Are you looking to gain clarity on your loan balance? Understanding your financial commitments can be a daunting task, but it doesn't have to be. A well-structured letter for loan balance confirmation not only streamlines communication with your lender but also gives you a clear picture of your current situation. Ready to simplify your financial journey? Let's dive into the details!

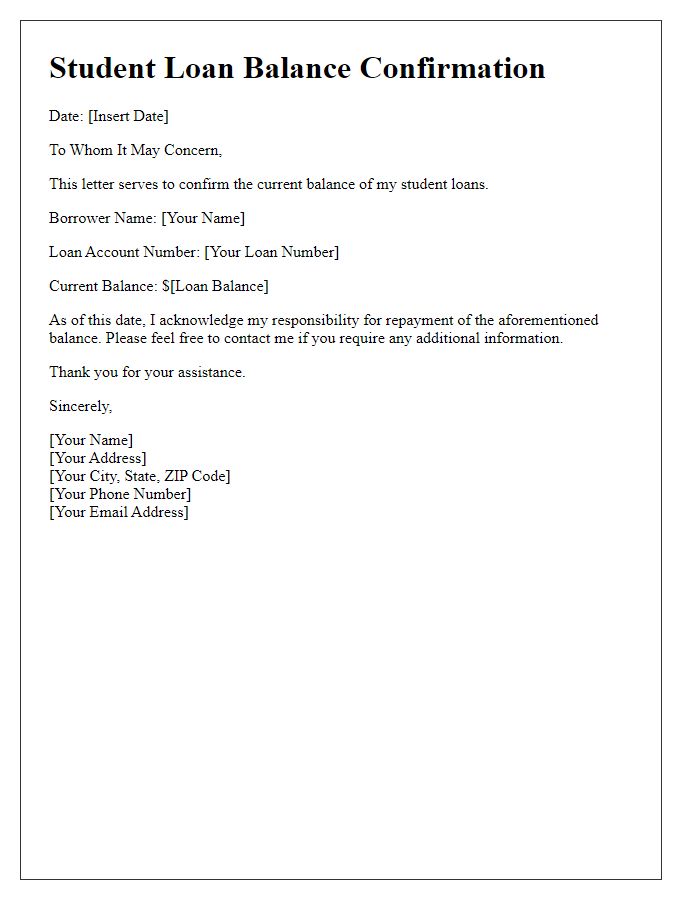

Borrower Information

A loan balance confirmation document typically includes essential details related to the borrower's account. Borrower information should encompass full name, such as Johnathan Smith, alongside the account number, for instance, 123456789, to ensure accurate identification of the loan in question. The address section may detail the residential location, such as 456 Elm Street, Springfield, State, ZIP Code 12345, which verifies the borrower's identity. Additionally, the contact information includes a phone number, for example, (555) 123-4567, and an email address, such as johnathan.smith@email.com, facilitating communication regarding account details. Furthermore, the date of the loan origination and the loan type, such as a personal loan or mortgage, should also be explicitly stated to provide a comprehensive overview of the borrower's financial obligation.

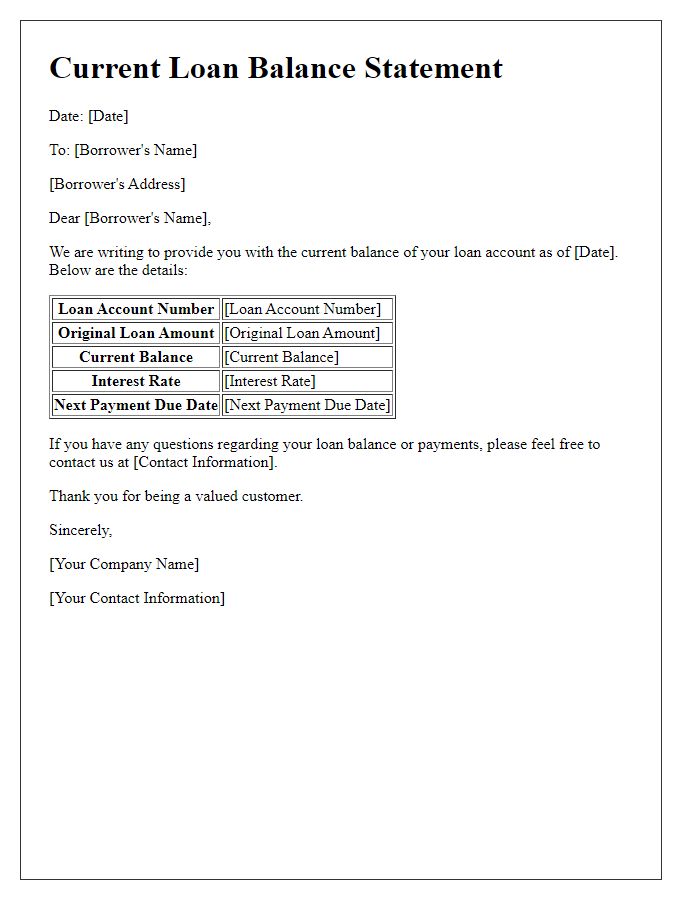

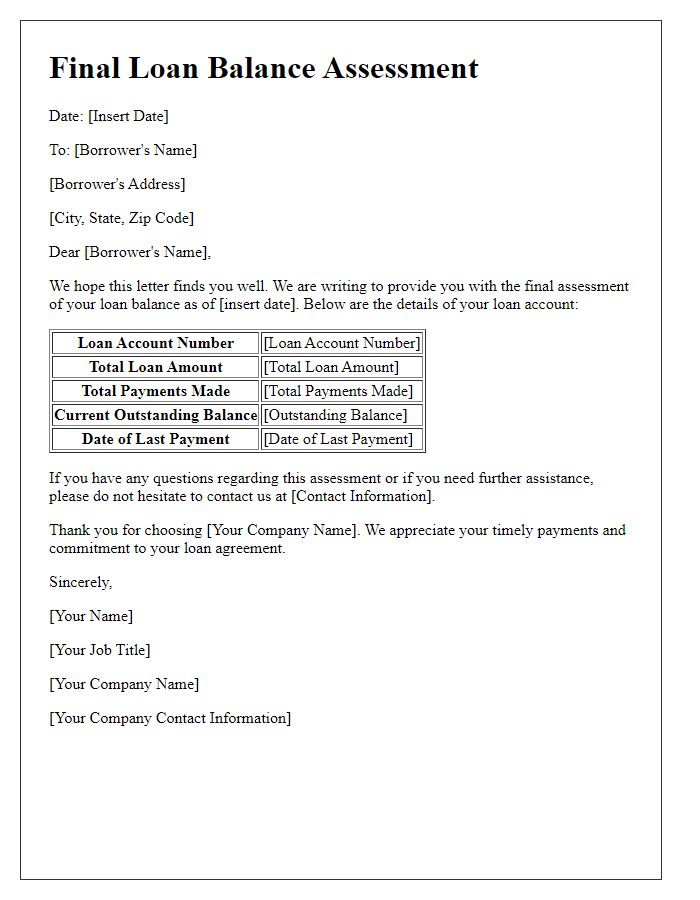

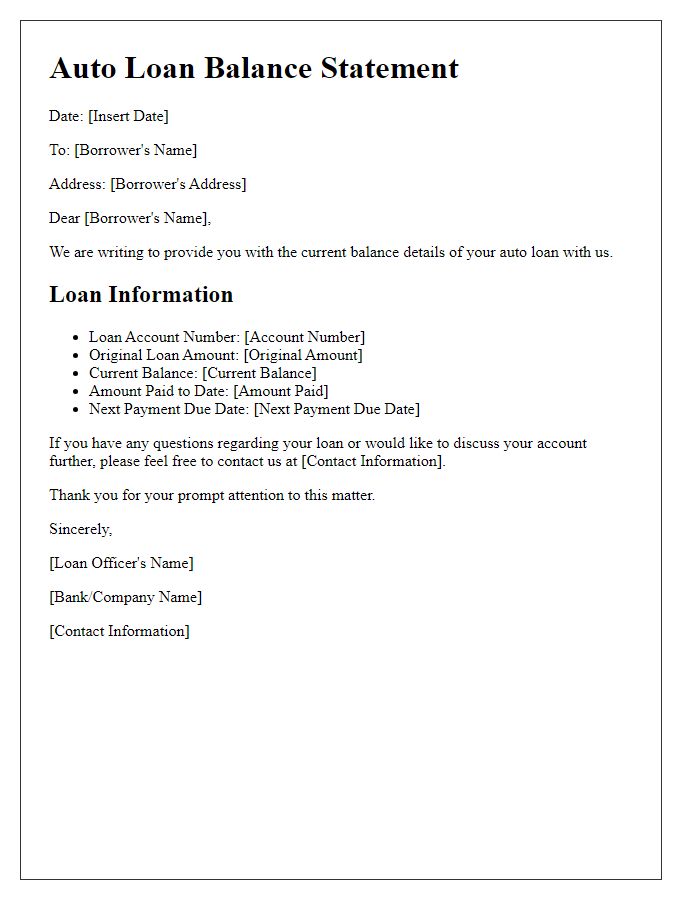

Loan Account Details

Loan account details encompass essential information regarding the borrowed amount and repayment terms. For instance, a typical personal loan might involve principal amounts like $10,000, with an annual interest rate of 5% at a two-year term. Payment schedules can vary, with monthly installments around $500. The balance confirmation reflects the remaining outstanding balance, including any accrued interest or fees, which can be articulated as a specific figure, often adjusted for recent payments made or changes to the loan conditions. This ensures clarity in understanding the financial obligations related to the loan account, crucial for effective personal finance management.

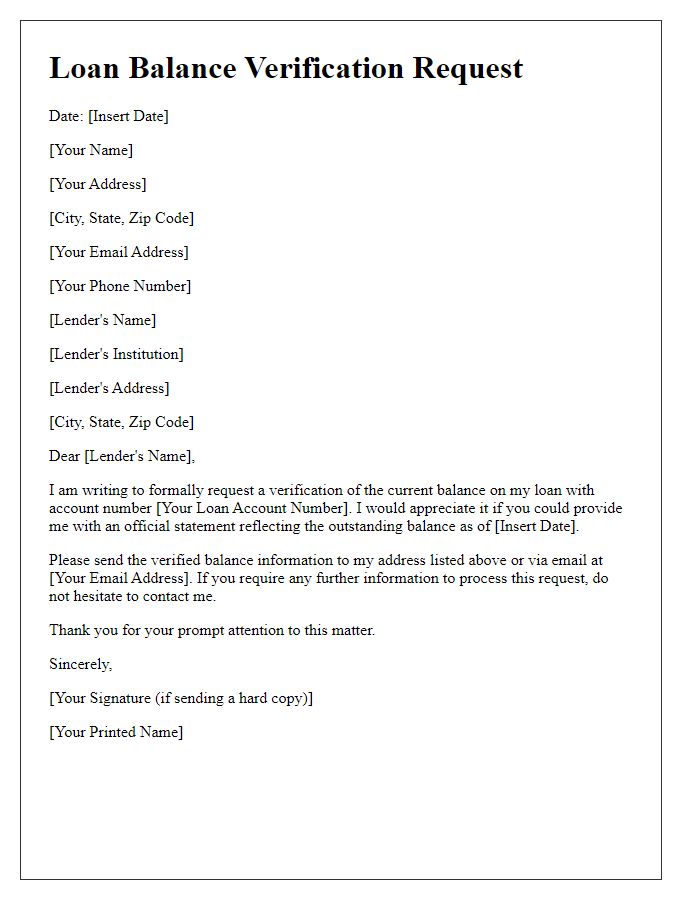

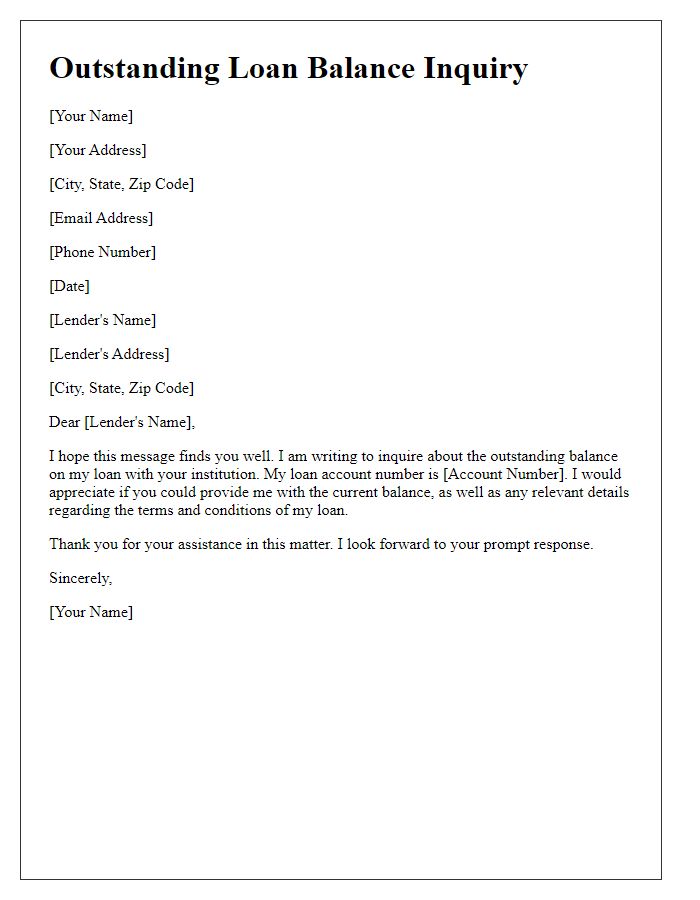

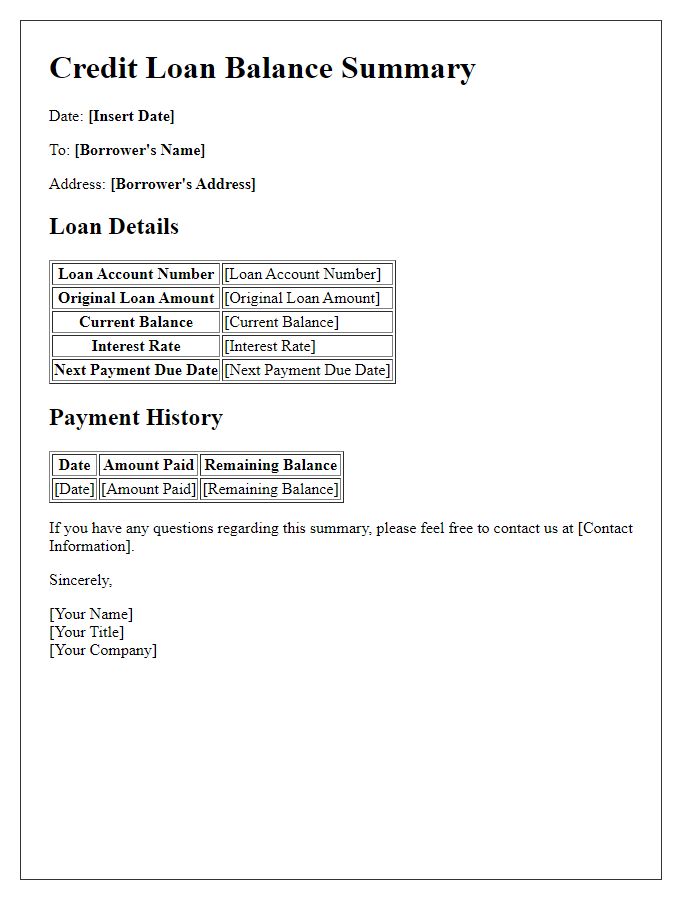

Request for Balance Confirmation

Loan balance confirmation is essential for financial transparency and accountability regarding outstanding debts. Financial institutions such as banks (e.g., JPMorgan Chase, Bank of America) regularly provide detailed statements indicating the remaining balance on loans like personal loans, mortgages, or auto loans. A request for balance confirmation typically includes vital information such as the loan account number, principal amount, interest rate, and payment history. This confirmation process ensures both parties understand the current liability, which is crucial during refinancing or resolving discrepancies. Accurate documentation is necessary for compliance with regulations set by entities like the Consumer Financial Protection Bureau (CFPB). Timely responses from financial bodies can significantly aid borrowers in managing their finances effectively.

Contact Information

Loan balance confirmation is a critical document for borrowers, requested frequently by loan providers, such as banks and credit unions, to ensure accurate loan repayment information. This document typically includes specific details like the outstanding loan amount, which can vary significantly depending on the type of loan (e.g., personal loan, mortgage), the interest rate (fixed or variable), and the remaining repayment term (often spanning several years). Inserting the date of the request is also essential for timely processing, while accuracy in listing the borrower's account number facilitates identification within the financial institution's system. Moreover, this confirmation may require contact information, such as the borrower's full name, address, and phone number, to ensure any follow-up communications are seamless and efficient.

Signature and Date

Loan balance confirmation statements are essential documents verifying the outstanding amount owed by borrowers to financial institutions, typically involving personal loans or mortgages. These documents usually detail crucial information such as the total loan balance, account number, and interest rates. Institutions like banks or credit unions often issue these statements to ensure transparency between borrowers and lenders. A signature from an authorized representative and the date of issuance serve as authentication, confirming the information's validity and accuracy for the referenced transaction or account.

Comments