Are you looking to streamline your payment processes with an electronic payment authorization letter? This handy template can help you clearly communicate your authorization to process transactions electronically, ensuring a smooth and efficient payment experience. With just a few simple details, you'll set the stage for timely payments while maintaining essential financial control. Ready to simplify your payments? Keep reading to explore our detailed letter template!

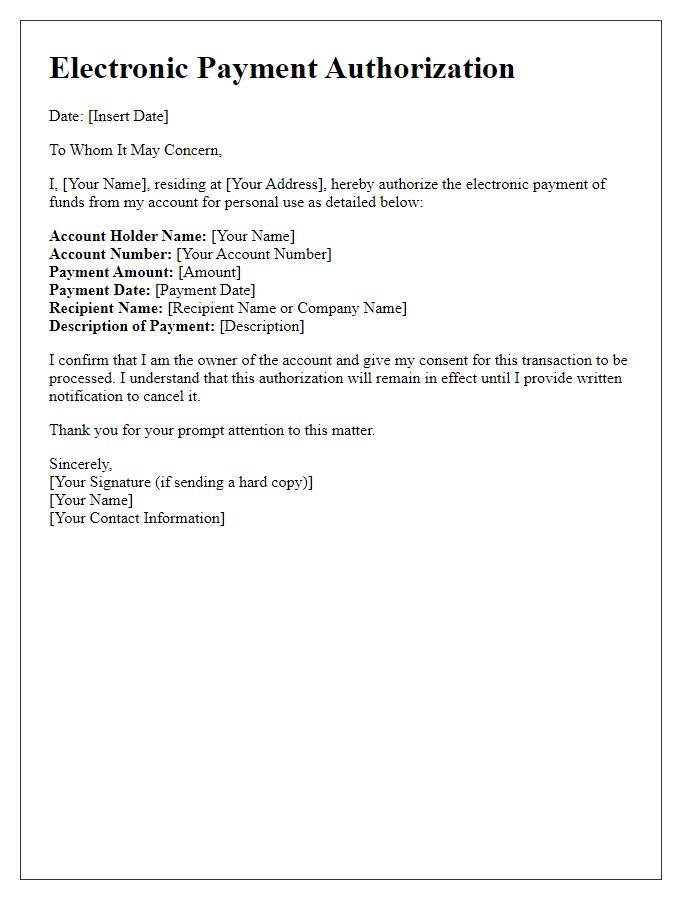

Sender and recipient details

Electronic payment authorization facilitates secure transactions between financial institutions. The sender, identified by their name, address, and authorized account details, initiates the process, while the recipient, often a business or service provider, provides specific banking information, including bank name, account number, and routing number. Timely completion of this authorization is crucial, as it triggers the transfer of funds, ensuring that payments are processed efficiently within the designated timeframe. Increased reliance on electronic payment methods highlights the need for stringent security measures to protect sensitive information from potential cyber threats.

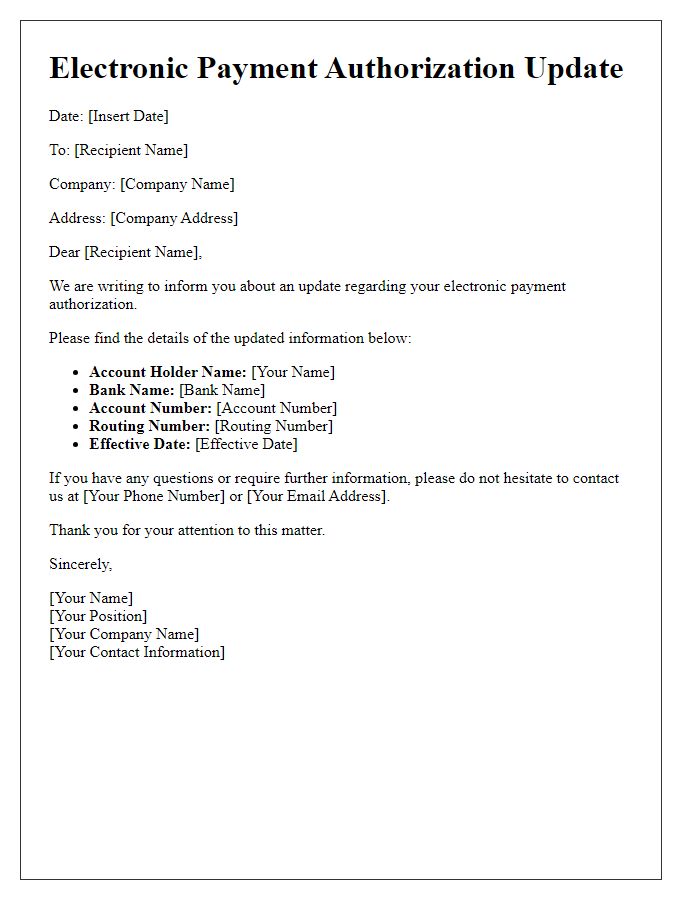

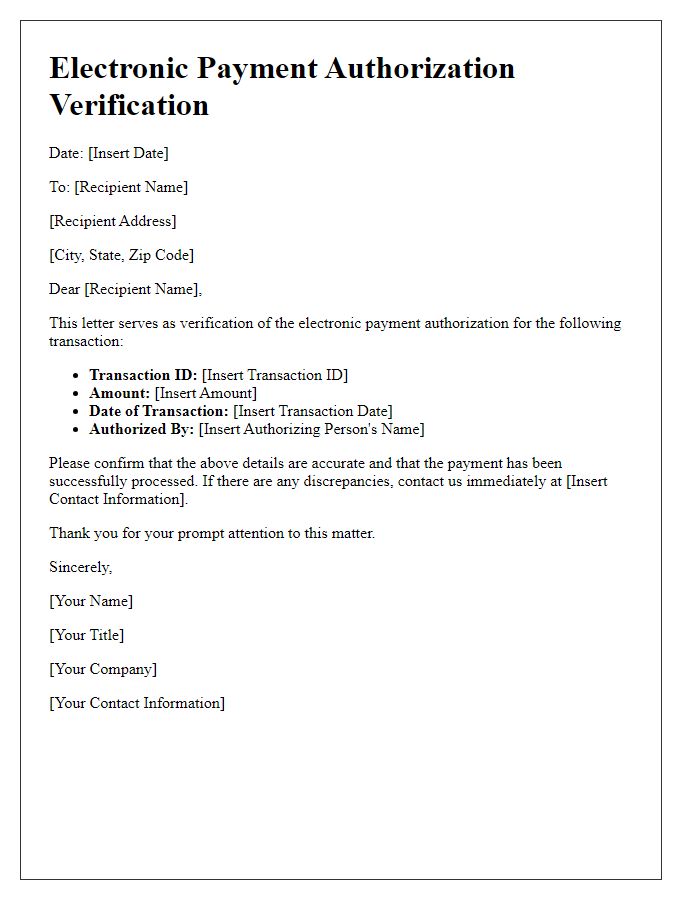

Payment details and amount

Electronic payment authorization involves the processing of funds via digital methods, such as credit cards or bank transfers. Accurate payment details (including name, account number, and transaction reference) are crucial to avoid errors. Payment amount is critical, often stated in currency formats like USD or EUR, determining the value being transferred. Incorrect details may lead to payment delays or cancellations, impacting both sender and receiver. Security protocols, such as encryption, protect sensitive information during the transaction process, ensuring financial safety. Entities involved typically include banks, payment processors, and the receiving merchant or service provider.

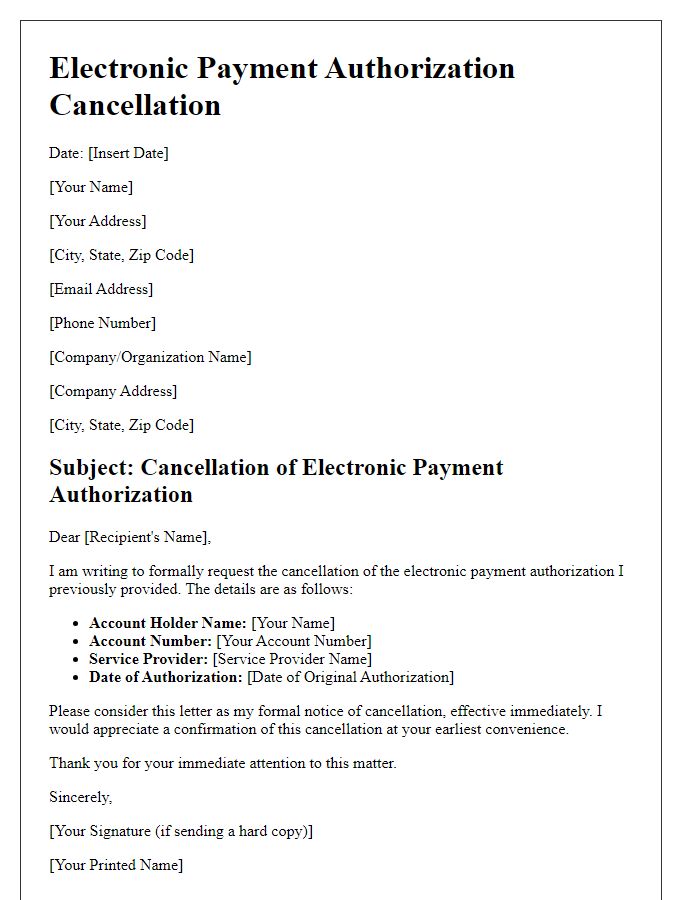

Authorization statement

Electronic payment authorization enables seamless financial transactions between entities, facilitating efficient fund transfers without the need for physical checks. This process involves sensitive information, such as bank account numbers, credit card details, or digital wallets, which require robust security measures to prevent unauthorized access. Compliance with regulations, such as the Payment Card Industry Data Security Standard (PCI DSS), ensures that personal and financial data remains protected throughout the transaction process. Additionally, various payment platforms, like PayPal and Stripe, offer built-in processing capabilities that streamline approvals for users, enhancing the overall payment experience while minimizing transaction times and associated fees.

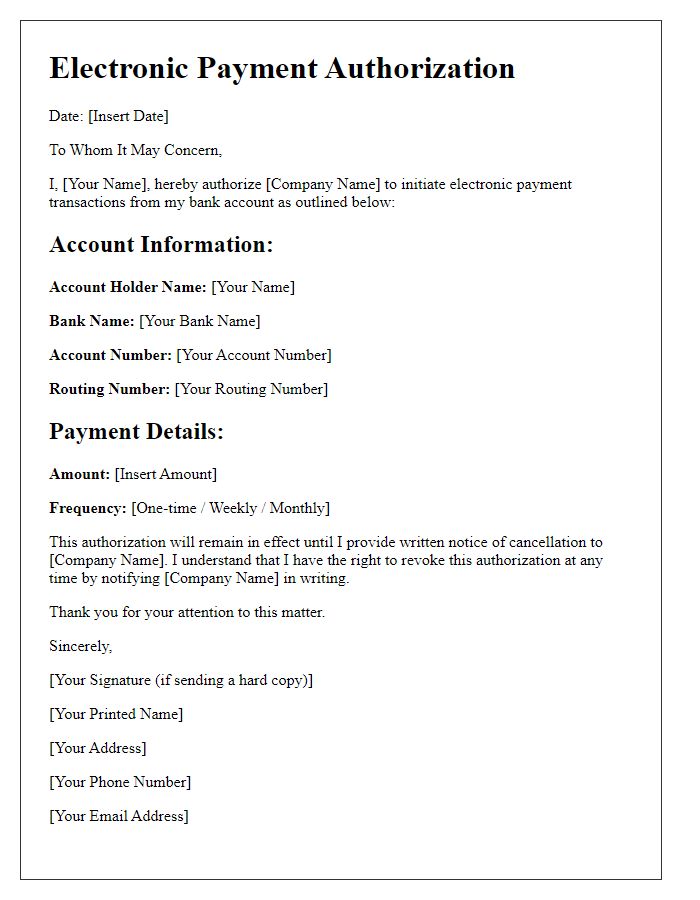

Account information

Electronic payment authorization requires specific account information to facilitate secure transactions. Essential details include the account holder's name, typically the individual or business name registered with the bank. The bank account number, a unique identifier assigned by the financial institution, must also be provided to ensure accurate processing. Additionally, the routing number, which specifies the bank's location and facilitates fund transfers, is crucial. Date of authorization is necessary for record-keeping, establishing when the authorization was granted. Signature, either digital or handwritten, validates the transaction and confirms consent to process payments from the specified account. Ensuring all details are accurate is vital to prevent transaction errors or delays.

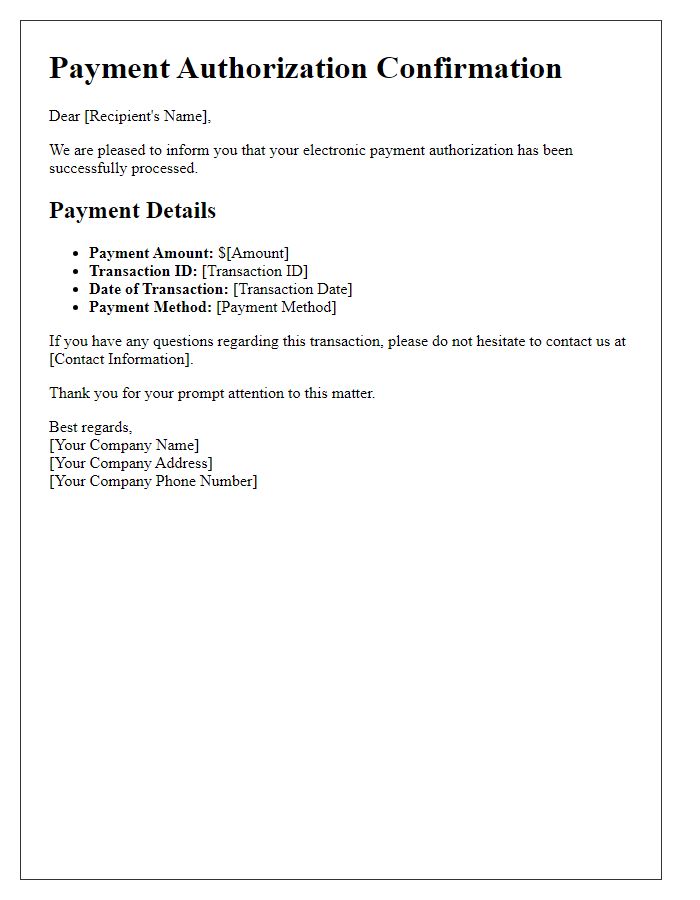

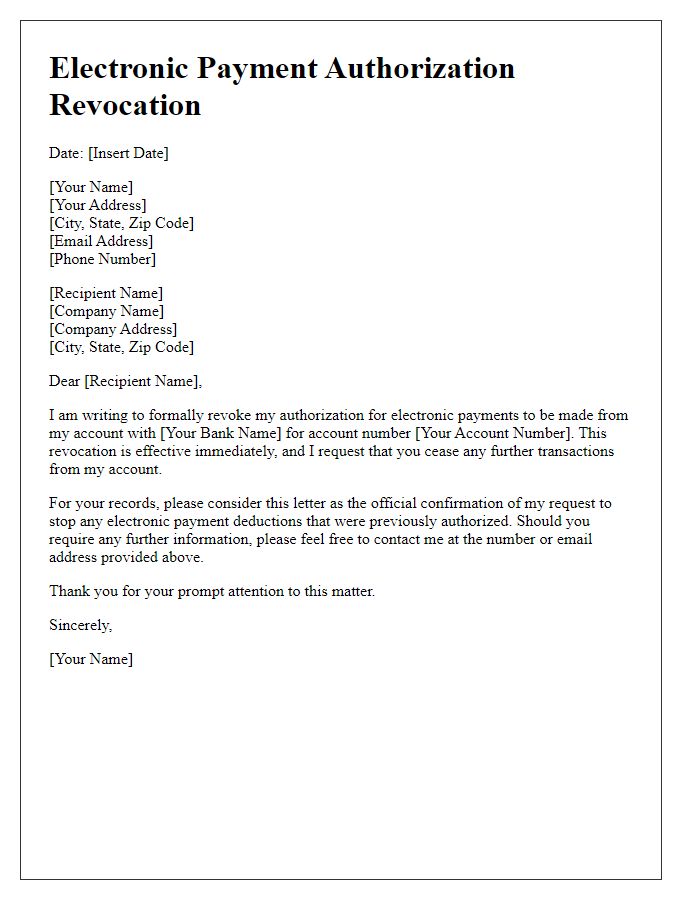

Contact information and signature

Electronic payment authorization requires clear contact information and a valid signature. The full name of the individual authorizing the payment should be provided, along with their email address and phone number for any necessary follow-up. The signature must be either digital or handwritten, depending on the company's policies and legal requirements. Including the date of authorization ensures a timeline for the transaction, enhancing accountability. Essential details may also include the transaction amount, type of payment (credit card, ACH), and the name of the service provider or vendor receiving the payment. Proper formatting can facilitate smooth processing and compliance with electronic payment regulations.

Letter Template For Electronic Payment Authorization Samples

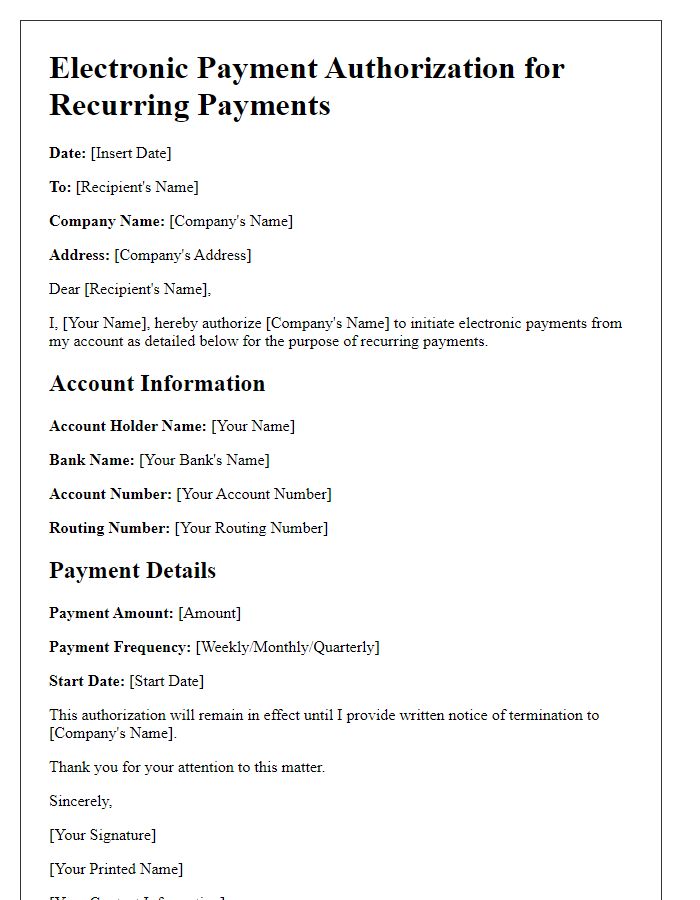

Letter template of electronic payment authorization for recurring payments.

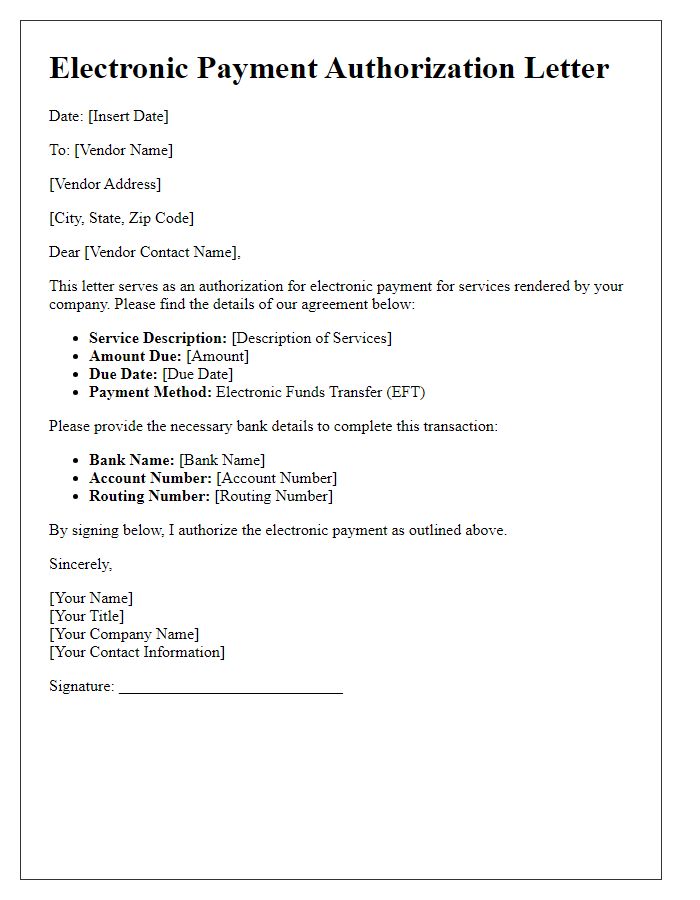

Letter template of electronic payment authorization for vendor services.

Comments