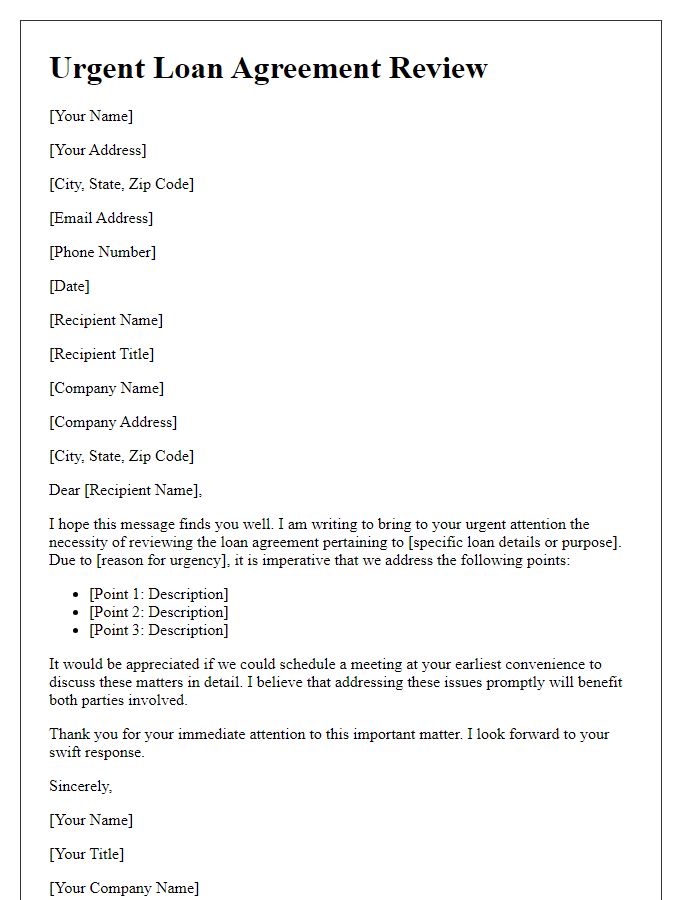

Are you considering modifying your loan agreement but aren't sure how to approach it? Navigating the complexities of loan modifications can feel daunting, but it's essential for maintaining your financial health. Whether it's adjusting your payment terms or negotiating a lower interest rate, a well-crafted letter can make all the difference. Dive in to discover our comprehensive template that simplifies the process, ensuring your request is clear and compelling!

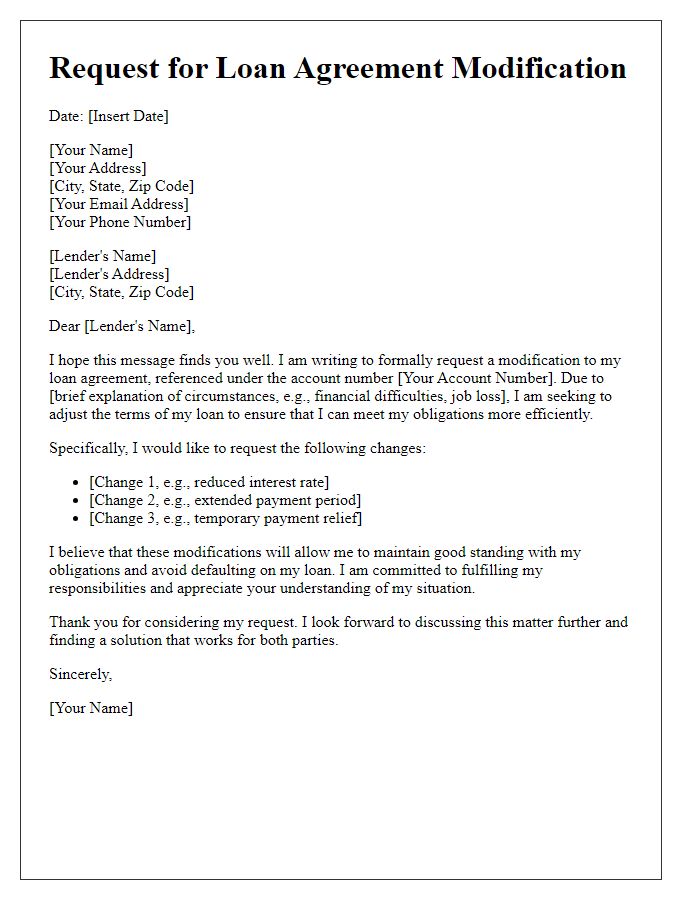

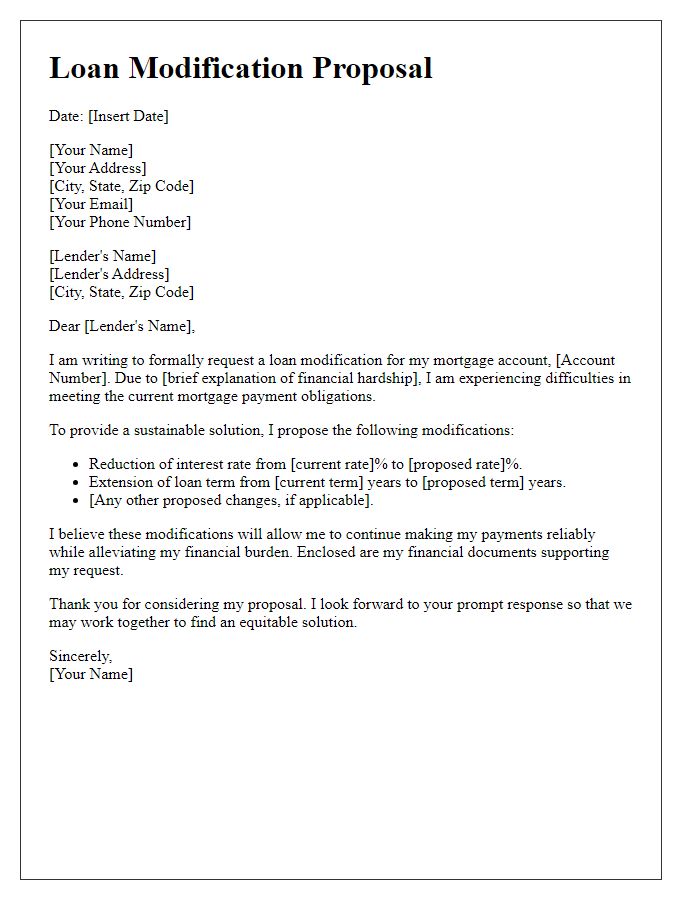

Borrower and lender information

Borrowers seeking modification of a loan agreement must provide comprehensive information to ensure clarity and process efficiency. For the borrower, personal details include full name, residential address, Social Security number, and contact information, while the lender should include the financial institution's name, address, contact person, and relevant account number. Additional information might encompass the original loan amount, loan number, current payment terms, and any specific reasons for seeking modification, such as financial hardship or changes in employment status. Clear documentation enhances understanding and expedites the modification process, ensuring both parties have aligned expectations and a mutual agreement moving forward.

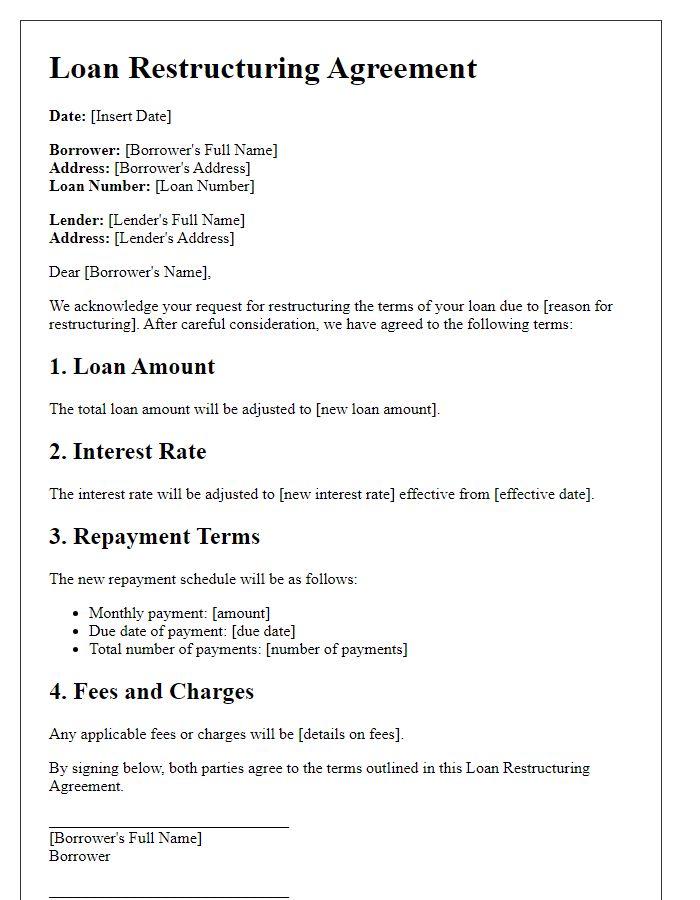

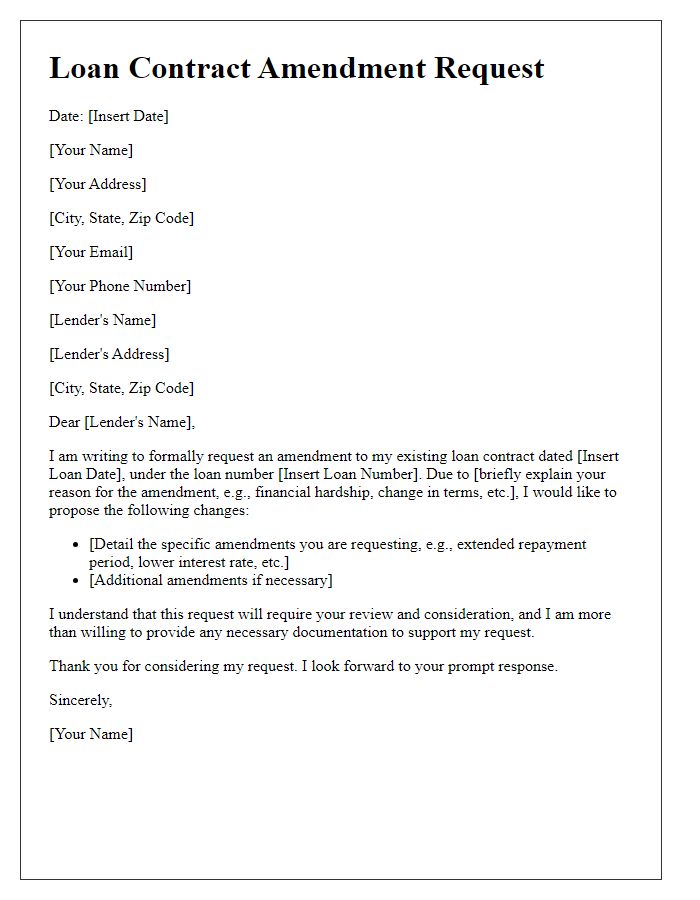

Loan details and modification terms

A loan agreement modification involves altering the original terms of a loan, such as interest rates, payment schedules, or collateral requirements. For example, a borrower may seek a reduction in the interest rate from 5% to 3% on a $50,000 loan taken in 2020, which spans until 2025. The modification might extend the repayment period from 15 years to 20 years, reducing monthly payments from $400 to $350. Additionally, collateral terms may shift, removing the need for property collateral valued at $100,000. Both parties, lender and borrower, must agree to these details, ensuring clarity and legal compliance in the new modified agreement.

Repayment schedule and interest rates

Loan modification involves adjustments to the repayment schedule and interest rates for borrowers facing financial difficulties. A revised repayment schedule can extend the loan term, reducing monthly payments, which is beneficial for individuals experiencing economic hardship. Lowering interest rates can alleviate financial stress, making it easier for borrowers to meet their obligations. Federal regulations may mandate specific disclosures, ensuring transparency regarding the loan's total cost and any potential penalties. It is crucial for borrowers to understand the implications of these changes on their overall financial health, including the total interest paid over the life of the loan. Engaging with a financial advisor or legal professional can provide clarity and assistance during the modification process.

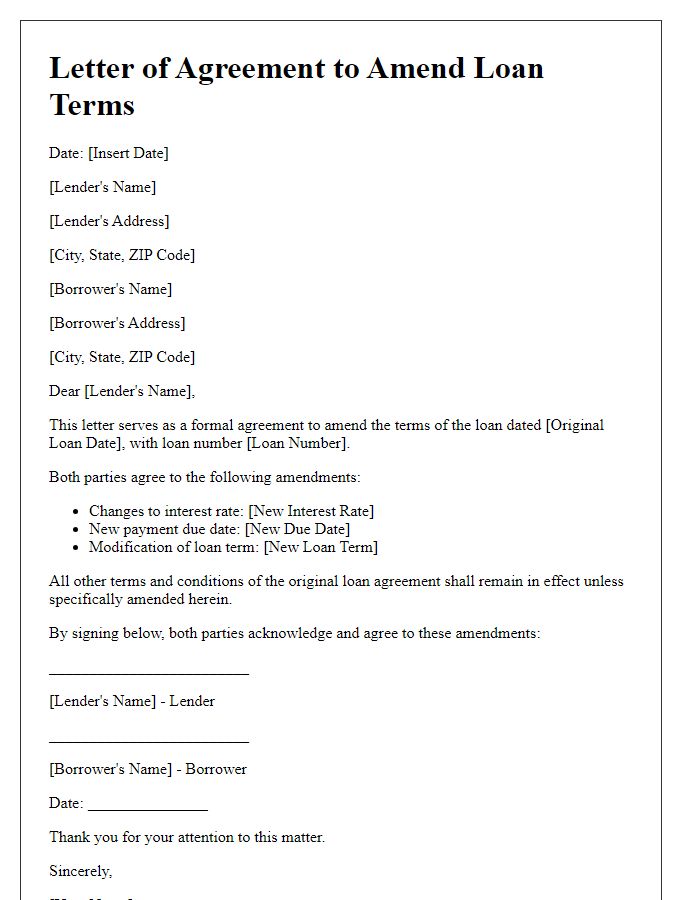

Legal clauses and borrower obligations

A loan agreement modification serves to amend the original loan contract between parties, ensuring clarity and compliance with changed circumstances. Key elements include the revised loan amount, interest rate adjustments, and repayment terms, which often become necessary due to unforeseen events such as economic downturns or changes in borrower financial conditions. Legal clauses should explicitly outline the obligations of the borrower, including timely payments, maintenance of insurance on collateral, and adherence to any additional stipulations such as guarantor involvement. Furthermore, clauses addressing default situations provide clear consequences for failure to meet obligations, including potential foreclosure on secured assets or litigation options under the jurisdiction of relevant laws, particularly focusing on the governing state's code. Proper documentation of the modification must be signed by both parties to ensure enforceability and record maintenance.

Signatures and notarization

Loan agreement modifications require clear documentation to ensure all parties are in agreement. Signatures must be provided by authorized individuals, often including both the borrower and the lender, to confirm their consent to the modifications. Notarization involves a licensed notary public verifying identities and witnessing the signing process. This step enhances the agreement's legal standing, especially in cases involving significant sums, such as home mortgages or business loans, often exceeding thousands of dollars. The notarized document serves as a safeguard against future disputes, ensuring clarity of terms and mutual understanding of obligations.

Comments