Are you considering an interest-only loan but unsure if it's the right fit for you? These types of loans allow borrowers to pay only the interest for a specific period, making monthly payments lower during that time. However, there are crucial factors to consider, such as the potential for increased payments later on and the impact on your long-term financial health. Join us as we dive deeper into the pros and cons of interest-only loans and help you make an informed decision!

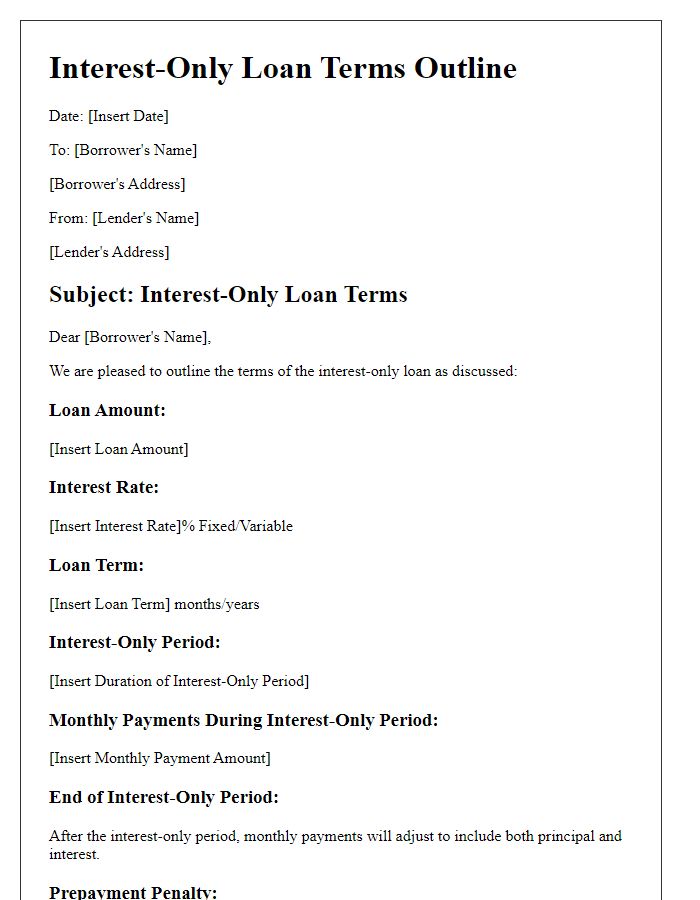

Loan specifics and terms

Interest-only loans allow borrowers to pay only the interest for a specified period, typically between 5 to 10 years. During this initial phase, monthly payments are lower, making it attractive for homeowners looking to manage cash flow. After the interest-only period ends, borrowers must start paying off the principal, leading to significantly higher payments. The maximum loan amount varies based on factors such as credit score, income, and property value, often reaching up to $1 million for qualified buyers in major markets like San Francisco or New York City. Interest rates on these loans can be fixed or adjustable, with fixed rates generally ranging from 3% to 5%. Lenders often require a down payment of at least 10%, ensuring commitment while managing risk. Understanding the potential for payment shock during the transition period is crucial for a well-informed decision.

Interest rate details

Interest-only loans present a unique financial opportunity for borrowers seeking lower initial monthly payments and potential cash flow benefits. The current interest rate for these loans hovers around 3.5% to 4.5% annually, varying based on creditworthiness and market conditions. Borrowers should note that these rates apply during the interest-only period, typically spanning 5 to 10 years before transitioning to a repayment phase, which may significantly increase monthly obligations. It's essential to consider the implications of the loan's structure, especially after the interest-only period ends, as the principal balance remains unchanged, potentially leading to larger payments in the long term. This strategy can be particularly beneficial for investors in real estate markets like San Francisco, where property values have historically appreciated over time.

Repayment schedule information

An interest-only loan, typically associated with mortgage products, allows borrowers to pay only the interest on the principal balance during a specified period, often 5 to 10 years. During this time, monthly payments consist solely of interest at a fixed or variable rate, which can lead to lower initial payments compared to standard loans. After the interest-only period ends, borrowers transition to a repayment schedule where they start paying both principal and interest, often resulting in a significant increase in monthly payments. Notable factors include the interest rate (commonly between 3% and 6%) and the remaining term of the loan (often 15 to 30 years), which impacts overall payment amounts. Understanding the repayment schedule is critical, as it dictates the financial obligations and planning required for borrowers in markets such as the United States or the United Kingdom.

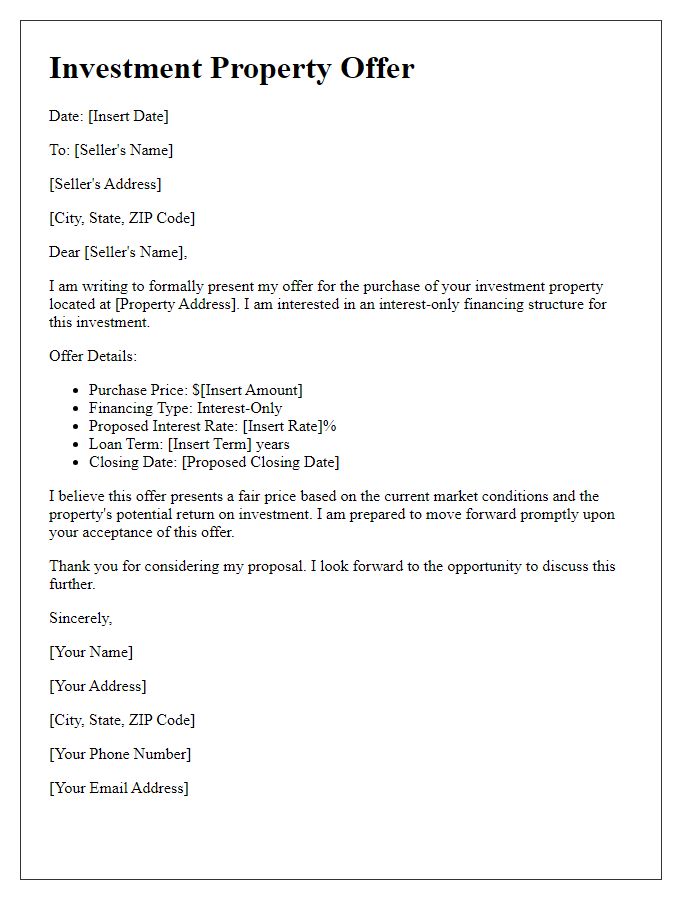

Eligibility and qualification criteria

Interest-only loan offers cater to borrowers seeking lower initial payments. Eligibility criteria typically include a minimum credit score of 620, a stable income verification, and a debt-to-income ratio not exceeding 43%. Properties must meet certain qualifications, often requiring that they are owner-occupied or investment properties valued above $100,000. Lenders may impose loan-to-value (LTV) ratios of 80% or less, ensuring borrowers have sufficient equity in their homes. Documentation such as tax returns, W-2 forms, and bank statements will be required to verify financial stability and repayment capability. Additionally, interest-only loans may necessitate a larger down payment, often around 20% or more of the property's value.

Contact information for inquiries

Interest-only loans can significantly impact monthly payments and overall financial strategy. The loan structure allows borrowers to pay only interest for a specified period, typically 5 to 10 years, before transitioning to principal repayment. This type of financing can benefit individuals seeking lower initial payments, often appealing to first-time homebuyers or investors in high-value markets like San Francisco or New York City. However, potential risks include payment shock when the loan flat rate adjusts after the interest-only term, potentially leading to financial strain. For inquiries about this loan offer, individuals can reach the lender's customer service team at their dedicated helpline, ensuring prompt assistance and guidance throughout the loan process.

Comments