Welcome to our exploration of variable interest rate adjustments! In this article, we'll break down what a variable interest rate is and how fluctuations can impact your financial commitments. Understanding the nuances of these rate adjustments can empower you to make informed decisions that resonate with your financial goals. So, if you're curious about how this can affect your loans or investments, keep reading to uncover valuable insights!

Interest Rate Change Explanation

Variable interest rates, typically associated with loans or credit products, fluctuate based on market conditions, measured by indices like the London Interbank Offered Rate (LIBOR) or the U.S. Prime Rate. When an adjustment occurs, customers may see changes in monthly payments. Recent economic indicators, such as Inflation Rate (currently near 3.7% in the U.S. as of October 2023) or Federal Reserve interest rate decisions, significantly influence these fluctuations. For instance, an increase of 0.25% in the Federal Funds Rate can elevate loan interest rates, impacting overall debt servicing costs. Understanding these adjustments helps customers manage their financial obligations more effectively, enabling informed decisions regarding mortgages, personal loans, or credit cards.

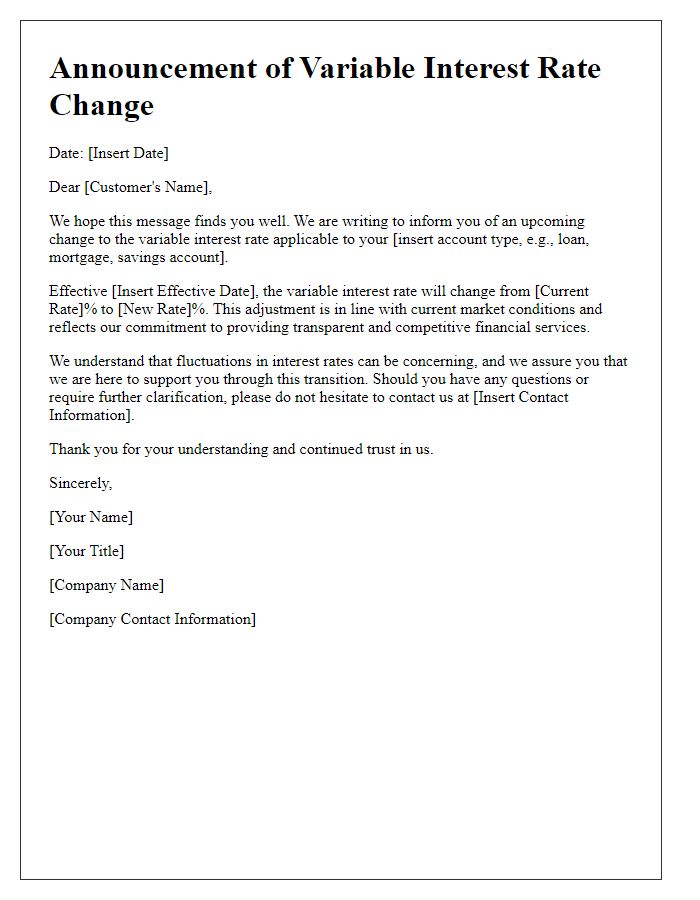

New Rate Effective Date

The adjustment of variable interest rates can significantly impact borrowers, with lenders notifying clients of new rates. For example, financial institutions, such as banks or credit unions, may implement changes in response to market conditions or central bank policies. Effective dates for new rates often align with the first day of a month, impacting monthly payments. Suppose a variable interest rate rises from 3.5% to 4.1%--this change can increase a borrower's financial obligations. Clear communication regarding this adjustment is crucial, detailing the rationale, effective adjustments, and repayment expectations. Transparent guidelines help borrowers understand implications for their budgets, ensuring they remain informed about their financial commitments.

Current Account Details

Variable interest rate adjustments can significantly impact mortgage holders, such as borrowers on adjustable-rate mortgages (ARMs). Monthly payments may fluctuate based on changes in benchmark interest rates, typically tied to indices like the London Interbank Offered Rate (LIBOR) or the U.S. Treasury yields. For example, a rise in the Federal Reserve's benchmark interest rate by 0.25% could lead to an increase in monthly payments for homeowners across the United States, affecting affordability. Accurate accounting of current account details, including principal balance, rate change frequency, and payment history, is essential for understanding potential financial implications. Borrowers are encouraged to monitor these changes regularly to manage their financial commitments effectively.

Impact on Monthly Payments

Variable interest rates, typically associated with loans such as mortgages or personal loans, fluctuate based on market conditions, impacting monthly payment amounts. For example, a recent adjustment of 0.5% in Federal Reserve interest rates can lead to significant changes in monthly payments for borrowers, particularly those with outstanding principal balances exceeding $200,000. When the rate rises, monthly payments may increase by hundreds of dollars, depending on the loan term and remaining balance. This adjustment process underscores the importance of monitoring market trends and understanding the relationship between interest rate changes and overall loan affordability. Individuals should assess their financial plans accordingly to mitigate potential impacts on their budgets.

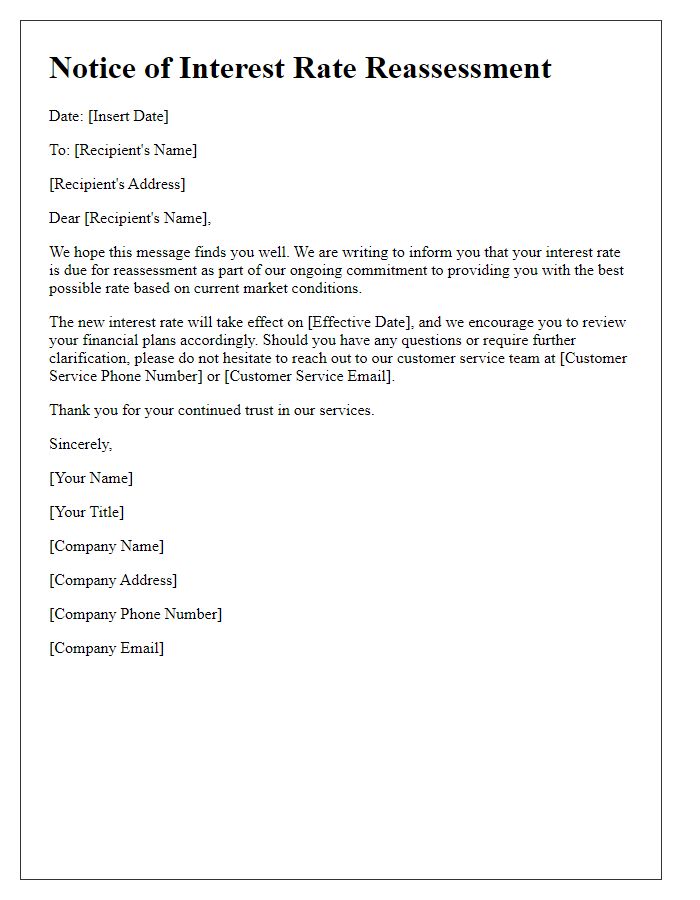

Contact Information for Queries

Variable interest rate adjustments can significantly impact borrowers, particularly in mortgage agreements or personal loans linked to fluctuating market rates. Specifically, lenders typically base these adjustments on benchmark indices such as the LIBOR (London Interbank Offered Rate) or the prime rate, affecting monthly payments and overall loan costs. For borrowers seeking clarification about these changes, lenders usually provide detailed contact information on their official correspondence. This contact information includes customer service phone numbers, dedicated email addresses, and sometimes live chat options available during business hours to address concerns regarding interest rate variations. Understanding this process ensures borrowers make informed financial decisions in light of changing economic conditions.

Comments