Are you considering a mobile home as your next big investment? Navigating the world of mobile home loans can feel overwhelming, but a well-structured acceptance letter can make all the difference. This essential document paves the way for securing funding, providing you with clarity and confidence in your purchase journey. Ready to dive deeper into crafting the perfect letter for your mobile home loan acceptance?

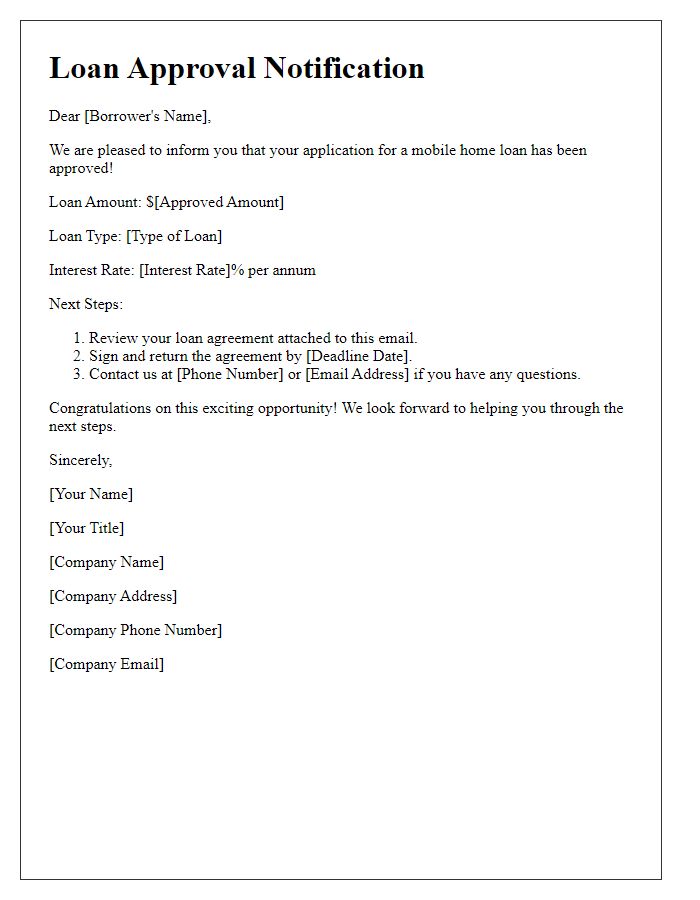

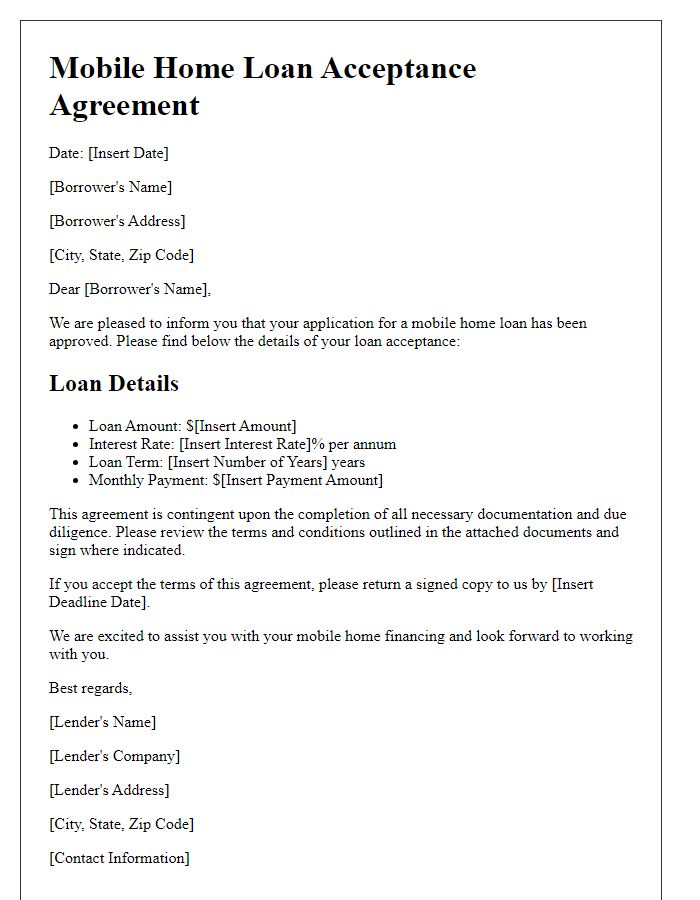

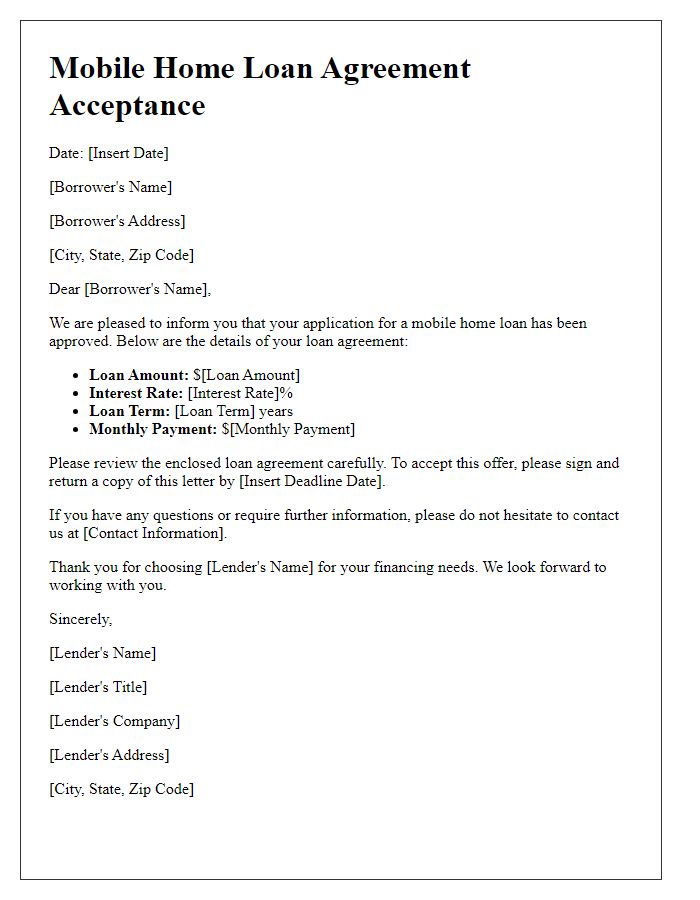

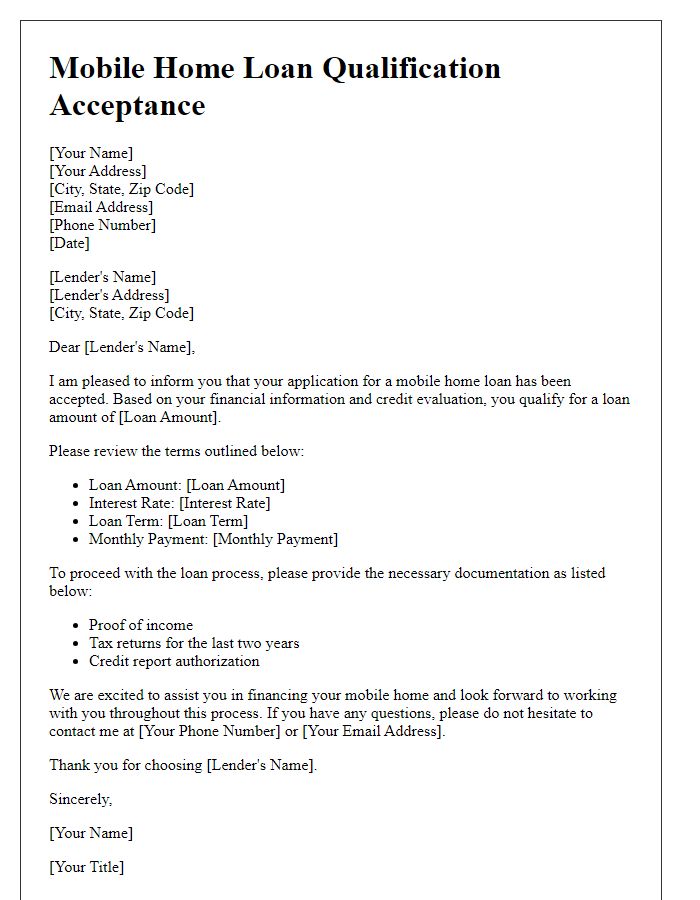

Borrower's Information

The borrower's information section includes essential details such as the full name of the borrower, which is required for identification purposes in loan documents. The address must include the street number, street name, city, state, and zip code, providing a complete physical location of the borrower's residence. The Social Security number, a unique nine-digit identifier, is necessary for credit checks and financial background verification. The date of birth helps establish the borrower's age, confirming eligibility requirements. Additionally, details regarding the borrower's employment status and income level, including monthly income, sources of income, and duration of employment, support the assessment of financial stability and repayment ability.

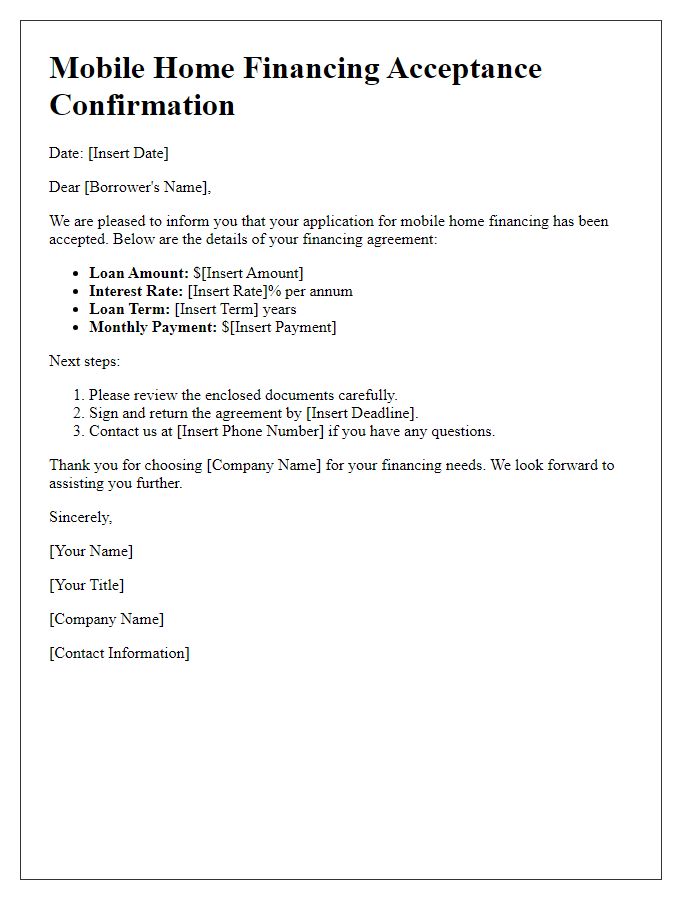

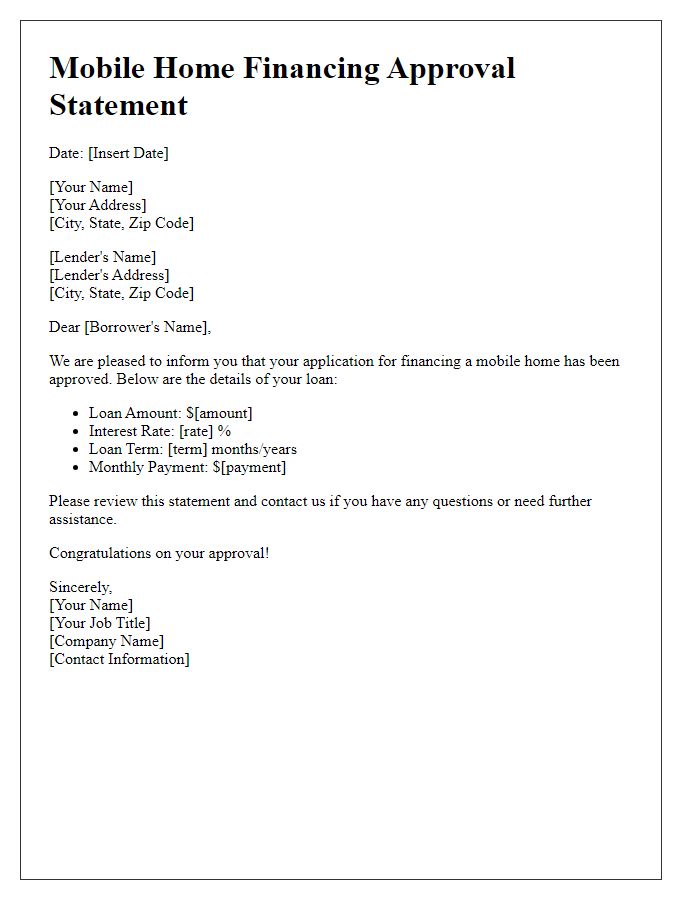

Loan Terms and Conditions

Mobile home loan acceptance entails a complex set of terms and conditions that must be carefully considered. The loan amount typically ranges from $10,000 to $100,000, depending on the value of the mobile home, interest rates might vary between 4% and 10% based on credit scores and other risk factors. Loan durations can span from 15 to 30 years, affecting monthly payments significantly. Borrowers may be required to provide a down payment, often around 5% to 20% of the home's purchase price, along with necessary documentation, including proof of income and employment verification. Closing costs can include fees such as title insurance, appraisal fees, and recording fees, amounting to approximately 2% to 5% of the loan, which should also be factored into the total financial commitment. Failure to comply with agreed-upon terms may result in penalties, including late fees or potential foreclosure, making it crucial for borrowers to fully understand their obligations and the implications of their borrowing decisions.

Payment Schedule

Accepting a mobile home loan involves understanding the payment schedule, including principal and interest amounts. The loan agreement usually outlines monthly payments, typically due on the first day of each month. For example, a loan of $50,000 at an interest rate of 5% over 10 years can result in monthly payments of approximately $530. Missing payments can lead to late fees and potentially damage credit scores. Payment methods include electronic transfers, checks, or auto-debit options, providing flexibility for borrowers. Annual statements summarize payments made and remaining balances, essential for financial planning.

Interest Rate and Fees

Interest rates for mobile home loans can significantly impact overall financing costs. Rates fluctuate depending on various factors including credit score, lender policies, and loan duration, typically ranging from 4% to 8% annually. Additionally, borrowers may encounter fees such as origination fees (usually 1% to 2% of the loan amount), appraisal fees (approximately $300 to $500), and processing fees. These fees can contribute to closing costs, which may total around 2% to 5% of the loan amount. Understanding the breakdown of these charges is crucial for effective budgeting in the home buying process. Knowledge of these terms can empower borrowers to negotiate better rates or seek alternative financing options.

Contact Information of Loan Officer

A mobile home loan acceptance often comes through direct communication with a loan officer, who serves as the primary point of contact throughout the financing process. Key details include the loan officer's contact information, typically consisting of a full name, work phone number (often a 10-digit number formatted as (XXX) XXX-XXXX), and a professional email address (including the domain name of the lending institution). Additionally, it may be beneficial to include the name of the lending institution, along with its physical address (street, city, state, and zip code), to ensure complete context. This information allows borrowers to reach out with questions regarding terms, interest rates, or any necessary documentation required for the mobile home financing process.

Comments