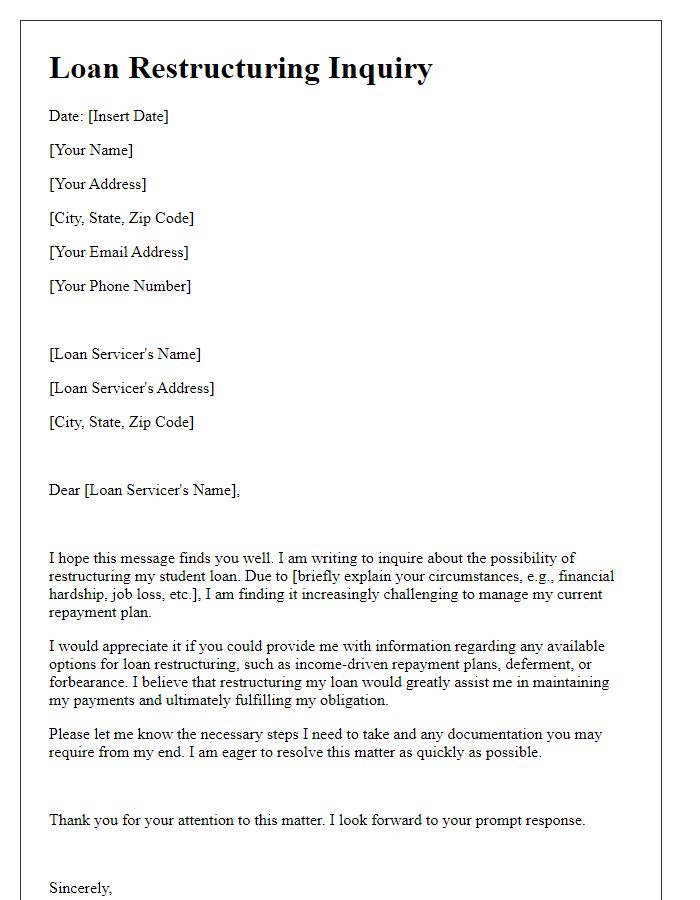

Are you feeling overwhelmed by your current loan situation? You're not alone, and there are options available to help you regain control. In this article, we'll walk you through a customizable letter template that makes requesting loan restructuring a breeze. So, let's dive in and explore how you can effectively communicate your needs to lendersâread on to find the perfect words for your request!

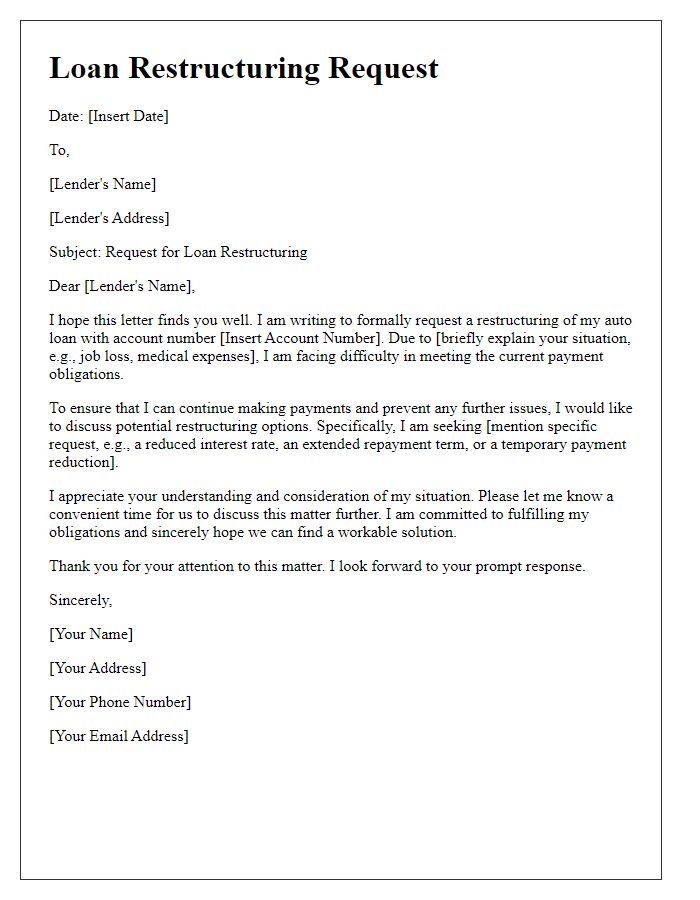

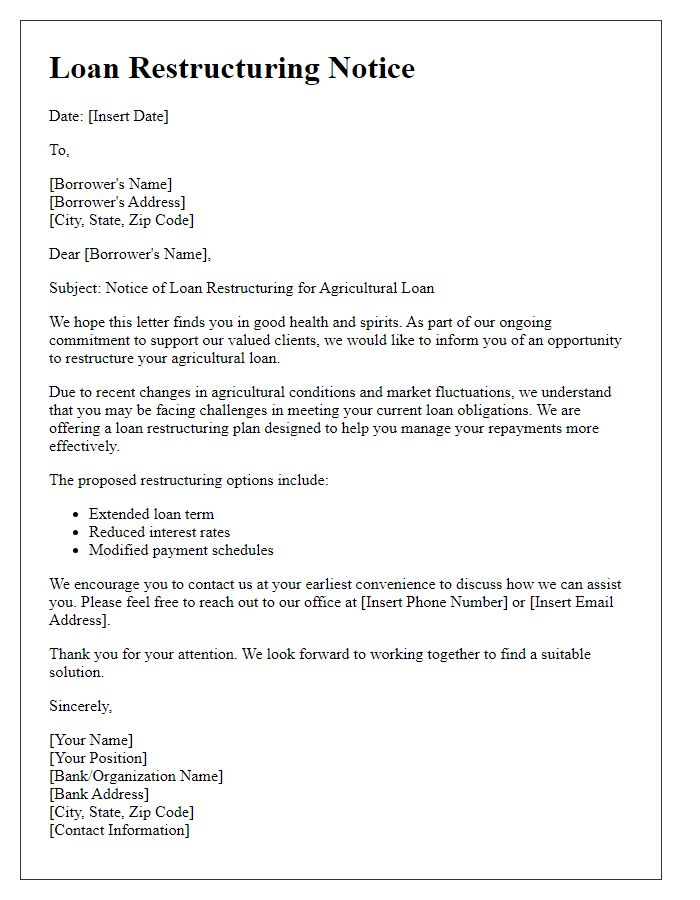

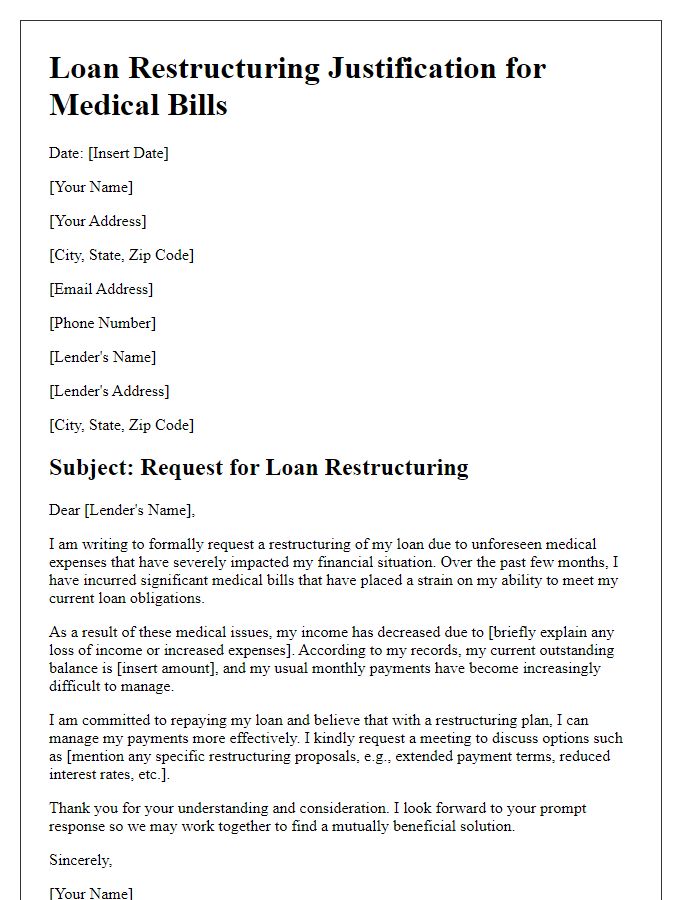

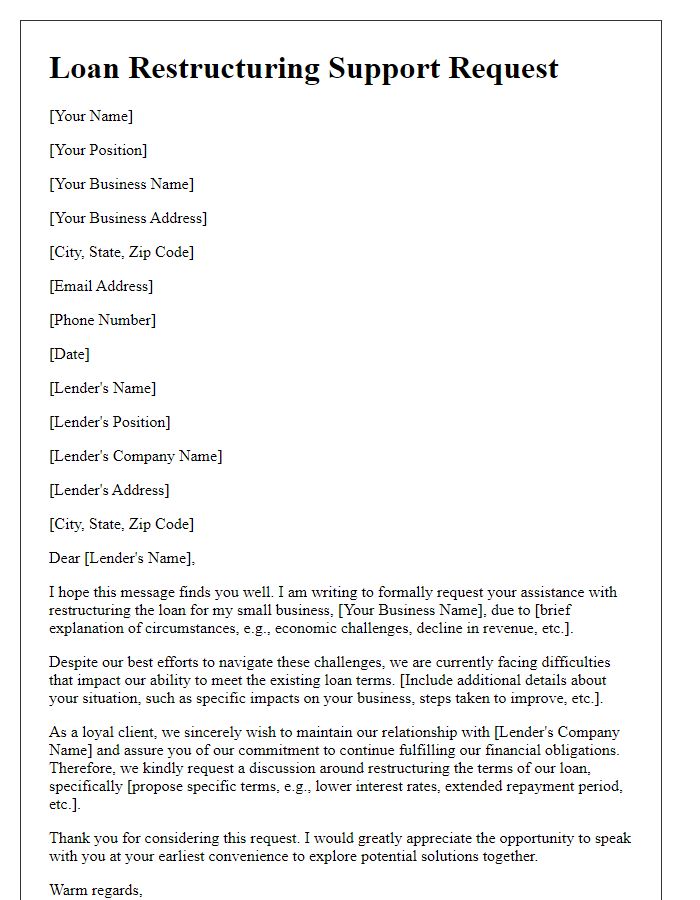

Borrower information details

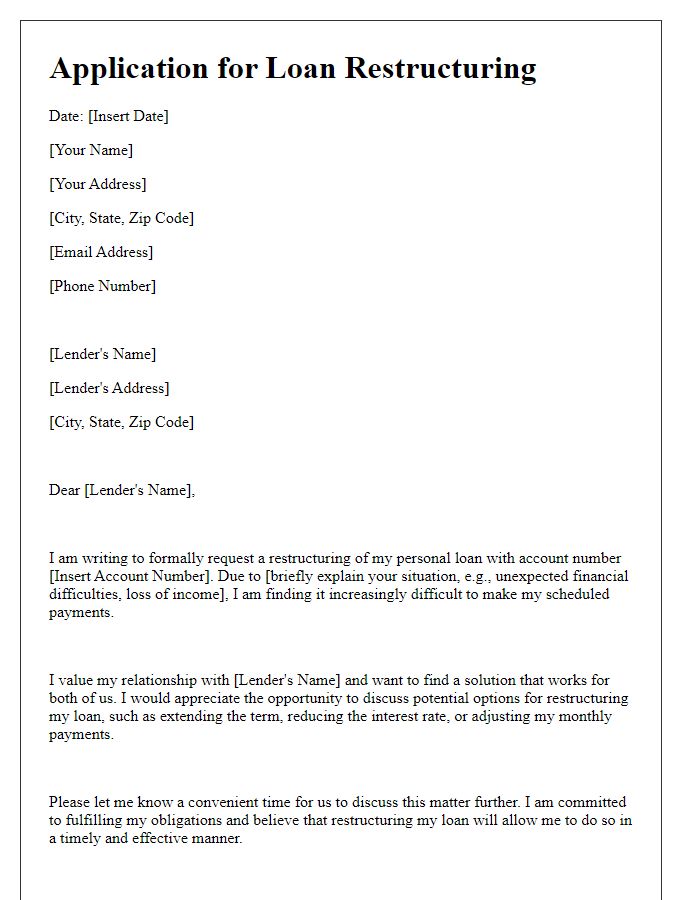

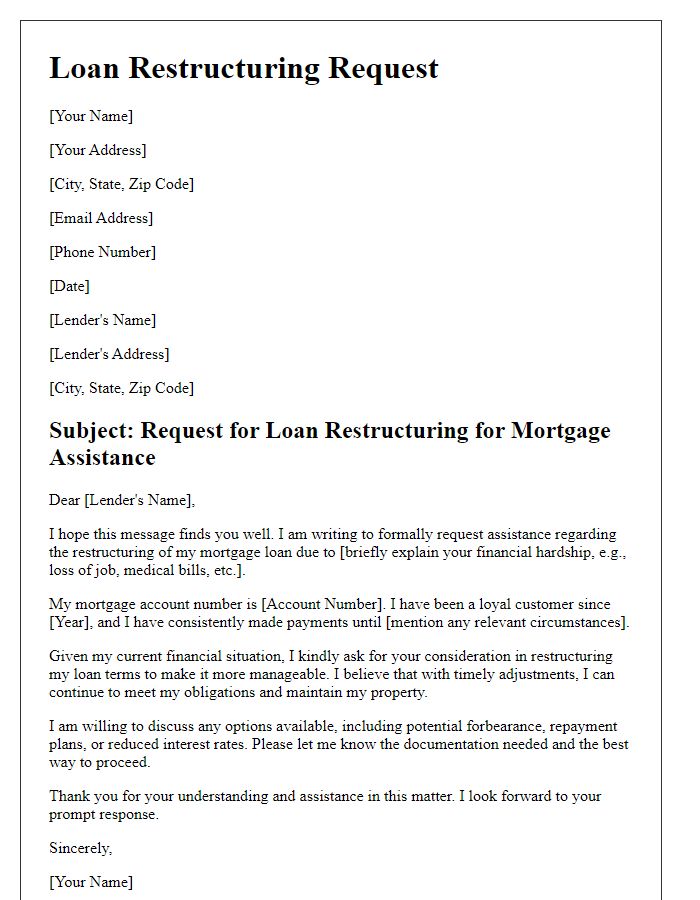

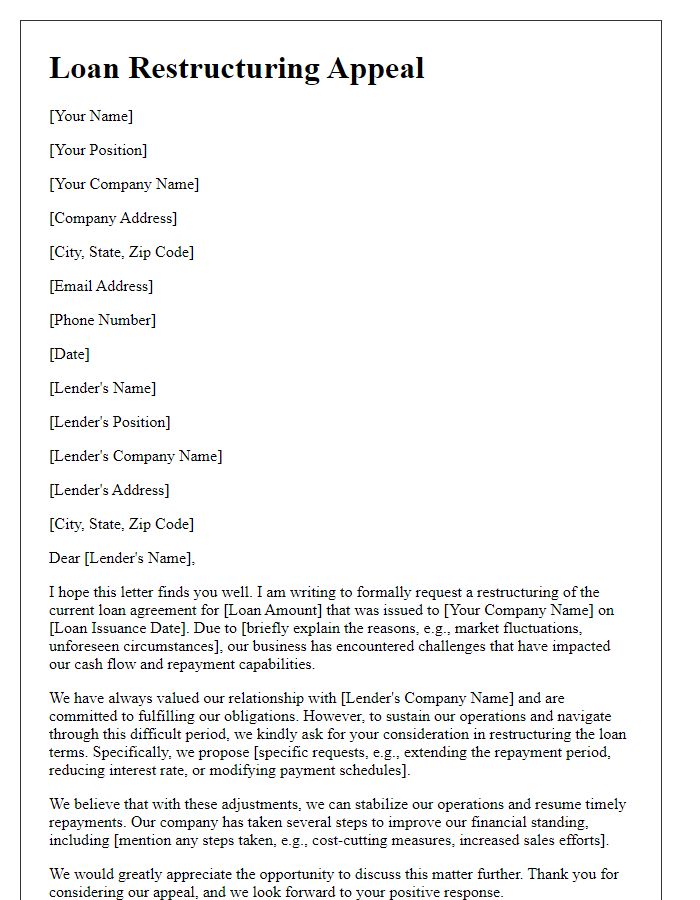

Loan restructuring requests often involve a detailed presentation of the borrower's information to facilitate the process. A comprehensive borrower profile includes essential details such as the full name, Social Security Number (or equivalent identifier), contact information (address, phone number, email), and the loan account number associated with the restructuring request. Additionally, financial status outlines current income (monthly or annual), employment details (including employer's name and position), and any additional financial commitments or debts to provide context for the request. Lastly, a brief history of the loan including the original loan amount, current balance, payment history, and reasons for restructuring, such as financial hardship, change in employment status, or unexpected expenses, should be clearly articulated to convey the borrower's situation effectively.

Current loan terms and conditions

Current loan terms typically include factors like principal amount (e.g., $50,000), interest rate (e.g., 5% annually), repayment period (e.g., 10 years), monthly payment amount (e.g., $530), and any prepayment penalties. Borrowers must consider their credit score (e.g., 650) and employment status (e.g., full-time at Company XYZ) when requesting restructuring. Loan types may vary, including fixed-rate mortgages, variable-rate loans, or personal loans, each with specific conditions affecting the request. Economic factors like inflation rates (e.g., 3%) and changes in income levels can also contribute to the need for restructuring to arrive at more manageable monthly payments or extended loan terms.

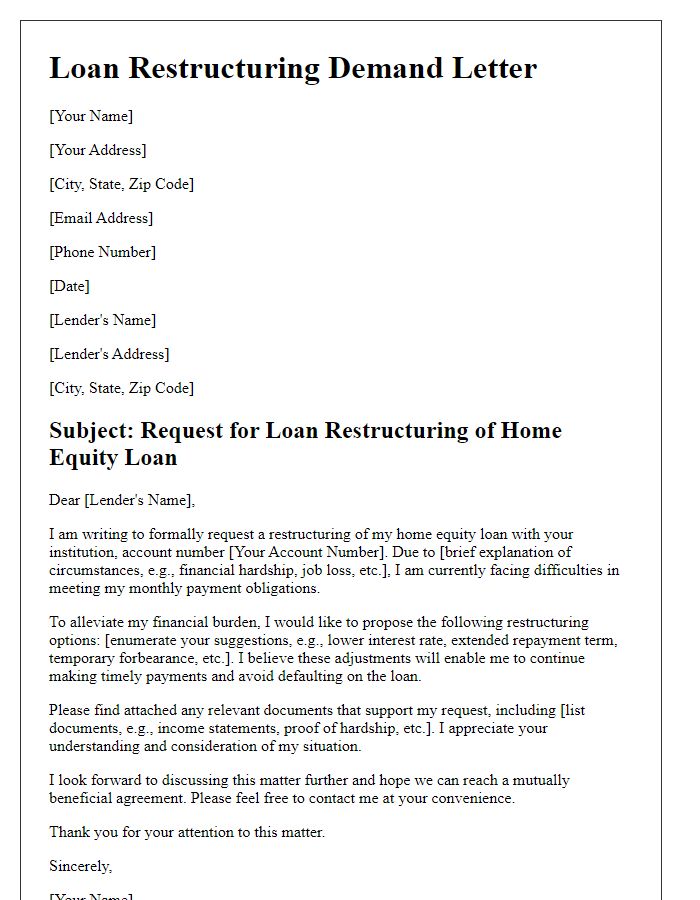

Reason for restructuring request

Financial difficulties can lead to the need for loan restructuring, particularly in uncertain economic times. Borrowers may face job loss, reduced income, or increased living expenses that impact their ability to meet monthly payments. A request for restructuring aims to adjust terms, such as decreasing interest rates (often around 3-5% for personal loans) or extending repayment periods (potentially up to 30 years for mortgages), to enhance affordability. In light of significant events, such as the 2020 economic downturn caused by the COVID-19 pandemic, many individuals have sought these modifications to avoid default. This proactive approach can help maintain a positive credit score while allowing borrowers to regain financial stability.

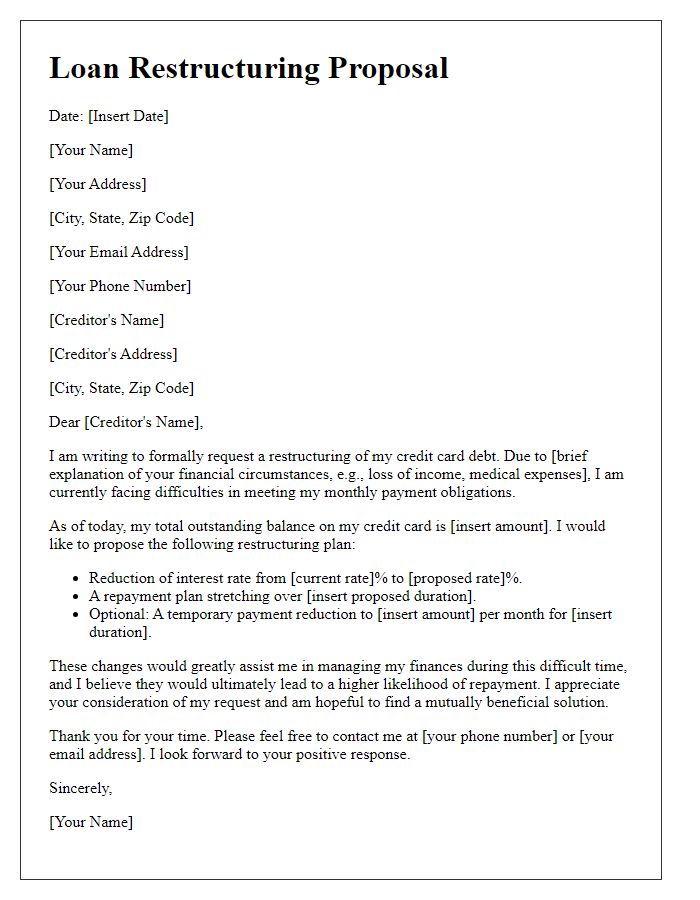

Proposed restructuring terms

When negotiating loan restructuring, it is essential to propose terms that consider both repayment capacity and lender interests. Proposed restructuring terms might include a reduced interest rate, outlining a decrease from 6% to 4% annually, or extending the loan term from five years to seven years to lower monthly payments. Additionally, temporarily postponing payments for three months (a grace period) could alleviate immediate financial strain. Including a specific loan amount, such as $50,000, emphasizes the financial commitment while suggesting a revised monthly payment based on new terms, approximately $700 instead of $1,000. These adjustments aim to create a sustainable repayment plan that benefits both borrower and lender, ensuring timely repayments and reducing default risk.

Supporting financial documents

Financial documents play a crucial role in loan restructuring requests, providing lenders with essential insights into a borrower's financial health and circumstances. Key documents include recent bank statements showcasing cash flow patterns, tax returns for the previous two years that reveal income stability, and pay stubs indicating current employment and earnings. Additionally, a detailed list of monthly expenses helps present a clear picture of financial obligations. If applicable, a profit and loss statement may illustrate business income and expenditures, aiding in understanding the borrower's situation. Supporting documents, such as a credit report reflecting the borrower's creditworthiness, enhance the request's credibility by demonstrating transparency and responsibility towards existing financial commitments.

Comments