Hello there! As we wrap up another year, we want to keep you informed and engaged with your finances by providing your annual account statement. This letter serves as a friendly reminder that we're here to support you on your financial journey, ensuring you have all the details you need at your fingertips. If you're curious about how your investments performed or want to explore new opportunities, we invite you to read more about our insights and offerings!

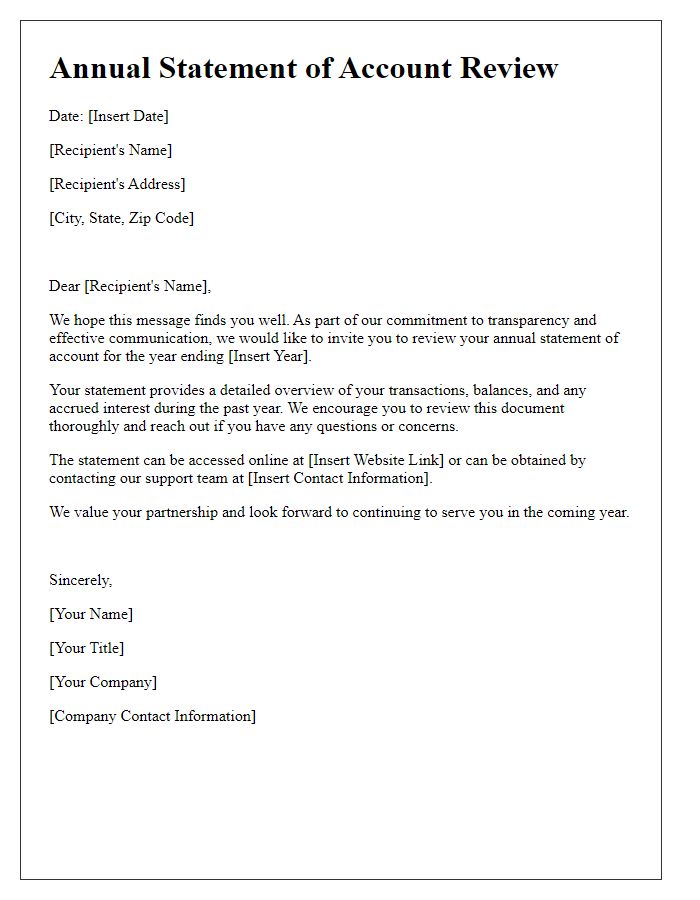

Introduction and Account Overview

The annual account statement provides a detailed overview of financial activity for the fiscal year 2023, summarizing transactions, and account balances for clients. This statement includes essential account details, such as account number (e.g., 123456789), total deposits ($10,000), withdrawals ($2,500), and interest accrued ($150). Additionally, it highlights significant events, including any fees incurred, rewards earned, and notable transactions during the year. This comprehensive report is crucial for clients to assess their financial standing and aids in preparing for upcoming tax obligations.

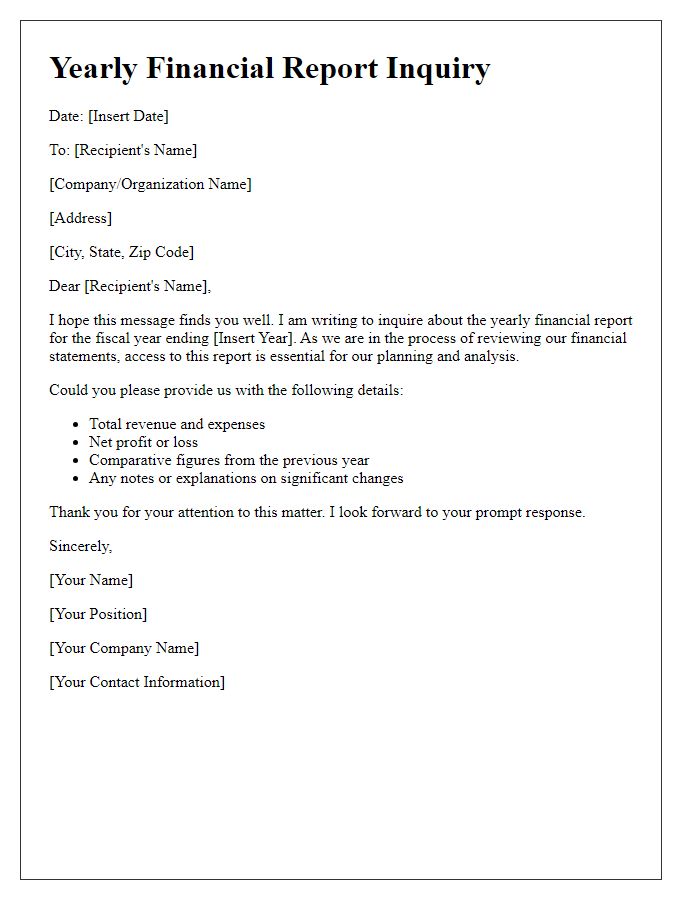

Summary of Financial Activity

Annual account statements provide a comprehensive overview of financial activity, including detailed summaries of income (monthly deposits, interest earned) and expenses (transaction fees, service charges) throughout the fiscal year. For example, a client account may reflect a total income of $15,000, with monthly deposits averaging $1,250. The expense section may indicate $500 in total transaction fees accrued due to account usage. Year-end balances offer insights, showing an overall account growth of 20%, aligning with financial goals. Additionally, clients receive a detailed breakdown of significant transactions, highlighting contributions and withdrawals. This annual statement serves as a crucial tool for individuals and businesses to assess financial health and plan future budgets.

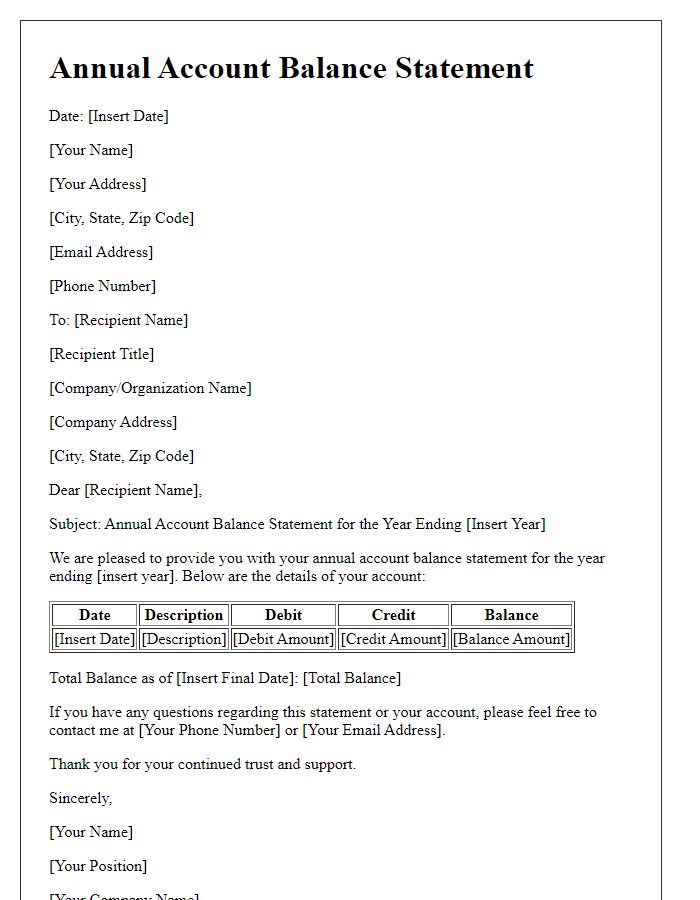

Detailed Transaction History

Annual account statements provide customers with a comprehensive overview of their financial activities throughout the year. Transaction history includes key details such as transaction dates (specific days when the transactions occurred), amounts (monetary values exchanged), and descriptions (identifying information about the nature of each transaction). This document typically lists all deposits (incoming funds), withdrawals (outgoing funds), and service fees (charges incurred for account maintenance). Additionally, end-of-year summaries offer insight into total income (aggregate sum of all deposits) and total expenses (overall outflow of funds), helping individuals assess their financial health. The statement serves not only as a record for personal budgeting but also as a tool for preparing annual tax filings, ensuring accurate reporting of income and deductions.

Year-end Balances and Interest Earned

At the end of the financial year, the annual account statement showcases critical information regarding year-end balances and interest earned within various financial accounts. Each account holder can review their total balance, which represents the sum of all deposits, withdrawals, and any additional fees incurred during the year. Interest earned, pivotal for savings accounts, typically reflects the growth of deposited funds and may vary based on annual percentage yield (APY) rates, which can range from 0.01% to 2.00% depending on the account type and financial institution, such as banks like JPMorgan Chase or online institutions like Ally Bank. Detailed transactions may also be included, illustrating how monthly deposits influenced the overall interest accumulation. Furthermore, tax implications regarding interest earned are outlined, reflecting IRS regulations relevant to the fiscal year.

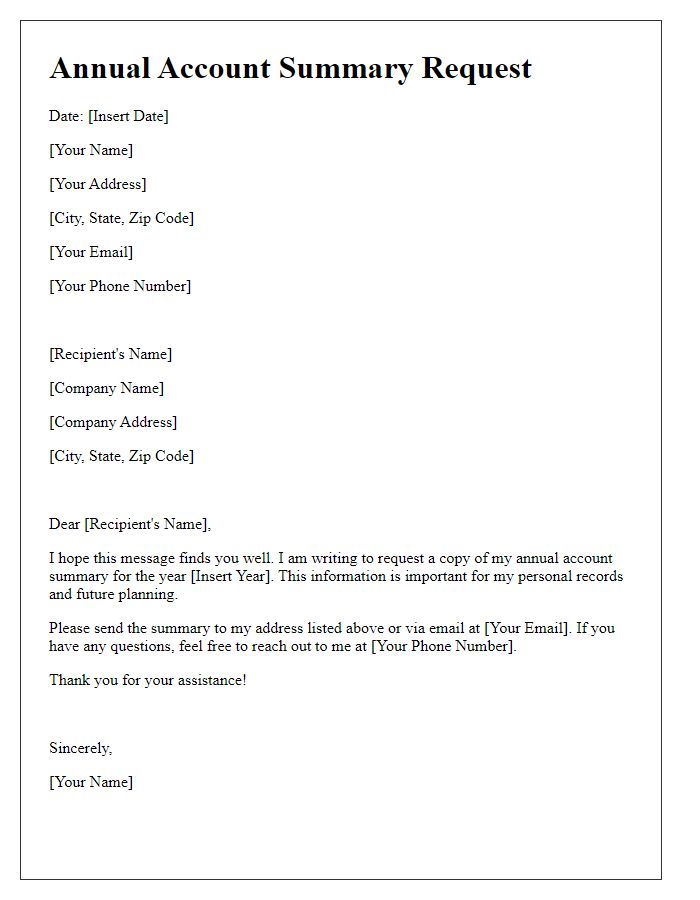

Contact Information for Inquiries

Annual account statements provide essential details about financial transactions and account status throughout the fiscal year. For any clarifications or inquiries regarding discrepancies, individuals can reach out to customer service representatives at the respective financial institution. Typically, the contact information is prominently displayed, including a dedicated phone number (often toll-free, such as 1-800-123-4567 in the United States), email address (like support@financialinstitution.com), and physical mailing address, ensuring clients can easily access assistance. Business hours are usually specified, such as weekdays from 9 AM to 5 PM EST, allowing for efficient communication during operational hours.

Comments