When life throws unexpected challenges our way, it can sometimes lead to financial strugglesâlike the unfortunate situation of a loan default. If you find yourself needing to explain your circumstances to a lender, crafting a thoughtful letter can make all the difference. In this article, we'll guide you through the essential elements of a loan default explanation letter that conveys honesty and accountability. So, grab a cup of coffee, and let's dive deeper into how to effectively communicate your situation!

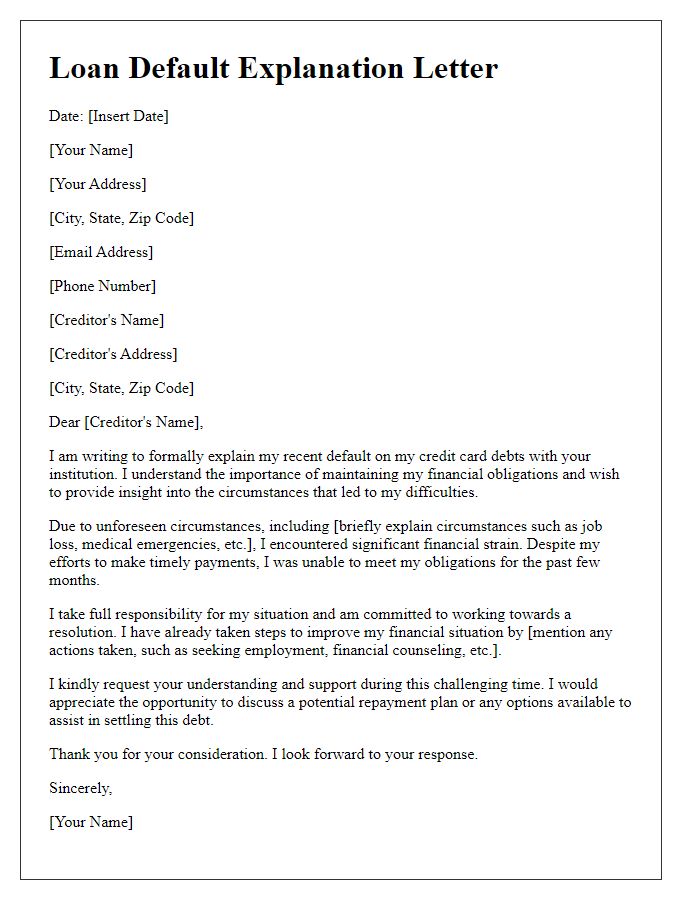

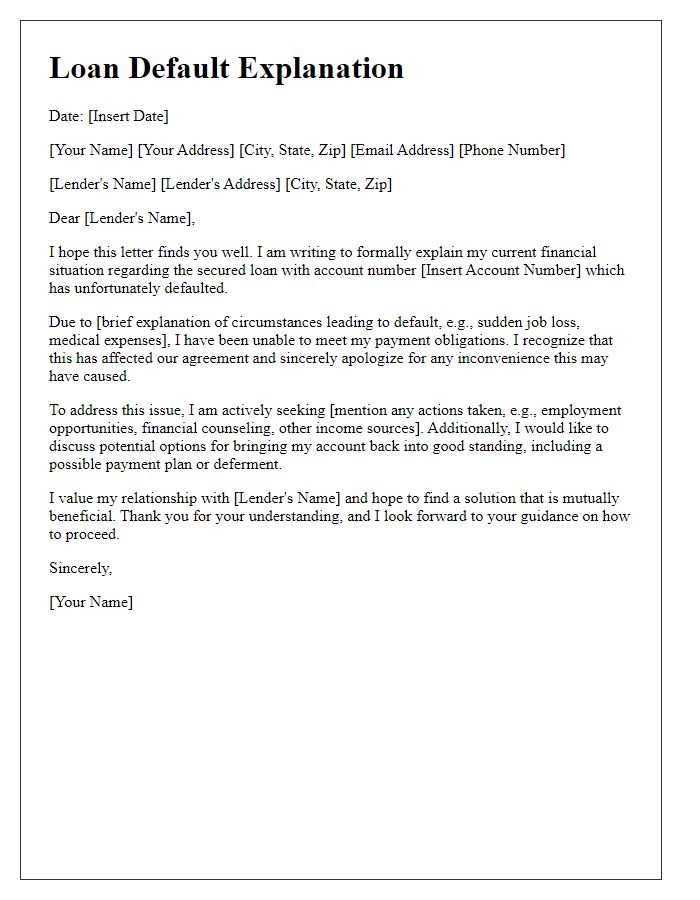

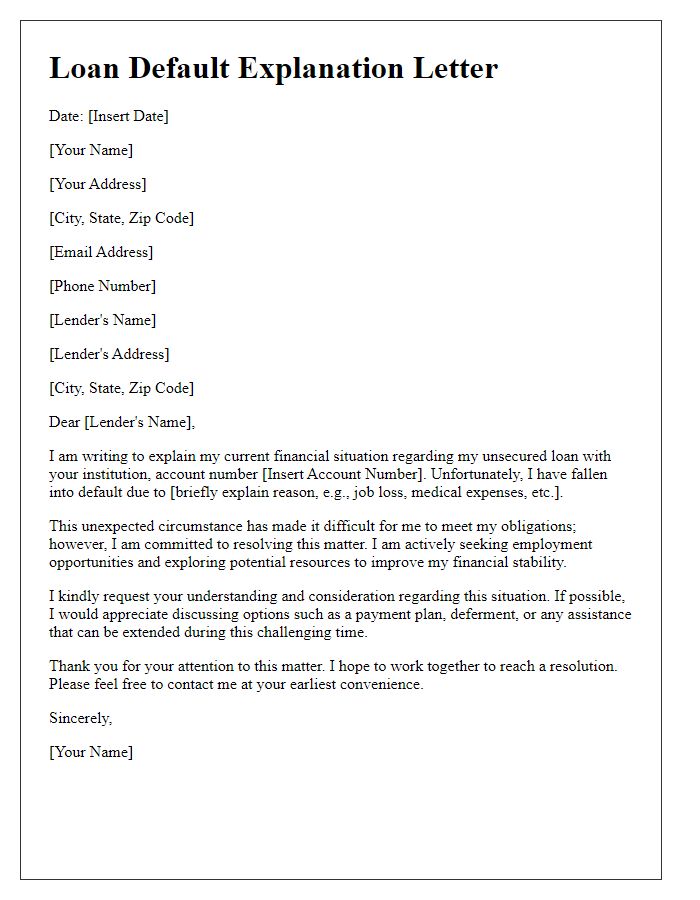

Borrower's details and contact information

The borrower, John Smith, a 35-year-old resident of Springfield, Missouri, has been experiencing financial difficulties due to the unexpected job loss in September 2023, leading to missed mortgage payments. His contact information includes a mobile number: (555) 123-4567, and an email address: john.smith@email.com. Since taking out a loan of $250,000 through ABC Lending Institution in June 2022, unforeseen medical expenses and rising living costs have made it increasingly challenging for him to meet financial obligations. The loan, originally structured over a 30-year term at a 4.5% interest rate, was intended for purchasing a home in a neighborhood with an average property value of $280,000. As of October 2023, John is actively seeking employment opportunities and exploring assistance programs to improve his financial situation.

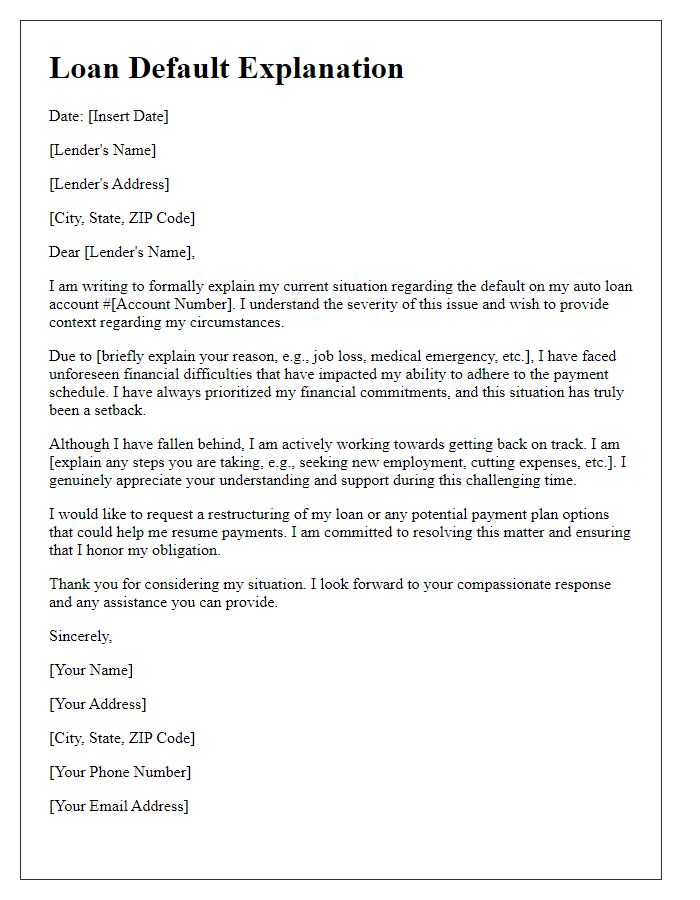

Loan account number and lender's information

Loan defaults can occur due to various circumstances impacting borrowers' financial situations. For example, an individual may experience sudden job loss (such as a layoff from a corporate position) or unexpected medical expenses (like hospitalization due to a serious illness), which hinder their ability to meet monthly repayments. In the context of a personal loan, it's essential to reference the loan account number (specifically an alphanumeric code provided by the lender) and include precise lender information (such as the institution's name, contact details, and address). Such documentation can help clarify the situation and open a dialogue for potential modifications to repayment plans or discussions about possible forbearance options. Prompt communication with the lender, ideally within 30 days of the first missed payment, can demonstrate a willingness to resolve payment issues. Keeping detailed records of correspondence with the lender further aids in managing the loan default scenario effectively.

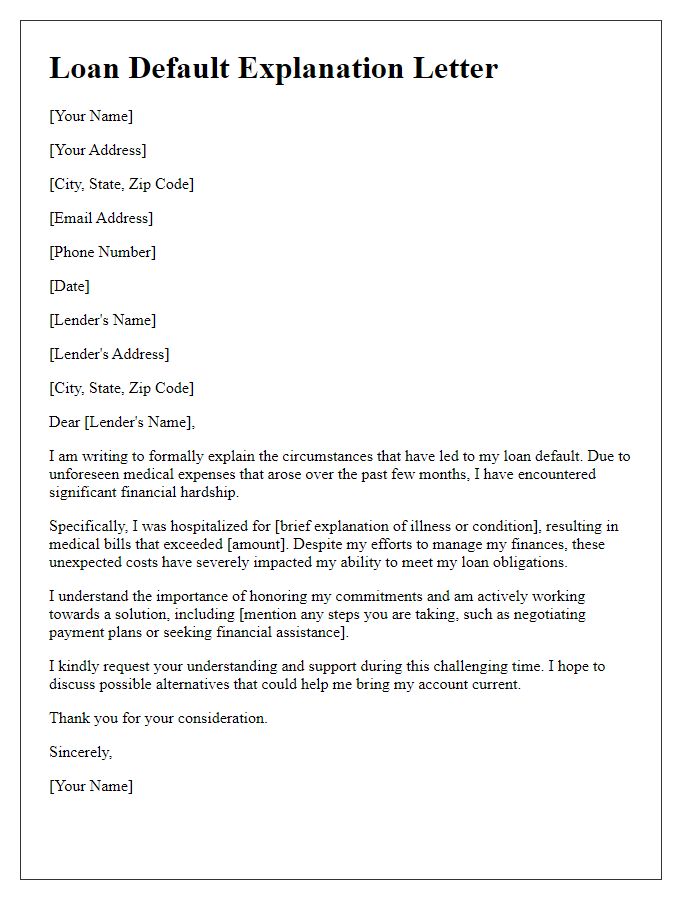

Reason for default, highlighting unforeseen circumstances

Loan defaults often arise from unforeseen circumstances, significantly impacting an individual's financial stability. Sudden job loss, affecting approximately 10 million Americans in 2020 alone, can plunge borrowers into distress, impeding their ability to meet repayment terms. Unexpected medical expenses, averaging $2,000 per hospital visit, can deplete savings rapidly, leaving individuals without a financial cushion. Additionally, natural disasters, such as hurricanes or wildfires, can devastate properties and disrupt income streams, with reconstruction costs exceeding $50,000 in some cases. These factors create a domino effect, highlighting the challenges that can lead to default, even for borrowers who were previously reliable. Understanding these circumstances is crucial for lenders when evaluating loan performance and borrower potential.

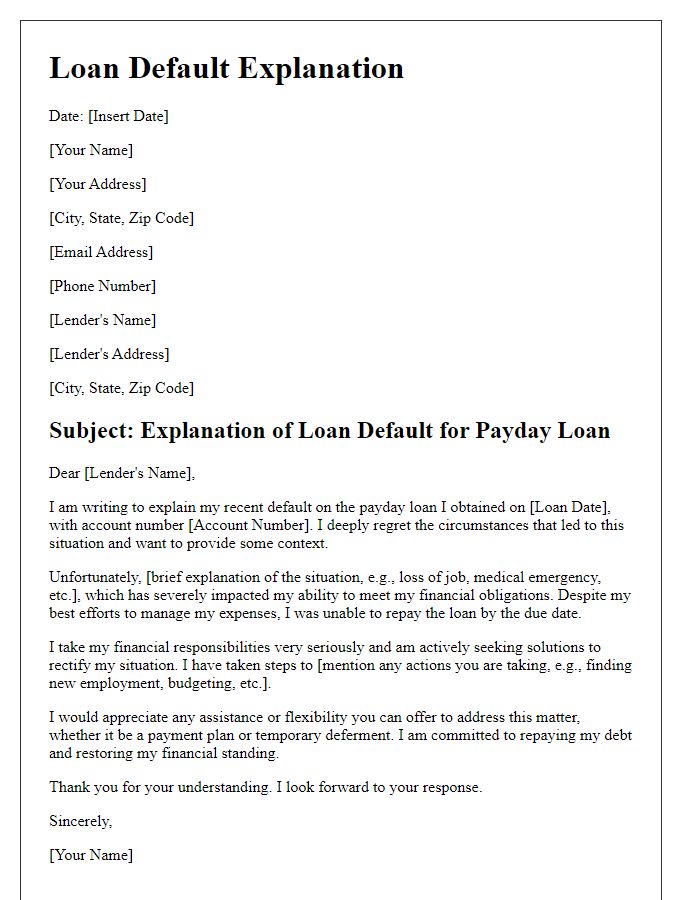

Current financial situation and repayment proposal

A borrower may encounter loan default due to unexpected financial challenges. Current circumstances often include job loss (unemployment rate at 3.7% as of October 2023), medical emergencies, or significant unexpected expenses. These factors can hinder the ability to meet scheduled repayments, leading to complications with lenders. A repayment proposal may include alternative arrangements such as extending the loan term (typically from 5 to 30 years), modified monthly payments, or temporary forbearance plans. Such proposals aim to demonstrate a commitment to resolving the debt while acknowledging the borrower's current financial limitations, ensuring open communication with lenders, and fostering a cooperative relationship during challenging times.

Request for understanding and potential resolution options

Loan default situations often stem from unexpected financial difficulties, such as job loss or medical emergencies. For instance, an individual may face a sudden reduction in income due to a layoff from a company like XYZ Corp, leading to a struggle to meet monthly payments. In the event of medical expenses, an unforeseen hospitalization could result in bills upwards of $20,000, severely straining finances. Open communication with lenders such as ABC Bank, which may offer assistance programs, is crucial. Options like deferment, forbearance, or loan modification can provide temporary relief by adjusting payment terms, helping borrowers avoid drastic measures like foreclosure or bankruptcy. Understanding and empathy from lenders during these challenging times can pave the way for mutually beneficial resolutions.

Comments