Are you looking for a clear and effective way to communicate about dual-advance loan disbursement? Writing a letter for this purpose may seem daunting, but it can be quite simple with the right approach. In this article, we'll guide you through creating a template that conveys the necessary details while maintaining a professional tone. So, let's dive deeper into the essentials of drafting the perfect letter and help you make the process smoother!

Loan Details (amount, interest rate, term)

The dual-advance loan disbursement outlines specific financial details that borrowers should be aware of such as the total loan amount, which is often a significant sum varying between $10,000 and $500,000. The interest rate, typically ranging from 5% to 12% annually depending on creditworthiness and market conditions, directly affects the total cost of borrowing. The loan term, usually spanning from 1 year to 30 years, determines the repayment schedule, with monthly installments comprising both principal and interest. Understanding these factors is crucial for borrowers to assess the affordability and financial implications of the loan agreement.

Borrower Information (name, address, contact)

In the context of financial transactions, a dual-advance loan disbursement refers to a structured lending approach allowing borrowers to receive funds in two distinct phases. The borrower's information--such as the full name (e.g., John Doe), residential address (e.g., 123 Elm Street, Springfield, IL), and contact details (such as a phone number, 555-123-4567)--is crucial for identification and communication purposes. Accurate borrower information ensures the effective tracking of the loan and compliance with regulatory requirements during the disbursement process. The financial institution typically requires this data to initiate agreements, process payments, and maintain open lines of communication throughout the loan term.

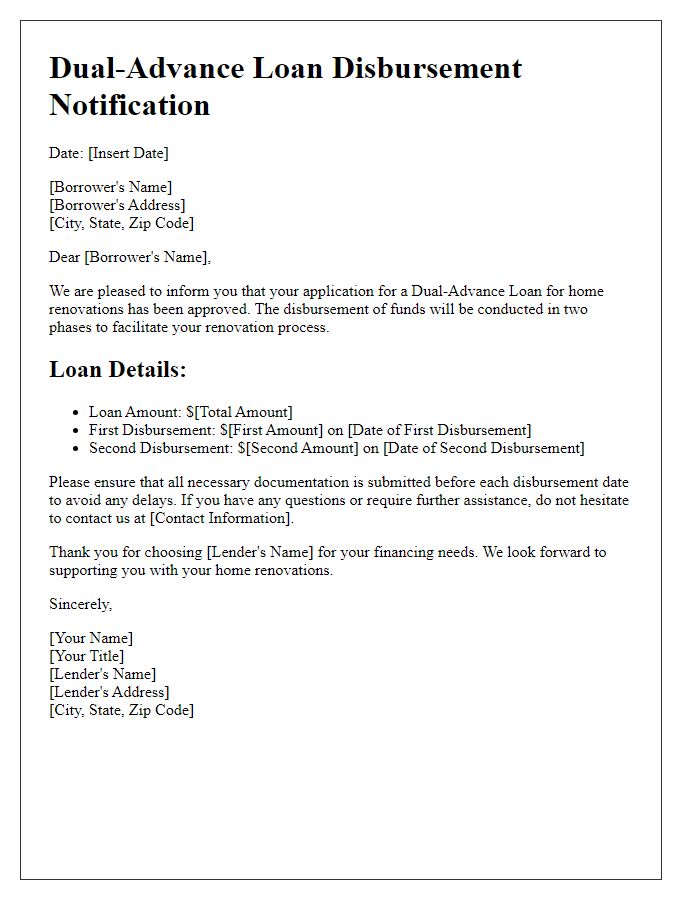

Disbursement Schedule

A dual-advance loan disbursement schedule details the structured release of funds to borrowers, typically in two distinct phases. This schedule outlines the specific amounts to be disbursed, including the initial advance, often used for immediate expenses such as home renovations or business startup costs, and a subsequent advance, which may be allocated for additional financing needs or unexpected expenditures. It is critical for borrowers to clearly understand the timeline, which can span weeks or months depending on the financial institution's policies and the nature of the loan agreement. Regular communication with lenders, including important dates for the release of funds and any required documentation, can help ensure a smooth disbursement process.

Repayment Terms and Conditions

A dual-advance loan disbursement typically involves specific repayment terms and conditions that borrowers must understand. The loan amount, often represented in thousands or millions, is divided into two separate advances provided at different intervals. For instance, the initial advance may be released upon loan approval, while the second advance is contingent on meeting predetermined milestones, such as completing a specific phase of a project. Interest rates, commonly ranging from 4% to 12%, apply to both advances, affecting the total repayment amount significantly. Repayment schedules can vary, with some loans offering monthly payments over a period of 5 to 30 years, allowing borrowers to budget for their financial obligations accordingly. Late payments can incur fees, often set at a percentage of the missed payment, emphasizing the importance of maintaining timely payments. Additionally, collateral may be required, such as property or equipment, to secure the loan, which can impact the borrower's financial stability if default occurs.

Authorization and Signatures

Dual-advance loan disbursement requires precise documentation to ensure compliance and efficiency within financial transactions. Clear authorization protocols must be established, typically necessitating signatures from both the borrower and the lending institution. The borrower must provide identification details, such as a driver's license number or passport information, to validate their identity. Additionally, a loan agreement detailing the terms of the dual-advance loan should be signed, including the interest rate (often ranging from 3% to 10%), repayment schedule (monthly or bi-weekly), and any applicable fees (like origination fees, typically 1% to 5% of the loan amount). Signature lines must be designated for the lender's authorized representatives, including titles (such as Branch Manager or Loan Officer), to ensure acknowledgment and legal binding of the agreement. All parties involved should retain a copy of the signed documents for their records, facilitating transparency and accountability throughout the loan process.

Letter Template For Dual-Advance Loan Disbursement Samples

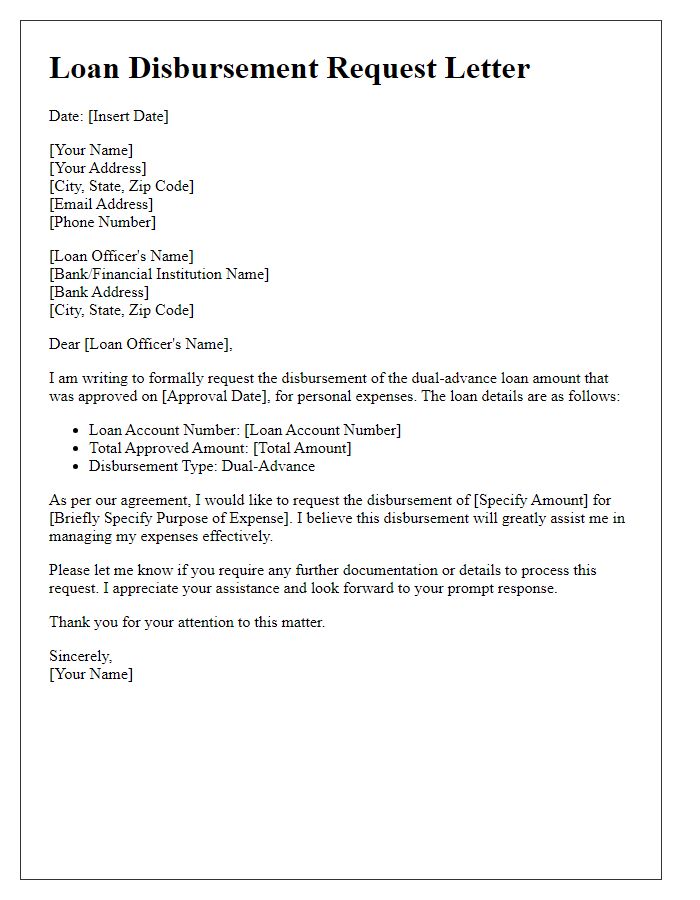

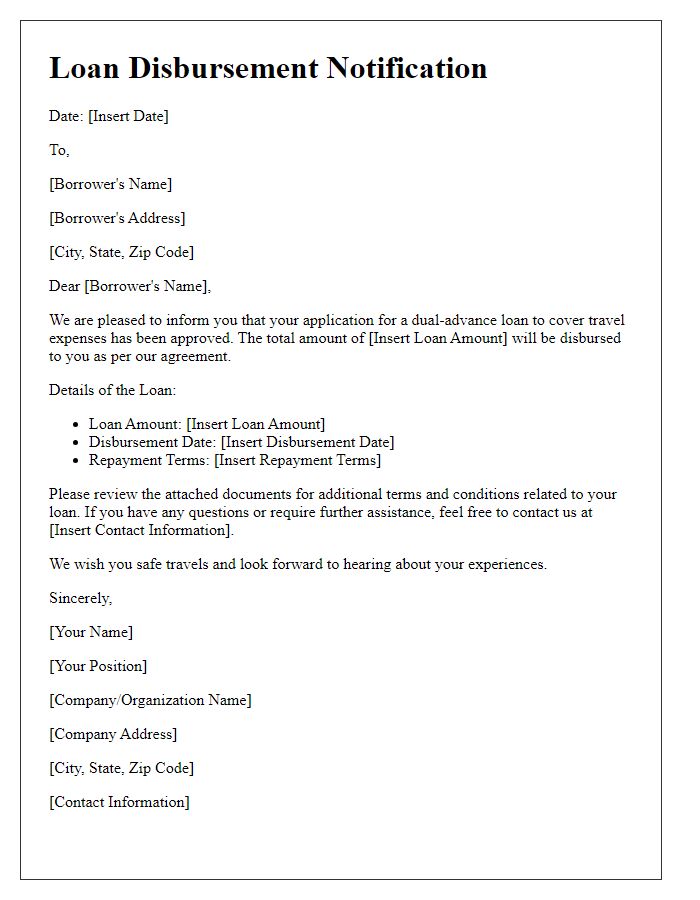

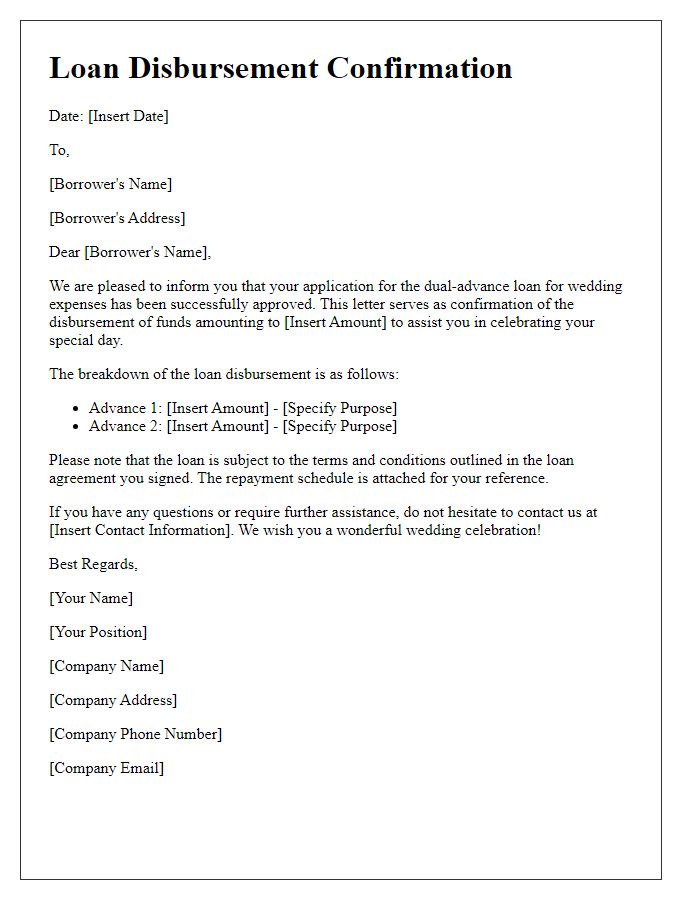

Letter template of dual-advance loan disbursement request for personal expenses.

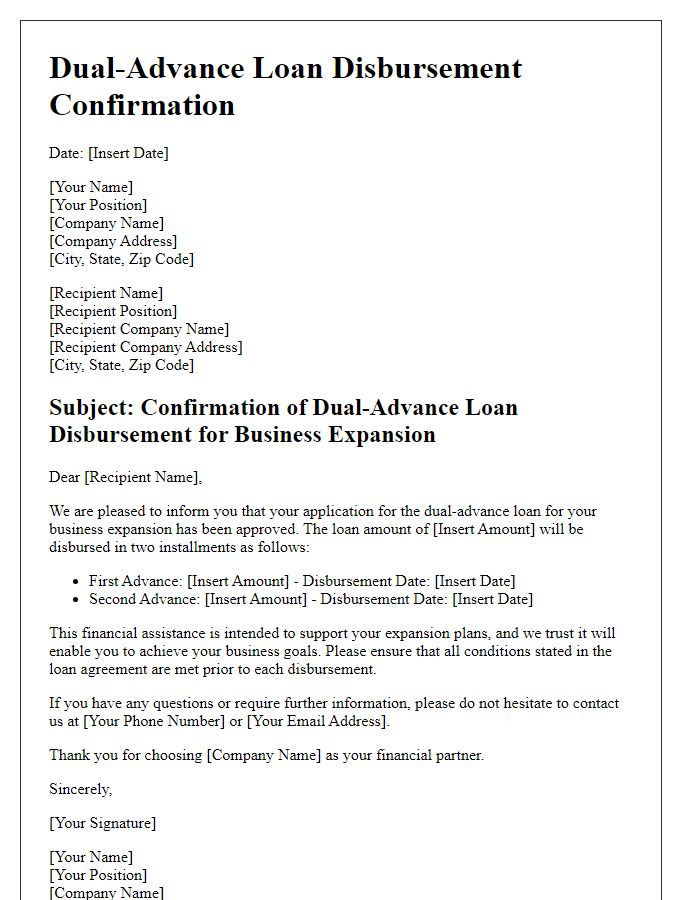

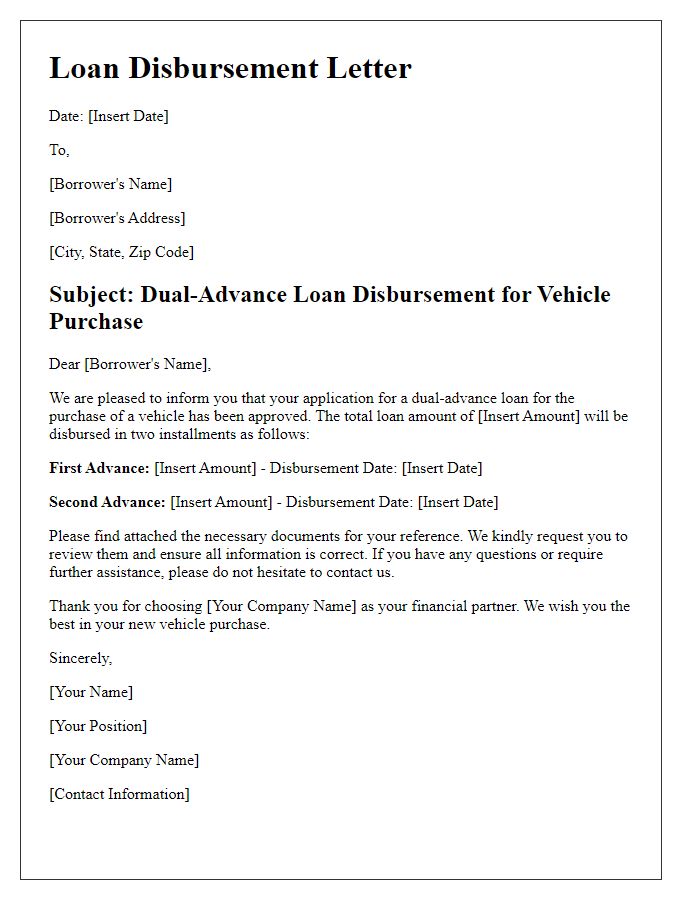

Letter template of dual-advance loan disbursement for business expansion.

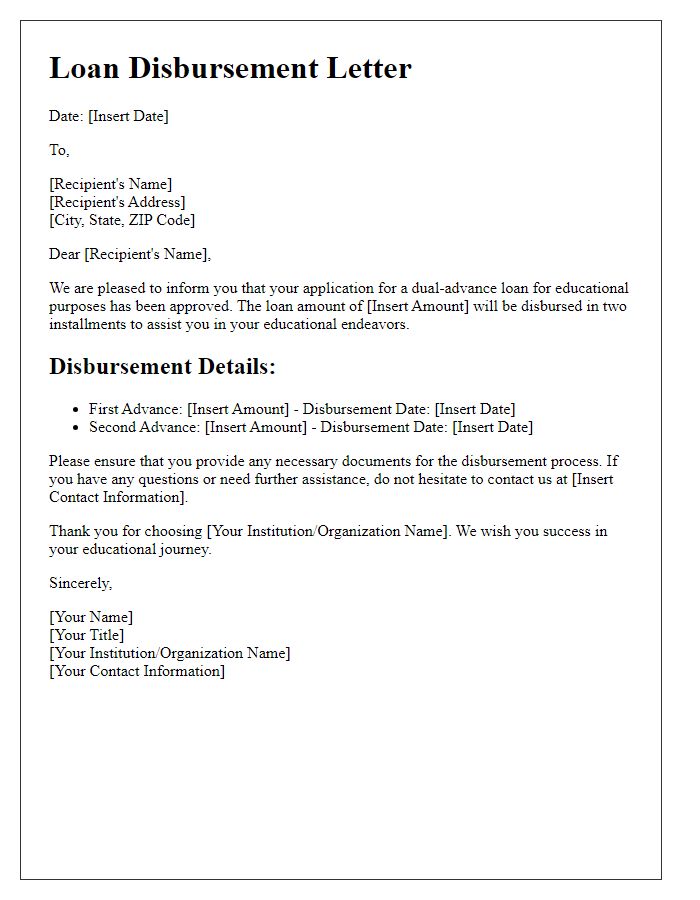

Letter template of dual-advance loan disbursement for educational purposes.

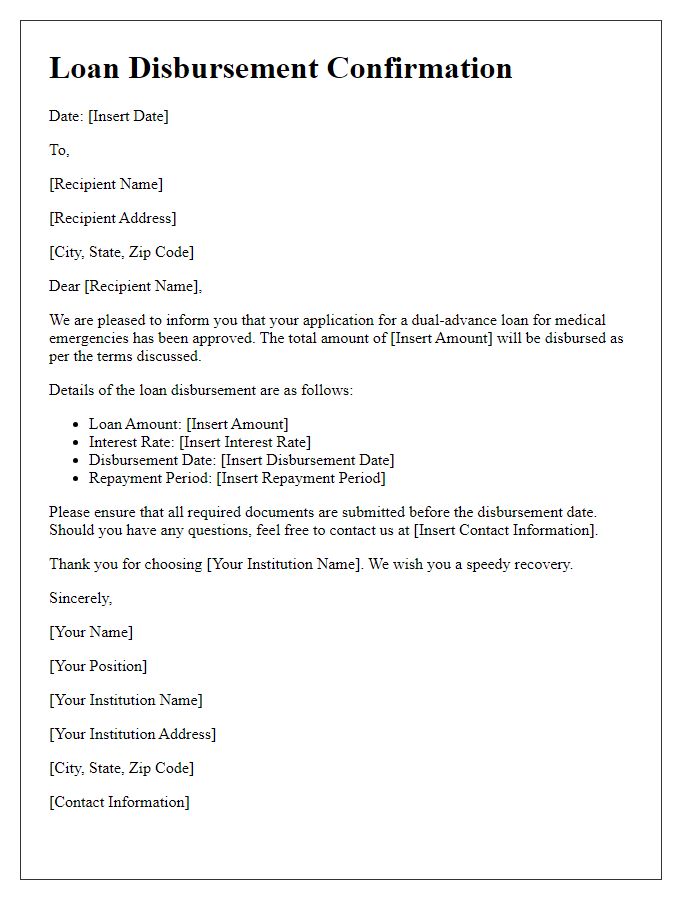

Letter template of dual-advance loan disbursement for medical emergencies.

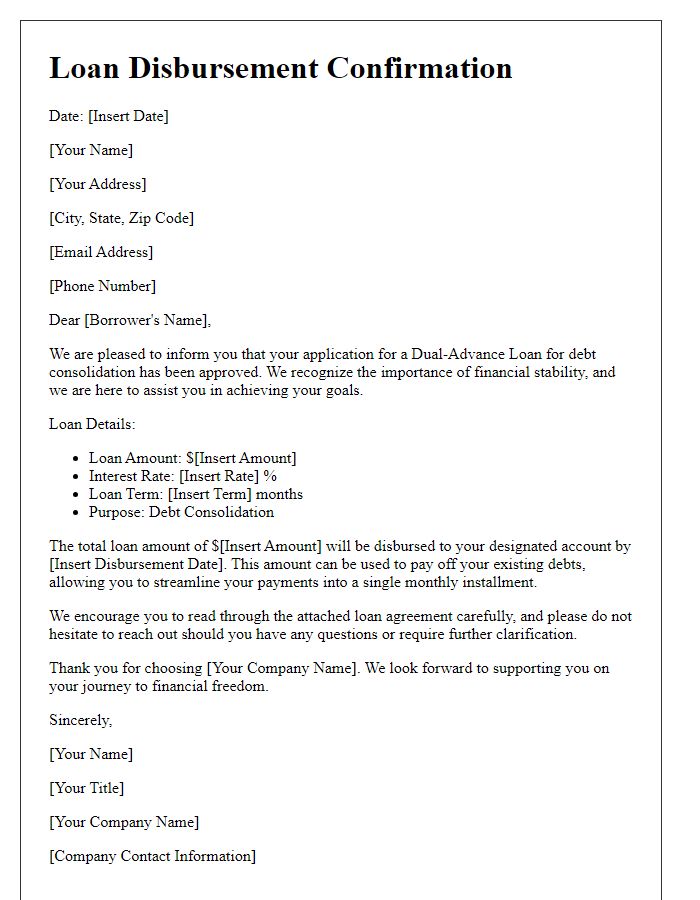

Letter template of dual-advance loan disbursement for debt consolidation.

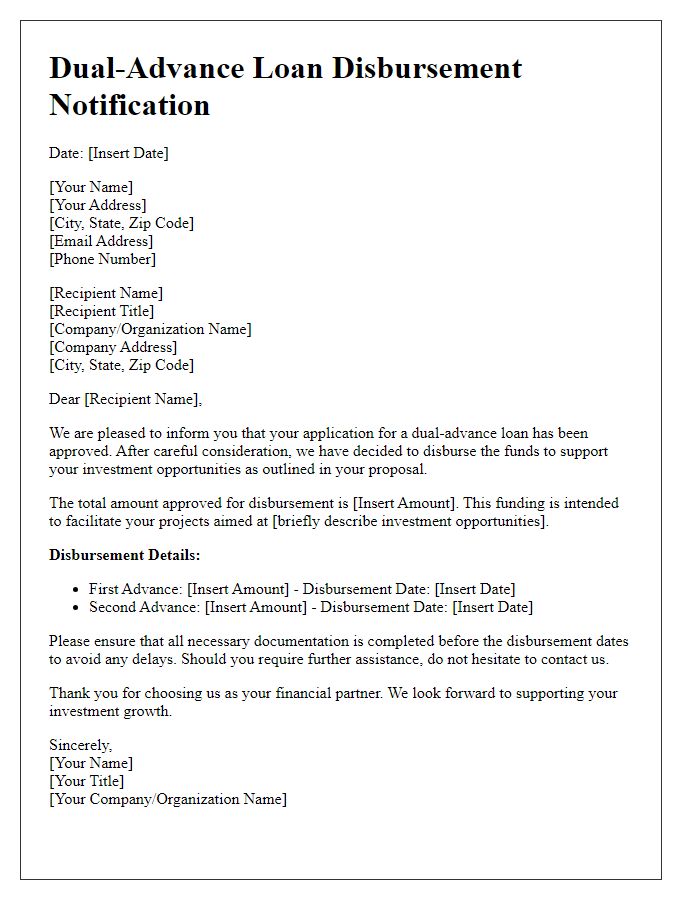

Letter template of dual-advance loan disbursement for investment opportunities.

Comments