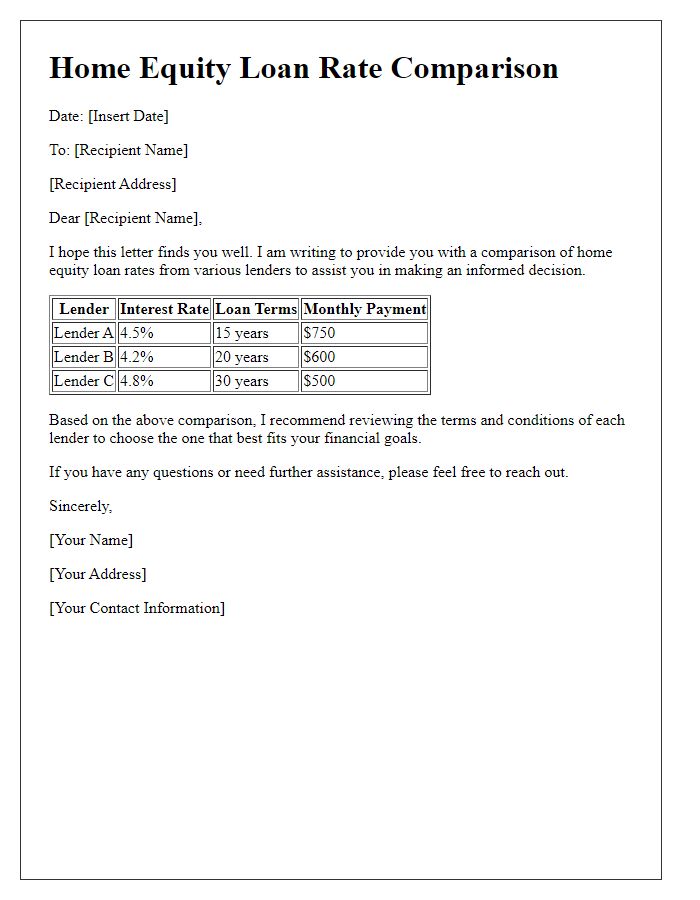

Financial Overview

A home equity loan provides homeowners the opportunity to leverage their property's value for financial needs, such as debt consolidation, renovations, or education expenses. Typically, lenders evaluate the property's current market value alongside the remaining mortgage balance to determine the loan amount. With the average U.S. home appreciating approximately 5% annually, tapping into this equity can yield substantial funds. Interest rates for home equity loans vary based on credit scores, often ranging from 3% to 7%, impacting monthly payments and total interest accrued over time. Borrowers should also note that defaulting on a home equity loan can result in foreclosure, jeopardizing their valuable asset and financial stability. Careful financial planning is essential for responsible borrowing and managing repayment.

Contact Information

A home equity loan request typically includes essential details such as the applicant's name, address, phone number, and email. The property address is crucial, as it identifies the collateral. Financial information, including the loan amount requested, current mortgage balance, and estimated home value, is vital for lenders to assess equity. Applicants may also provide details about their employment and income, often necessary for evaluating eligibility. Including any additional context, such as the purpose of the loan--like home renovations, debt consolidation, or educational expenses--can strengthen the request's purpose.

Comments