Are you eagerly waiting for an update on your loan application and feeling a bit in the dark? Rest assured, it's completely normal to have questions, and reaching out for clarification can make all the difference. In this article, we'll guide you through crafting a thoughtful inquiry letter to effectively check the status of your loan. So, if you're ready to take the next step, keep reading to discover the perfect template that will get you the answers you seek!

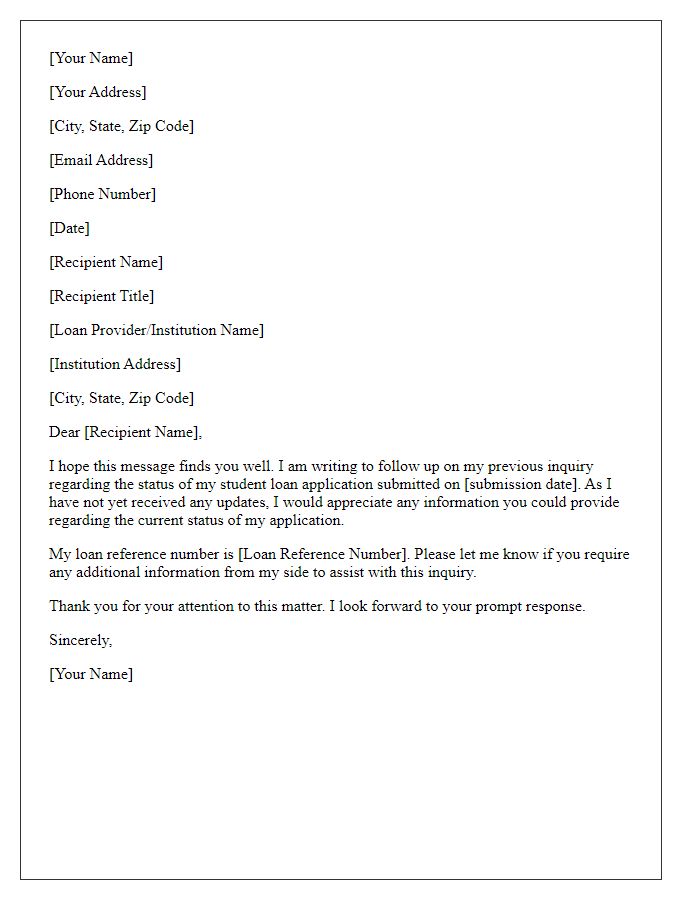

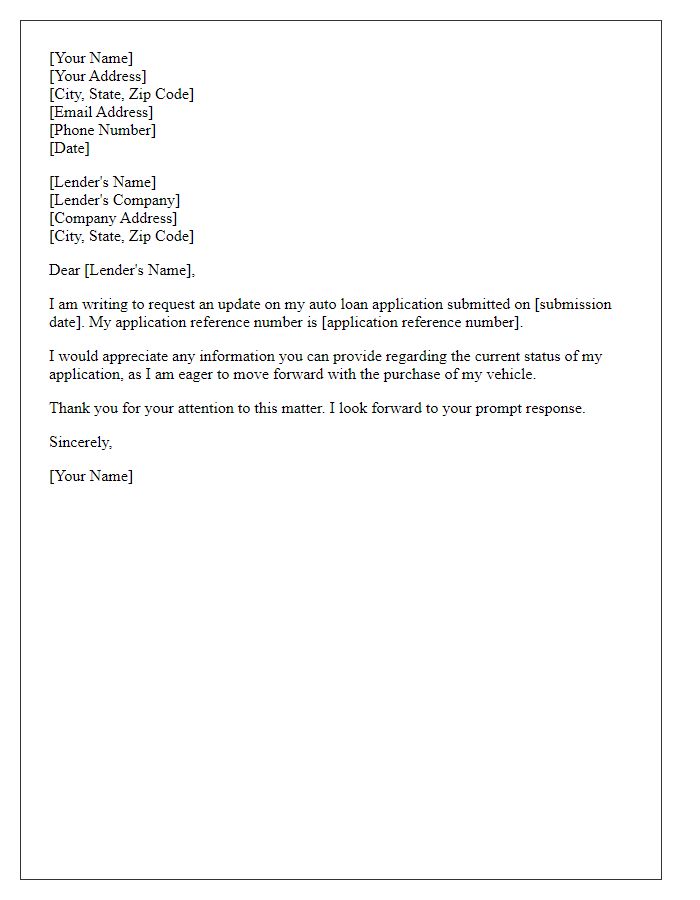

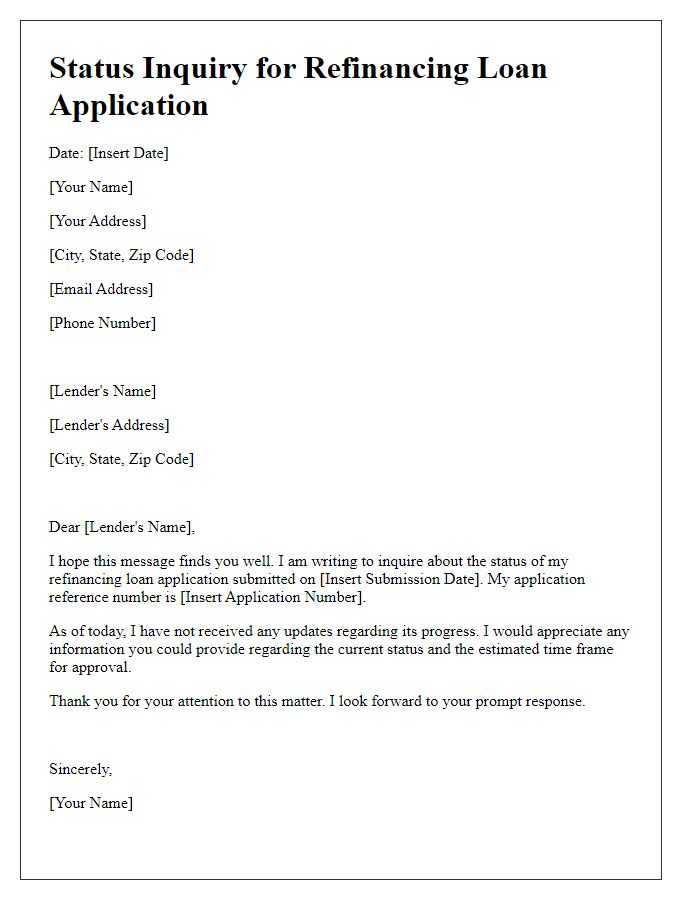

Clear subject line

Loan Status Update Request: Inquiry on Application Progress Note: Loan status reflects the progress of financial assistance applications, often influenced by factors like credit score evaluations, income verification, and lender processing times.

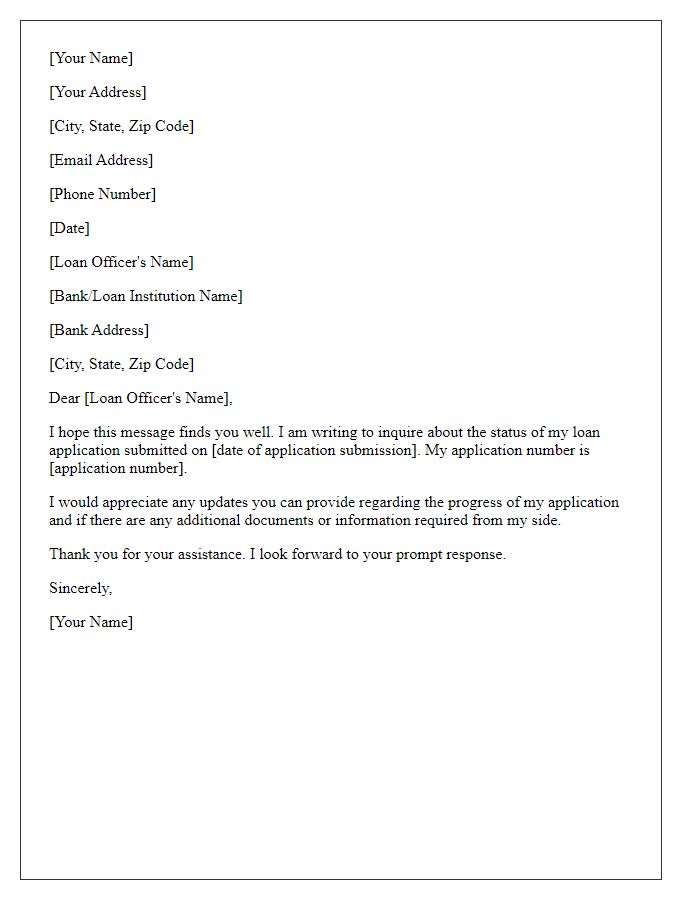

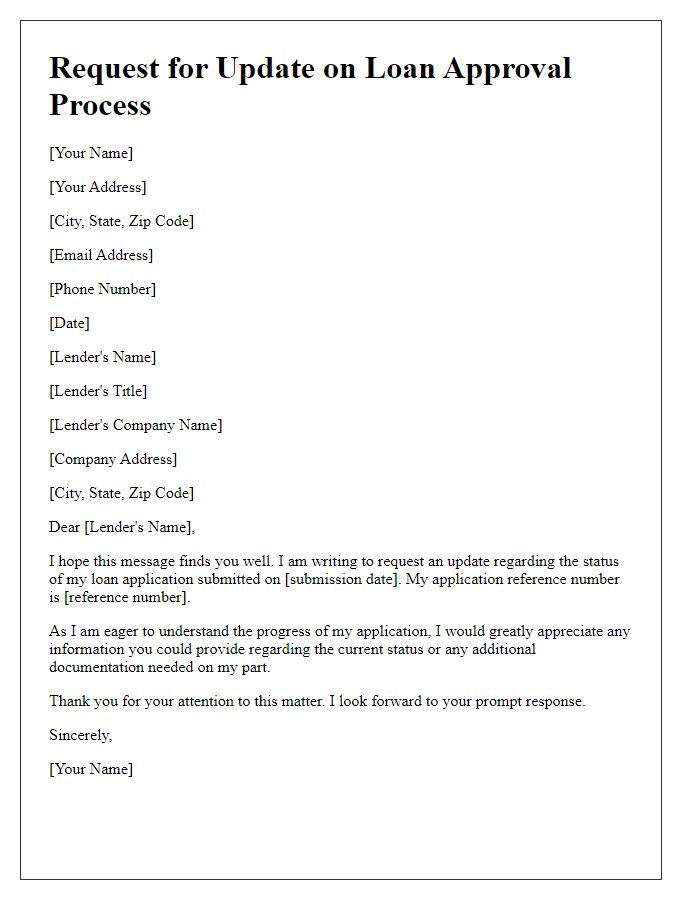

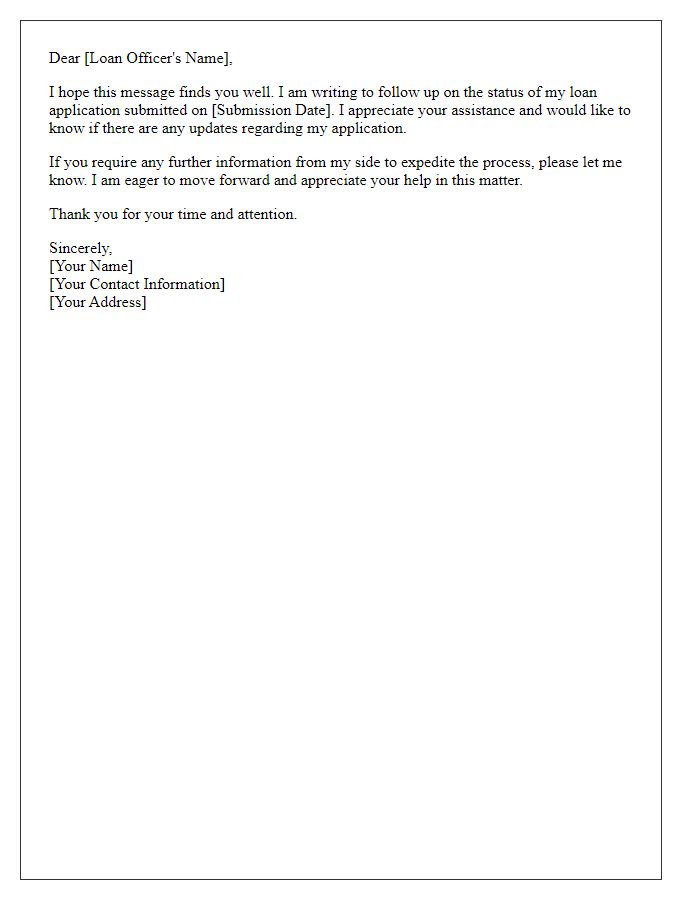

Polite salutation

Inquiring about the status of a loan application involves understanding various key elements such as processing times, interest rates, and specific loan types. Financial institutions typically have distinct timelines for reviewing applications, which can range from a few days to several weeks. For instance, a personal loan may take up to 5 business days for initial review, while a mortgage can take 30 to 45 days due to extensive documentation and verification processes. Borrowers should also note the importance of credit scores (numerical values ranging from 300 to 850) in determining loan approval and interest rates, as lower scores can lead to higher rates or denied applications. Additionally, communication methods through emails, phone calls, or in-person meetings with loan officers can provide clarity on the loan status.

Specific loan details

Increased loan inquiries often arise from the complexity of loan applications, especially regarding specific details such as loan amount, interest rate, and repayment term. For instance, a home mortgage loan of $250,000 at a 3.5% fixed interest rate for 30 years can impact financial planning significantly. Applicants frequently seek updates on their loan status, particularly after significant milestones such as underwriting completion or appraisal results, which can affect approval timelines. In addition, lenders may require specific documentation, including proof of income or employment verification, which can further delay the loan status process if not submitted promptly. Understanding these components is crucial for borrowers to navigate their financing journey effectively.

Inquiry purpose

The inquiry regarding loan status aims to clarify the current situation of a financial loan application. Key information includes the loan amount, which may range from thousands to millions of dollars, and the submission date for the application, often set within a specific timeframe such as the last two to four weeks. Entities such as banks like JPMorgan Chase or credit unions must be engaged to obtain updates. Details such as the loan type, which can include mortgages, personal loans, or auto loans, shape the inquiry's focus. Understanding approval timelines, typically between seven to thirty days, is crucial for the borrower to align their financial plans accordingly.

Contact information

Inquiry regarding loan status reveals essential details for a borrower. Individuals often request updates about their home loans, personal loans, or auto financing. The lender's contact information, typically including a phone number (such as 1-800-xxx-xxxx) or email address (e.g., support@lender.com), is crucial for direct communication. Timely follow-ups play a significant role in the loan approval process, which may involve critical milestones like underwriting, approval, or disbursement dates. Gathering information related to interest rates, payment schedules, and remaining balance aids in understanding overall loan management. Proper documentation, including loan identification numbers, enhances the efficiency of inquiries, ensuring prompt responses from lending institutions.

Comments