Are you considering a seasonal income loan to help you navigate the fluctuations of your earnings? These loans can be a fantastic solution for those who experience spikes in income during certain times of the year, such as small business owners or freelancers. By understanding the ins and outs of these loans, you can take control of your financial situation and ensure a smooth cash flow when you need it most. Stay tuned to learn more about how a seasonal income loan can benefit you!

Income fluctuations and seasonality

Seasonal income loans cater to individuals experiencing income fluctuations due to specific times of the year, like harvest seasons in agriculture or holiday sales in retail. Many businesses depend on cyclical revenue, with peak earnings in months, and lower income during off-peak periods. Lenders analyze the borrower's income patterns, identifying high and low seasons to assess repayment capabilities. For example, a local farm might earn significant income during the fall harvest, but find cash flow tight during winter months. Seasonal loans provide necessary funding during lean periods, ensuring businesses maintain operations, manage expenses, and invest in growth opportunities without the stress of unstable cash flow.

Purpose of the loan

Seasonal income loans serve as financial tools designed to support individuals or businesses during peak earning periods, such as holiday seasons or harvest times. These loans, often utilized in agriculture or tourism, help cover essential expenses such as inventory, payroll, and operational costs. For instance, a farmer may seek a seasonal income loan to purchase seeds and equipment before the planting season, ensuring a fruitful harvest. In retail, businesses might request these loans to expand their product range ahead of significant shopping holidays like Black Friday. These financial aids typically feature flexible repayment options aligned with the expected income influx, enabling borrowers to maintain cash flow and capitalize on seasonal opportunities effectively.

Loan amount and terms

Seasonal income loans provide financial assistance tailored for individuals with earnings that fluctuate throughout the year, often due to the nature of their work, such as agricultural, tourism, or seasonal retail jobs. Commonly, these loans offer amounts ranging from $1,000 to $50,000, determined by the borrower's income history and repayment capability. Terms typically span 6 to 24 months, with interest rates varying based on credit scores and lender policies, often averaging between 5% to 25%. Seasonal income loans are crucial for managing expenses during off-peak periods, enabling borrowers to maintain stability before income becomes available again.

Repayment plan and timelines

Seasonal income loans provide financial support for individuals with fluctuating income patterns, often associated with agricultural cycles, tourism seasons, or freelance work. A well-structured repayment plan is crucial for managing financial obligations. For example, a borrower might outline a timeline that aligns repayments with peak income months; farmers may schedule repayments post-harvest in October, while tour guides may opt for repayments in December, coinciding with holiday seasons. The repayment plan could be divided into monthly installments, with the first payment due one month after the loan disbursement, ensuring borrowers can manage cash flow While minimizing stress during off-peak periods. Such strategic planning helps maintain a positive credit profile and fosters a sustainable approach to handling seasonal income fluctuations.

Financial management strategies

Implementing effective financial management strategies is crucial for individuals seeking seasonal income loans for businesses like agriculture or tourism in locations such as California or Florida. Establishing a comprehensive budget allows for the allocation of funds, helping to manage expenses during off-peak seasons when income is scarce. Seasonal cash flow analysis is essential, projecting income and expenses based on historical data from previous years, mitigating potential financial shortfalls. Maintaining an emergency fund, ideally covering three to six months of operating expenses, provides a buffer against unexpected downturns. Utilizing tools like financial software can streamline income tracking and expense management, while regular financial reviews help identify areas for improvement. Furthermore, exploring alternate financing options, such as lines of credit or peer-to-peer lending, can sustain operations during lean periods, ensuring business continuity throughout seasonal fluctuations.

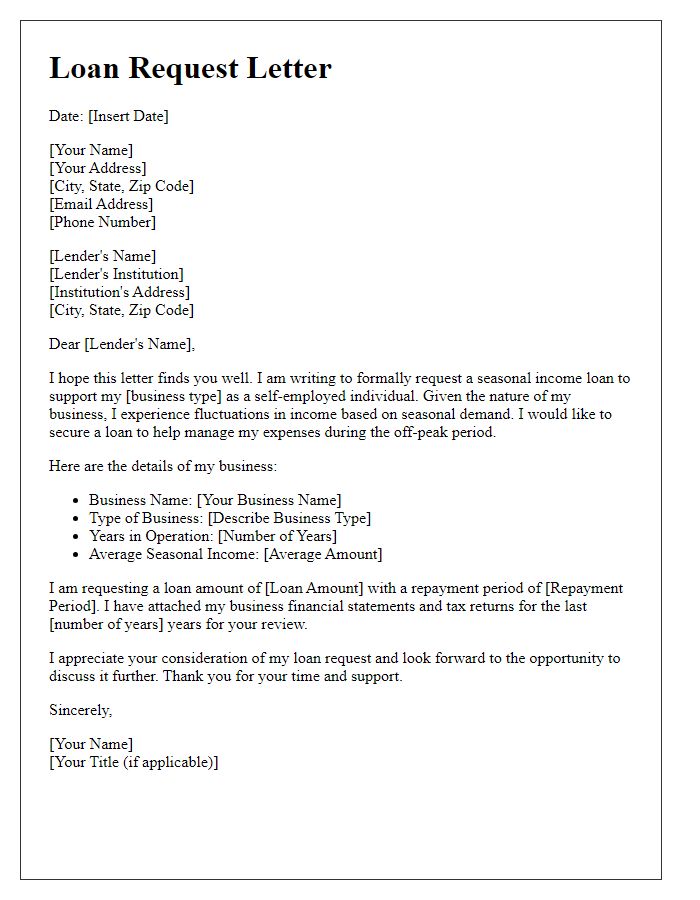

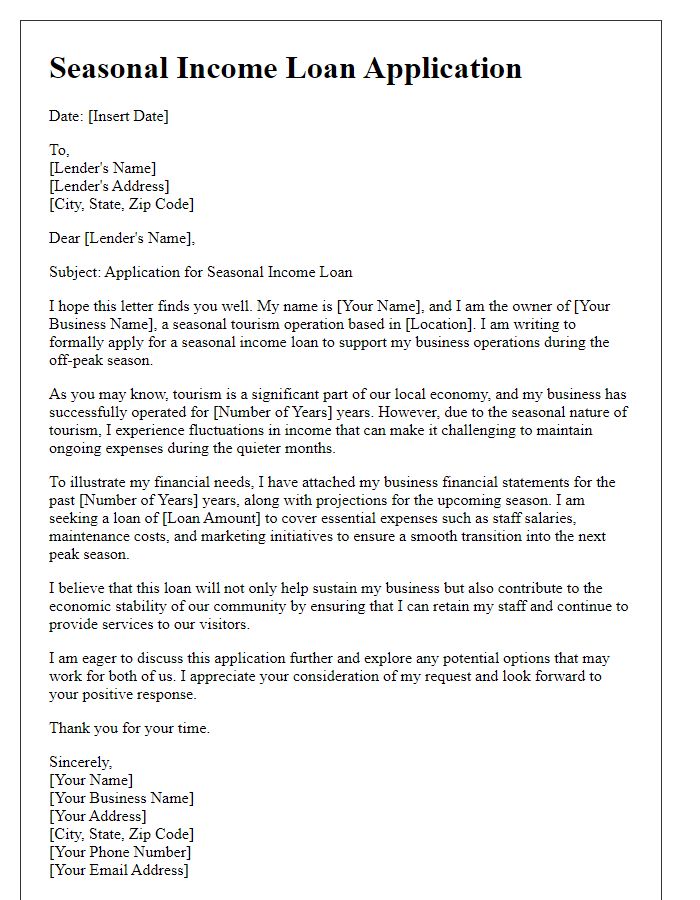

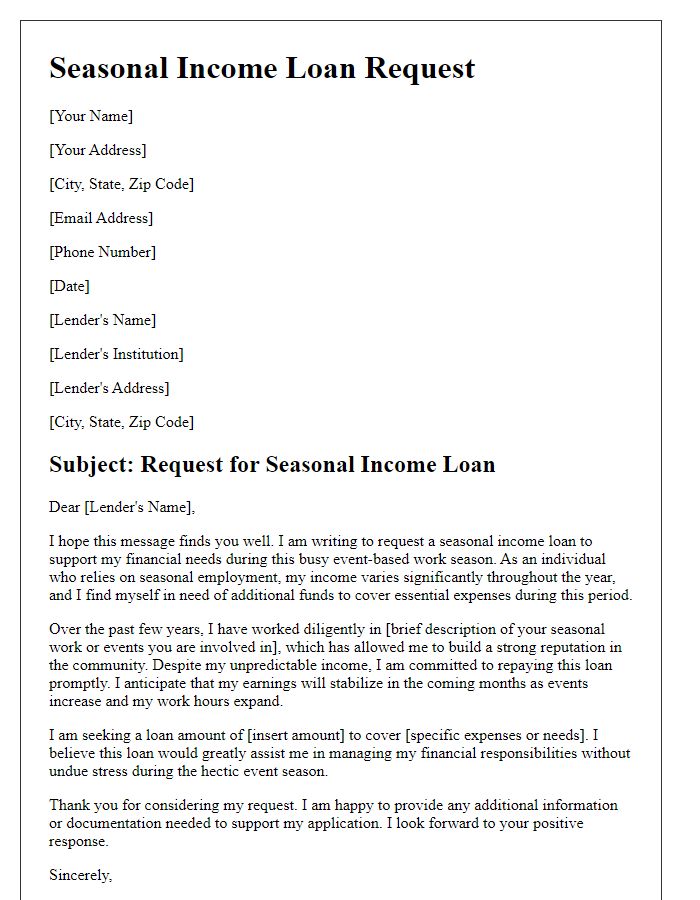

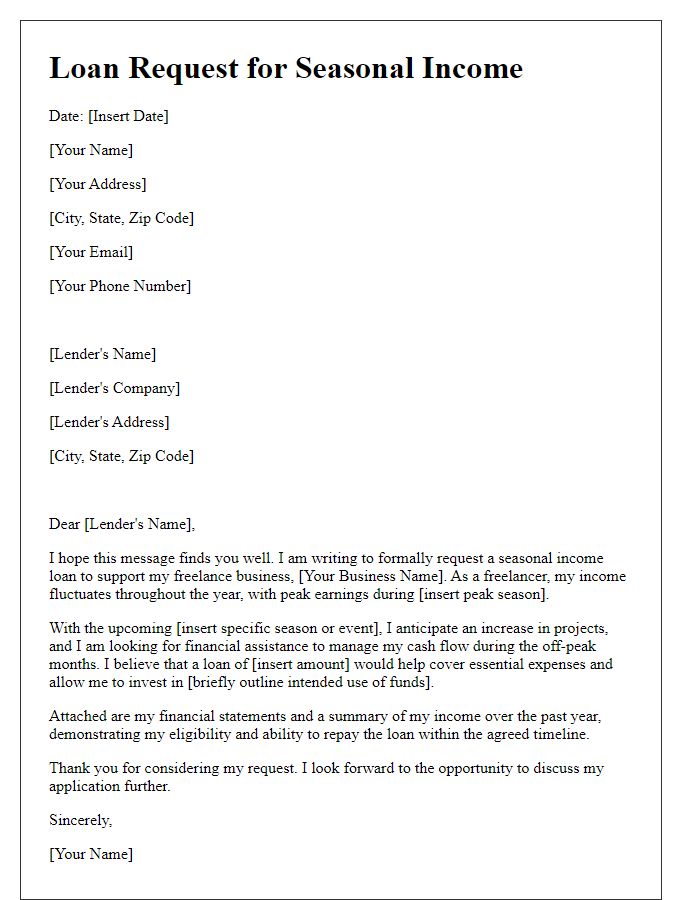

Letter Template For Seasonal Income Loan Samples

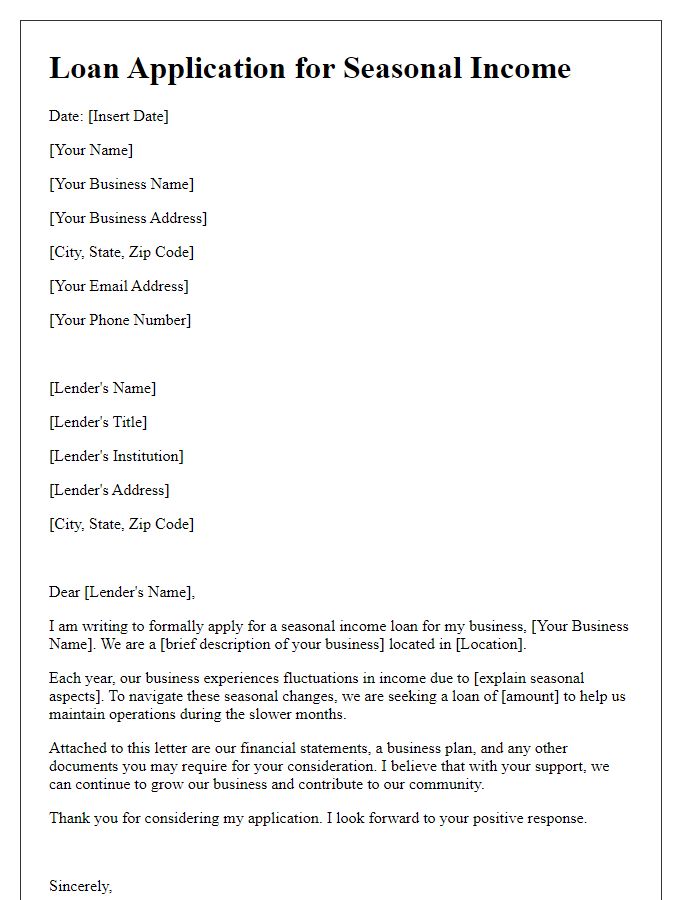

Letter template of seasonal income loan application for small business owners.

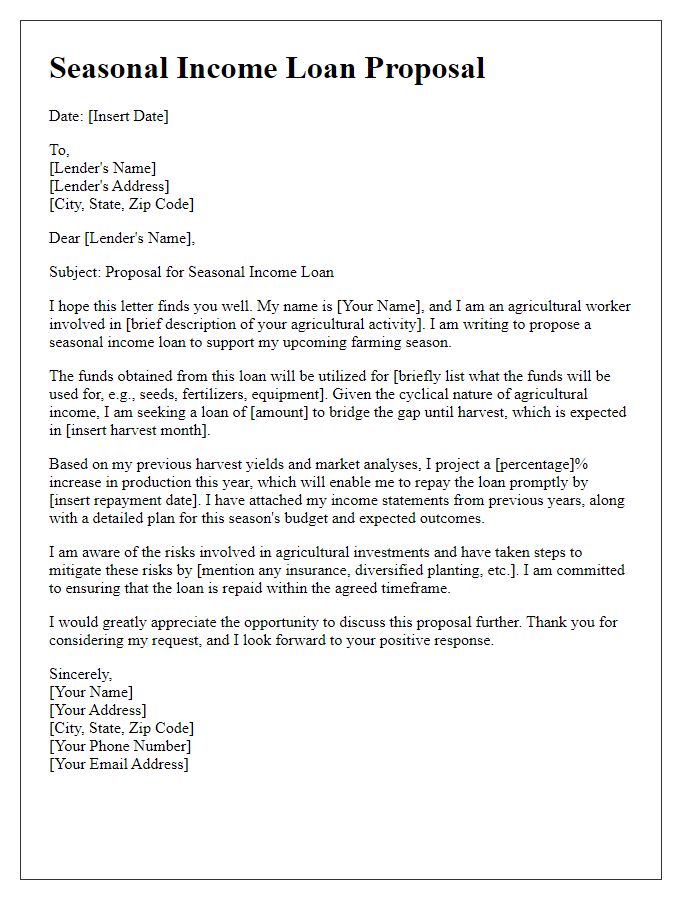

Letter template of seasonal income loan proposal for agricultural workers.

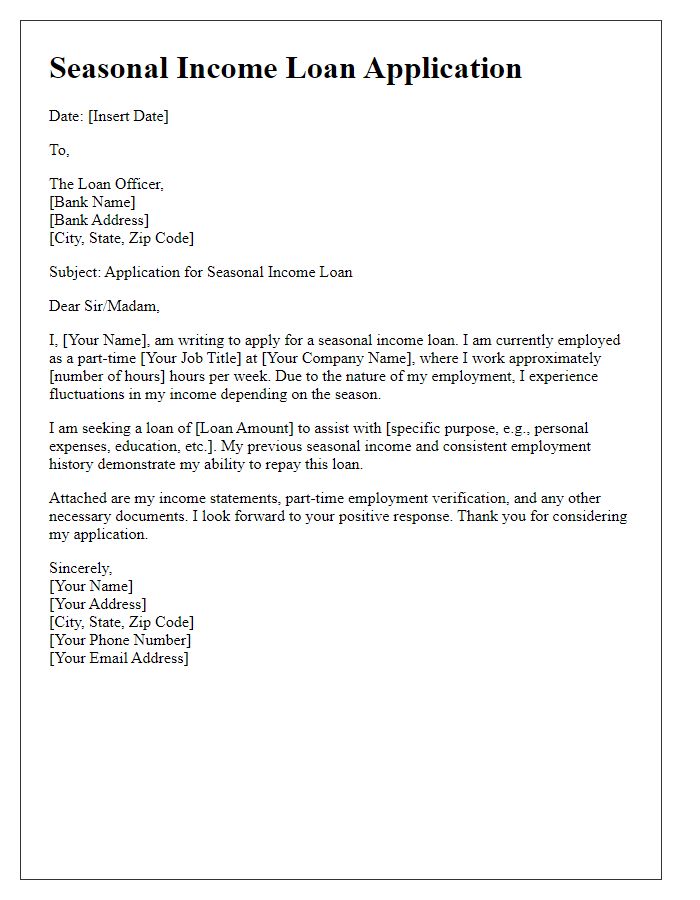

Letter template of seasonal income loan application for part-time employees.

Letter template of seasonal income loan request for self-employed individuals.

Letter template of seasonal income loan application for seasonal tourism operators.

Letter template of seasonal income loan request for event-based workers.

Comments